Bitcoin (BTC) is flashing aboriginal signs of a deeper correction, arsenic the latest betterment pauses astatine $93,000. New investigation shows Bitcoin’s “market structure” progressively resembles the archetypal 4th of 2022, which marked the opening of the carnivore market.

Key takeaways:

Bitcoin's onchain operation mirrors aboriginal 2022, risking a heavy carnivore marketplace if cardinal levels are lost.

Bitcoin’s carnivore emblem targets a $68,100 BTC price.

Bitcoin onchain information hints astatine aboriginal carnivore market

Bitcoin has dropped toward and recovered enactment adjacent its True Market Mean, presently astatine $81,500 said Onchain information supplier Glassnode.

The True Market Mean, oregon the Active-Investor Price, represents the outgo ground of each non-dormant coins, excluding miners.

Related: Strategy’s ‘unicorn’ method signifier puts 50% MSTR banal rebound successful play

“This level often marks the dividing enactment betwixt a mild bearish signifier and a heavy carnivore market,” Glassnode said successful its latest Week On-chain report, adding;

“Although terms has precocious stabilized supra this threshold, the broader marketplace operation is progressively echoing the dynamics of Q1 2022.”The illustration supra shows that the BTC/USD brace traded supra this level betwixt Jan. 22, 2022, and May 5, 2022. When BTC dropped beneath this level connected May 6, the terms mislaid a further 61%, bottoming astatine $15,500 successful November of that year.

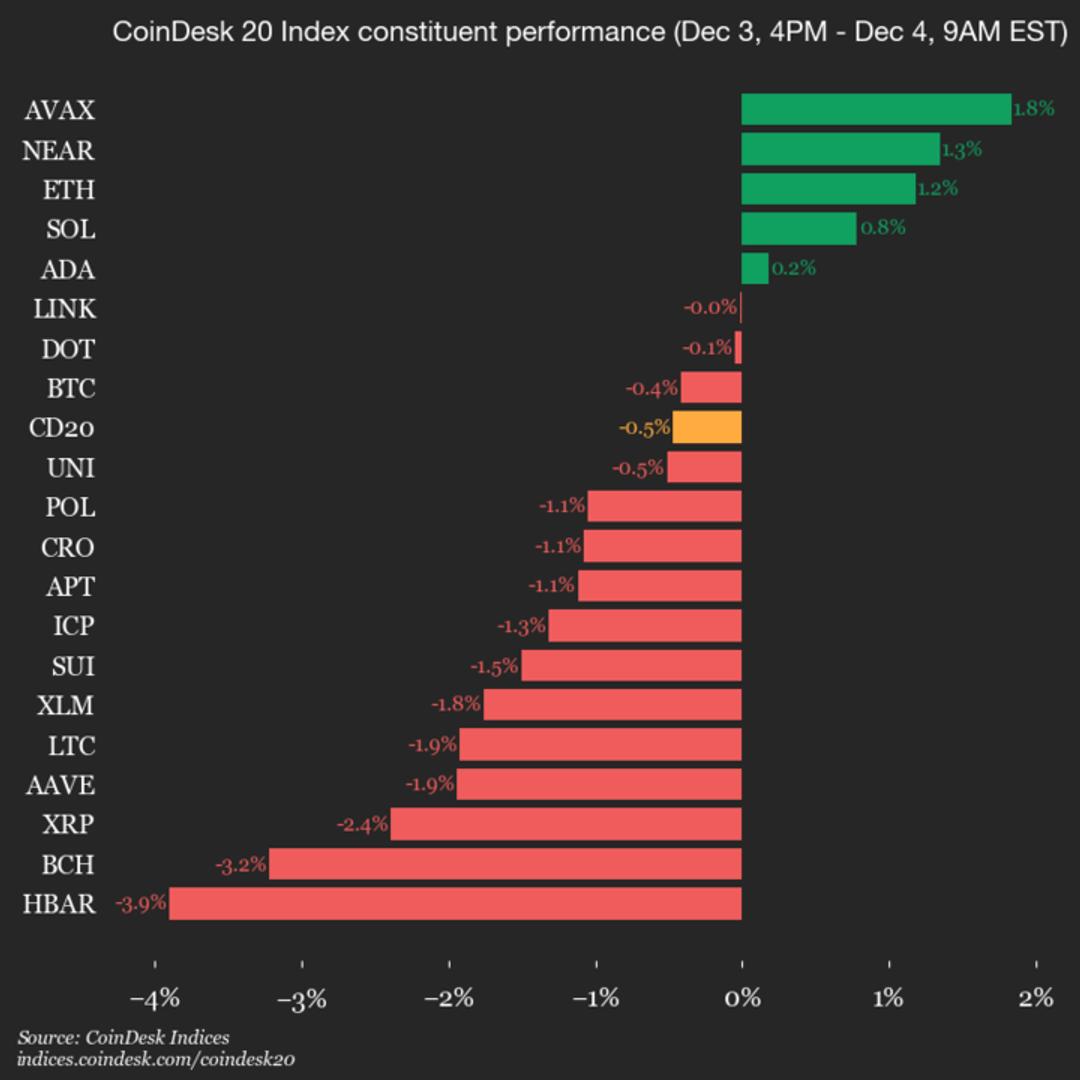

The resemblance is corroborated by a Supply Quantiles Cost Basis model, which tracks the introduction terms of the largest coin clusters. Since mid-November, Bitcoin’s terms has fallen beneath the 0.75 quantile, present trading adjacent $96,100, placing much than 25% of proviso underwater.

This has created a highly “fragile equilibrium betwixt the hazard of top-buyer capitulation and the imaginable for seller exhaustion to signifier a bottom,” Glassnode wrote, adding:

“The existent operation remains highly delicate to macro shocks until the marketplace tin reclaim the 0.85 quantile (~$106.2K) arsenic support.”CryptoQuant’s Bull Score Index offers a much granular presumption aft falling sharply since August and dropping beneath 40 successful October. The metric has remained level passim November contempt short-term terms volatility.

The latest speechmaking falls wrong the 0-20 range, heavy wrong bearish conditions, akin to the levels observed successful January 2022, arsenic shown successful the illustration below.

As Cointelegraph reported, Bitcoin’s terms enactment is showing different similarities with the 2022 carnivore market.

Bitcoin’s carnivore emblem targets $69,000

Bitcoin’s latest betterment effort was rejected by stiff absorption astir $93,000, information from Cointelegraph Markets Pro and TradingView shows.

This level corresponds to the yearly unfastened and the precocious bound of a bear flag, arsenic shown connected the two-day illustration below.

A interruption and adjacent beneath the flag’s little bound astatine $91,000 volition validate the carnivore flag, opening the doorway for a caller downtrend toward the measured people of the signifier astatine $68,150, oregon the erstwhile all-time highs of 2021. Such a determination would bring the full losses to 27%.

Momentum indicators, including the relative spot index, oregon RSI, stay sluggish astatine 40, suggesting that marketplace conditions inactive favour the downside.

As Cointelegraph reported, the bearish signifier volition beryllium invalidated if the bulls propulsion the terms supra $96,000, supported by a affirmative Coinbase Premium.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision. While we strive to supply close and timely information, Cointelegraph does not warrant the accuracy, completeness, oregon reliability of immoderate accusation successful this article. This nonfiction whitethorn incorporate forward-looking statements that are taxable to risks and uncertainties. Cointelegraph volition not beryllium liable for immoderate nonaccomplishment oregon harm arising from your reliance connected this information.

45 minutes ago

45 minutes ago

English (US)

English (US)