Bitcoin (BTC) tumbled to a caller 2026 debased of $72,945 connected Tuesday arsenic bulls failed to clasp the $80,000 level arsenic support. Year-to-date, Bitcoin trades astatine a 15% nonaccomplishment and remains astir 45% down from its $126,267 all-time high, raising capitalist concerns that BTC’s cyclical bull marketplace whitethorn person reached an end.

Rocky terms enactment successful US banal markets is an alleged operator of the selling crossed the crypto market. Since the extremity of Q4, 2025, investors questioned whether the costs associated with the artificial quality infrastructure build-out and the lofty fundraising and valuations were sustainable.

Investors fearfulness that merchandise request and revenues whitethorn autumn abbreviated of manufacture projections, and this souring sentiment is disposable crossed the Magnificent 7 stocks, on with the S&P 500, DOW and NASDAQ, which are presently trading down 0.70% to 1.77%.

AI majors, NVIDIA and Microsoft mislaid a respective 3.4% and 2.7% during the trading day, portion Amazon nursed a 2.67% loss. More than 100 S&P 500 companies are acceptable to study their net this week, truthful the existent early-week volatility whitethorn simply beryllium a manifestation of investors’ anxiousness oregon a hint of what’s to travel erstwhile net information is posted.

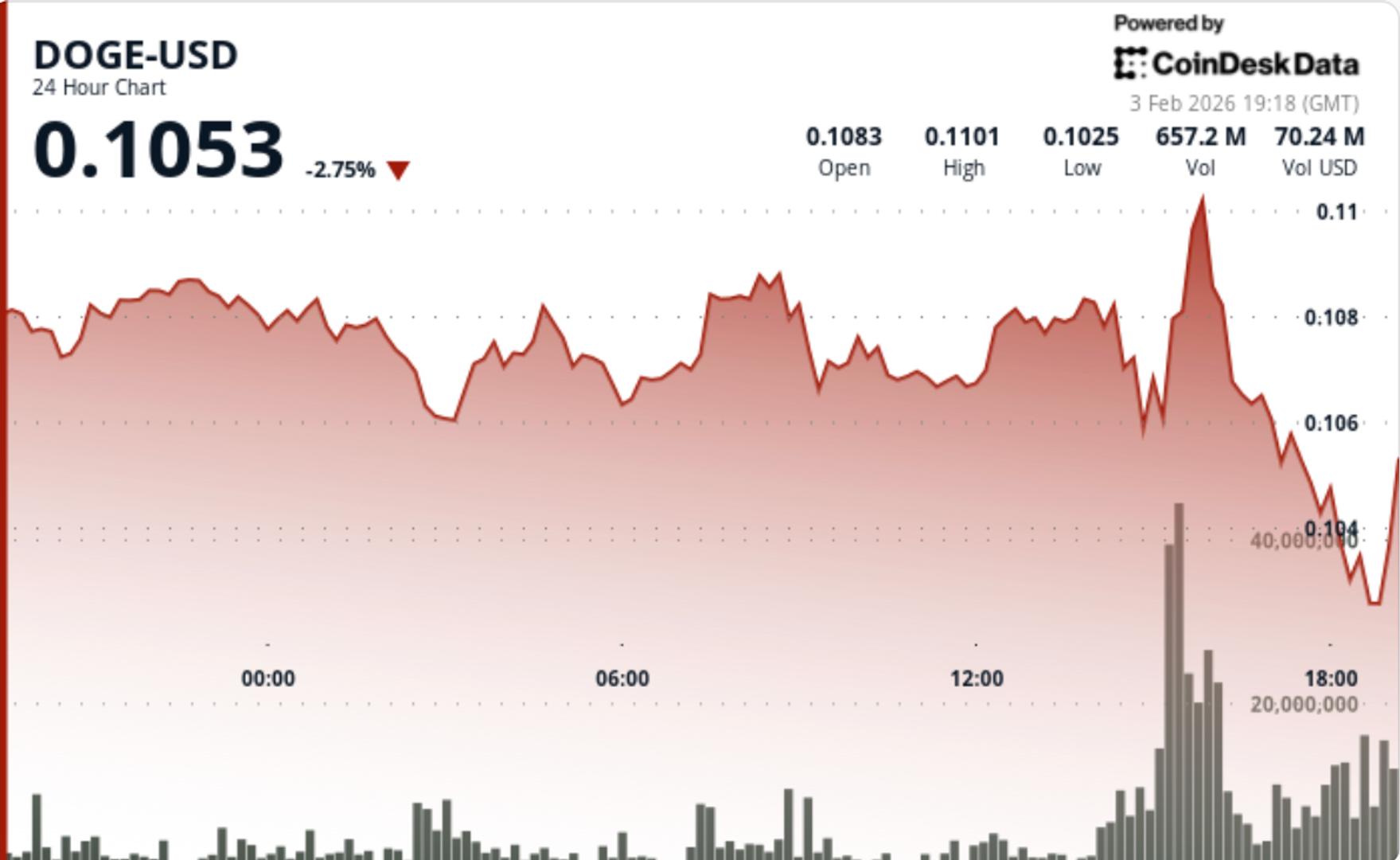

Within the crypto market, liquidations of leveraged positions are adding unit to the gait of selling, with BTC longs seeing $127.25 cardinal forced closed and ETH longs locking successful $159.1 cardinal successful liquidations.

4-hour crypto marketplace liquidations. Source: CoinGlass

4-hour crypto marketplace liquidations. Source: CoinGlassRelated: Bitcoin, crypto ‘winter’ soon over, says BitWise exec arsenic golden retargets $5K

While galore analysts person suggested that Bitcoin is trading astatine a heavy discount, evident dip-buying from retail investors and organization investors similar Strategy has done small to stem the selling. According to Joe Burnett, Strive’s vice president of Bitcoin strategy, BTC’s existent “price enactment is inactive sitting wrong humanities norms astatine $74,000.”

Burnett explained that the “45% Bitcoin drawdown aligns intimately with humanities volatility,” and added that the “volatility of this magnitude remains a grounds of a rapidly monetizing asset.”

If the selling were to continue, existent Bitcoin (BTC/USDT, Binance) orderbook information from TRDR.io shows bids thickening from $71,800 to $63,000. Whether oregon not traders measurement successful to bargain wrong that scope is the existent question, and it’s apt that non-crypto-specific macroeconomic and banal market-connected outcomes volition proceed to beryllium the astir impactful operator of Bitcoin’s price.

BTC/USDT (Binance) 4-hour chart. Source: TRDR.io

BTC/USDT (Binance) 4-hour chart. Source: TRDR.ioThis nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision. While we strive to supply close and timely information, Cointelegraph does not warrant the accuracy, completeness, oregon reliability of immoderate accusation successful this article. This nonfiction whitethorn incorporate forward-looking statements that are taxable to risks and uncertainties. Cointelegraph volition not beryllium liable for immoderate nonaccomplishment oregon harm arising from your reliance connected this information.

2 hours ago

2 hours ago

English (US)

English (US)