As the facilitators of the network’s information and transaction verification process, Bitcoin miners importantly power the proviso of BTC successful the market.

This is wherefore nary marketplace investigation tin beryllium implicit without analyzing the changes successful miners’ balances and activity. Firstly, changes successful miner equilibrium and enactment supply penetration into the sector’s economical wellness and operational stability. Secondly, miners’ decisions to merchantability oregon clasp their BTC bespeak their assurance successful aboriginal worth and tin awesome changes successful marketplace sentiment. Moreover, since miners are the superior root of caller BTC entering the market, their selling and holding patterns tin straight interaction Bitcoin’s terms volatility and liquidity.

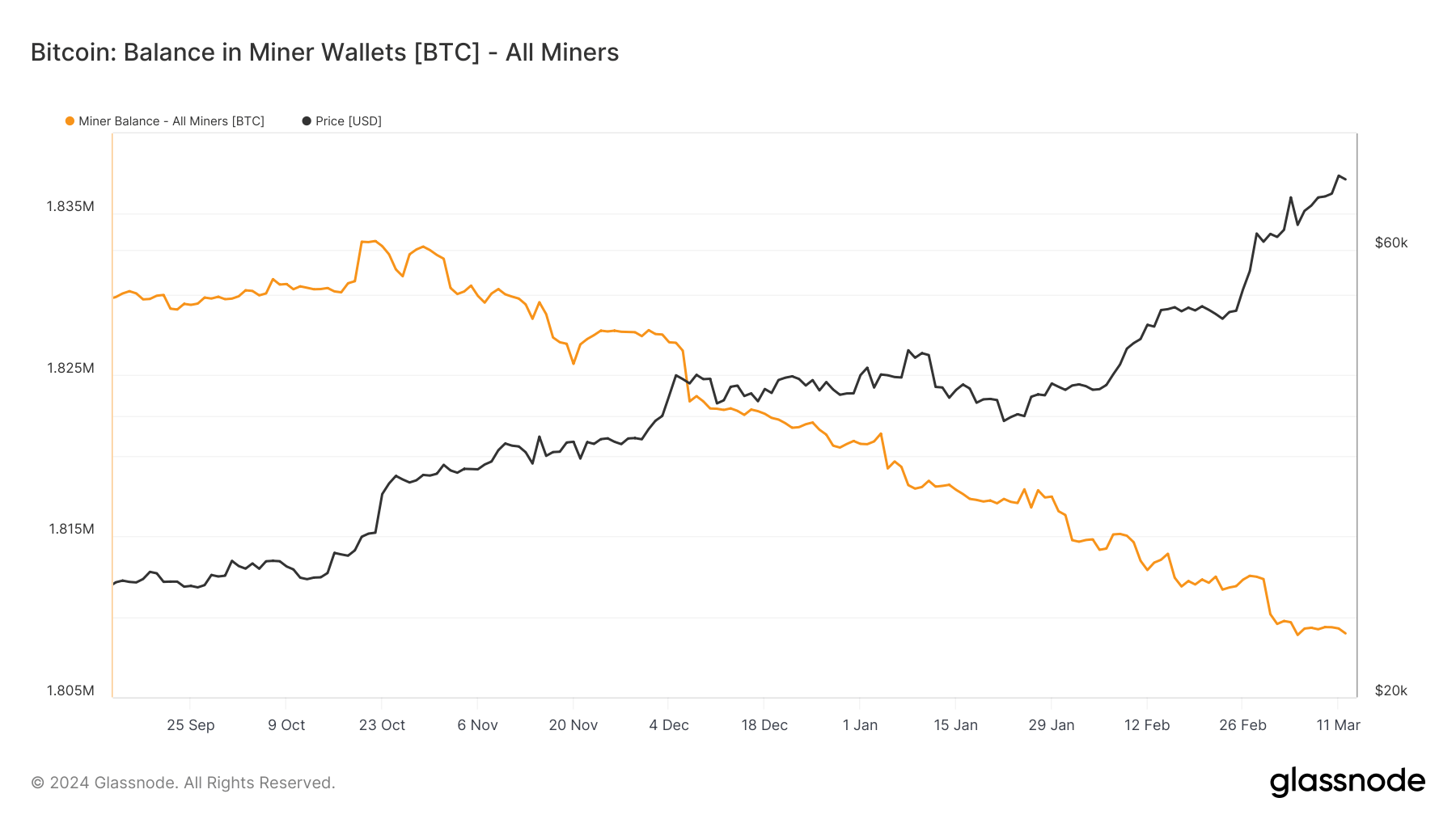

Data from Glassnode shows that determination has been a gradual diminution successful the equilibrium of BTC held successful miner wallets since the autumn of 2023. The equilibrium decreased from 1.833 cardinal BTC connected Oct. 22, 2023, to 1.808 cardinal BTC by Mar. 12.

Over 4,000 BTC near miner balances since the opening of March. This decrease, which seems to person sped up importantly this month, shows accordant selling unit from miners, who could beryllium reducing their holdings to screen operational costs oregon capitalize connected terms increases.

Graph showing the full magnitude of Bitcoin held successful miner wallets from Sep. 14, 2023, to Mar. 12, 2024 (Source: Glassnode)

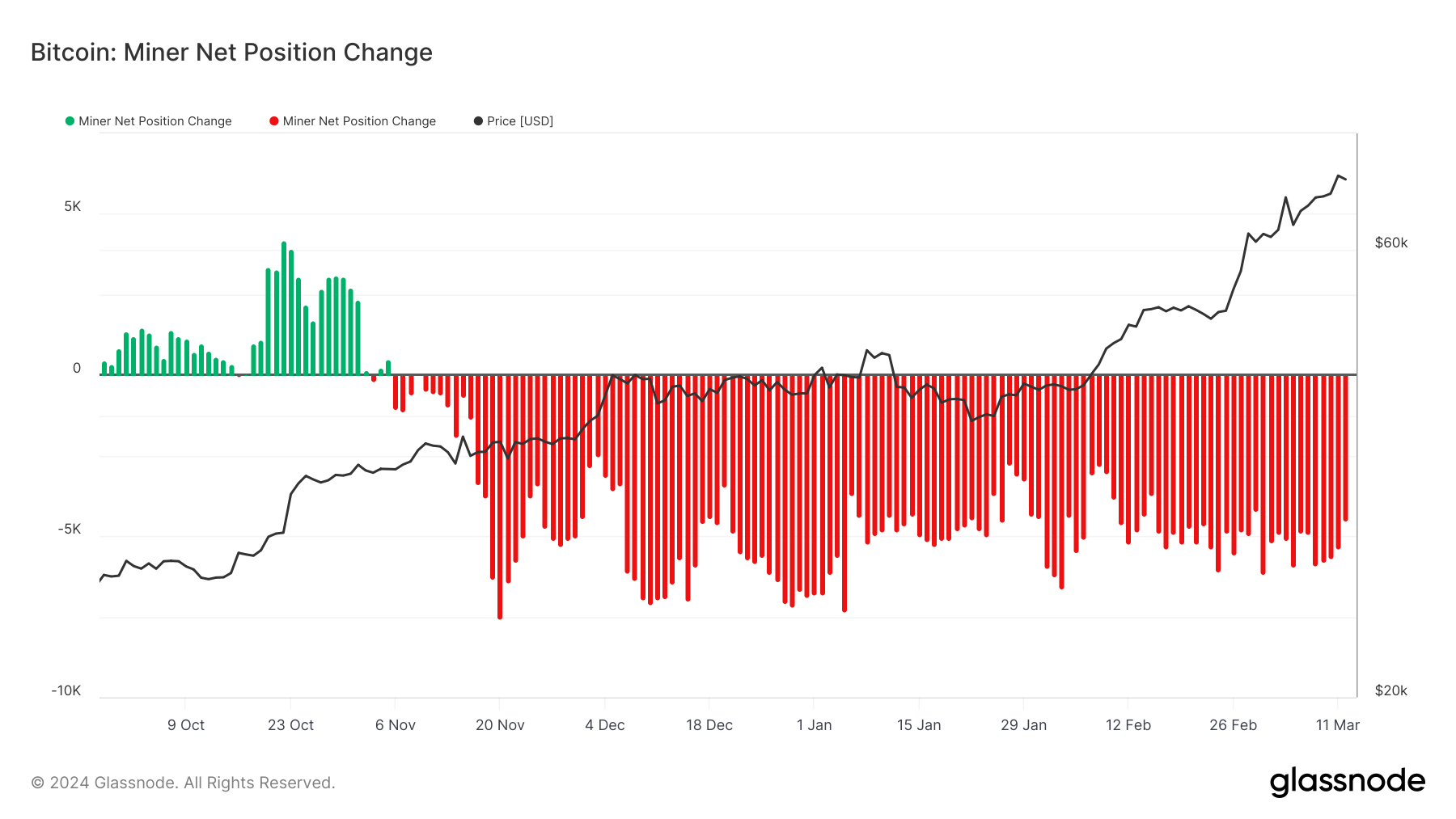

Graph showing the full magnitude of Bitcoin held successful miner wallets from Sep. 14, 2023, to Mar. 12, 2024 (Source: Glassnode)The nett alteration successful miner balances, which has been consistently antagonistic since November 2023, shows the extent of this selling trend. The largest outflow of 7,310 BTC was recorded connected Jan. 5, with different large outflow of 6,165 BTC seen connected Mar. 1.

These outflows person preceded captious marketplace events — the motorboat of spot Bitcoin ETFs successful the US and the assertive rally that pushed Bitcoin’s terms supra $70,000 — and amusement the miners person been anticipating large marketplace movements.

Graph showing the 30-day nett alteration successful the magnitude of Bitcoin held successful miner wallets from Sep. 28, 2023, to Mar. 12, 2024 (Source: Glassnode)

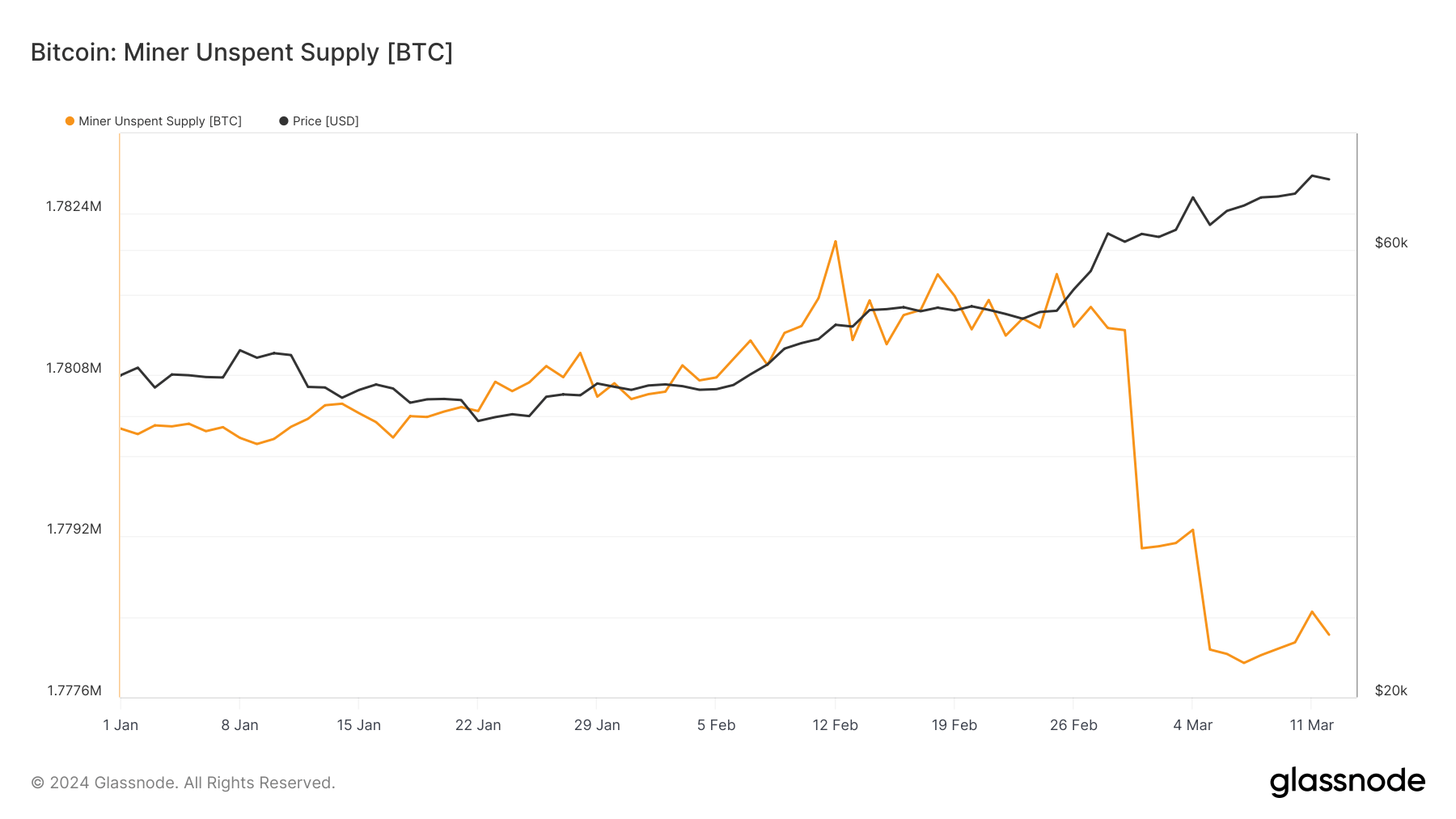

Graph showing the 30-day nett alteration successful the magnitude of Bitcoin held successful miner wallets from Sep. 28, 2023, to Mar. 12, 2024 (Source: Glassnode)Interestingly, contempt the selling, the miner unspent proviso — BTC that miners person mined but not yet sold — has shown comparative stability, fluctuating somewhat from 1.780 cardinal BTC astatine the commencement of the twelvemonth to 1.778 cardinal BTC by Mar. 12. This suggests that portion miners person been selling, the complaint of caller BTC mined and held is astir balancing retired the BTC sold.

Graph showing the full miner unspent proviso from Jan. 1 to Mar. 12, 2024 (Source: Glassnode)

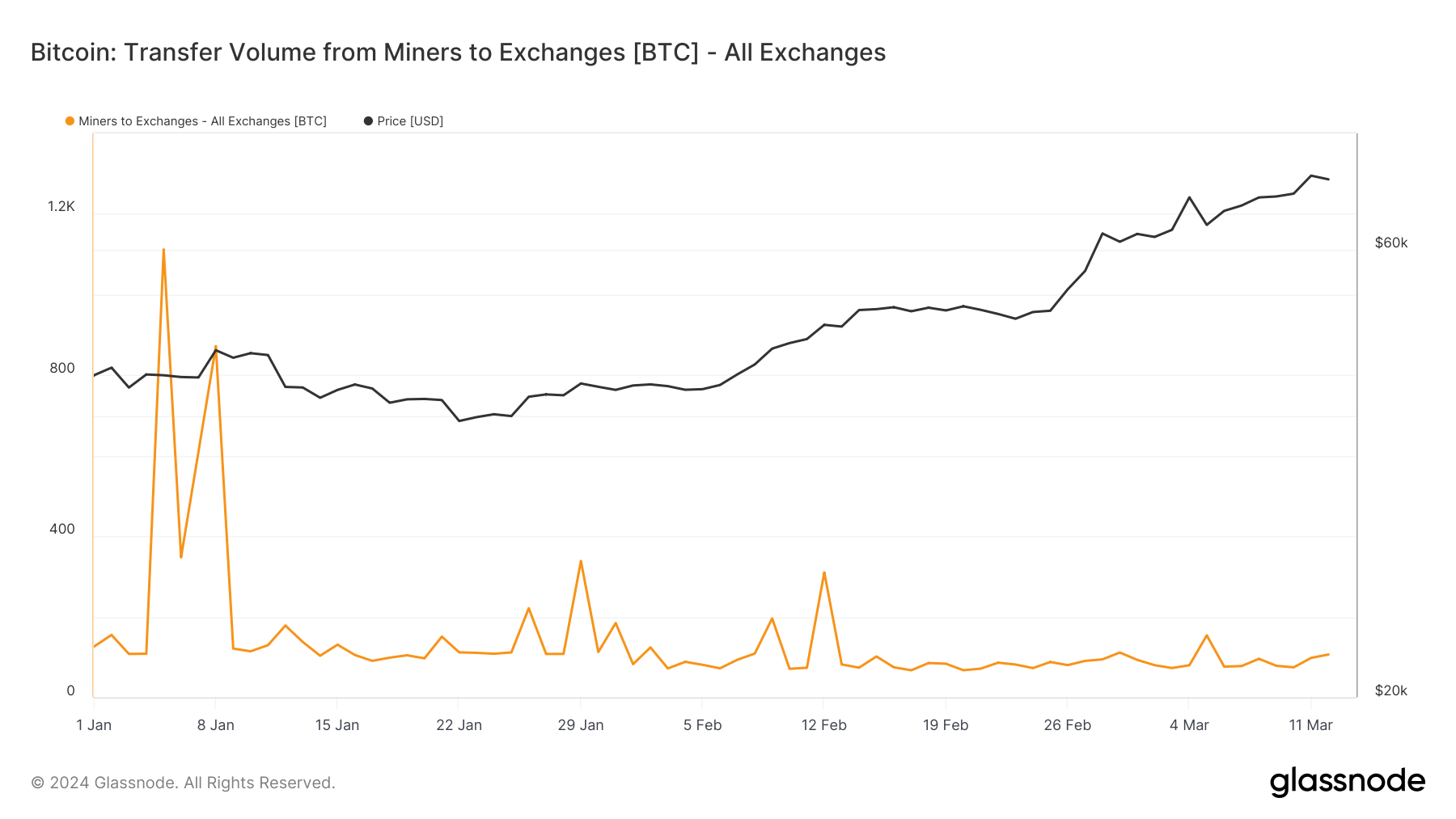

Graph showing the full miner unspent proviso from Jan. 1 to Mar. 12, 2024 (Source: Glassnode)The transportation of coins from miners to speech wallets, peaking notably astir the motorboat of spot Bitcoin ETFs, shows miners capitalizing connected opportunities oregon managing liquidity needs.

With transfers averaging betwixt 67 BTC and 150 BTC successful the archetypal 4th of 2024 and a notable highest of 106 BTC connected Mar. 12, it’s wide miners are actively managing their holdings, but not astatine a standard that suggests wide liquidation.

Graph showing the full magnitude of coins transferred from Bitcoin miners to speech wallets from Jan. 1 to Mar. 12, 2024 (Source: Glassnode)

Graph showing the full magnitude of coins transferred from Bitcoin miners to speech wallets from Jan. 1 to Mar. 12, 2024 (Source: Glassnode)While Bitcoin miners person been nett sellers for the past six months, the instauration and adoption of spot ETFs successful the US person injected important liquidity and buying unit into the market. The selling by miners, though significant, has been absorbed by the marketplace without derailing the bullish momentum established since the commencement of the year.

The station Bitcoin maintains terms resilience contempt accrued miner selling appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)