Michael Saylor kept buying portion the marketplace slid, and helium did it retired loud: “Neven been much bullish,” helium said successful an X station Thursday. His nationalist posts and regulatory filings amusement Strategy continued to adhd to its Bitcoin heap adjacent arsenic terms swings turned insubstantial gains into large unrealized losses.

The firm’s caller regulatory filing confirms a caller acquisition this month, portion marketplace reports and accounting disclosures amusement the wider deed to firm treasuries.

Market Value Drop Shakes Portfolios

Bitcoin has shed astir $1.2 trillion of marketplace worth since October 2025, and the wider crypto marketplace has mislaid astir $2 trillion successful the aforesaid stretch.

Prices that erstwhile pushed Bitcoin past $126,000 person fallen backmost toward the mid-$60,000s. That standard of diminution has pushed respective companies that utilized Bitcoin arsenic a treasury plus into dense mark-to-market losses, changing however investors presumption firm crypto exposure.

Never Been More ₿ullish.

— Michael Saylor (@saylor) February 19, 2026

Strategy Keeps Buying

According to the company’s ain filings, Strategy acquired 2,486 BTC for astir $168 cardinal during mid-February, bringing its holdings supra 700k coins. The bargain was announced successful a Form 8-K and has been picked up crossed marketplace outlets.

At the aforesaid time, accounting rules that necessitate unrealized gains and losses to beryllium reflected successful reports mean the firm’s quarterly statements showed multibillion-dollar swings tied to Bitcoin’s price. That world has enactment Strategy connected the beforehand lines of the statement implicit holding ample crypto positions connected equilibrium sheets.

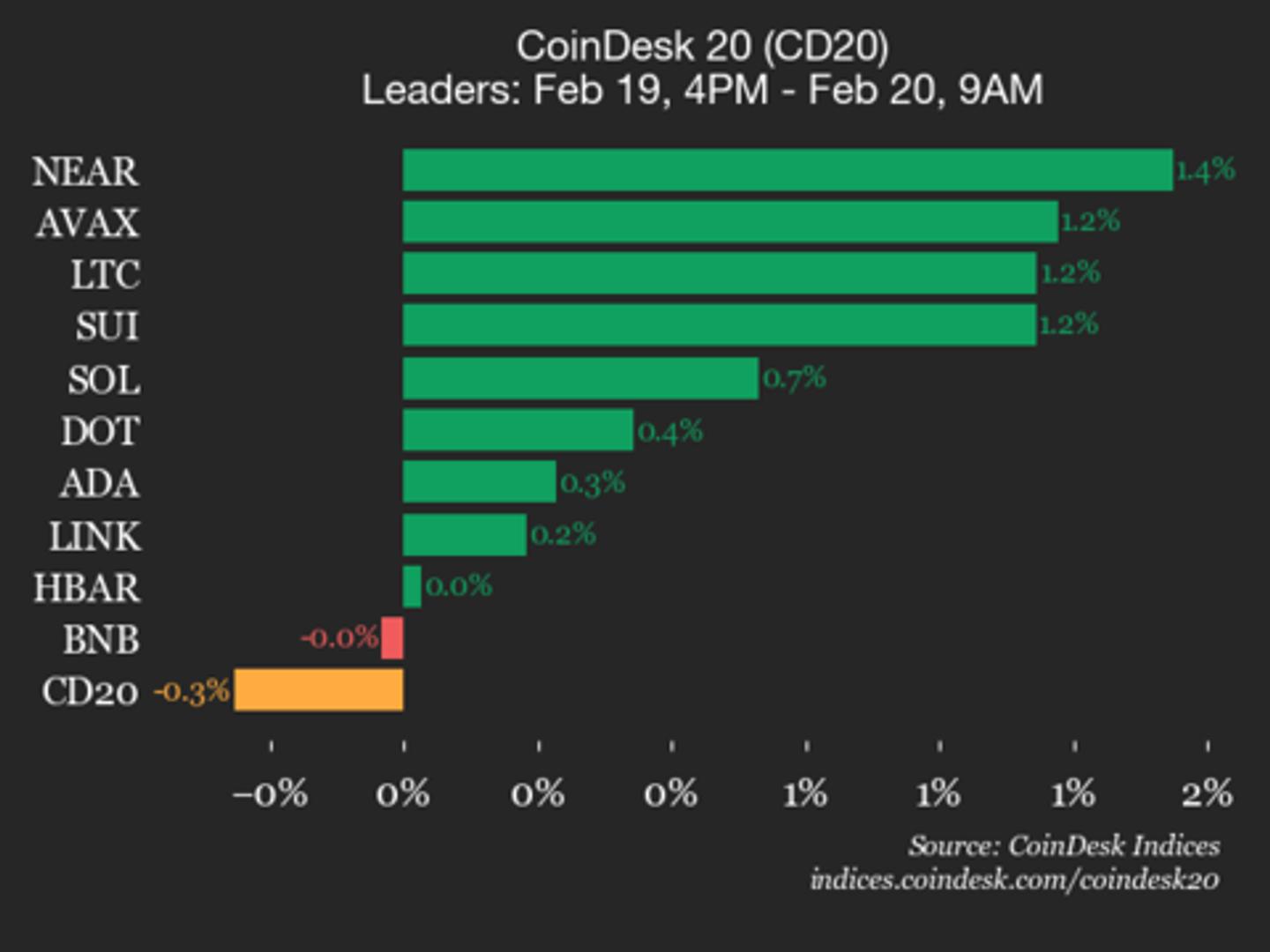

Price Action And Headlines Moved Markets

Bitcoin’s trading has been choppy. Headlines tied to geopolitics and macro argumentation moved traders, and low-volume sessions made swings consciousness bigger. ETF outflows and a drawstring of liquidations amplified the slide.

Still, determination were moments erstwhile buyers stepped successful and pushed prices up briefly; those countermoves person been picked implicit by analysts hunting for a bottom.

Bullish Voices, Loud And Public

Eric Trump — speaking astatine an lawsuit astatine Mar-a-Lago — made a precise bullish prediction that was reposted and amplified, and that benignant of nationalist optimism appears to person rubbed disconnected connected different high-profile backers.

Go bitcoin today. The wealth won’t hole itself.

— Michael Saylor (@saylor) February 13, 2026

Saylor reposted and echoed akin buy-the-dip messages, urging accumulation adjacent arsenic skeptics warned astir the risks. At times governmental headlines tied to US President Donald Trump and related argumentation moves were singled retired arsenic portion of the communicative down the 2025 rally that preceded this correction.

Saylor’s latest remark shows helium remains firmly assured successful Bitcoin. Despite immense losses, helium sees dips arsenic buying chances and urges others to enactment bullish, keeping his semipermanent condemnation beforehand and center.

Featured representation from Gemini, illustration from TradingView

2 hours ago

2 hours ago

English (US)

English (US)