Bitcoin’s driblet to beneath $50,000 connected Aug. 5 marked the largest drawdown successful the existent cycle, resulting successful important profit losses and liquidations. And portion BTC has shown coagulated signs of betterment since then, consolidating astir $60,000, the marketplace inactive remains cautious arsenic it precocious dipped beneath this intelligence support.

This cautiousness is champion seen successful the derivatives market, wherever the futures long/short ratio has stabilized astir 1, with longs astatine 50.16% and shorts astatine 49.85%.

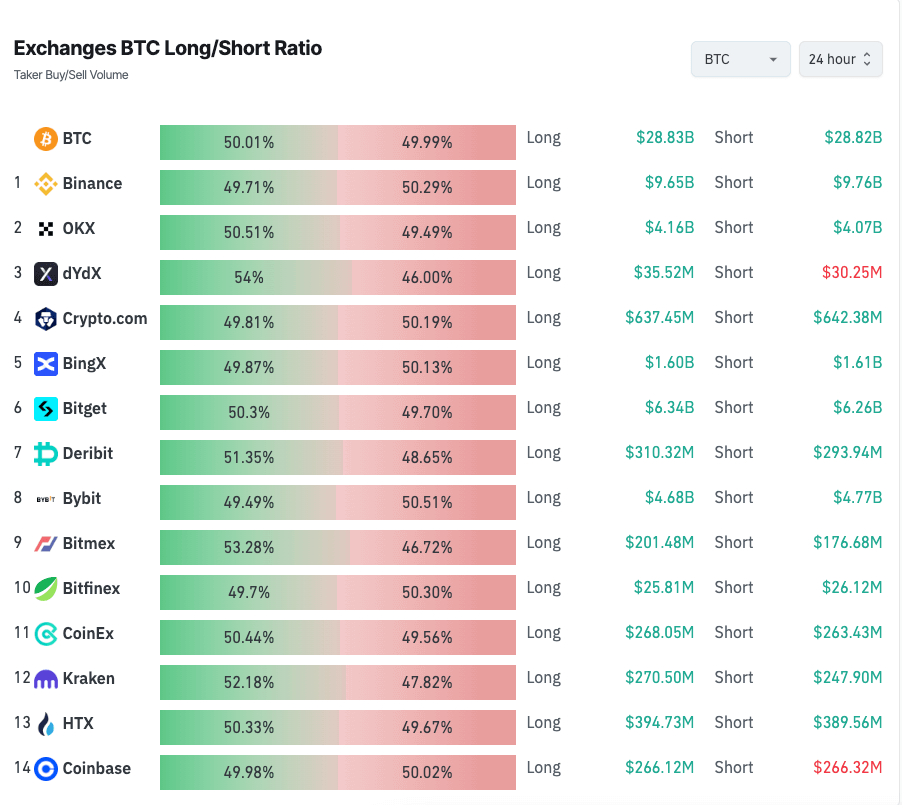

Table showing the Bitcoin futures long/short ratio crossed exchanges connected Aug. 14, 2024 (Source: CoinGlass)

Table showing the Bitcoin futures long/short ratio crossed exchanges connected Aug. 14, 2024 (Source: CoinGlass)This near-equal organisation shows a deficiency of wide directional bias among traders. The existent ratio represents a important displacement from the bullish outlook observed earlier successful the month, which peaked connected Aug. 8 with a ratio of 1.068.

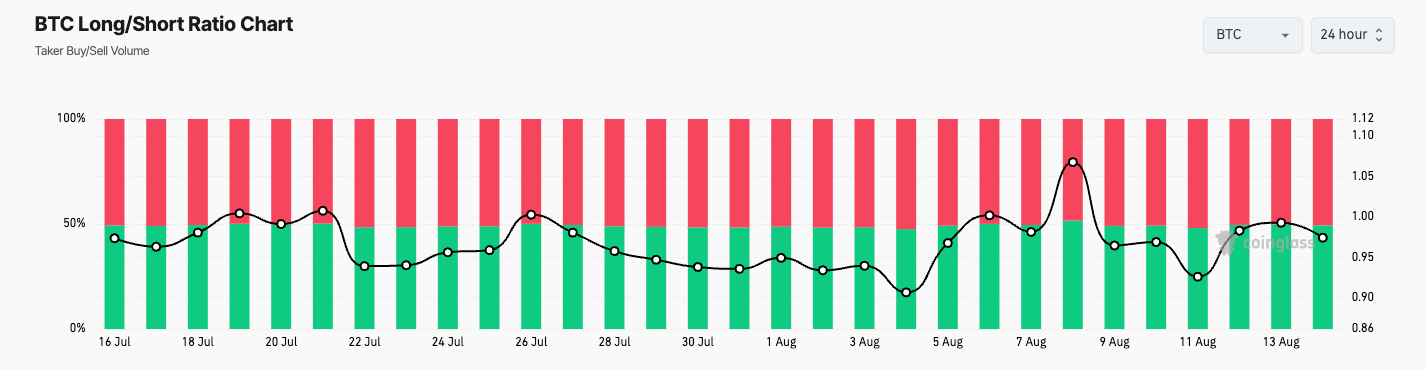

Chart showing the Bitcoin futures long/short ratio from July 16 to Aug. 14, 2024 (Source: CoinGlass)

Chart showing the Bitcoin futures long/short ratio from July 16 to Aug. 14, 2024 (Source: CoinGlass)With perpetual futures becoming the ascendant Bitcoin derivatives trading instrument, this deficiency of directional bias tin beryllium easy maintained. On Aug. 5, perpetual futures measurement reached $67.88 billion, astir 8 times the spot marketplace measurement of $8.58 billion. The perpetual futures to spot measurement ratio deed its second-highest level this twelvemonth connected Aug.10, reaching 11.60.

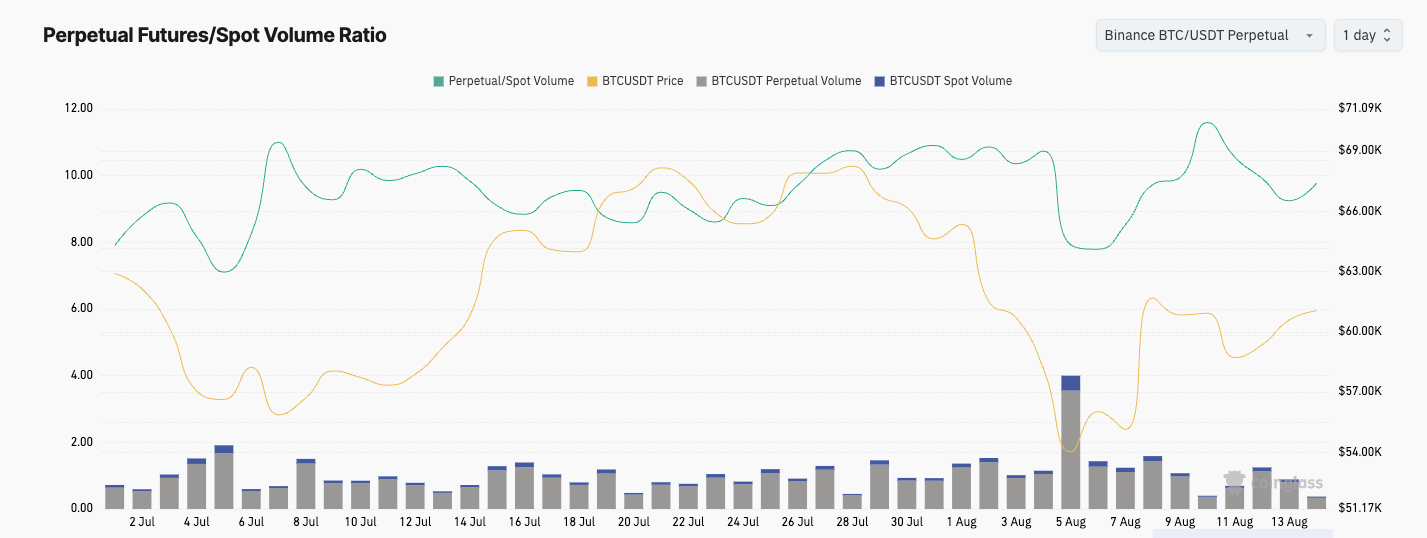

Chart showing the perpetual futures/spot measurement ratio from July 1 to Aug. 14, 2024 (Source: CoinGlass)

Chart showing the perpetual futures/spot measurement ratio from July 1 to Aug. 14, 2024 (Source: CoinGlass)Such a precocious futures-to-spot measurement ratio shows conscionable however important derivatives are successful terms find and liquidity. High volumes, arsenic we’ve seen implicit the past year, thin to pb to accrued volatility and faster terms movements. And with the bulk of that measurement connected Binance, the volatility hazard becomes adjacent greater.

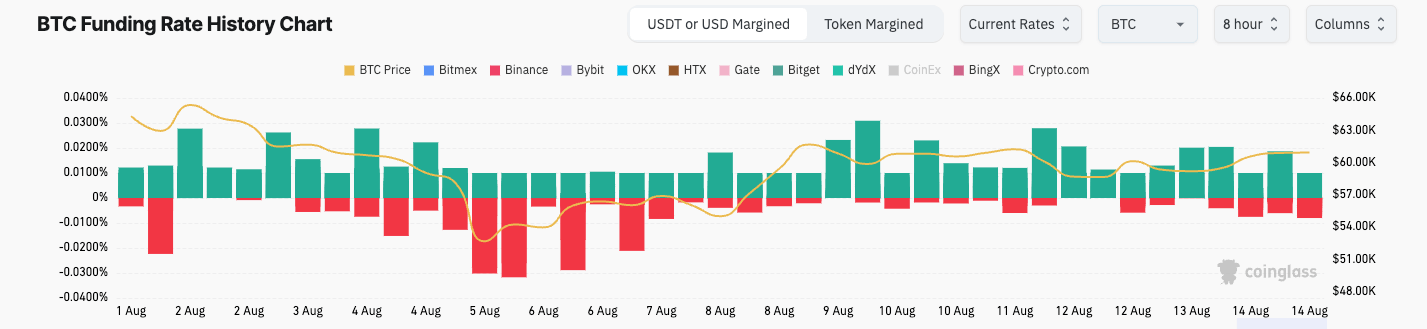

Perpetual futures backing rates person been consistently antagonistic since Aug. 13, pursuing a play of chiefly affirmative rates earlier successful the month. The important measurement successful Bitcoin perpetual futures suggests precocious leverage successful the market. Negative backing rates successful the perpetual futures marketplace bespeak short-term bearish pressure. However, this could besides acceptable the signifier for a imaginable abbreviated compression if buying unit emerges from different rally.

Chart showing the Bitcoin perpetual futures backing complaint from Aug. 1 to Aug. 14, 2024 (Source: CoinGlass)

Chart showing the Bitcoin perpetual futures backing complaint from Aug. 1 to Aug. 14, 2024 (Source: CoinGlass)The dilatory betterment we’ve seen successful open interest further confirms that the Bitcoin marketplace is presently successful a authorities of cautious recovery. While the terms has rebounded from its caller low, derivatives information shows that traders are inactive uncertain astir aboriginal direction.

The dominance of perpetual futures and the balanced long/short ratio constituent to a marketplace that could acquisition important volatility successful the adjacent term, arsenic a ample information of highly blase traders are preparing for the marketplace to spell some ways.

The station Bitcoin marketplace cautious arsenic longs and shorts equilibrium out appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

![Why Crypto Market Is Going Up Today [Live] Updates, Reasons & Price Action](https://image.coinpedia.org/wp-content/uploads/2025/11/11142238/Crypto-Market-Today-Bitcoin-Holds-Around-105K-Altcoins-Stay-Cautious-While-UNI-WLFI-TRUMP-Thrive-1024x536.webp)

English (US)

English (US)