Bitcoin’s (BTC) ongoing terms correction has been accompanied by respective different antagonistic developments that proceed to drawback investors’ attention. Most recently, marketplace expert Darkfost has observed a important clang successful Bitcoin spot trading volume, portion highlighting imaginable semipermanent implications of specified an event.

Binance Records $40B Loss In BTC Monthly Spot Trading

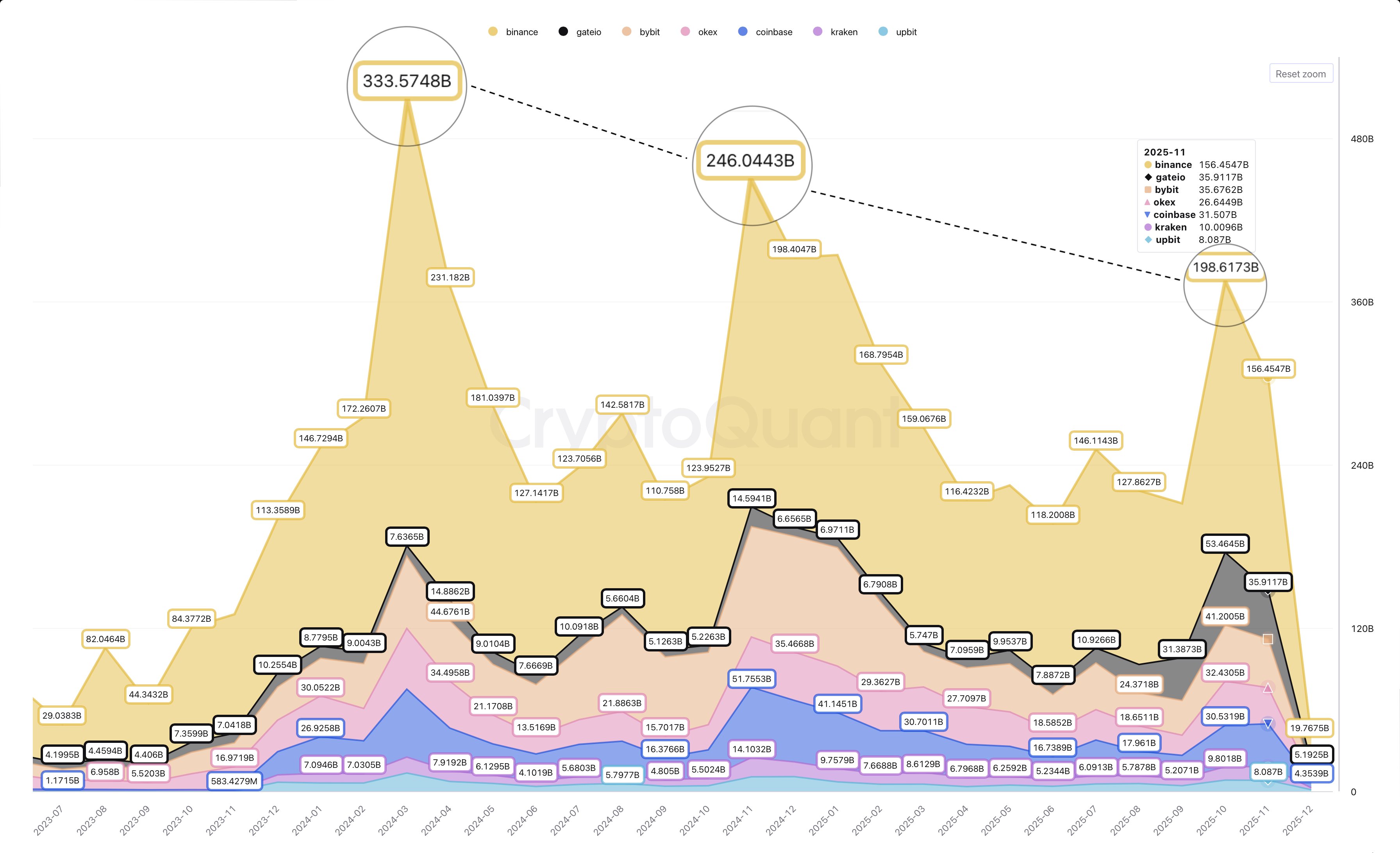

The spot trading measurement refers to the full magnitude of Bitcoin that is bought and sold for contiguous transportation connected exchanges wrong a circumstantial clip period. It is simply a cardinal marketplace indicator utilized to gauge participation, liquidity, and capitalist interest. According to Darkfost successful an X post connected December 6, the Bitcoin market, successful November, experienced a large autumn successful spot trading measurement crossed large crypto exchanges. This improvement has been attributed to the asset’s terms struggles, wherein it recorded a 17.5% devaluation during this period.

On Binance, which accounts for much than fractional of each Bitcoin spot trading activity, spot measurement fell from $198 cardinal successful October to $156 cardinal successful November, representing a 21% decline. The downturn was mirrored crossed different large exchanges, with ByBit posting a 13.5% drop, Gate.io sliding 33%, and OKX down 18%.

Source: @Darkfost_Coc connected X

Source: @Darkfost_Coc connected XInterestingly, Darkfost explains that Bitcoin’s caller terms action, the large antagonistic catalyst, pales successful examination to erstwhile corrections. However, different reddish speechmaking successful December could initiate a marketplace deterioration marked by conditions specified arsenic continued selling pressure, debased marketplace confidence, and, importantly, further drops successful spot activity.

A continuous diminution successful spot trading measurement chiefly mirrors a deficiency of marketplace involvement and is accompanied by different concerning factors, specified arsenic a weaker demand, precocious vulnerability to terms swings, and constricted enactment for rallies arsenic investors similar to beryllium connected the sidelines. This dynamic, successful turn, weighs connected terms growth, creating a self-reinforcing bearish loop.

Spot Trading Volume Peak Sees Consistent Regression

In related news, Darkfost besides reports that the contiguous marketplace rhythm has featured a accordant diminution successful spot trading measurement peaks. Notably, the illustration supra shows a marketplace precocious of $333.57 cardinal connected Binance successful March 2024, followed by the little highest of $246.04 cardinal successful November 2024, and past conscionable $198.6 cardinal past October.

This inclination becomes adjacent much concerning erstwhile looking astatine the spot-to-futures measurement ratio, which presently sits astatine 0.23, meaning futures enactment present accounts for much than 75% of wide trading. In essence, portion the Bitcoin marketplace remains active, capitalist enthusiasm connected the spot broadside is fading. By contrast, traders look progressively consenting to speculate successful the futures market, apt driven by elevated uncertainty and short-term volatility.

At property time, Bitcoin trades astatine $89,300, reflecting a 0.21% nonaccomplishment successful the past day.

Featured representation from Pexels, illustration from Tradingview

1 month ago

1 month ago

English (US)

English (US)