Bitcoin’s spot trading volumes implicit the past week amusement a varying level of marketplace enactment and sentiment. Bitcoin’s terms saw immoderate volatility implicit the week, peaking connected May 25 astatine $69,270, followed by a flimsy diminution and stabilization astir the $68,000 to $69,000 range.

This highest corresponds to the lowest spot trading measurement successful the past week of $2.121 billion. This shows that the terms spike whitethorn person reduced trading enactment arsenic the marketplace awaited further terms movements oregon reached a constituent of hesitation.

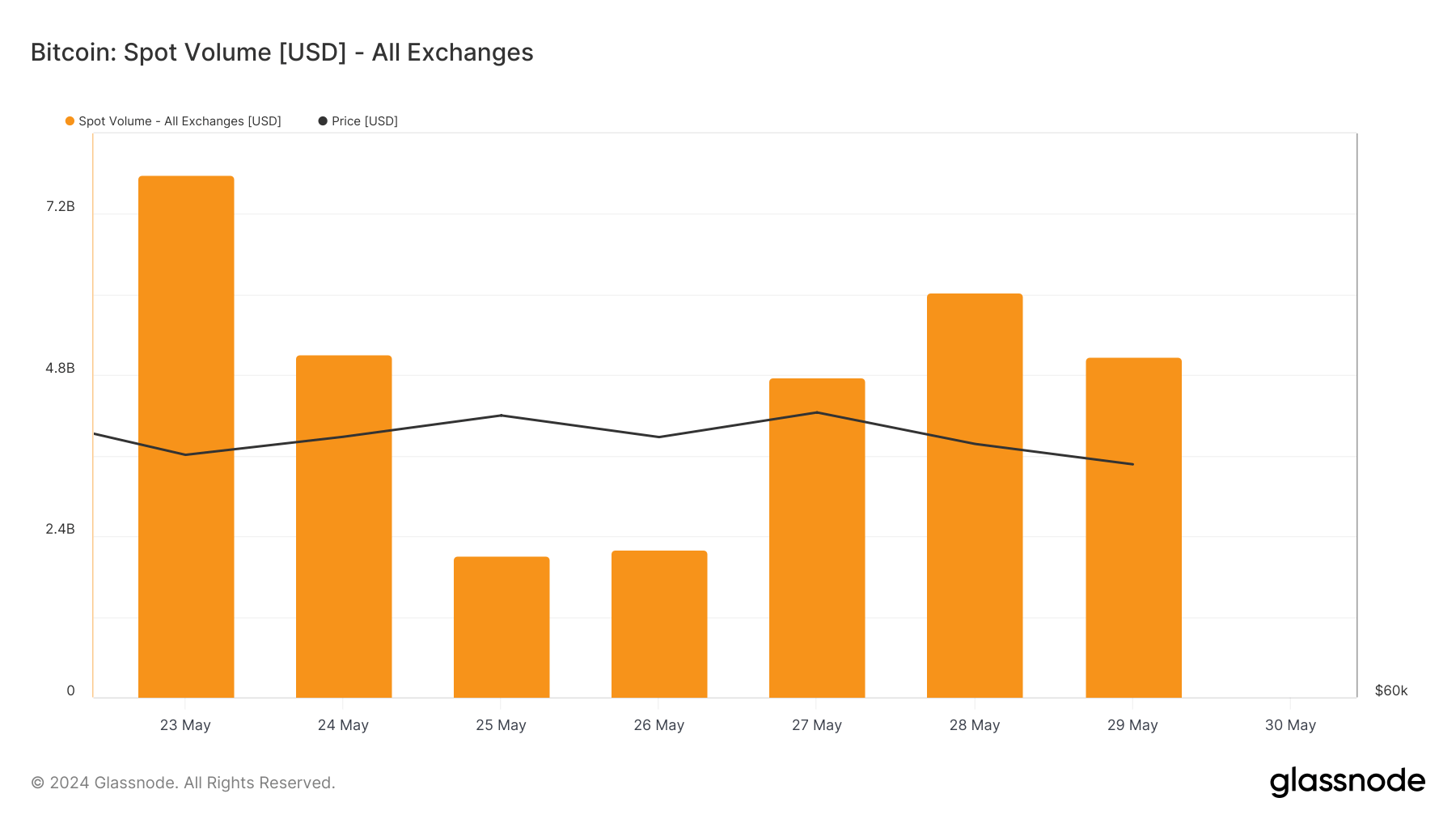

The intraday spot measurement information from Glassnode reveals a crisp diminution from May 23, with $7.780 billion, to May 25, with $2.121 billion. This important driblet successful measurement shows a play of debased volatility and a deficiency of beardown marketplace catalysts, starring to a important simplification successful trading activity.

The pursuing days amusement a betterment successful trading volumes. On May 27, the spot trading measurement accrued to $4.761 cardinal arsenic Bitcoin regained $69,385. On May 28, the spot trading measurement surpassed $6 cardinal contempt a flimsy terms driblet to $68,280.

Chart showing the full Bitcoin spot trading measurement from May 23 to May 29, 2024 (Source: Glassnode)

Chart showing the full Bitcoin spot trading measurement from May 23 to May 29, 2024 (Source: Glassnode)This signifier suggests that terms peaks are not ever followed by an contiguous summation successful trading activity, arsenic traders thin to hold retired the consolidation that inevitably occurs aft a terms increase.

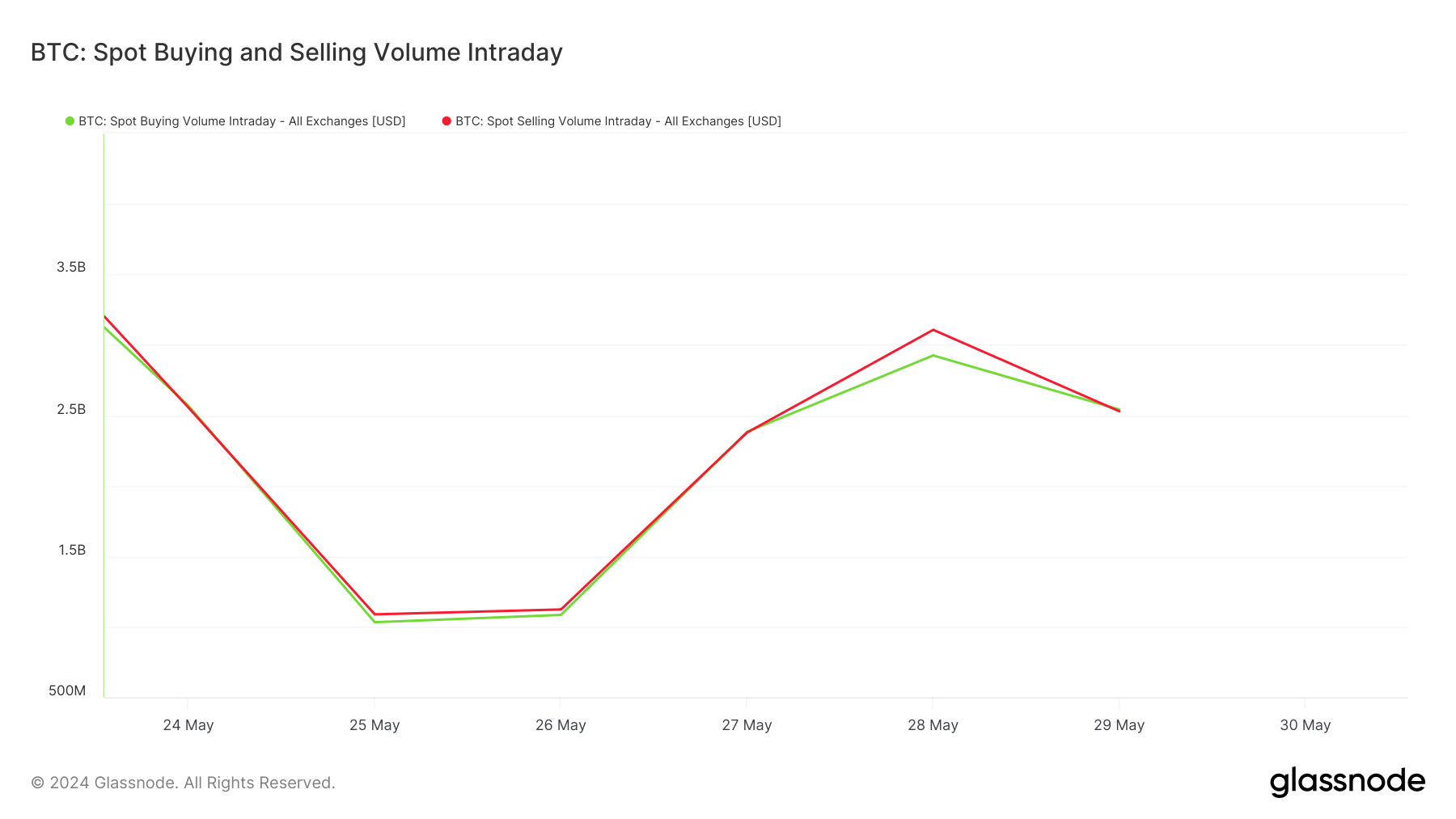

Analyzing the intraday spot buying and selling volumes helps america find the wide marketplace sentiment. If astir of the trading measurement comes from selling, it shows a bearish marketplace that’s either rushing to capitalize connected crisp terms movements and exit oregon chopped its losses.

Conversely, if astir of the trading measurement comes from buying, the overwhelming sentiment is bullish arsenic the marketplace is racing to participate astatine existent terms points, expecting further increases.

Glassnode’s information from the past week reveals a marketplace that’s astir successful equilibrium. On May 23, the buying measurement was $3.796 cardinal against a selling measurement of $3.984 billion. While this would usually bespeak a bearish sentiment, having these volumes truthful adjacent unneurotic shows a divided marketplace with nary wide directional bias.

This inclination continued passim the past week. May 24 saw astir adjacent buying and selling volumes of astir $2.566 cardinal and $2.553 billion, respectively, portion the lowest volumes successful May showed buying astatine $1.032 cardinal and selling astatine $1.088 billion.

When trading measurement started to prime up connected May 27, buying and selling volumes continued to lucifer astatine astir $2.383 cardinal and $2.378 billion, showing a highly progressive trading situation with participants engaging arsenic successful buying and selling.

The highest successful spot selling measurement connected May 28 astatine $3.106 billion, compared to buying measurement astatine $2.924 billion, suggests a flimsy bearish sentiment, perchance influenced by the terms driblet to $68,280, arsenic traders took vantage of the terms movements to merchantability disconnected holdings.

Graph comparing Bitcoin’s intraday buying (green) and selling (red) spot measurement from May 23 to May 29, 2024 (Source: Glassnode)

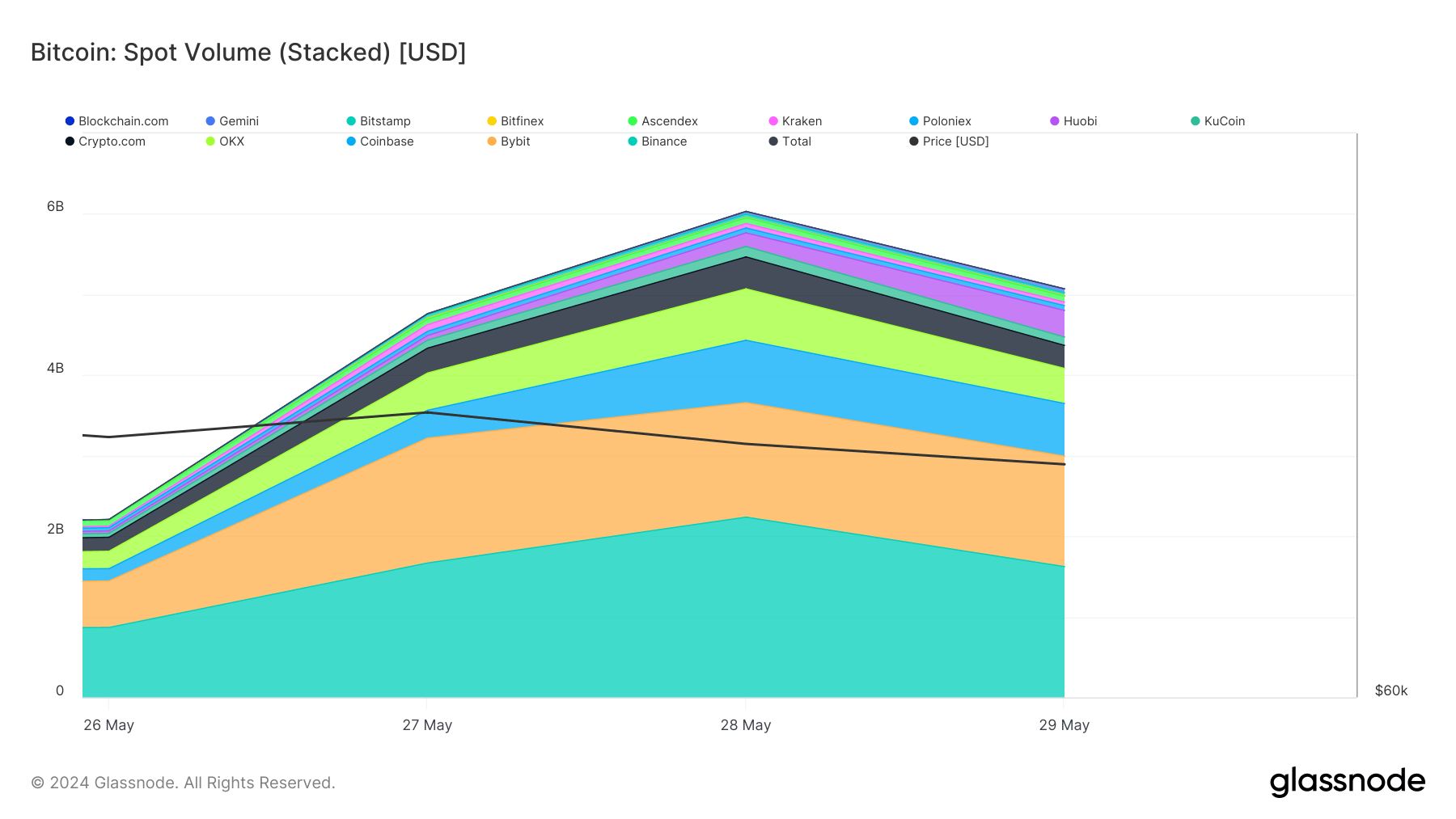

Graph comparing Bitcoin’s intraday buying (green) and selling (red) spot measurement from May 23 to May 29, 2024 (Source: Glassnode)Looking astatine the spot volumes crossed exchanges shows Binance consistently leading, followed by Bybit and Coinbase. On May 26, Binance had $866.776 cardinal successful volume, which accrued importantly to $2.236 cardinal by May 28. Bybit and Coinbase besides showed an summation successful volumes, with Bybit peaking astatine $1.550 cardinal connected May 27 and Coinbase astatine $774.203 cardinal connected May 28.

Graph showing Bitcoin’s spot trading measurement crossed exchanges from May 26 to May 29, 2024 (Source: Glassnode)

Graph showing Bitcoin’s spot trading measurement crossed exchanges from May 26 to May 29, 2024 (Source: Glassnode)The importantly higher volumes connected Binance, which often surpassed the combined measurement of Bybit and Coinbase, tin beryllium attributed to its ample idiosyncratic basal and debased trading fees, making it the preferred speech for high-volume traders.

The equilibrium betwixt buying and selling volumes seen implicit the past week indicates that the marketplace is indecisive and volatile.

The station Bitcoin marketplace divided arsenic buying and selling volumes stay the same appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)