Bitcoin’s caller descent has near traders squinting astatine charts and asking the aforesaid blunt question: correction oregon crash? Prices person tumbled sharply, but immoderate marketplace watchers inactive spot this arsenic a heavy pullback wrong a longer uptrend. Others pass the information points to thing colder.

Price Decline And Hard Numbers

According to XWIN Research’s CryptoQuant analysis, Bitcoin has fallen astir 46% from a highest adjacent $126,000 and present trades astir $67,900 aft 5 consecutive months of losses.

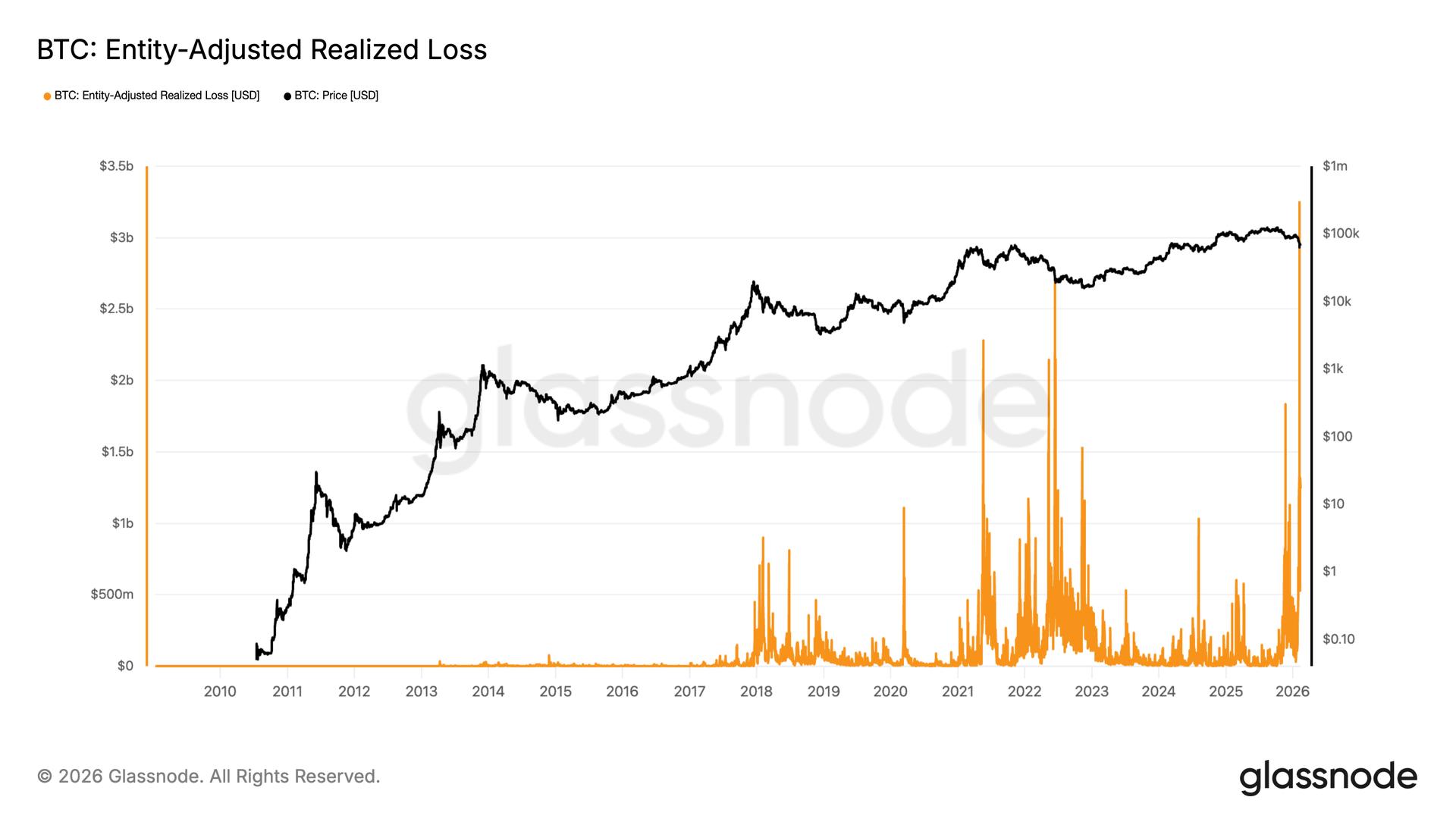

The Fear & Greed Index sits astatine 14 — a speechmaking labeled Extreme Fear. Reports enactment that nett realized losses precocious deed implicit $13 billion, a level that matched the worst stretches of the 2022 slump.

In 2024, astir $10 cardinal of inflows helped assistance marketplace cap. Then successful 2025, much than $300 cardinal flowed successful portion the wide marketplace worth shrank. That unusual premix of dense inflows and falling marketplace headdress suggests selling unit is higher than caller buying.

How Rising Prices Are Masking a Quiet Shift successful Bitcoin’s Structure

“The basal script is that Bitcoin whitethorn already beryllium entering winter, with higher prices and stronger operation delaying recognition.” – By @xwinfinance

Read much ⤵️https://t.co/7soxNoBhqi pic.twitter.com/fEsSXpAmuK

— CryptoQuant.com (@cryptoquant_com) February 11, 2026

Capital Flows Versus Price Action

Based connected reports, the superior travel numbers are the astir awkward information for bulls. Money moved in, but worth fell. Who was selling into that demand? Large holders, insubstantial traders, oregon analyzable derivatives desks mightiness person taken profits oregon hedged positions.

The information unsocial doesn’t sanction the seller, but the signifier is simply a reddish flag. On-chain measures besides uncover shrinking realized gains adjacent arsenic prices remained acold supra anterior bear-era levels. That tends to weaken the interior spot of the marketplace implicit time.

Sentiment And Historical Echoes

Some traders constituent to a quirk of memory: precocious nominal prices marque symptom consciousness milder. People don’t privation to relive the chaos of 2022. Reports accidental the motorboat of spot ETFs and deeper organization entree person changed the market’s plumbing, and that gives galore confidence.

Yet sentiment readings astatine utmost fearfulness often amusement up adjacent capitulation points. It’s worthy remembering that successful 2022 realized losses peaked astir 5 months earlier the marketplace bottom, which means large losses tin precede a last debased by a agelong stretch.

Technical Patterns And The Bigger Picture

Bitcoin posted 4 consecutive losing months and a 41% diminution crossed that agelong — a streak past seen during 2018 alternatively than 2022. That signifier matters due to the fact that akin sequences person led to extended downturns successful the past.

Bitcoin At A Crossroads As XWIN Flags Early Signs Of Crypto Winter

For XWIN Research, the connection is simple: terms unsocial does not specify the cycle. What matters is who is buying, who is selling, and whether request tin sorb proviso without marketplace worth shrinking.

Right now, that equilibrium looks strained. Until inflows statesman translating into sustained marketplace headdress maturation and realized losses chill meaningfully, the steadfast believes the marketplace should beryllium treated with caution alternatively than optimism. Winter whitethorn not person afloat arrived, but based connected the data, the somesthesia is intelligibly dropping.

Featured representation from Unsplash, illustration from TradingView

2 hours ago

2 hours ago

English (US)

English (US)