Bitcoin (BTC) has changed a batch successful 4 years, distancing itself from shady centralized entities similar FTX and emerging arsenic the plat du jour among organization investors. However, this month’s thrust backmost into six-figures amid cooling tariff tensions is presenting a fig of informing signs that look eerily akin to the 2021 rhythm high.

In 2021, bitcoin made an historical grounds precocious successful April of $65,000, coinciding with a flurry of enactment from Michael Saylor’s (then-named) MicroStrategy and the IPO of Coinbase (COIN). The excitement was capitalized connected by shrewd traders, who shorted the large quality and rode BTC down to an eventual bottommost astatine $28,000 conscionable 2 months later.

Then, arsenic the full manufacture began preparing for a sustained carnivore marketplace oregon adjacent the extremity of bitcoin (remember the Chinese mining ban), BTC turned process and began a rally that didn’t halt for 4 months. This relentless surge to the upside resulted successful a caller grounds precocious of $69,000, contempt each on-chain metrics pointing towards a bearish outcome.

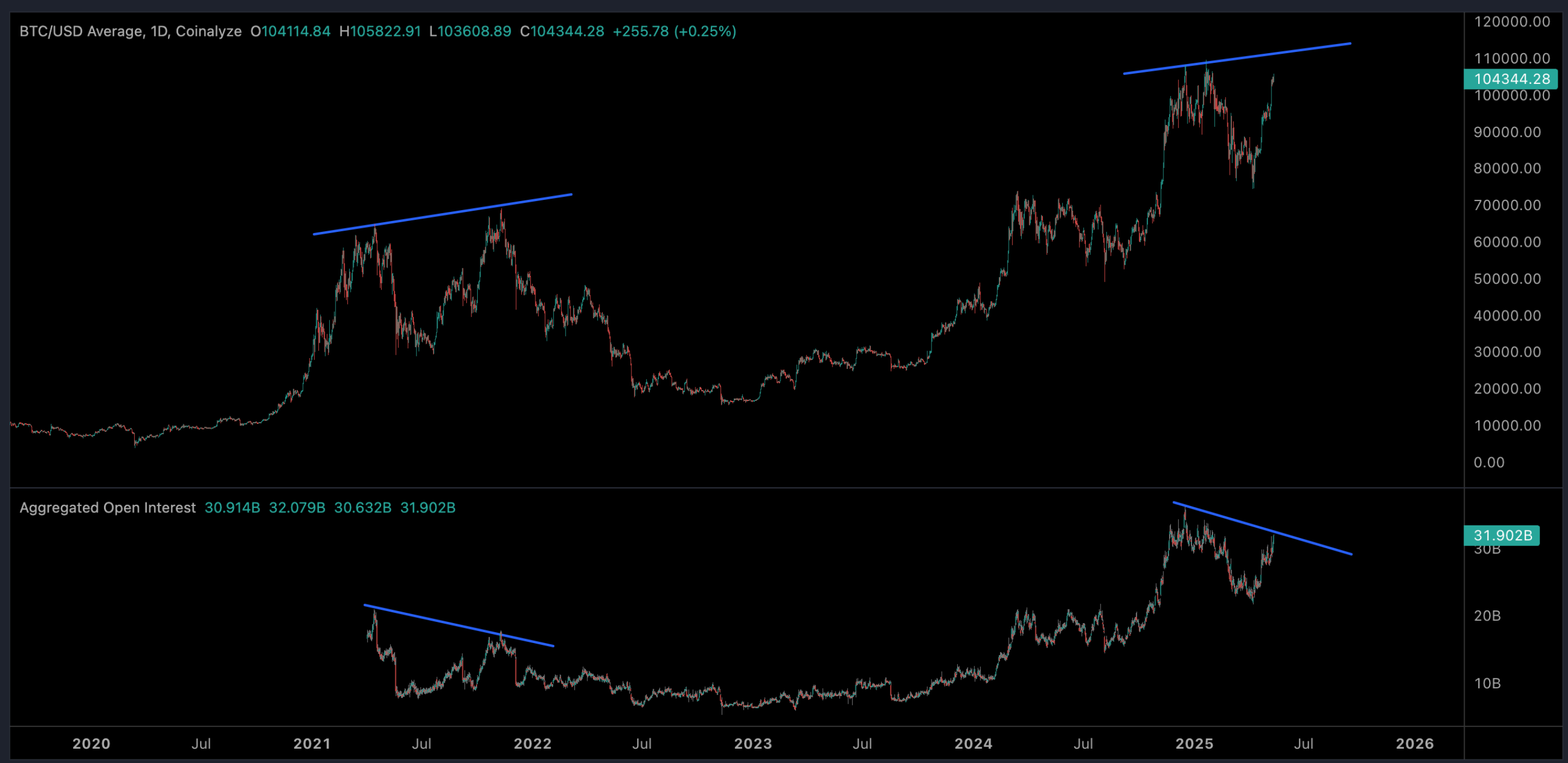

Ominously, the existent terms enactment this clip astir is being accompanied by those aforesaid on-chain metrics telling a akin communicative astir a imaginable treble top.

A deeper dive

The archetypal of those metrics is play RSI, which is exhibiting 3 strikes of bearish divergence from March 2024, December 2024 and May 2025. RSI is an indicator that compares averages gains with mean losses implicit a acceptable play to gauge perchance overbought oregon oversold conditions. Bearish divergence is wherever RSI is trending to the downside whilst terms is trending to the upside.

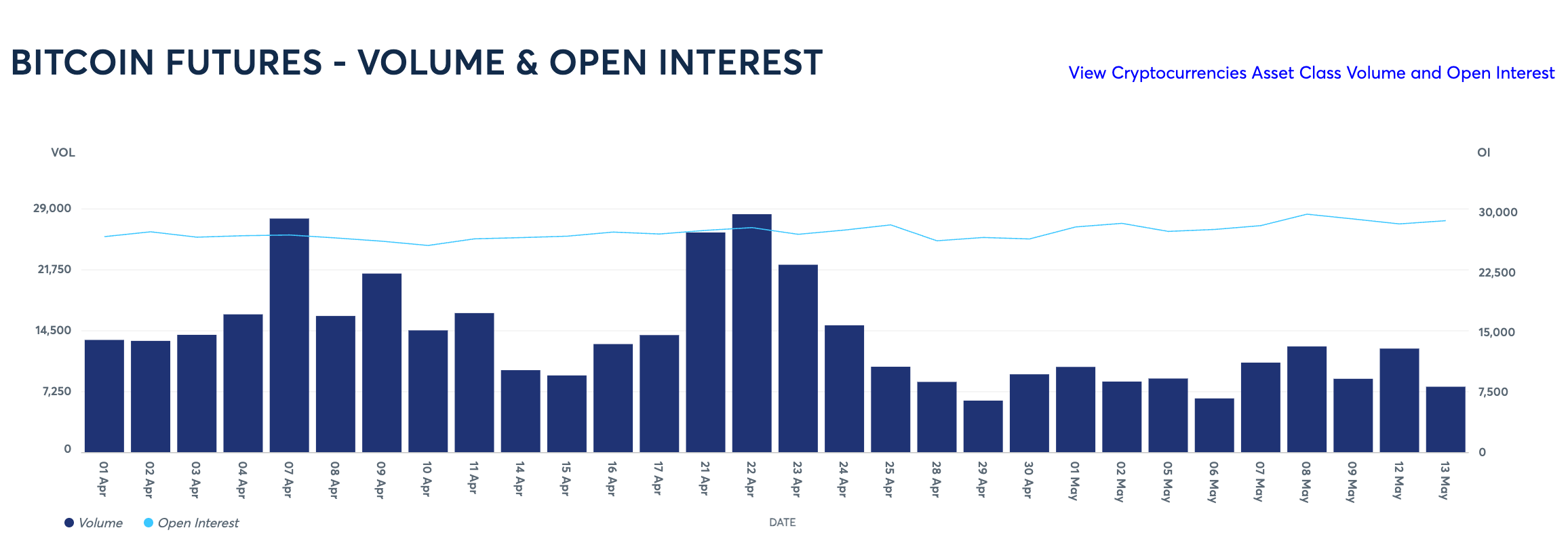

This, coupled with trading volumes that are little compared to the archetypal determination supra $100K, suggests that the momentum of this plaything higher is dwindling. Volumes are down crossed some crypto and organization venues, with measurement connected CME BTC futures failing to surpass 35,000 contracts during 3 of the erstwhile 4 weeks. The archetypal determination saw volumes regularly transcend 65,000 contracts, hitting much than 85,000 connected 3 occasions. One declaration connected the CME is worthy 5 bitcoin ($514,000).

Like successful 2021, unfastened involvement is besides diverging from terms action, presently Open involvement 13% little than the archetypal thrust to $109K successful January portion terms is conscionable 5.8% lower. Four years agone erstwhile bitcoin deed $69,000, unfastened involvement was 15.6% little than the archetypal $65,000 precocious contempt the terms being 6.6% higher.

What does this mean?

The similarities with 2021 are wide but it’s worthy noting that the crypto marketplace operation is wholly antithetic than 4 years ago. Mostly acknowledgment to Michael Saylor's Strategy and a increasing fig of firm copycats ramping up BTC acquisitions astatine immoderate cost, the beingness of organization involvement is acold higher successful this cycle. There is besides the constituent of spot bitcoin ETFs, which allows intuitional investors and companies to get BTC successful a accepted regulated venue.

As learned successful 2021, on-chain metrics tin beryllium an inaccurate measurement of forecasting terms action. It is feasible that BTC breaks a caller grounds precocious aft Trump inevitably reveals details of a U.S. bitcoin treasury, but that could besides go a “sell the quality event,” successful which traders effort to capitalize connected affectional buying from uninformed retail investors.

What the indicators bash suggest is that whilst a caller grounds precocious could beryllium formed similar successful 2021, the momentum of this determination is waning and analysts who are boldly calling for $150K oregon adjacent $200K terms targets could beryllium successful for a rude awakening erstwhile the sell-off genuinely begins. Bitcoin entered much than a one-year carnivore marketplace astatine the extremity of 2021, resulting successful important layoffs crossed the manufacture and the implosion of respective trading firms, centralized lending companies and DeFi protocols.

This clip around, the marketplace has respective different elements to see if prices statesman to tumble. Notably, MSTR’s leveraged BTC position, the emerging BTC DeFi manufacture that has $6.3 billon successful full worth locked (TVL), and the billions of frothy dollars that bounce astir the memecoin ecosystem, which is known to disproportionately declaration during times of marketplace pressure

4 months ago

4 months ago

English (US)

English (US)