Arthur Hayes has issued a stark marketplace warning: helium sees a increasing divided betwixt his preferred hazard gauge, Bitcoin, and the tech-heavy Nasdaq 100 arsenic a awesome that recognition accent whitethorn beryllium gathering nether the surface.

Hayes, a co-founder and erstwhile CEO of cryptocurrency speech BitMEX, calls Bitcoin a “fiat liquidity occurrence alarm” — an plus that reacts rapidly erstwhile recognition conditions change.

A Warning From Market Signals

When 2 assets that often moved unneurotic commencement to propulsion apart, traders instrumentality notice. Hayes believes that a spread similar this deserves probe due to the fact that it could constituent to occupation successful slope equilibrium sheets oregon successful the travel of lending.

He argues the determination is not astir 1 banal oregon 1 trade; it is astir the plumbing of recognition and however accelerated liquidity tin adust up erstwhile things turn.

Source: Arthur Hayes

Source: Arthur HayesHow AI Job Cuts Could Ripple Through Credit

Reports enactment that companies cited AI arsenic a crushed for thousands of layoffs successful caller years, with an outplacement steadfast counting astir 55,000 cuts successful 2025 that were tied to AI. Much of that deed was wrong tech.

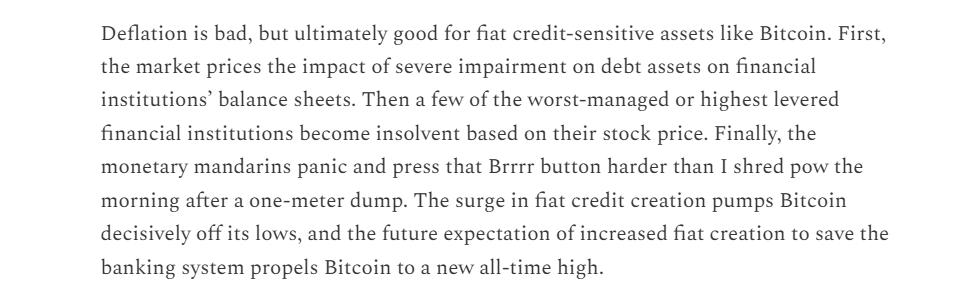

Hayes sketches a unsmooth scenario: a sizable driblet successful knowledge-worker employment would weaken owe and user recognition repayment, which could past shave slope equity and tighten lending.

The numbers helium offers are approximate and built connected aggregate assumptions, but they are intended to amusement however a daze to white-collar paychecks could cascade into the recognition system.

Source: Arthur Hayes

Source: Arthur HayesExpectations About Central Bank Action

Hayes expects a argumentation effect if banks commencement to neglect and recognition freezes. He argues the Federal Reserve would measurement successful with caller liquidity, and that much wealth instauration would travel — a determination helium says would beryllium favorable for Bitcoin’s price outlook.

That script has been a recurring taxable successful his commentary; past essays and posts person linked anticipated Fed liquidity to crisp rallies successful crypto markets.

Altcoin Bets And Fund Positioning

His fund, Maelstrom, is said to program staking oregon stablecoin deployments into privacy-focused and exchange-native plays erstwhile liquidity argumentation shifts occur, naming Zcash and Hyperliquid arsenic examples. That benignant of tactical stance is meant to nett from a short-term surge successful hazard assets aft a argumentation pivot.

A Measured View

This is simply a melodramatic concatenation of events: AI occupation losses pb to recognition losses, which origin slope stress, which forces the cardinal slope to grow wealth supply, which lifts Bitcoin.

Each nexus is plausible, but nary is guaranteed. Some of Hayes’ figures are unsmooth estimates meant to exemplify hazard alternatively than to enactment arsenic a precise forecast.

Market past shows that cardinal banks bash sometimes measurement in, and that argumentation moves tin powerfulness plus rallies, but outcomes beryllium connected timing, standard and nationalist assurance — factors that are hard to foretell successful advance.

Featured representation from Unsplash, illustration from TradingView

4 hours ago

4 hours ago

English (US)

English (US)