Bitcoin, the crypto marketplace leader, could beryllium successful for a betterment rally, arsenic retail involvement declines, analysts told CoinDesk.

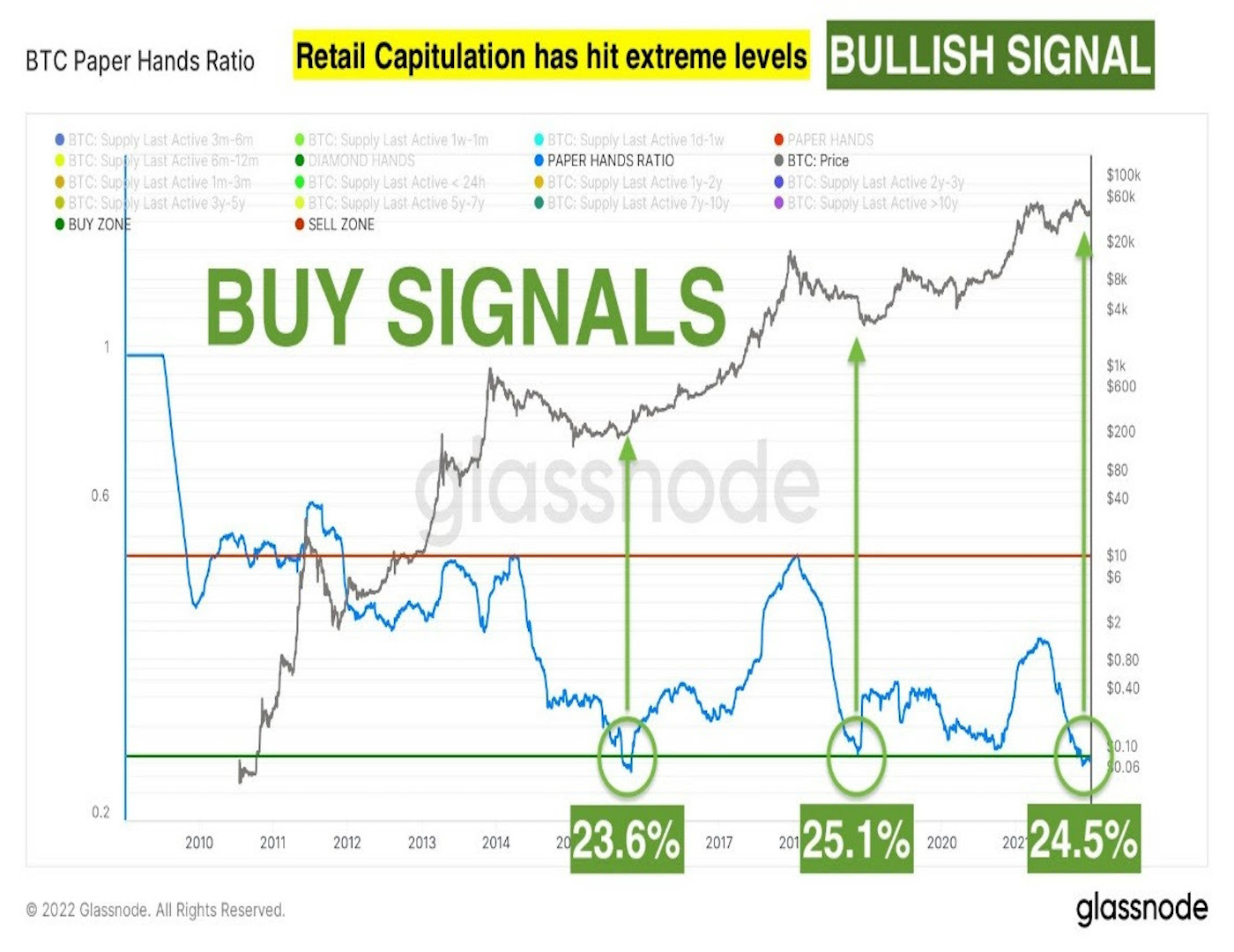

“Whilst bitcoin remains level successful the abbreviated term, on-chain metrics similar the insubstantial hands ratio from Glassnode suggest a bottommost could beryllium nearing,” Marcus Sotiriou, an expert astatine the U.K.-based integer plus broker GlobalBlock, told CoinDesk successful an email.

The BTC insubstantial hands ratio is the ratio of young coins progressive successful the past six months to the cryptocurrency’s circulating supply. A precocious speechmaking represents greed among retail oregon short-term traders, portion a debased fig signals retail disinterest.

Retail investors are often referred to arsenic having insubstantial hands – anemic capableness oregon tendency to clasp an plus for a agelong clip – and are usually the past to participate the bull tally and exit the carnivore run. Hence, declining retail enactment is considered a contrary indicator – a hint of an impending reversal higher.

Chart showing retail capitulation successful bitcoin (GlobalBlock, Glassnode)

“If this ratio gives a precocious reading, it suggests retail greed, but if it is low, it suggests the marketplace is astatine retail capitulation,” Sotiriou said. “We are astatine 24.5% currently, the lowest level since the 2015 carnivore market. Every clip the ratio has reached astir 25% previously, it has sparked a multiyear bull marketplace with unthinkable gains, which indicates that this fearful play could beryllium a large buying accidental based connected humanities data.”

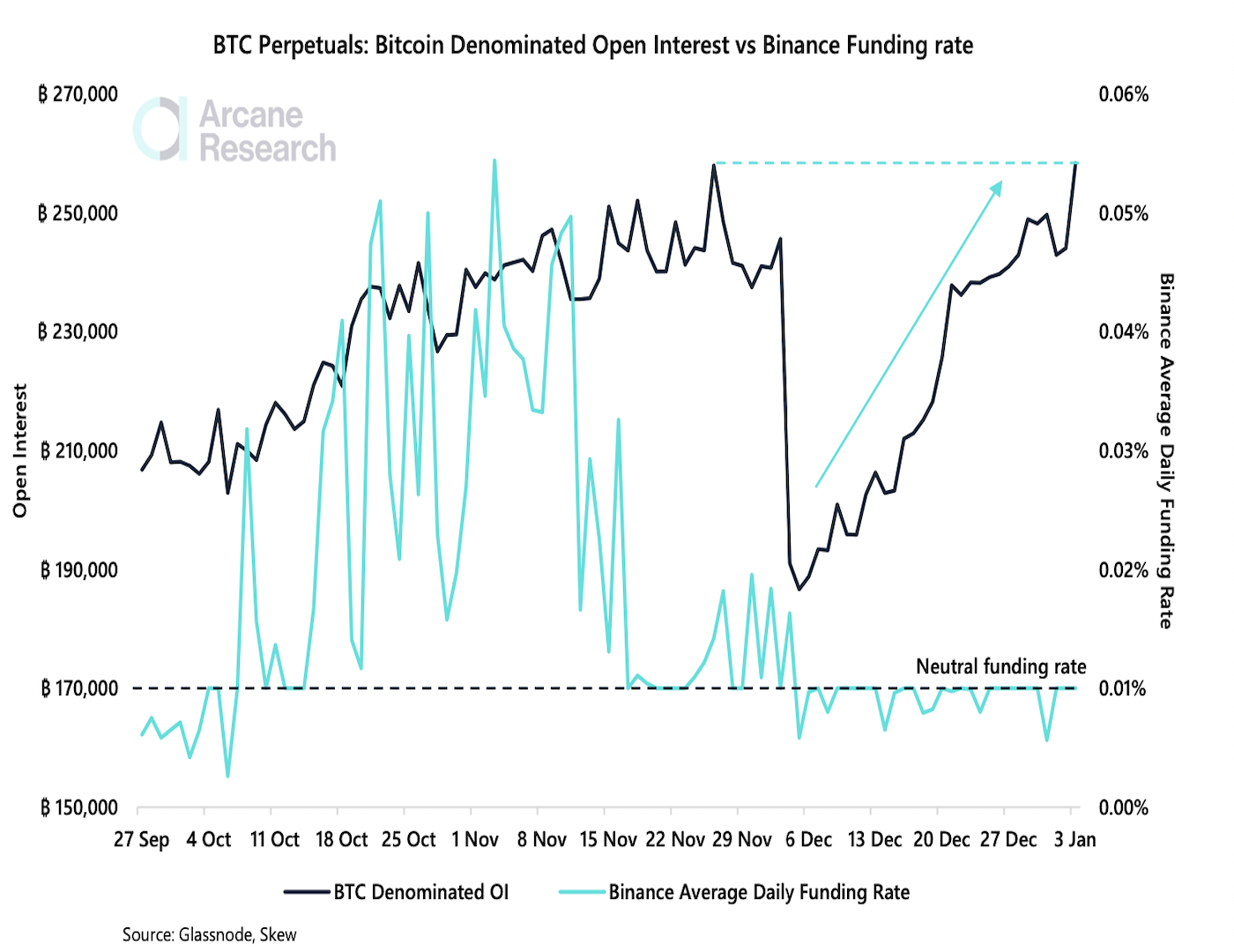

Further, the prevalent cautious temper successful the derivatives marketplace whitethorn portend a determination higher. “The neutral to somewhat beneath neutral backing rates seen precocious suggest that a abbreviated compression is simply a plausible scenario,” according to Arcane Research’s play enactment published connected Tuesday.

Funding rates refer to the outgo of holding agelong oregon abbreviated positions successful the futures perpetuals market. The mechanics helps support the terms of perpetuals oregon futures with nary expiry tethered to the spot price. Positive backing rates mean longs are paying shorts, portion antagonistic rates mean the opposite.

Since aboriginal December, the fig of unfastened positions connected Binance, the world’s largest cryptocurrency speech by trading measurement and unfastened interest, has accrued from 190,000 BTC to 258,000 BTC. Meanwhile, backing rates person been consistently neutral to negative, meaning investors person been predominantly holding shorts contempt bitcoin’s downside momentum moving retired of steam and the cryptocurrency consolidating successful the scope of $45,400-$52,100.

Chart showing a pickup successful BTC-denominated unfastened involvement and neutral-to-negative backing rates (Arcane Research, Glassnode)

A cautious oregon bearish temper aft notable sell-off and consolidation often leads to abbreviated compression and corrective rallies. Costs associated with holding shorts go an contented for the bears erstwhile the marketplace stops falling, frankincense forcing them to unwind their bearish bets. However, a compression higher whitethorn stay elusive if the macro representation turns bleak, arsenic discussed here.

Bitcoin was past seen trading adjacent $46,750, representing a 2% summation connected the day.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)