On-chain information from Glassnode shows the largest Bitcoin whales person been showing the other behaviour to what different investors person been doing.

Bitcoin Market Is Observing A Moderate Distribution Phase Currently

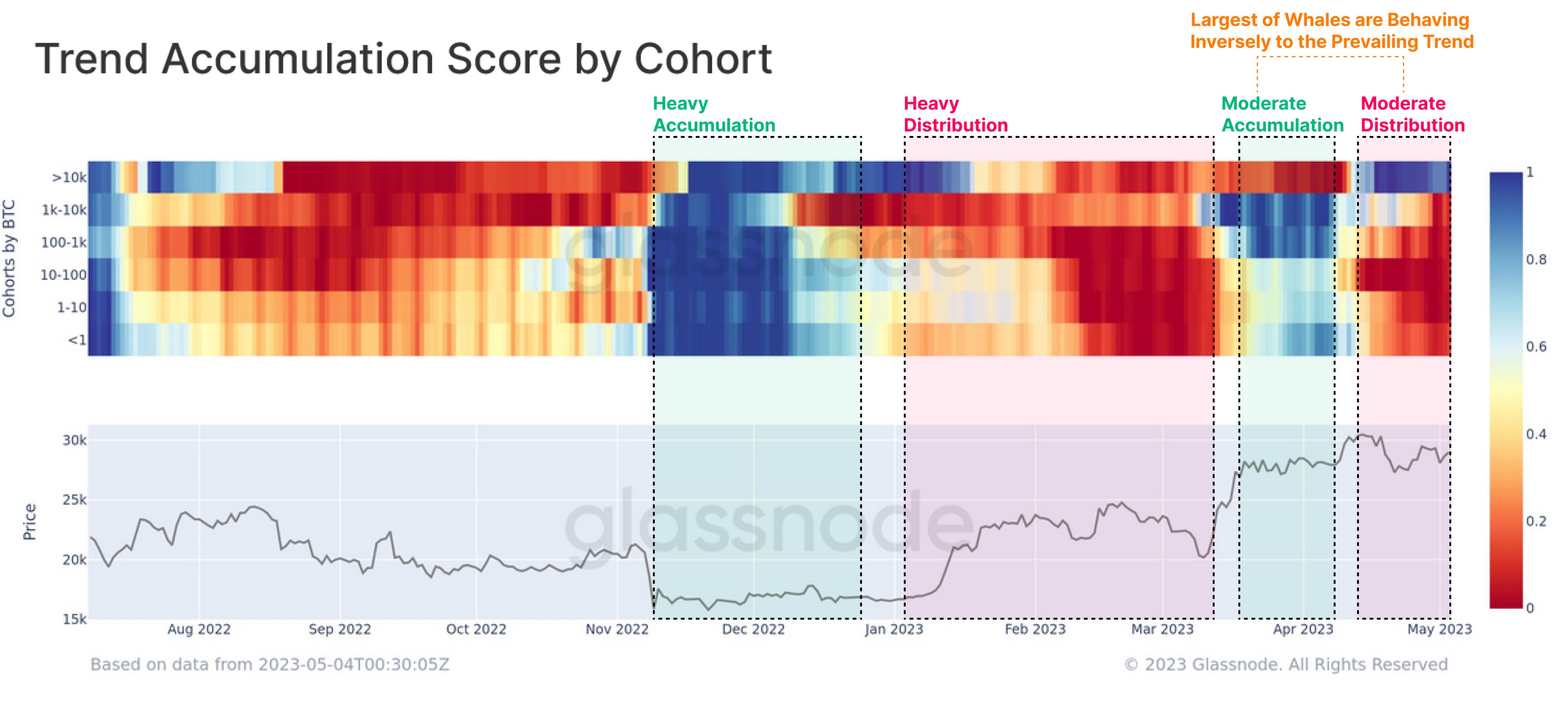

According to information from the on-chain analytics steadfast Glassnode, the behaviour of the largest BTC whales has erstwhile again deviated from the remainder of the market. The applicable indicator present is the “Trend Accumulation Score,” which tells america whether Bitcoin investors are buying oregon selling.

There are chiefly 2 factors that the metric accounts for to find this score: the equilibrium changes taking spot successful the holders’ wallets and the size of the investors making specified changes. This means that the larger the capitalist making a buying oregon selling move, the larger their weightage successful the Trend Accumulation Score.

When the worth of this metric is adjacent to 1, it means that the larger holders successful the assemblage are accumulating close present (or a immense fig of tiny investors are displaying this behavior). On the different hand, the indicator has a worth adjacent the zero people suggesting the investors are presently displaying a organisation trend.

This indicator is mostly defined for the full marketplace but tin besides beryllium utilized connected circumstantial capitalist segments. In the beneath chart, Glassnode has displayed the information for the Bitcoin Trend Accumulation Score of the assorted holder groups successful the market.

Here, the investors successful the marketplace person been divided into six antithetic cohorts based connected the magnitude of BTC that they are carrying successful their wallets: nether 1 BTC, 1 to 10 BTC, 10 to 100 BTC, 100 to 1,000 BTC, 1,000 to 10,000 BTC, and supra 10,000 BTC.

From the supra graph, it’s disposable that the Trend Accumulation Score for each these groups had a worth of astir 1 astatine the carnivore marketplace lows pursuing the November 2022 FTX crash, suggesting that the marketplace arsenic a full was participating successful immoderate dense buying backmost then.

This accumulation continued until the rally arrived successful January 2023, erstwhile the marketplace behaviour started shifting. The holders began distributing during this period, selling particularly heavy betwixt February and March. Following this crisp distribution, the rally mislaid steam, and the terms plunged beneath $20,000.

However, these investors erstwhile again started to accumulate arsenic the terms sharply recovered and the rally restarted. Though, this time, the accumulation was lone moderate.

Interestingly, portion the behaviour successful the marketplace had been much oregon little azygous successful the months starring up to this caller accumulation streak (meaning that each the groups had been buying oregon selling astatine the aforesaid time), this caller accumulation streak didn’t person the largest of the whales (above 10,000 BTC group) participating. Instead, these humongous investors were going done a signifier of distribution.

Since Bitcoin broke supra the $30,000 level successful the mediate of April 2023, the investors person again been selling, showing mean organisation behavior.

Like the accumulation signifier preceding this selling, the supra 10,000 BTC whales haven’t joined successful with the remainder of the market; they person alternatively been aggressively accumulating and expanding their wallets. These holders look to person decided to determination successful the other absorption of the wide market.

BTC Price

At the clip of writing, Bitcoin is trading astir $28,900, up 1% successful the past week.

Featured representation from Rémi Boudousquié connected Unsplash.com, charts from TradingView.com, Glassnode.com

2 years ago

2 years ago

English (US)

English (US)