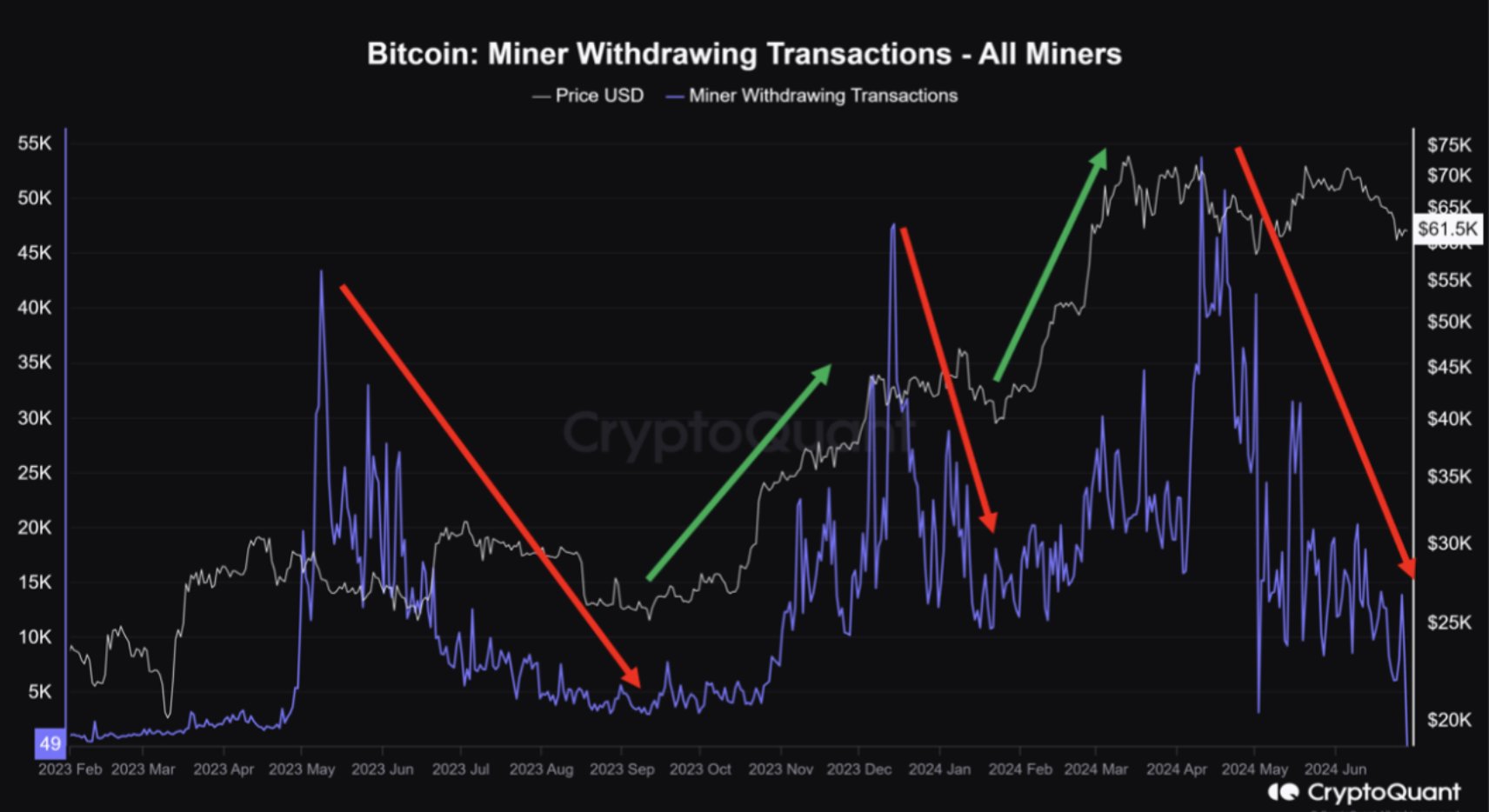

In an analysis provided by CryptoQuant, a important alteration successful Bitcoin miner behaviour has been noted, perchance indicating a turning point. CryptoQuant analyst, known arsenic Crypto Dan, outlined a simplification successful miners’ selling pressure, which has historically been a pivotal origin affecting Bitcoin’s terms trajectory.

Bitcoin Mining Selling Pressure Decreases

According to Crypto Dan, “Miners’ selling unit decreases. One of the whales that person caused the cryptocurrency marketplace to autumn precocious person been miners.” He explained that the BTC halving, which halved mining rewards, led to a alteration successful the usage of older, little businesslike mining rigs, subsequently reducing wide mining activity. This alteration forced miners to merchantability Bitcoin successful over-the-counter (OTC) transactions to prolong their operations.

The investigation suggests that the marketplace is presently absorbing the sell-off, with a notable diminution successful the measurement and frequence of Bitcoin being transferred retired of miners’ wallets. “The existent marketplace tin beryllium seen arsenic being successful the process of digesting this sell-off, and fortunately, the quantity and fig of Bitcoins miners are sending retired of their wallets has been rapidly decreasing recently,” Crypto Dan stated.

The implications of this displacement are significant. Crypto Dan added, “In different words, the selling unit of miners is weakening, and if each of their selling measurement is absorbed, a concern whitethorn beryllium created wherever the upward rally tin proceed again.” He projected optimism for the market, predicting affirmative movements successful the 3rd 4th of 2024.

Historical information from CryptoQuant corroborates the analysis. BTC has antecedently shown a akin signifier wherever miner selling enactment exerted a beardown power connected marketplace prices, peculiarly noted from May to September 2023 and from December 2023 to January 2024. During these periods, prolonged sideways question successful BTC prices was observed, aligning with peaks successful miner selling. Notably, erstwhile these selling activities diminished, Bitcoin prices resumed an upward trend.

Bitcoin miner withdrawing transactions | Source: CryptoQuant

Bitcoin miner withdrawing transactions | Source: CryptoQuantThis signifier suggests that the caller alteration successful miner selling could beryllium the precursor to different important bullish phase for Bitcoin, arsenic marketplace conditions look ripe for a akin reversal of fortunes.

Key Price Level For A Bullish Breakout

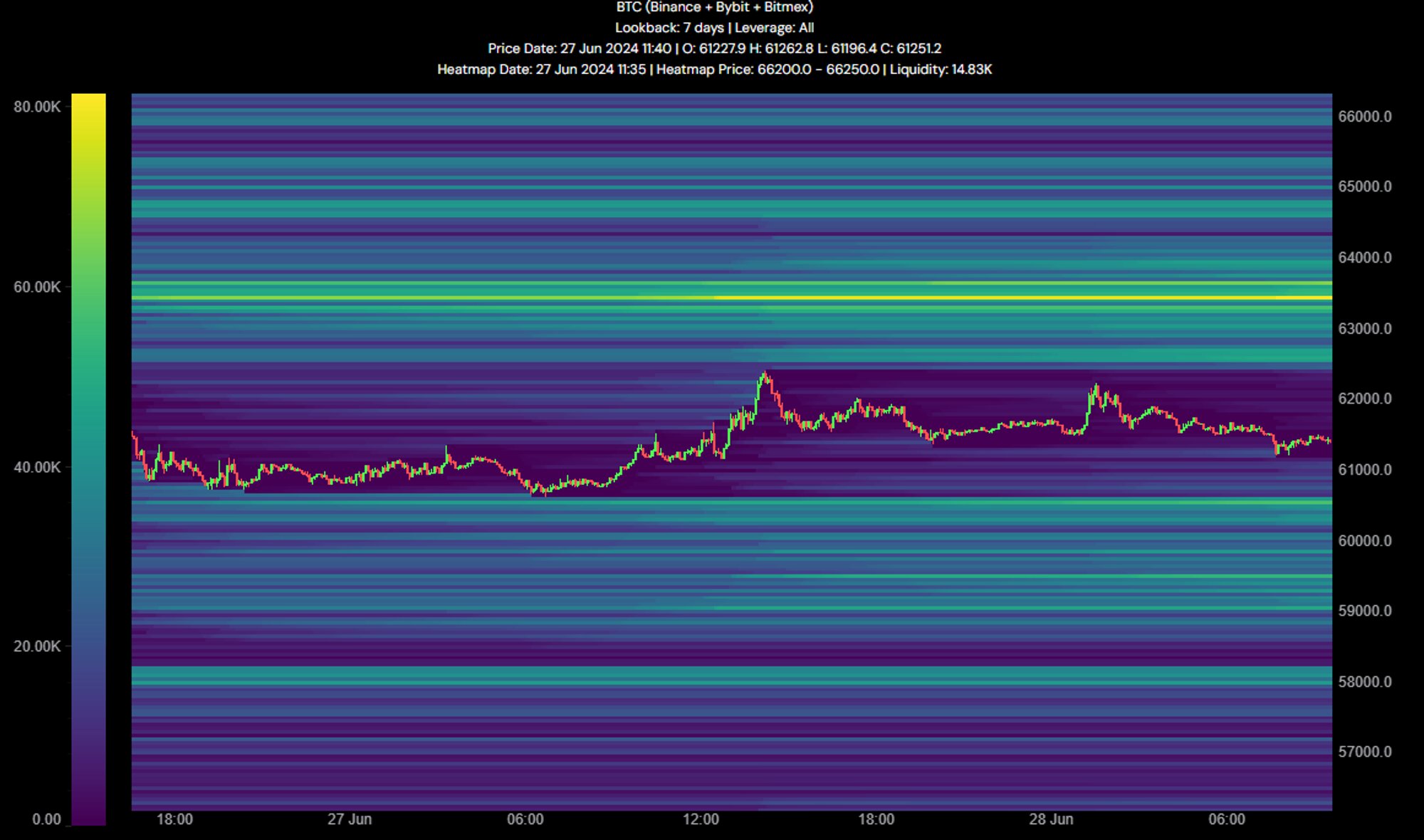

Further insights from method analysts astatine alpha dōjō supply a granular presumption of the marketplace conditions. Their regular update connected Bitcoin done X underscores the existent marketplace indecision, characterized by Bitcoin “chopping around” without wide directional movement. However, the analysts person identified captious terms levels which could bespeak aboriginal marketplace movements: “If BTC reclaims the $63.5k area, it would beryllium bullish; if it loses the $60k level, it would beryllium bearish.”

The method investigation besides reveals that the liquidity successful the Bitcoin marketplace is presently dispersed, with fewer important clusters of orders. The astir notable attraction of orders is astir the $63.5k level, suggesting that this terms constituent is pivotal for marketplace sentiment and imaginable bullish momentum.

BTC heatmap | Source: X @alphadojo_net

BTC heatmap | Source: X @alphadojo_netThe bid publication information provided by alpha dōjō highlights a existent dominance of merchantability orders, indicating a bearish sentiment among traders. Conversely, the bid broadside is described arsenic weak, with less bargain orders supporting upward terms movements. This imbalance suggests that the marketplace is presently cautious, perchance awaiting much definitive signals earlier committing to much important positions.

At property time, BTC traded astatine $61,704.

BTC trades supra $61,000, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC trades supra $61,000, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)