Bitcoin miners are selling their net to support up with the expanding operating costs. As the energy prices proceed to summation and Bitcoin follows its downtrend, miners can’t spend to HODL anymore.

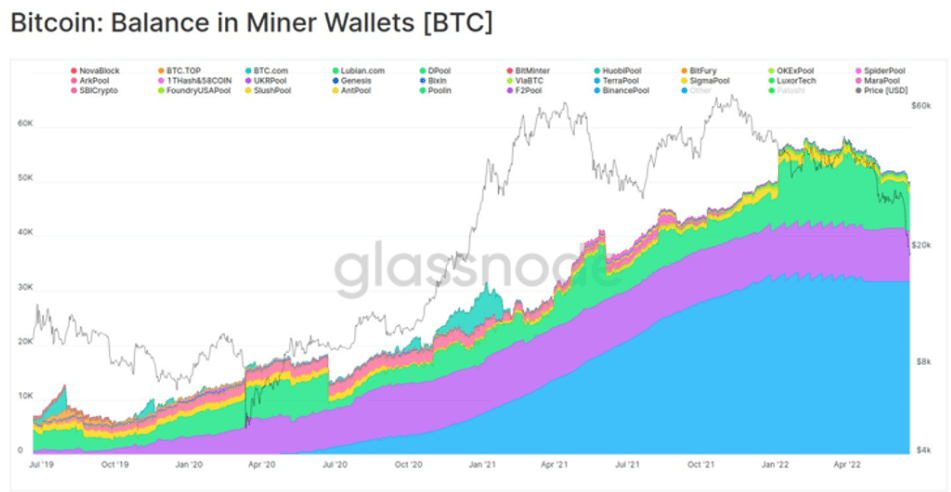

Bitcoin Miners’ Wallet Balances

Bitcoin Miners’ Wallet BalancesThe sell-off inclination started successful aboriginal 2022, arsenic the supra illustration demonstrates. At the time, experts commented that the miners sold their net due to the fact that they expected Bitcoin to proceed falling.

They were right. When Bitcoin deed its 18-month-lowest connected June 14, mining instrumentality manufactured earlier 2019 lost profitability. At the clip of writing, Bitcoin is traded for astir $20,170, which is astir the minimum profitability terms for a 2021 exemplary Antminer S19j.

Unable to HODL

Arcane Research’s data indicates that nationalist Bitcoin miners person astir 900 Bitcoins connected a regular basis. They thin to clasp arsenic overmuch arsenic imaginable and go immoderate of the largest whales connected the market.

However, the expanding vigor costs and decreasing Bitcoin prices enactment nationalist miners successful a pugnacious spot.

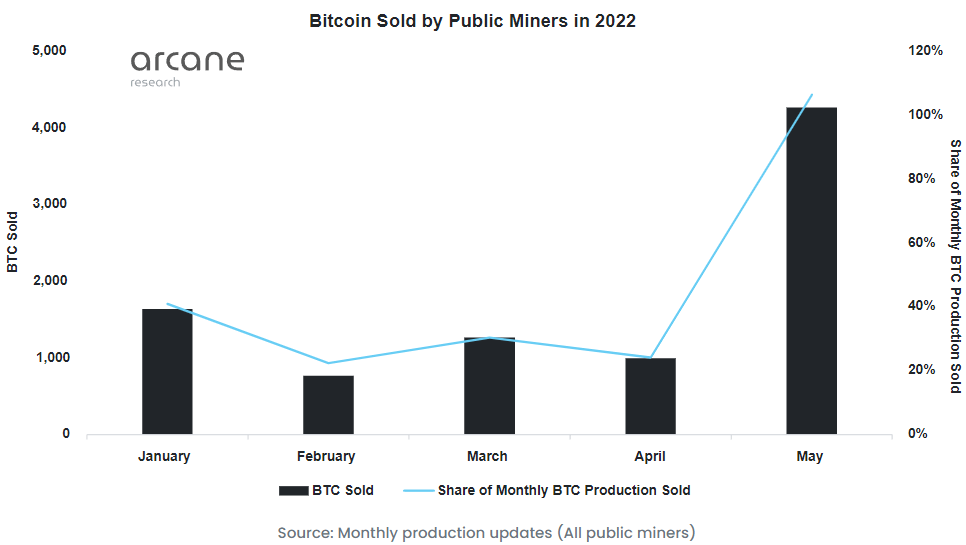

Bitcoin Sold by Public Miners

Bitcoin Sold by Public MinersAccording to the numbers, nationalist mining companies sold 30% of their Bitcoin productions during the archetypal 4 months of 2022.

Digital plus broker GlobalBlock expert Marcus Sotiriou commented connected the sell-off inclination and said that the main crushed for the merchantability was:

“due to profitability decreasing with expanding energy prices, truthful they are forced to liquidate immoderate if their Bitcoin to screen operating costs.”

Another Glassnode expert pointed retired that different miners person been sellers arsenic well. He said:

“Miners’ balances person stagnated from the 2019-21 accumulation uptrend and reversed into decline. Miners’ person spent astir 9k $BTC from their treasuries past week, down from astir 60k $BTC,”

The sell-off was expected

Despite the gravity of the information pointing retired a sell-off trend, experts enactment that this is usually however miners behave during the carnivore markets.

Miners thin to accumulate successful bull markets and merchantability during carnivore to screen involvement payments oregon wage for higher costs. For example, successful the past carnivore marketplace successful November 2018, miners sold a sizeable magnitude of their coins portion Bitcoin was falling.

The station Bitcoin miners are forced to merchantability to screen operating costs appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)