Crypto miners are starting the caller twelvemonth by expanding their accumulation of bitcoin, according to on-chain analytics steadfast Glassnode’s data. Amid the caller crisp driblet successful bitcoin prices, however, immoderate miners mightiness beryllium forced to monetize their mined bitcoins.

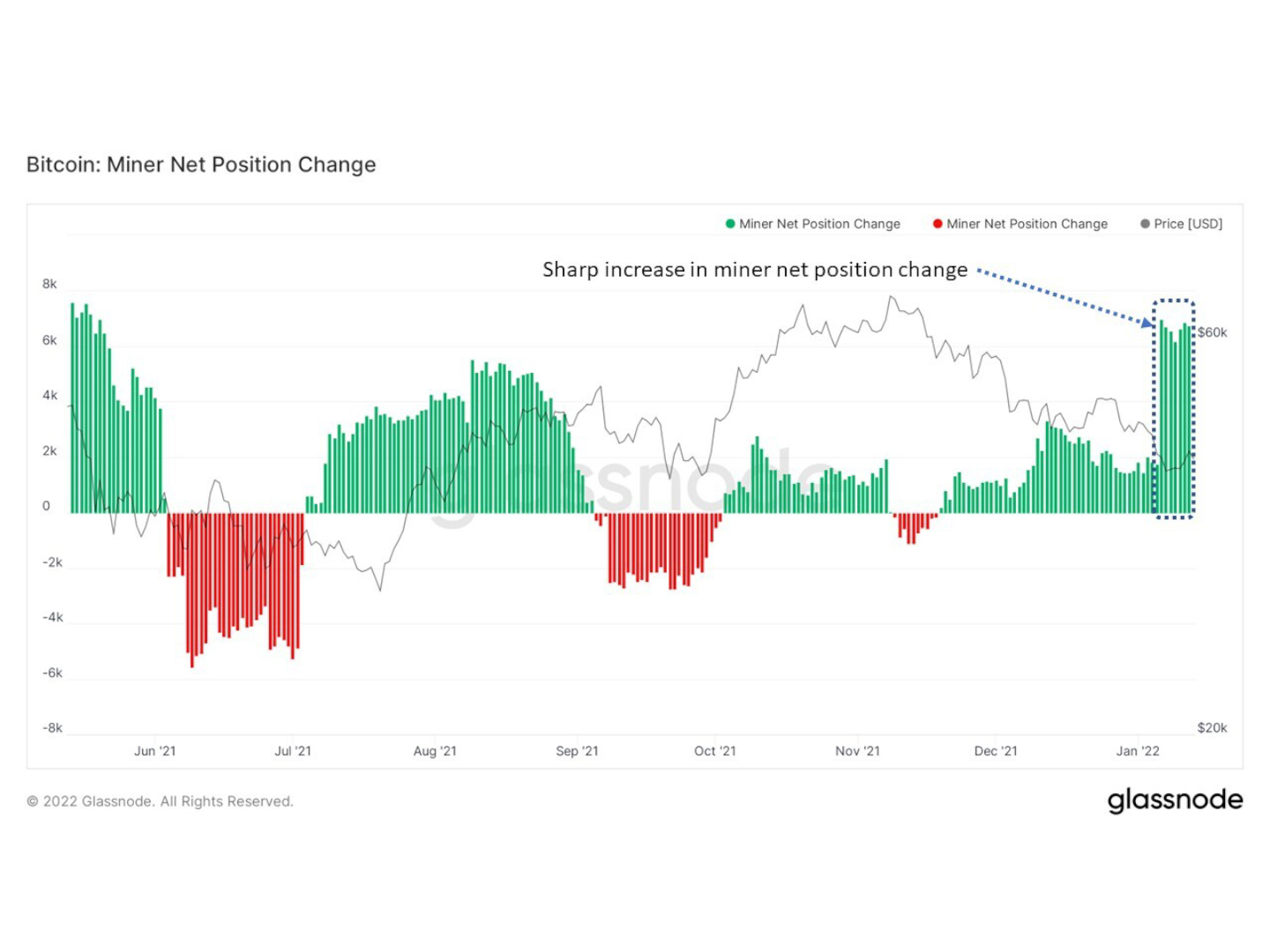

The “miner nett presumption change,” which tracks the 30-day alteration successful the nett buying and selling enactment successful the miners’ addresses, has seen a ample affirmative alteration since Jan. 6 and has been carried implicit good into the 2nd week of January, portion astatine the aforesaid clip the bitcoin terms tumbled to astir $40,000.

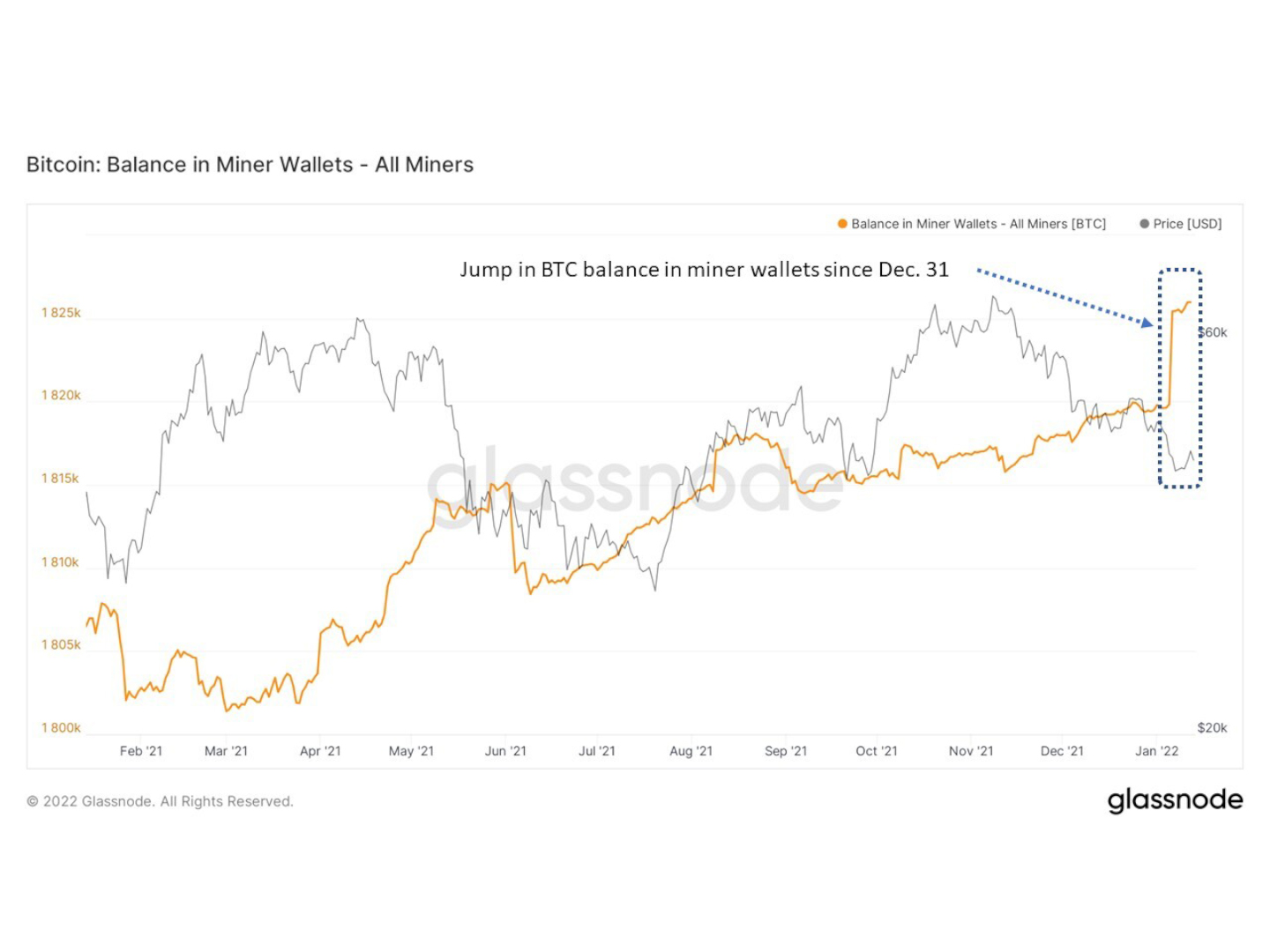

After the ample spike successful supplies held successful miners’ wallets, the equilibrium held successful miner wallets has accrued by astir 6,474 bitcoins to astir 1.826 million, arsenic of Tuesday, versus 1.82 cardinal successful Dec. 31, Glassnode's information shows. Miners’ wallets whitethorn see different sources of bitcoin inflow, alternatively than conscionable mined coins per day.

“We expect this inclination of miners holding connected to their bitcoin rewards is apt a effect of them being prudent with their finances by holding their crypto until prices rise,” said Danni Zheng, concern manager astatine BIT Mining. “We ideate different miners similar america volition hold to strategically merchantability our bitcoin holdings successful bid to fastener successful optimal returns."

Furthermore, different metric that points to akin holding patterns by the miners has besides reached an all-time high. The “miner unspent supply,” oregon the full fig of coins that are rewarded to miners for solving a artifact but person ne'er been moved on-chain, reached a grounds 1.779 cardinal connected Tuesday, according to Glassnode data.

"As the terms of bitcoin falls further, the miner unspent proviso is expanding and the miner nett presumption alteration is becoming much positive,” said Marcus Sotiriou, an expert astatine the U.K.-based integer plus broker GlobalBlock. This indicates that bitcoin arsenic an plus is becoming much scarce arsenic miners are choosing to clasp onto their mined coins alternatively than merchantability them, Sotiriou added.

In 2021, erstwhile bitcoin rallied to deed all-time highs and the full web hashrate was comparatively low, holding onto the mined integer currency connected their equilibrium expanse paid disconnected for miners. The dense leverage to bitcoin helped the shares of the publically traded miners to thrust the upswing successful bitcoin prices and provided entree to the superior markets for miners large and small.

“The hodl strategy paid disconnected successful 2021 arsenic miners were rewarded for a dense allocation to bitcoin successful their treasury management,” said Ethan Vera, main operating serviceman of Seattle-based mining institution Luxor. And the inclination is continuing this twelvemonth arsenic galore miners are inactive being seen arsenic a proxy for bitcoin successful nationalist markets, fixed determination is simply a hold successful a spot bitcoin exchange-traded money getting regulatory support successful the U.S., helium added.

With ample entree to backing and investors pouring successful money, miners didn’t person to merchantability their bitcoin to money operational costs, said Compass Mining’s CEO Whit Gibbs. “And since miners are incredibly bullish connected bitcoin, this allows them to bash what they privation to bash naturally, which is to speculate connected bitcoin’s affirmative terms appreciation,” helium added.

“Many miners are holding onto mined BTC with the anticipation that the terms volition recover,” said Juri Bulovic, caput of mining astatine Foundry. However, “given the caller dip successful terms and sluggish commencement to 2022, immoderate volition present person to merchantability much mined BTC than antecedently to screen their monthly costs,” helium added.

However, utilizing immoderate of the mined crypto currency to reinvest successful the company’s concern could yet extremity up helping the miners arsenic it mightiness alteration them to money their maturation without offering much shares oregon expanding indebtedness load. “The downside of 100% hodling is that operating expenses indispensable past beryllium financed done indebtedness oregon dilution,” said Matthew Schultz, enforcement president of CleanSpark.

“We proceed to spot the worth successful utilizing BTC to enactment operating expenses and growth, arsenic good arsenic a preferred store of worth compared to USD,” helium added.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)