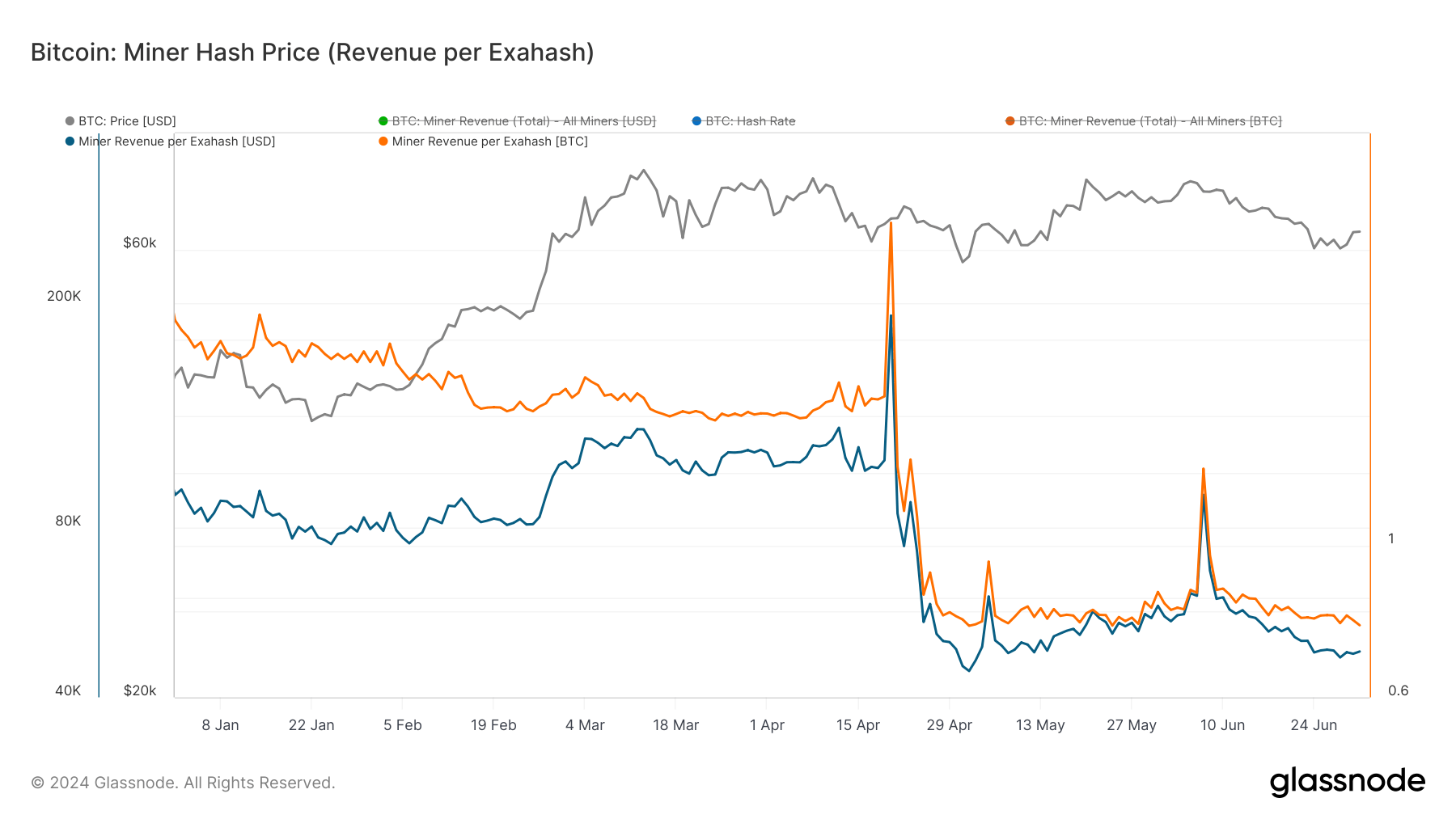

Miner revenue per exahash measures miners’ regular income comparative to their publication to the network’s hash rate, showing however overmuch miners gain per portion of computational powerfulness they contribute. This metric is important due to the fact that it reflects the profitability and economical viability of Bitcoin mining, straight influencing decisions connected assets allocation, investment, and operational strategies. Given the size of the Bitcoin mining assemblage and the show of nationalist mining companies, these metrics go adjacent much significant.

Since Bitcoin’s 4th halving connected April 20, miner gross per exahash has declined steeply. While this diminution was anticipated and miners person been preparing for it, it caused important economical unit for miners. Initially, connected April 20, the miner gross per exahash was $190,620 oregon 2.96 BTC. However, by May 2, it had plummeted to an all-time debased of $44,538 oregon 0.76 BTC.

Graph showing the full USD (blue) and BTC (orange) denominated miner gross per exahash from Jan. 1 to July 1, 2024 (Source: Glassnode)

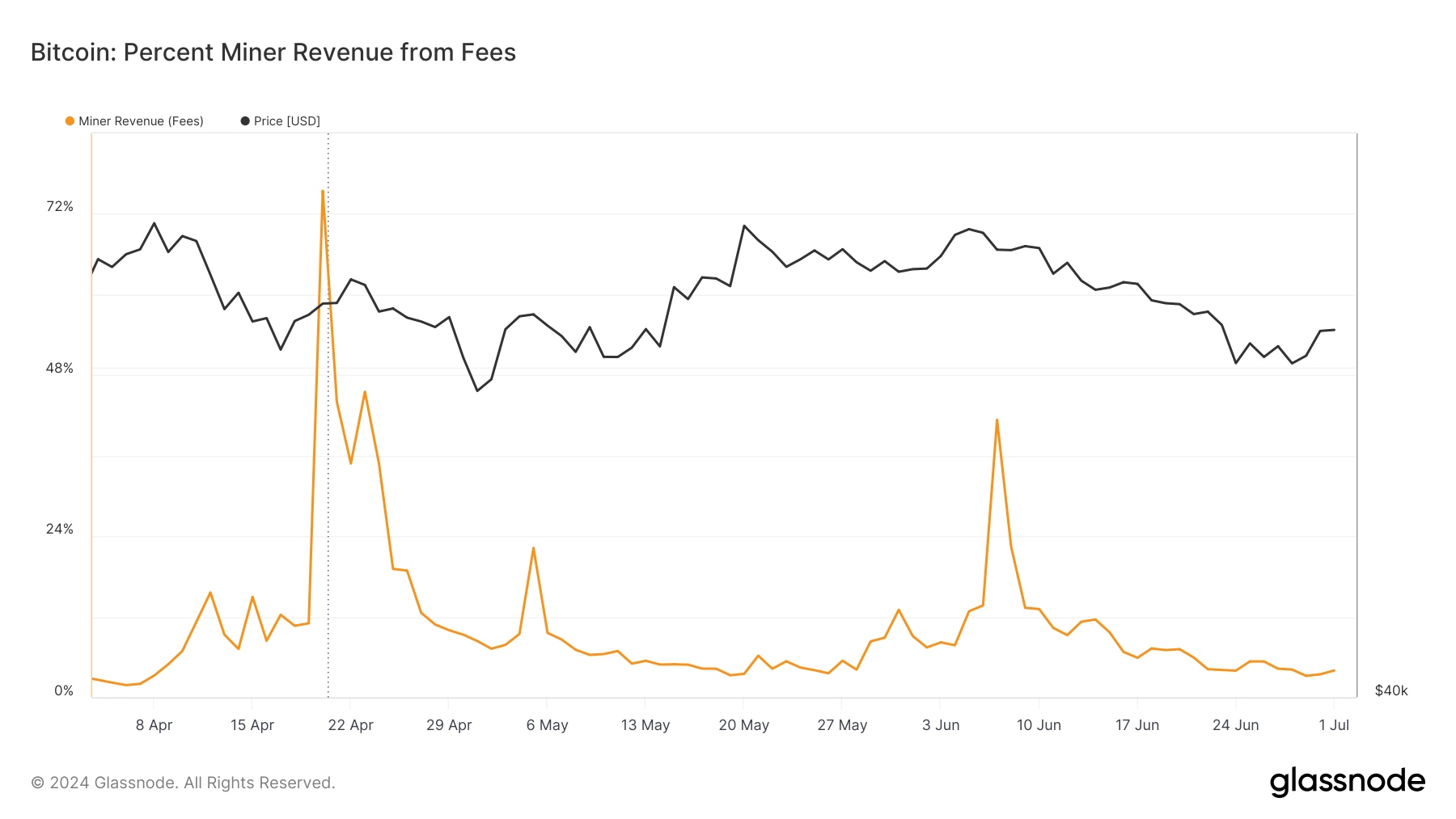

Graph showing the full USD (blue) and BTC (orange) denominated miner gross per exahash from Jan. 1 to July 1, 2024 (Source: Glassnode)Glassnode’s information showed a little gross betterment peaking connected June 7 with $91,774 oregon 1.29 BTC per exahash. This impermanent summation was driven by a important surge successful transaction fees owed to web congestion, with fees comprising 41.335% of miner gross connected that day, a important emergence from conscionable 7% 3 days earlier. This highest shows the occasional spikes successful miner gross owed to web enactment and highlights the value of transaction fees arsenic a supplementary income watercourse for miners, importantly erstwhile artifact rewards diminish.

Graph showing the percent of miner gross derived from fees from Apr. 4 to July 1, 2024 (Source: Glassnode)

Graph showing the percent of miner gross derived from fees from Apr. 4 to July 1, 2024 (Source: Glassnode)As of July 1, miner gross per exahash stands astatine $48,230 oregon 0.76 BTC, indicating a little stabilization level than pre-halving figures. This prolonged play of reduced gross poses challenges for miners, peculiarly those with higher operational costs oregon little businesslike hardware.

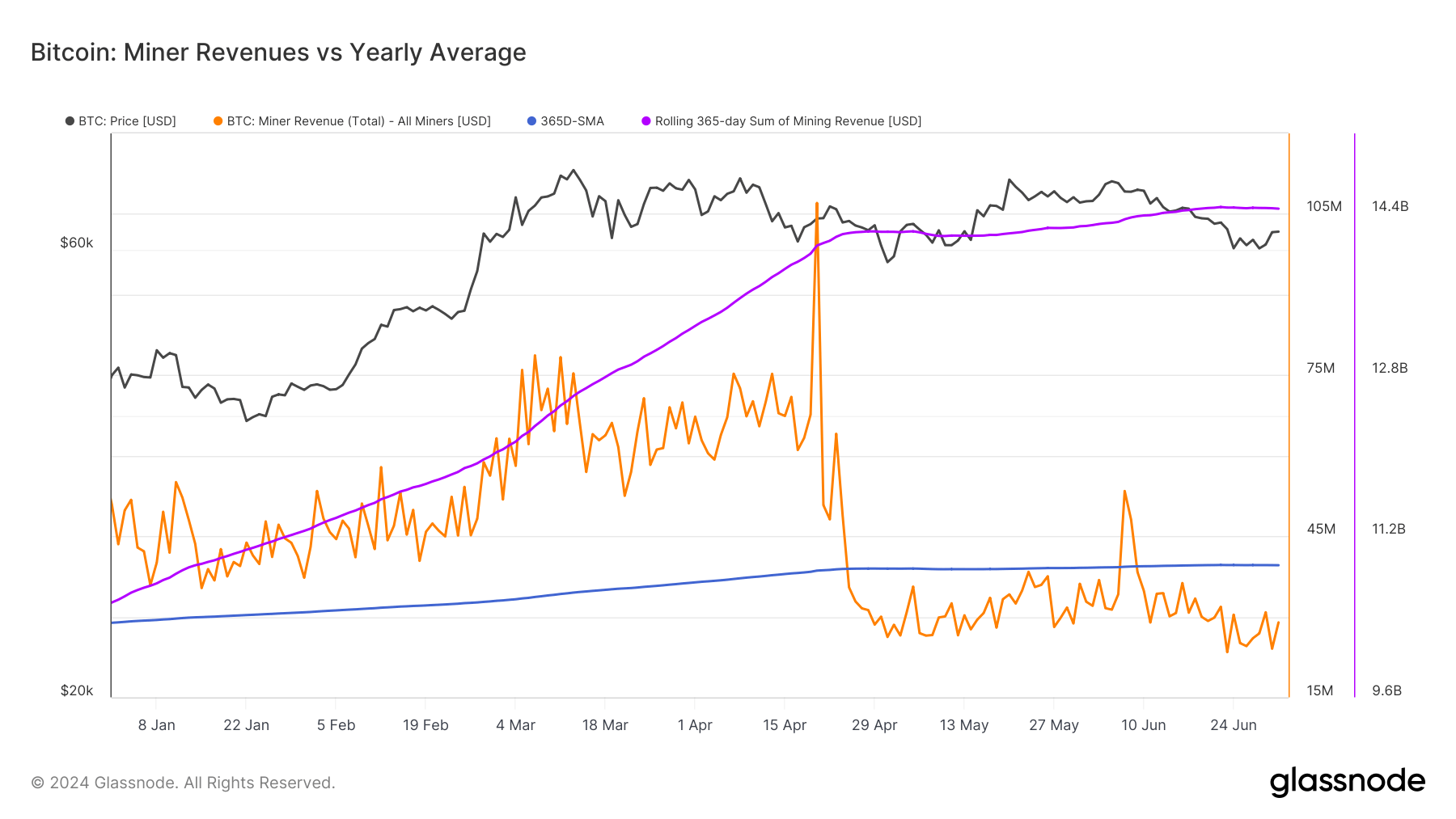

In comparing miner gross against the yearly average, we spot that full regular USD gross paid to Bitcoin miners has remained beneath the 365-day elemental moving mean since April 25, but for the spike connected June 7. This important inclination marks a departure from the erstwhile 15 months, wherever miner gross mostly exceeded the yearly average. Sustained gross beneath the yearly mean suggests a play of reduced profitability for miners, which could pb to broader implications for the mining manufacture and the Bitcoin network.

Graph showing the yearly mean (blue) and full regular USD gross paid to miners from Jan. 1 to July 1, 2024 (Source: Glassnode)

Graph showing the yearly mean (blue) and full regular USD gross paid to miners from Jan. 1 to July 1, 2024 (Source: Glassnode)The driblet successful gross comparative to the yearly mean highlights accrued volatility and the imaginable for fiscal strain connected miners. In effect to these economical pressures, Bitcoin miners person been undertaking assorted strategies to mitigate the interaction of reduced revenues. CleanSpark’s acquisition of GRIID Infrastructure for $155 cardinal shows companies are consolidating to leverage economies of scale. Bitdeer’s announcement of a 570 MW enlargement successful Ohio demonstrates the aforesaid strategical approach: expanding operational capableness to heighten wide output and mitigate the effects of little gross per portion of hash power.

Marathon’s diversification into mining altcoins similar Kaspa is different illustration of miners seeking alternate gross streams. By not solely relying connected Bitcoin, Marathon Digital is hedging against Bitcoin-specific marketplace risks and broadening its gross base. Core Scientific signed a $3.5 cardinal woody with CoreWeave to diversify beyond Bitcoin mining into AI-related activities, showcasing different displacement successful strategy.

The marginal driblet successful Bitcoin mining trouble shows that respective miners find it challenging to stay operational. This trouble accommodation could assistance rebalance the network, allowing remaining miners to payment from somewhat reduced contention and perchance higher revenues if the Bitcoin terms oregon transaction fees increase.

However, the assurance successful the mining assemblage lone seems to grow. US-listed Bitcoin miners saw a monolithic surge successful banal terms implicit the past week, reaching a record marketplace capitalization of $22.8 billion. This indicates investors are optimistic astir the semipermanent prospects of Bitcoin mining companies, apt owed to their strategical adaptations and the imaginable for aboriginal gross maturation arsenic web congestion and transaction fees fluctuate.

The station Bitcoin miners diversify and consolidate to past gross drop appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)