Cipher Mining and Stronghold Digital started the caller twelvemonth by announcing important expansions successful their Bitcoin mining capabilities, scaling up operations successful effect to changing marketplace dynamics. These developments travel arsenic Bitcoin miners accommodate to an evolving scenery wherever transaction fees, bolstered by caller technologies similar Inscriptions, are progressively captious successful gross generation.

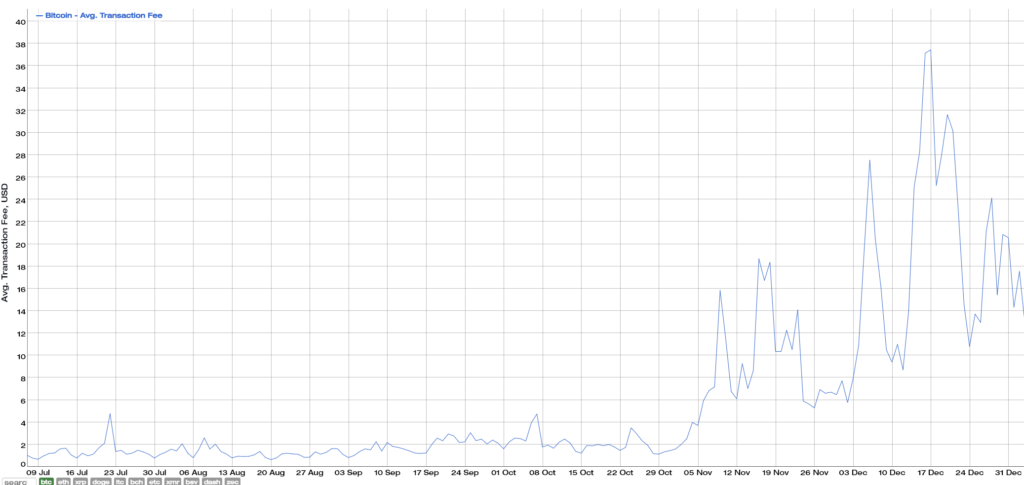

Bitcoin transaction fees peaked astatine astir $40 successful mid-December, starring to accrued gross for miners, indicating a imaginable haven up of the 2024 halving.

Bitcoin transaction fees (Source: Bitinfocharts)

Bitcoin transaction fees (Source: Bitinfocharts)Bitcoin miners gain gross successful 2 superior ways: by generating caller Bitcoin done mining and by collecting transaction fees from processing transactions connected the Bitcoin network. As the Bitcoin protocol is designed to halve the mining reward astatine circumstantial intervals, the value of transaction fees arsenic a root of gross for miners increases implicit time.

When transaction fees increase, this straight boosts miners’ income. For instance, precocious transaction fees person led to important gains for Bitcoin miners. A caller surge successful transaction fees has been driven by accrued web activity, specified arsenic the popularity of Ordinals Bitcoin Inscriptions.

The summation successful transaction fees is simply a effect to web congestion. As the Bitcoin web becomes much congested with accrued mempool size bloat owed to the size and measurement of Ordinals, users are consenting to wage higher fees to guarantee their transactions are processed and confirmed promptly. This dynamic creates a marketplace wherever miners tin prioritize transactions with higher fees, thereby expanding their earnings.

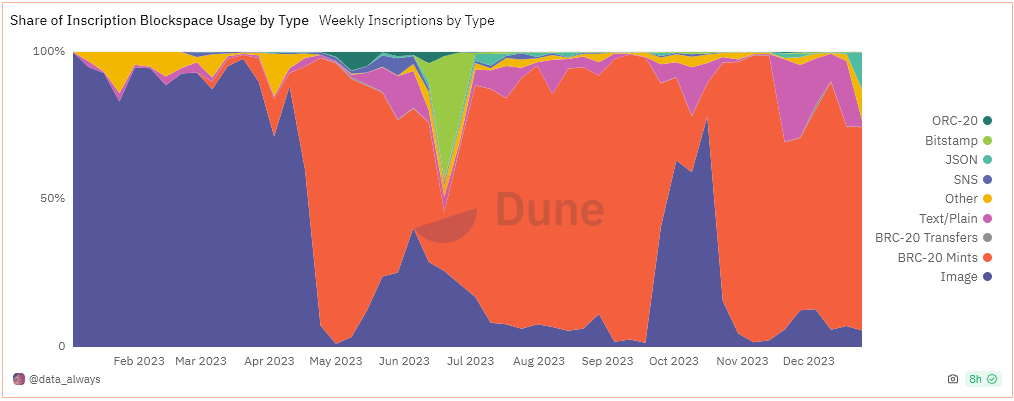

The illustration beneath shows the stock of blockspace taken up by each information benignant for Inscriptions, indicating BRC-20 tokens surpassed images astir May 2023. BRC-20 tokens use, connected average, 60 bytes of abstraction compared to betwixt 300 bytes to 15kb utilized by images.

In the agelong term, arsenic the mining reward continues to diminish, transaction fees are expected to go an progressively important root of gross for miners. This displacement is anticipated to guarantee the semipermanent economical viability and information of the Bitcoin network.

In the agelong term, arsenic the mining reward continues to diminish, transaction fees are expected to go an progressively important root of gross for miners. This displacement is anticipated to guarantee the semipermanent economical viability and information of the Bitcoin network.

Cipher and Stronghold caller miner acquisition.

Cipher Mining Inc. revealed plans for a 60 MW enlargement astatine its Bear and Chief Joint Venture Data Centers, coupled with purchasing 16,700 caller Avalon A1466 miners from Canaan. This increase, slated for the 2nd 4th of 2024, is acceptable to heighten Cipher’s self-mining capableness to astir 8.4 EH/s. Tyler Page, CEO of Cipher, emphasized the value of this enlargement for the company’s growth, peculiarly arsenic the manufacture approaches the Bitcoin halving lawsuit successful 2024. leafage confirmed,

“We look guardant to adding different 2.5 EH/s of their machines to our associated task information centers successful Texas with this purchase.”

Stronghold Digital Mining Inc. besides announced its acquisition of 5,000 Bitcoin miners, aiming to adhd astir 1 EH/s to its mining capability. The further miners volition beryllium a premix of Bitmain, MicroBT, and Caanan miners, including 2,800 Bitmain S19K Pro miners, 1,100 MicroBT Whastminer M50 miners, and 1,100 Avalon A1346 miners. These miners, boasting a hash complaint capableness of astir 600 PH/s and an ratio of 25 J/T, are expected to beryllium operational this month. Stronghold’s caller update highlighted a 2% sequential summation successful Bitcoin-equivalent accumulation for Dec. 2023, indicating the company’s beardown show amid fluctuating marketplace conditions.

Singapore-based Canaan notably played a pivotal relation successful these expansions, with caller orders totaling implicit 17,000 Bitcoin mining machines, highlighting Canaan’s increasing power alongside rivals Bitmain and MicroBT. Nangeng Zhang, CEO of Canaan, expressed enthusiasm for these partnerships, stating,

“The Canaan machines we purchased past twelvemonth are among the top-performing rigs successful our fleet, particularly successful the blistery summertime months successful Texas.”

Risk-reward of transaction interest reliance.

While these strategical expansions by Cipher and Stronghold travel erstwhile emerging technologies similar Inscriptions reshape Bitcoin miner revenue, determination is nary certainty that fees volition proceed astatine this level. A caller CryptoSlate Alpha Insight revealed a surge successful transaction fees successful 2023, which contributed importantly to the gross streams of miners. With the upcoming Bitcoin halving, wherever artifact rewards are acceptable to beryllium halved, miners whitethorn progressively trust connected transaction fees arsenic a cardinal gross source.

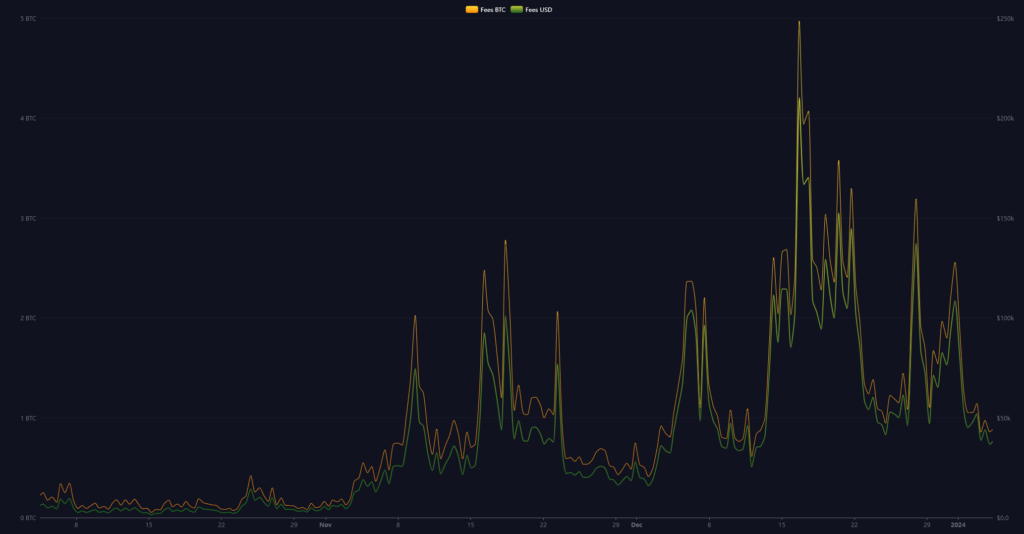

However, arsenic the illustration beneath shows, artifact fees peaked astatine astir $250,000 connected Dec. 16 and person since retraced to an mean of $38,000. While this is inactive notably higher than the mean of $4,700 successful Nov. 2023, Bitcoin miners whitethorn present beryllium gambling that Inscriptions proceed gaining traction to offset the imminent halving.

Bitcoin artifact fees (Source: mempool.space)

Bitcoin artifact fees (Source: mempool.space)This displacement represents a important translation successful the mining industry, wherever technological advancements and marketplace conditions continuously redefine gross models and operational strategies.

The station Bitcoin miners summation capableness though Inscription-fueled transaction interest surge cools up of halving appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)