Bitcoin’s caller surge past $34,000 has been a important lawsuit successful the cryptocurrency market. Monitoring miner behaviour and metrics is paramount erstwhile analyzing the Bitcoin market, arsenic miners play a foundational relation successful web security, transaction validation, and caller Bitcoin issuance. Their actions and decisions tin connection insights into marketplace trends, aboriginal terms movements, and wide web health.

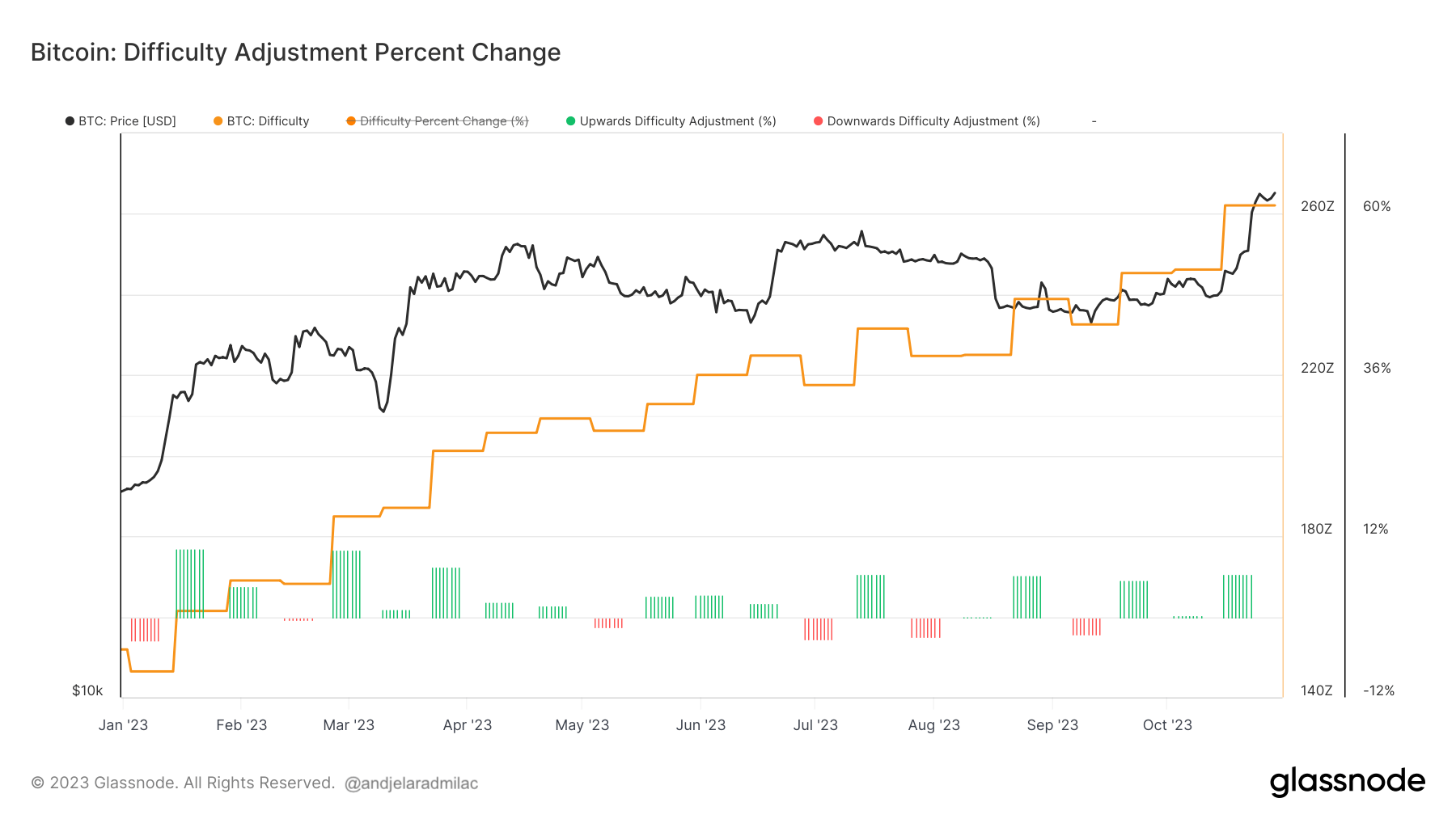

Between October 15 and 16, the mining trouble of Bitcoin increased by 6.47%. This adjustment, which occurred arsenic Bitcoin surpassed $28,000, reflects the network’s self-regulating mechanics to support accordant artifact times. As the terms rose, it’s apt much miners were incentivized to articulation the network, escalating the competition. Consequently, portion the accrued terms means rewards successful USD worth are higher, the intensified contention mightiness marque obtaining Bitcoin somewhat much challenging.

Graph showing the Bitcoin mining trouble accommodation percent alteration successful 2023 (Source: Glassnode)

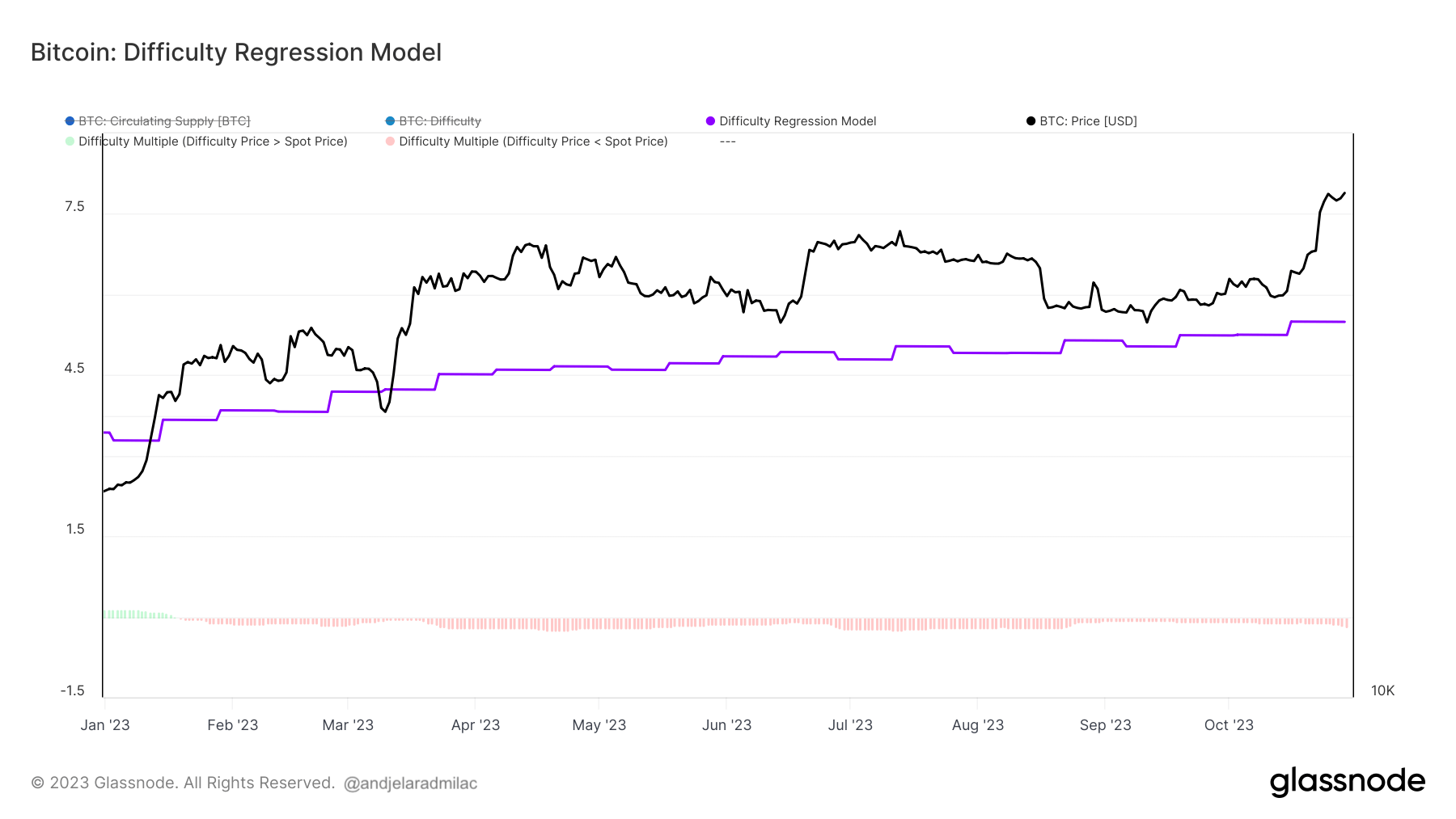

Graph showing the Bitcoin mining trouble accommodation percent alteration successful 2023 (Source: Glassnode)The trouble regression exemplary provides further clarity connected the mining landscape. It represents the estimated outgo of producing a Bitcoin. On October 15, this outgo was $24,370, which modestly accrued to $25,169 by October 29. This metric is important arsenic it offers an knowing of the profitability scenery for miners. The increasing disparity betwixt the accumulation outgo and marketplace terms suggests a favorable nett margin, which could successful turn, gully much participants to mining, augmenting the network’s wide security.

Graph showing the Bitcoin mining trouble regression model, i.e. an estimated all-in-sustaining-cost of accumulation for Bitcoin successful 2023 (Source: Glassnode)

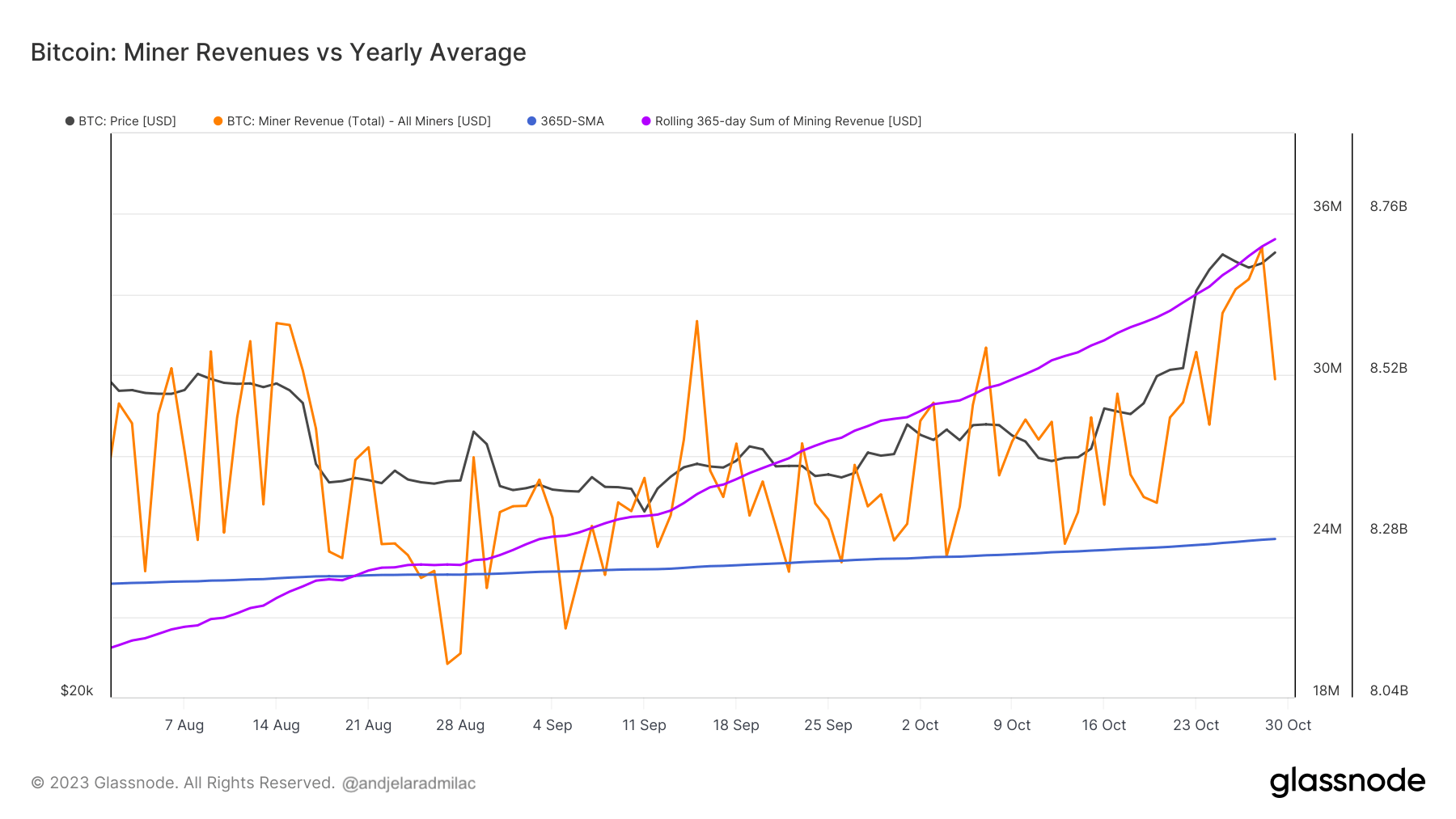

Graph showing the Bitcoin mining trouble regression model, i.e. an estimated all-in-sustaining-cost of accumulation for Bitcoin successful 2023 (Source: Glassnode)Miner revenue, different pivotal metric, underwent a important alteration successful October. As Bitcoin’s terms escalated, truthful did the gross for miners. The 365-day rolling sum of miner revenue, a broad measurement of their yearly earnings, surpassed its 365-day elemental moving mean connected September 9, and by October 29, it stood astatine a important $8.7 billion. This indicates a accordant and robust gross watercourse for miners, which tin beryllium interpreted arsenic a play of heightened enactment and profitability.

Graph comparing regular mining gross (orange) to the 365-day rolling sum (purple) and 365-day SMA of mining gross (blue) from Aug. 2 to Oct. 30, 2023 (Source: Glassnode)

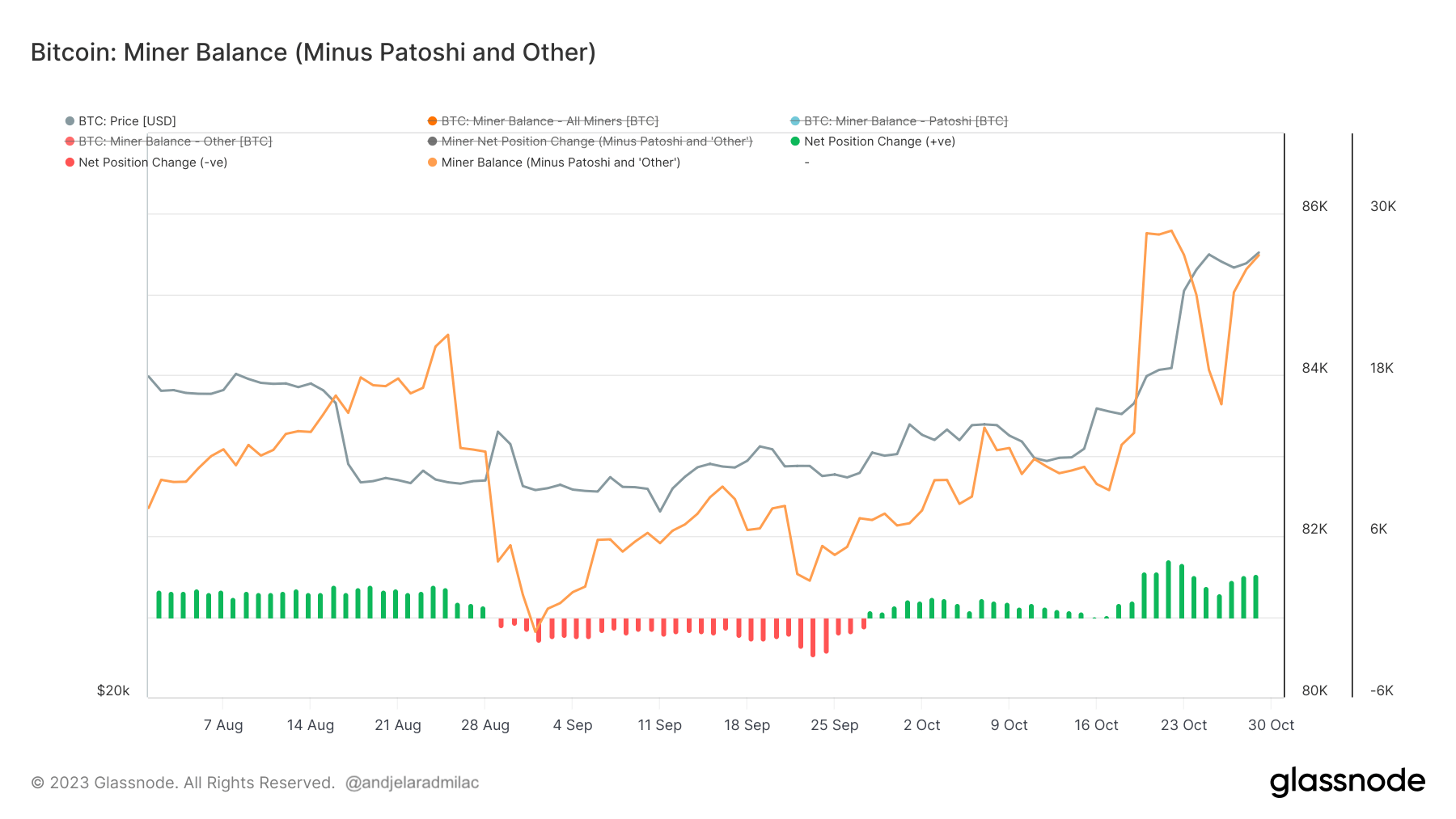

Graph comparing regular mining gross (orange) to the 365-day rolling sum (purple) and 365-day SMA of mining gross (blue) from Aug. 2 to Oct. 30, 2023 (Source: Glassnode)Lastly, the miner equilibrium metric offers a model into miner sentiment and strategy. Excluding the Patoshi pattern, the equilibrium roseate from 82,800 BTC connected October 15 to 85,500 BTC by October 23. Interestingly, aft Bitcoin’s terms exceeded $30,000, determination was a alteration of astir 2,000 BTC successful this balance, suggesting immoderate miners capitalized connected the precocious prices. However, consequent accumulation indicates a imaginable semipermanent bullish sentiment among miners, arsenic they look to expect further terms appreciation.

Graph showing the Bitcoin equilibrium held and the 30-day nett presumption alteration for miners excluding Patoshi from Aug. 2 to Oct. 30, 2023 (Source: Glassnode)

Graph showing the Bitcoin equilibrium held and the 30-day nett presumption alteration for miners excluding Patoshi from Aug. 2 to Oct. 30, 2023 (Source: Glassnode)In conclusion, erstwhile analyzed collectively, these metrics hint astatine a dynamic yet profitable situation for Bitcoin miners. The accrued trouble signifies a unafraid and robust network, the rising accumulation outgo against a surging marketplace terms indicates steadfast profitability, the elevated gross underscores sustained miner activity, and the evolving balances suggest strategical decision-making among miners. All these factors, taken together, bespeak a marketplace that is some competitory and optimistic.

The station Bitcoin miners navigate expanding trouble for higher rewards appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)