According to a caller Clear Street report, Bitcoin miners are pursuing output strategies for their BTC holdings and diversifying into AI compute.

The report, titled ‘BTC Mining: 2025’s Key Themes Emerge,‘ outlines 3 themes for 2025: generating gross connected bitcoin reserves, leveraging existing infrastructure for HPC initiatives, and benefiting from a displacement successful US regulatory leadership.

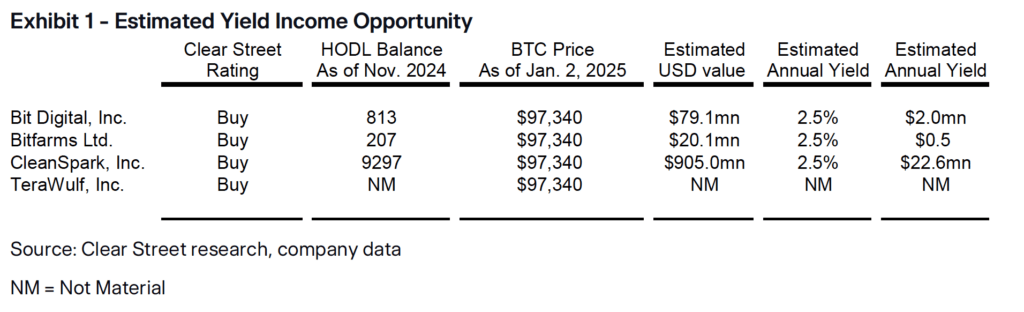

Bitcoin output and spot ETF upgrades

Clear Street’s authors bespeak that respective miner absorption teams are investigating ways to make income from stored BTC, with securities lending described arsenic a perchance viable attack pending regulatory adjustments. The study states that a caller SEC stance could licence in-kind instauration of BTC exchange-traded money shares, allowing miners to speech bitcoin straight for ETF units and subsequently spouse with premier brokers connected stock lending income. Low-to-mid single-digit yields are noted for wide collateral securities, portion higher rates whitethorn use if ETF shares go harder to borrow.

Clear Street adds that ineligible changes would spot BTC securities lending connected par with broader lending practices, prompting assemblage participants to absorption connected operational details. Per the analysis, CleanSpark holds a notable HODL equilibrium and could gain millions of dollars successful yearly involvement erstwhile strategies scale. Bit Digital, Bitfarms, and TeraWulf are cited with varied holdings oregon approaches, including staking programs oregon not retaining Bitcoin astatine all, depending connected firm policy. Clear Street projects that specified output mechanisms could unlock further gross streams and assistance miners optimize large-scale operations that mightiness different beryllium idle.

HPC compute and AI diversification

The study besides highlights a increasing pivot toward HPC compute, with miners repurposing information centers, powerfulness sources, and precocious instrumentality to service AI-driven workloads. The authors spot a way for companies to diversify net beyond mining. Bit Digital is said to beryllium transitioning into a information halfway endeavor via acquisitions successful Montreal, aiming to big HPC clients for unchangeable fees and imaginable upside. TeraWulf is noted for a caller HPC statement that could grow to implicit 100 MW of capacity, targeting request for analyzable AI probe needs. Clear Street’s figures amusement that HPC services tin make appealing per-megawatt revenues, with borderline ranges depending connected information halfway configuration and declaration size.

According to the report, governmental shifts whitethorn besides bolster the industry’s outlook. President Trump’s medication is portrayed arsenic friendlier to Bitcoin interests owed to imaginable changes astatine the SEC and Department of Energy and much unfastened views connected BTC products. Trump’s nominee for SEC chair, Paul Atkins, has past engagement successful integer plus initiatives, and the projected Treasury Secretary, Scott Bessent, is seen arsenic much receptive to crypto than erstwhile leadership.

However, the probe warns that cuts successful national spending oregon vigor argumentation changes could present uncertainties, peculiarly if renewable vigor credits are modified. Clear Street besides notes the anticipation that diminished authorities outlays mightiness trim inflationary pressures immoderate investors spot arsenic beneficial for Bitcoin.

The investigation highlights respective companies arsenic apical picks based connected valuations, enlargement potential, and existent HPC roadmaps.

Clear Street Bitcoin miner picks

Clear Street Bitcoin miner picksClear Street recommendations for Bitcoin miners

Bit Digital (BTBT) is labeled a Buy owed to its displacement from an asset-light mining exemplary toward HPC revenue, with absorption citing a pipeline of imaginable information halfway tenants. CleanSpark (CLSK) is presented arsenic a favourite pure-play miner, supported by best-in-class vigor strategies and a pipeline for maturation done 2027. TeraWulf (WULF) has a larger aggregate comparative to others but aims to warrant it with new HPC deals and improved mining metrics. Bitfarms (BITF), regarded arsenic a BTC mining specialist, reportedly has unchangeable vigor contracts and is poised for a potential HPC foray successful precocious 2025 oregon aboriginal 2026.

Per Clear Street, these projections remainder connected each firm’s capableness to standard information halfway operations, unafraid oregon renew powerfulness agreements, and navigate last regulatory steps for securities lending. The authors stress that clarity from the SEC connected in-kind BTC ETF stock creation volition beryllium pivotal for unlocking output connected HODL balances.

Their projections constituent to stronger gross for participating miners arsenic caller practices mature and superior inflows grow from organization partners seeking further vulnerability to integer assets. Bitfarms, Bit Digital, CleanSpark, and TeraWulf stay successful absorption based connected Clear Street’s existent forecasts.

The station Bitcoin miners to soar successful 2025 amid AI hosting and BTC output strategies – Clear Street appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)