The Bitcoin mining excavation Poolin connected Sept. 6 announced liquidity problems and subsequently suspended withdrawals, flash trades, and interior transfers from its network.

Mining pools collate processing powerfulness from contributing miners to make artifact rewards much rapidly and consistently versus “going alone.” The rewards are distributed successful proportionality to the members’ publication (or donated processing power) successful uncovering the close hash. Pool fees are payable.

Under mean circumstances, excavation members tin retreat their cryptocurrency rewards via their excavation wallets. In this case, the PoolinWallet.

On Sept. 14, arsenic a workaround to the withdrawal freeze, the excavation announced the issuance of IOU tokens connected a 1-to-1 ground to regenerate rewards held successful PoolinWallets.

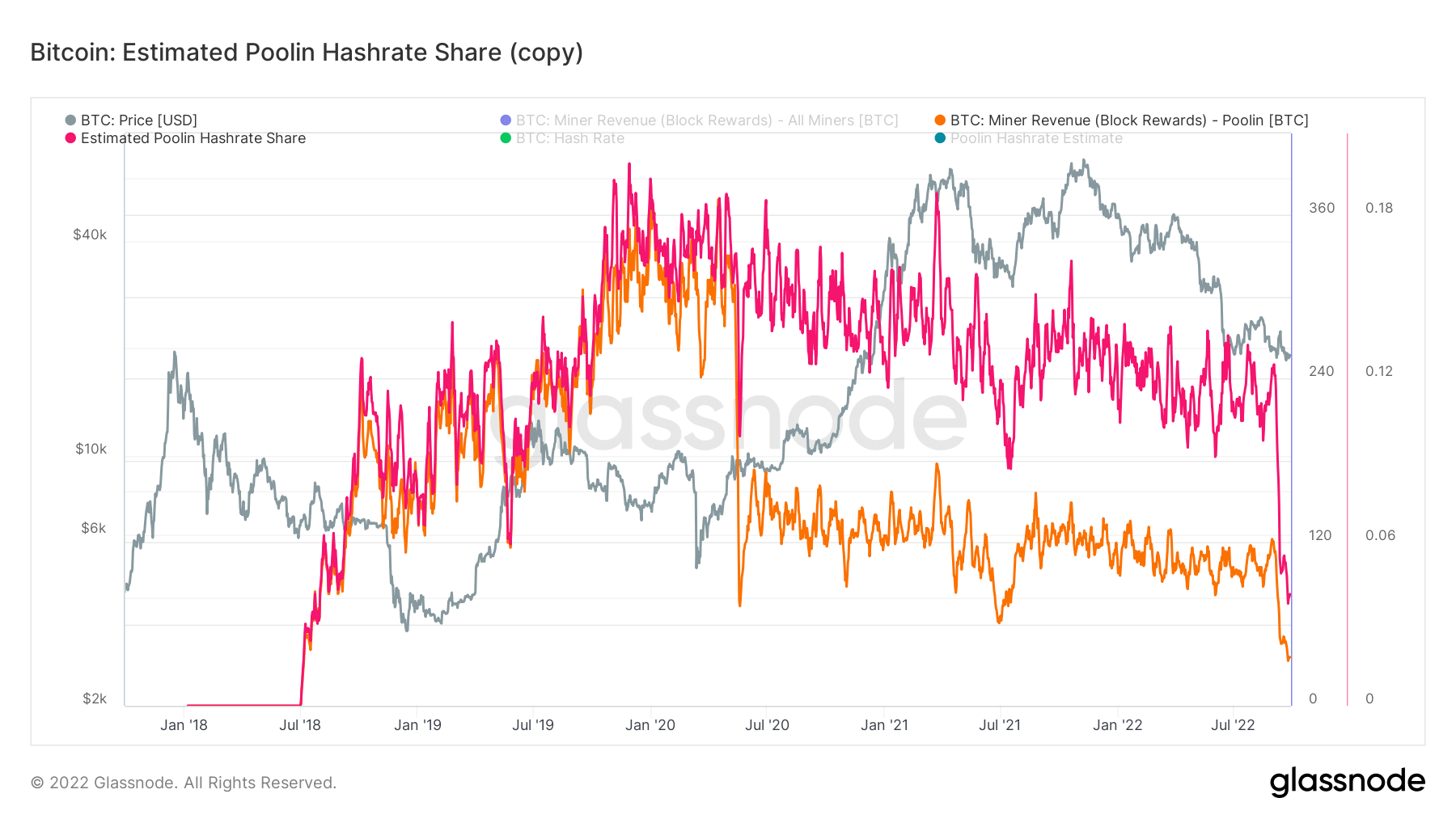

Poolin hashing powerfulness sinks

Since announcing a frost connected withdrawals, a slew of contributing miners person near the excavation starring to a driblet successful hashing powerfulness and, subsequently, mining revenue.

Previous to the announcement, the pool’s hash complaint accounted for astir 12% of the Bitcoin network. Although this had been trending downwards since the November 2021 top, pursuing the miner exodus, a crisp driblet saw its web stock shrink to conscionable 4%.

Similarly, artifact rewards generated by the excavation person been trending downwards. Pre-freeze, artifact rewards were astir 120 BTC, but existent rewards present travel successful astatine 36 BTC.

Source: Glassnode.com

Source: Glassnode.comPoolin has present been overtaken by ViaBTC to fertile sixth largest pool, down 1 place, according to btc.com.

The steadfast is successful the process of moving mining operations from China to Texas, pursuing Beijing’s crypto prohibition announced successful May.

The station Bitcoin mining excavation Poolin successful distress pursuing liquidity crisis appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)