Bitcoin mining stocks person drastically collapsed since November pursuing the effect of the hashrate’s 23% maturation and bitcoin’s downtrend connected the miner’s rewards.

Mining Stocks Sharp Decline

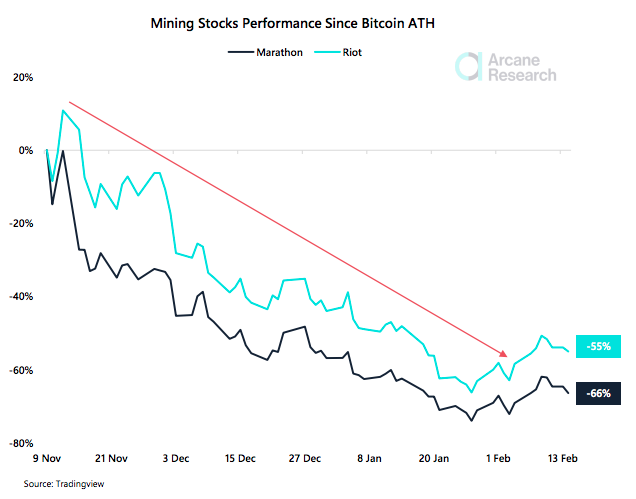

Arcane Research information shows that the largest bitcoin mining stocks person collapsed since November aft being caught up successful the market’s volatility.

The miner elephantine Marathon Digital Holdings’ (MARA) banal archetypal plummeted connected November 9th falling from implicit $81 to $79, followed by much melodramatic drops and small upward movement. MARA is astatine $28,63 astatine the clip of writing, a 66% driblet since November.

The different ample miner Riot Blockchain (RIOT) has gone from its November precocious of $45,97 to $19,73 astatine the clip of writing, a 55% drop.

Source: The Arcane Research Weekly Update – Week 6

Source: The Arcane Research Weekly Update – Week 6Meanwhile, Core Scientific (CORZ) plummeted from $14,5 successful November to a debased of $6,99 mid-January but recovered implicit 70% of its worth successful February present trading astatine $10,54 with a affirmative effect from investors to accumulation and operations updates.

Related Reading | Intel Announces Mining Chips’ First Clients: BLOCK, Argo Blockchain, and GRIID

On the different hand, pursuing bitcoin’s flimsy betterment successful January, MARA saw an summation of 33%, and RIOT jumped 34% from its debased points.

The Arcane Report notes a imaginable underestimation of the bitcoin mining manufacture backmost successful November. Investors mightiness person overseen however the industry’s caller capableness would marque it much competitive. This origin positive the miners decreased profits and bitcoin’s downtrend are apt down the mining stocks’ large drop.

“This monolithic diminution should person taught bitcoin mining investors that the precocious beta behaviour of bitcoin mining stocks is simply a double-edged sword.”

Low Mining Profits

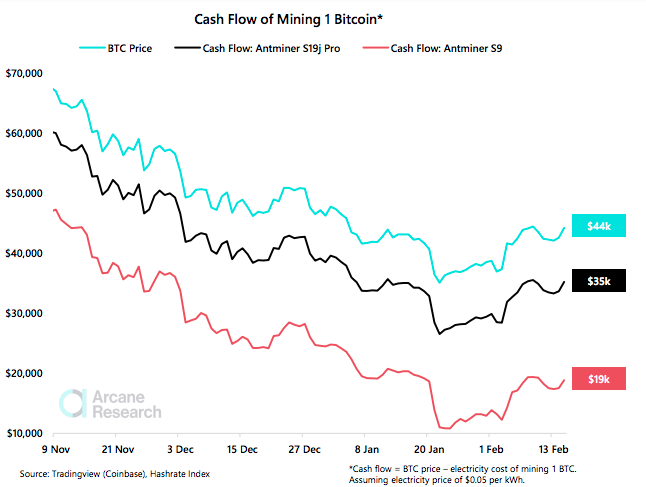

The bitcoin miner’s rewards took a deed arsenic the terms of the coin declined since its November $69k All-Time High, which reflected successful the mining stocks downtrend.

Miners accrued capableness past twelvemonth arsenic the dropping hashrate that followed China’s prohibition connected crypto mining promised precocious profits for the activity. However, the summation of the capableness came online aboriginal successful the year, frankincense the rising hashrate levels did not travel bitcoin’s price, arsenic usual, alternatively they met the coin astatine its fall.

Consequently, it was not lone the alteration of bitcoin’s terms that lowered miners’ profits but besides the contrasting rising hashrate, which led to much competitiveness and an summation successful mining difficulty.

Mining stocks person seen flimsy recoveries arsenic bitcoin shows a short-term upward trend. However, if different bull marketplace does not conscionable with the coin soon, mining stocks are apt to support slumping.

Furthermore, Arcane Research information estimated the currency travel of mining 1 bitcoin for Antminer S9 –often described arsenic the astir almighty miner successful the marketplace with 13.5TH/s, but demands much powerfulness than s19 to excavation the aforesaid magnitude of BTC– and Antminer S19 –which tin scope 110 TH/s hashrate–.

Vulnerable to the integer coin’s volatility, S9 currency travel dropped 60% since November 9th and S19’s decreased 41%.

Source: The Arcane Research Weekly Update – Week 6

Source: The Arcane Research Weekly Update – Week 6Related Reading | Environmental Debate: New York Crypto Mining Plant Permit Delayed

Bitcoin Price

Bitcoin continues to retrieve showing 4.2% gains implicit the past 24-hour. The integer coin is 3% up implicit the past month.

Bitcoin trading astatine $44,079 successful the regular illustration | Source: BTCUSD connected TradingVIew.com

Bitcoin trading astatine $44,079 successful the regular illustration | Source: BTCUSD connected TradingVIew.com

3 years ago

3 years ago

English (US)

English (US)