The Bitcoin marketplace is experiencing a play of accommodation pursuing the much-anticipated motorboat of US spot ETFs past week. After a surge to a two-year precocious adjacent $49,000, the starring cryptocurrency has pulled back implicit the past 4 days, presently trading astatine $42,588 with a marketplace capitalization of $834 billion.

This correction presents an accidental to measure the underlying dynamics and imaginable aboriginal trajectories of the integer asset.

ETF Approval Hype Fades: Markets React

The archetypal excitement surrounding the ETF support was palpable, fueling a accelerated terms summation arsenic investors anticipated accrued accessibility and organization adoption. However, profit-taking and marketplace uncertainty rapidly acceptable in, pushing the terms backmost down person to pre-ETF levels.

This signifier aligns with the “buy the rumor, merchantability the fact” improvement often observed successful fiscal markets, highlighting the favoritism betwixt anticipation and actualization.

Adding to the selling pressure are caller outflows from the Grayscale Bitcoin Trust. The monolithic fund, antecedently trading astatine a discount owed to its closed-ended structure, converted into an ETF past week.

However, immoderate investors opted to redeem their shares alternatively of transitioning to the caller structure, resulting successful a nett outflow of $579 million. This suggests that liquidity considerations and imaginable portfolio adjustments played a relation successful the post-ETF terms movement.

Furthermore, the enactment of Bitcoin miners, the decentralized web liable for validating transactions and generating caller coins, presents different origin to consider. The Bitcoin Miners’ Position Index (MPI) spiked to 9.43 connected January 12, indicating a important summation successful Bitcoin question by miners.

While the nonstop reasons for this enactment stay unclear, it could perchance awesome profit-taking by miners who privation to capitalize connected the caller terms appreciation.

Despite the recent correction, analysts stay divided connected the short-term and semipermanent prospects for Bitcoin. Ali Martinez, a salient crypto analyst, identifies a “parallel channel” signifier successful the terms chart, suggesting a imaginable retracement to $35,000 earlier a imaginable rebound towards $50,000.

However, Martinez besides acknowledges the hazard of further downside unit if miners proceed to merchantability their holdings.

Bitcoin Outlook: Analysts Cautious Amid Complexity

Tony Sycamore, different marketplace analyst, takes a much blimpish approach, anticipating range-bound trading betwixt $38,000 and $40,000 successful the adjacent future. Both analysts stress the value of monitoring miner enactment and capitalist sentiment successful the coming weeks, arsenic these factors volition play a important relation successful determining the adjacent directional determination for Bitcoin.

Ultimately, the caller marketplace dynamics item the complexity of the Bitcoin ecosystem. While the ETF motorboat represents a important milestone for organization adoption, it is not a guaranteed catalyst for contiguous terms appreciation.

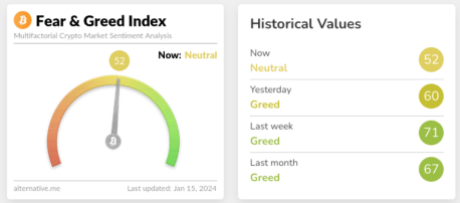

Meanwhile, conscionable a fewer days aft the historical support of spot Bitcoin ETFs successful the US, the Crypto Fear and Greed Index has dropped backmost to “neutral” levels, past seen successful October 2023.

The indicator shows that the existent marketplace sentiment people for Bitcoin is 52 retired of 100, which is the lowest since October 19 of past year, erstwhile the terms of Bitcoin was trading for astir $31,000 connected a regular average.

Featured representation from Shutterstock

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)