Bitcoin’s representation arsenic a dependable store of worth is being tested. What erstwhile was talked astir arsenic a hedge against uncertainty present moves much similar a high-upside, high-risk bet.

Signals Of A Growth Asset

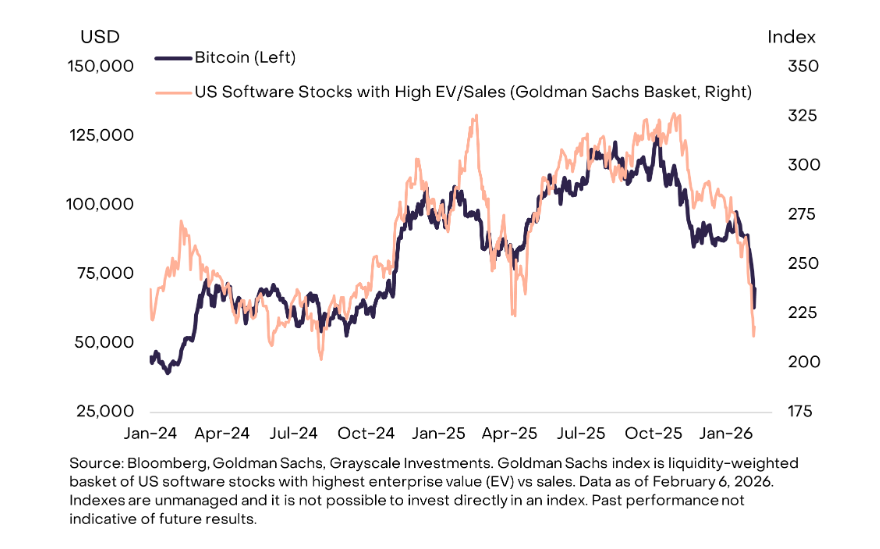

According to Grayscale, caller trading patterns amusement Bitcoin tracking intimately with shares of bundle companies alternatively than with golden oregon silver.

That alteration successful behaviour has been noticeable since aboriginal 2024, erstwhile organization flows and exchange-traded products pushed crypto into much mainstream hands.

Reports accidental investors who pursuit maturation — galore drawn by the AI communicative — person been selling bundle names hard, and Bitcoin has followed immoderate of that pressure.

Institutional Links And Market Forces

Reports enactment that deeper ties to accepted markets explicate portion of this shift. Large firms, ETF mechanics and increasing organization holdings mean movements successful banal markets tin spill into crypto.

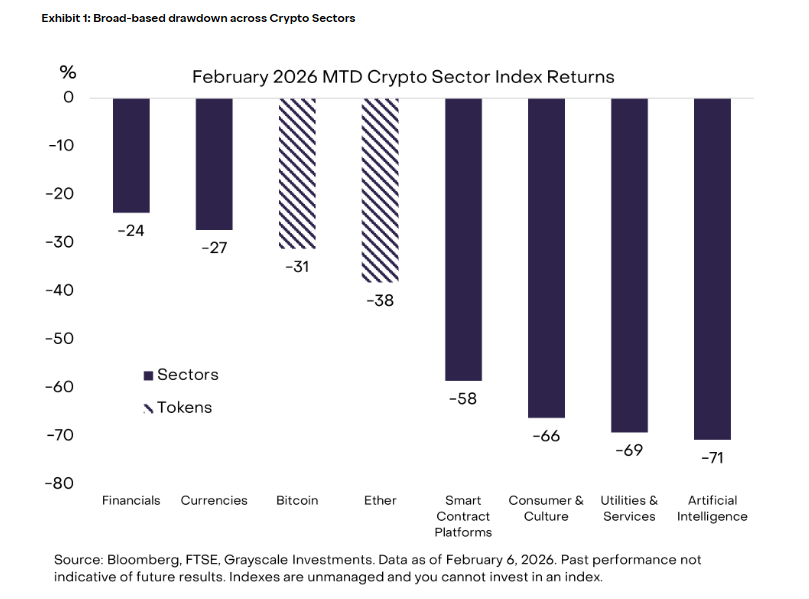

There has besides been progressive selling from US-based accounts that near Bitcoin trading astatine a discount connected immoderate platforms. That selling happened aft a drawstring of large liquidations precocious successful the twelvemonth and again successful caller weeks, which amplified losses for traders who utilized leverage.

Where Price Stands Now

Bitcoin is changing hands astir $66,900, with wide absorption adjacent $69,900 and enactment levels slipping nether $66,600. The swings are crisp and intraday moves tin beryllium wide, reflecting a temper that is cautious and reactive.

From its highest supra $126,000 successful October, the marketplace has pulled backmost by astir 50% successful respective waves, which shows however rapidly sentiment tin crook against adjacent the astir talked-about crypto.

Gold, Geopolitics And Risk Appetite

Reports constituent retired that bullion has climbed to fresh highs portion Bitcoin has failed to reflector those safe-haven flows. Rising geopolitical friction has driven immoderate wealth into metals and distant from riskier bets, including tech shares and crypto.

Traders who expected Bitcoin to enactment similar a fortress against turmoil person recovered that, for now, it behaves much similar an plus whose worth rises connected anticipation and falls erstwhile fearfulness returns.

A instrumentality of caller superior would apt beryllium needed to dependable prices. ETF inflows could help, and a renewed question of retail buyers would too.

Research suggests that retail involvement is presently focused connected AI stories and maturation narratives, which leaves crypto retired of favour for galore idiosyncratic investors. That attraction of attraction matters: superior flows are what assistance oregon descend these markets.

Bitcoin Tracks Tech, But Long-Term Value Still Intact

Grayscale says Bitcoin’s caller moves reflector tech stocks, not gold, but its semipermanent imaginable arsenic a store of worth remains. Short-term swings bespeak marketplace integration and capitalist activity, portion aboriginal show volition beryllium connected superior flows and broader economical trends.

Featured representation from ETF Trends, illustration from TradingView

2 hours ago

2 hours ago

English (US)

English (US)