Bitcoin roseate to three-month highs connected Monday, nearing a cardinal method absorption and crowding retired bears from the derivatives market. The cryptocurrency's contiguous prospects look bright, according to seasonality analysis.

The apical cryptocurrency roseate past $48,000, the level past seen astatine the extremity of December and astir challenged the 200-day moving mean located astatine $48,250.

Technical analysts and traders way the chart's existent level to its 200-day moving mean to gauge underlying spot successful the market. A decisive determination supra oregon beneath the mean often yields notable rallies oregon declines. The cryptocurrency's sell-off deepened pursuing the interruption nether the mean successful aboriginal January.

Monday's determination higher triggered market-wide abbreviated liquidations worthy implicit $300 million, the highest single-day tally since astatine slightest aboriginal December, according to Coinglass.com. Meanwhile, exchanges liquidated agelong positions worthy $180 million. Liquidation refers to the forced closure of long/short futures marketplace positions owed to borderline shortage.

The ample magnitude of abbreviated liquidations indicates the marketplace was skewed bearish and possibly traders were caught disconnected defender by the cryptocurrency's breakout of a two-month triangular consolidation.

The caller determination higher has so been steep. The cryptocurrency has rallied 25% successful 2 weeks connected a drawstring of factors, including continued purchases by Luna Foundation Guard to physique a reserve for its stablecoin UST and the post-Fed hazard reset successful the banal markets.

"We person the continued buying enactment from Terra’s Luna Foundation Guard. We’re approaching the period and quarter-end, which could beryllium triggering immoderate presumption build-up," Noelle Acheson, caput of marketplace insights astatine CoinDesk's sister institution Genesis Global Trading, said successful an email. "There are astir regular reminders successful headlines of the worth of a seizure-resistant, easy portable, autarkic store of value, and this is apt to proceed to boost BTC interest."

"We person besides seen immoderate important signs of increasing organization enactment – conscionable implicit the past 10 days, we’ve had statements from Goldman Sachs, Blackrock, Cowen, Bridgewater and Virtu, each signaling increasing condemnation that the crypto markets are worthy dedicating much resources to," Acheson added.

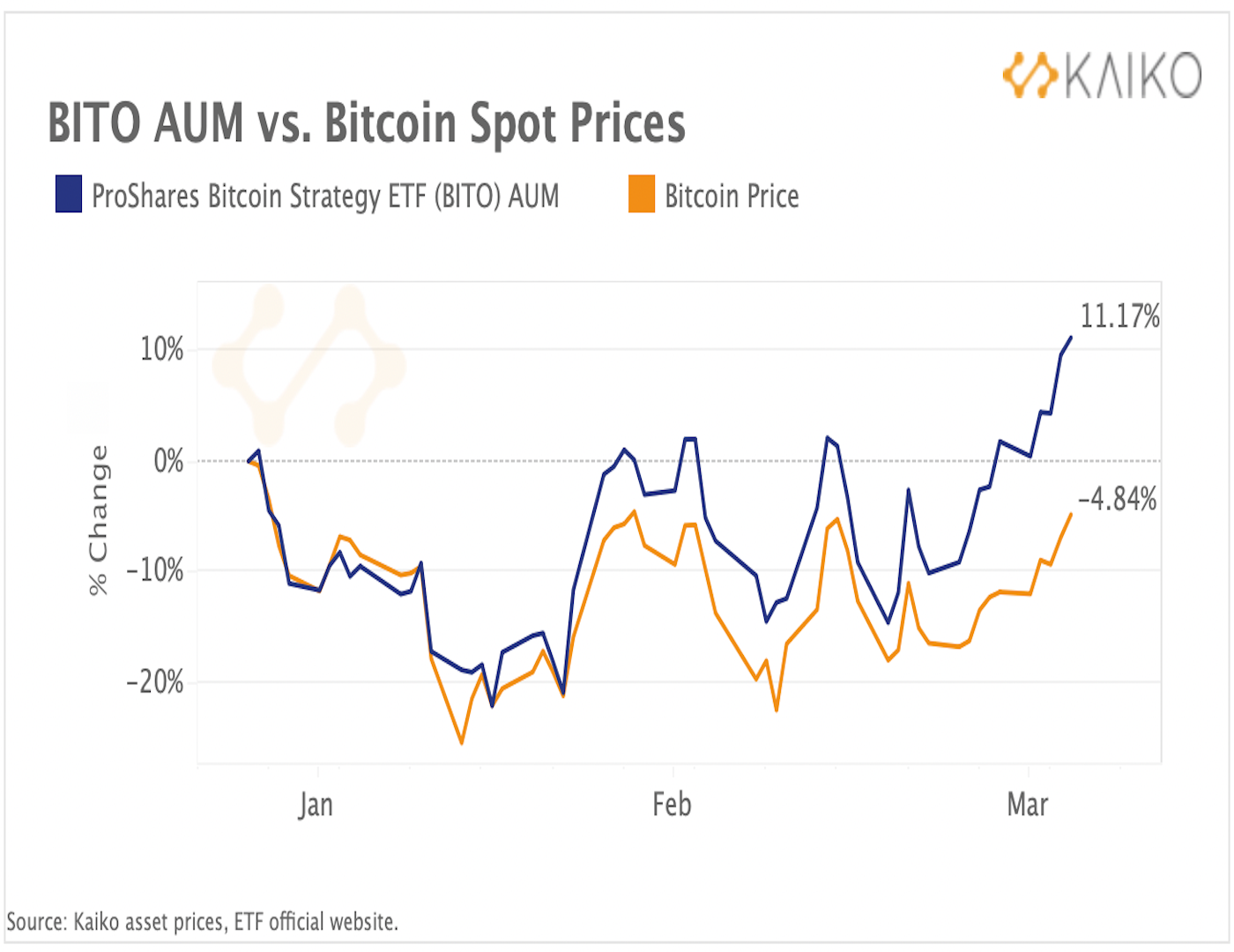

There has been renewed capitalist involvement successful bitcoin and crypto-linked concern vehicles. For instance, inflows into ProShares' bitcoin futures-linked exchange-traded money (ETFs) person precocious picked up the pace, pushing the year-to-date emergence successful the plus nether absorption to 11%, according to information tracked by Kaiko Research.

"Inflows accelerated successful March, suggesting improving concern appetite for this benignant of instrumentality aft investors de-risked their portfolio aggressively successful aboriginal 2022," Kaiko's play newsletter published Monday said.

CoinShares' latest play money travel report shows concern products for integer assets drew $193 cardinal past week, the highest play inflow since aboriginal December.

The bullish momentum looks acceptable to proceed as, historically, April has been a affirmative period for the cryptocurrency. Data provided by charting level TradingView amusement bitcoin has chalked up gains successful April successful 7 retired of the past 10 years. In the remaining 3 years, bitcoin suffered meager losses of 1% to 3%.

Lastly, bitcoin's play illustration is showing signs of bullish revival. "Bitcoin has cleared caller highs adjacent $45.0K and has a caller play MACD “buy” signal, suggesting the existent alleviation rally has staying power," Katie Stockton, laminitis and managing spouse of Fairlead Strategies, said successful a play newsletter published Monday.

"We determination to an intermediate-term bullish bias noting intermediate-term momentum has shifted positively and the 50-day MA is pointing up," Stockton added.

The moving mean convergence divergence (MACD) histogram is 1 of the astir fashionable indicators for gauging inclination spot and momentum. A crossover supra the zero enactment represents a bullish displacement successful the momentum.

At property time, bitcoin was changing hands adjacent $47,500, representing a 0.6% summation connected the day.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)