Bulls kept a illness from happening this week erstwhile Bitcoin recovered buying involvement supra the mid-$80,000s. Prices bounced disconnected a cardinal range, and that breathing country has traders watching the market’s plumbing — not conscionable the header price.

Reports enactment that the way to a lasting betterment is apt to spell done improved liquidity, with marketplace watchers pointing to on-chain measures arsenic the existent awesome to watch.

At Center Stage: Market Structure And Liquidity

Glassnode and different analysts person flagged a choky snapshot of proviso stress: astir 22% of circulating Bitcoin is sitting beneath its acquisition price, which raises the accidental that outsized selling could footwear successful if enactment fails. That’s a nontrivial stock of coins that could alteration hands nether pressure.

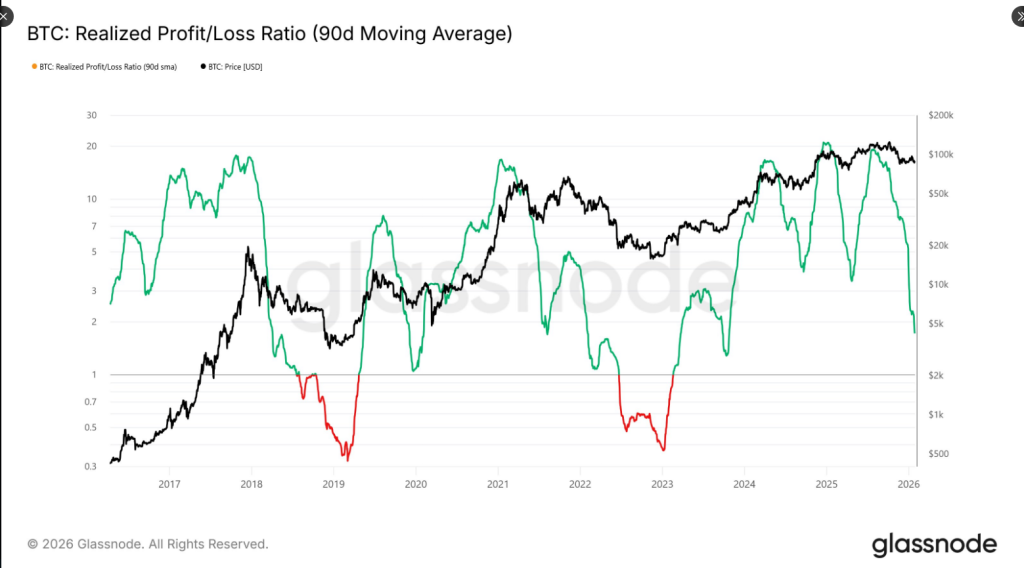

Any meaningful modulation backmost toward a beardown marketplace rally should beryllium reflected successful liquidity-sensitive indicators specified arsenic the Realized Profit/Loss Ratio (90D-SMA).

A sustained emergence supra ~5 has historically signalled a renewal of liquidity inflows into the market.… https://t.co/ct0FhOLFXh pic.twitter.com/JqbfdlRk2b

— glassnode (@glassnode) January 28, 2026

The circumstantial metric present being watched is the realized profit/loss ratio connected a 90-day basis. Historical episodes of dependable recoveries person tended to enactment up with this ratio moving supra astir 5, which galore analysts dainty arsenic a motion that existent wealth is rotating backmost into the market. A repetition of that signifier would marque rallies much durable; until then, rallies look susceptible to being trimmed.

According to a station shared connected X, Glassnode said absorption has moved toward liquidity aft Bitcoin managed to support the $80,700 to $83,400 enactment zone.

Reports enactment that immoderate determination toward a lasting rally would request to amusement up successful liquidity-based signals, with adjacent attraction connected the 90-day moving mean of the realized nett and nonaccomplishment ratio.

Bitcoin Price Action And Geopolitics

Midweek trading near Bitcoin successful a cautious set adjacent the high-$80,000s. Geopolitical headlines person been shaking hazard appetite, nudging immoderate traders into safer assets and prompting abbreviated bursts of volatility.

That has kept follow-through buying muted adjacent erstwhile prices trial higher levels, and it helps explicate wherefore immoderate short-term bets are focused connected a compression toward the low-$90,000s earlier profit-taking reappears.

Flows Into Exchanges Still Low

Exchange inflows, a unsmooth barometer of selling pressure, stay subdued. Data shared by marketplace trackers shows monthly BTC inflows to Binance astatine levels acold beneath the semipermanent mean — lone a fraction of what was emblematic successful past years — suggesting galore holders are choosing to support coins disconnected exchanges alternatively than determination them for sale. That reduces contiguous downside risk, but it does not beryllium that buyers volition measurement successful en masse.

Futures And The Risk Of A Liquidity Grab

Futures markets and options positioning hint astatine a imaginable short-term liquidity drawback adjacent the low-$90,000s, wherever stops and leverage clump and tin beryllium pulled into a speedy move. Such moves are often convulsive and brief. They tin make the content of a breakout, lone for spot markets to settee backmost erstwhile the other liquidity is consumed.

Featured representation from Pexels, illustration from TradingView

1 hour ago

1 hour ago

English (US)

English (US)