On-chain information shows the Bitcoin NUPL metric presently has values that would suggest the carnivore marketplace is yet to deed successful afloat swing, if the coin is successful one.

Bitcoin NUPL Value Still Not As Low As Previous Bear Markets

As pointed retired by an expert successful a CryptoQuant post, the BTC NUPL metric suggests marketplace hasn’t neared a carnivore marketplace bottommost yet.

The “net unrealized profile/loss” (or NUPL successful short) is an indicator that tells america astir the ratio of nett and nonaccomplishment successful the Bitcoin market.

The metric’s worth is calculated by taking the quality betwixt the marketplace headdress and the realized cap, and dividing it by the marketplace cap.

When the NUPL has a worth greater than zero, it means determination are much coins successful nett than ones successful nonaccomplishment astatine the moment.

On the different hand, antagonistic values of the indicator connote that investors are, connected average, successful a authorities of nonaccomplishment close now.

Related Reading | Bitcoin Bullish Signal: Exchange Reserve Loses Another 50k BTC Over Past Week

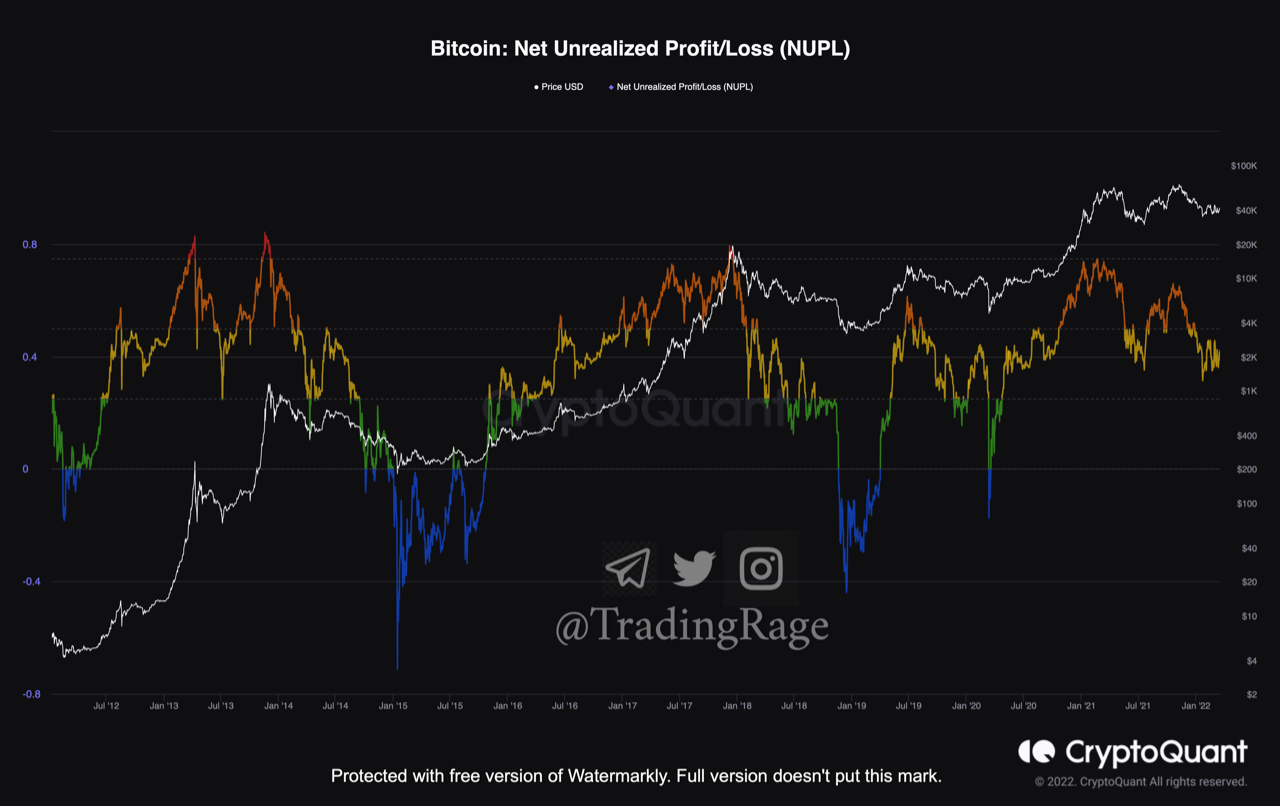

Now, present is simply a illustration that shows the inclination successful the Bitcoin NUPL implicit the past of the crypto:

As you tin spot successful the supra graph, the Bitcoin NUPL metric has often been capable to predict apical and bottommost formations done its assorted colored zones.

In the erstwhile carnivore markets, the indicator’s worth has usually fallen disconnected beneath zero (blue) arsenic a bottommost approached.

In the pb up to these bearish periods person been the yellowish and greenish phases, but presently the NUPL inactive looks to beryllium successful the yellowish zone.

This whitethorn mean that if Bitcoin has already entered into a carnivore market, it has inactive immoderate ways to spell earlier full capitulation and bottommost formation.

Related Reading | What’s Bitcoin Role After End of Petrodollar System? Arthur Hayes Says

However, it’s worthy noting that determination person been instances earlier wherever the indicator dropped into the yellowish portion aft a bull rally, but past jumped backmost up soon aft arsenic the bullish inclination continued, indicating a mid-cycle bottommost enactment instead.

The latest illustration of this was during the mini-bear play of May-July 2021, wherever the coin bottomed astatine astir $28k and rallied connected to a caller ATH.

BTC Price

At the clip of writing, Bitcoin’s price floats astir $41.4k, up 6% successful the past week. Over the past month, the crypto has gained 8% successful value.

The beneath illustration shows the inclination successful the terms of the coin implicit the past 5 days.

3 years ago

3 years ago

English (US)

English (US)