On-chain information shows Bitcoin whales with much than 1k BTC were the main sellers successful the latest crash, arsenic different cohorts displayed muted activity.

Bitcoin Spent Output Value Bands Shows Spike From 1k-10k Group

As pointed retired by an expert successful a CryptoQuant post, dissimilar successful the erstwhile declines, the 10-100 BTC and 100-1k BTC cohorts didn’t amusement immoderate spikes successful enactment during the latest crash.

The applicable indicator present is the “Spent Output Value Bands” (SOVB). which displays the fig of coins being moved by each worth set successful the Bitcoin market.

These “value bands” oregon groups are divided based connected the magnitude of coins moved successful each transaction connected the chain. For example, the 1k-10k BTC worth set includes each transfers that progressive betwixt 1k and 10k BTC.

The Spent Output metric for this worth set past specifically measures the full magnitude of Bitcoin that was shifted utilizing transactions of size falling successful this range.

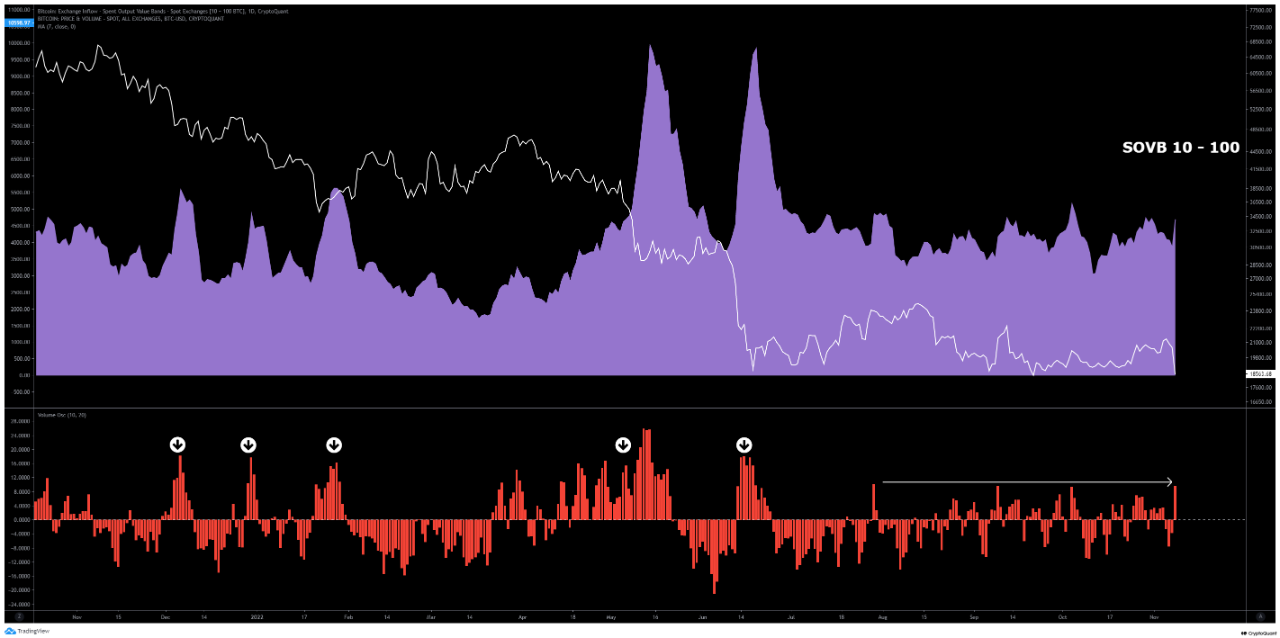

Now, present is simply a illustration that shows the inclination successful the Bitcoin SOVB for 10-100 BTC:

As you tin spot successful the supra graph, during the erstwhile selloffs, the Bitcoin Spent Output illustration for the 10-100 BTC worth set spiked up, suggesting that investors with astatine slightest 10 to 100 BTC were heavy selling their coins.

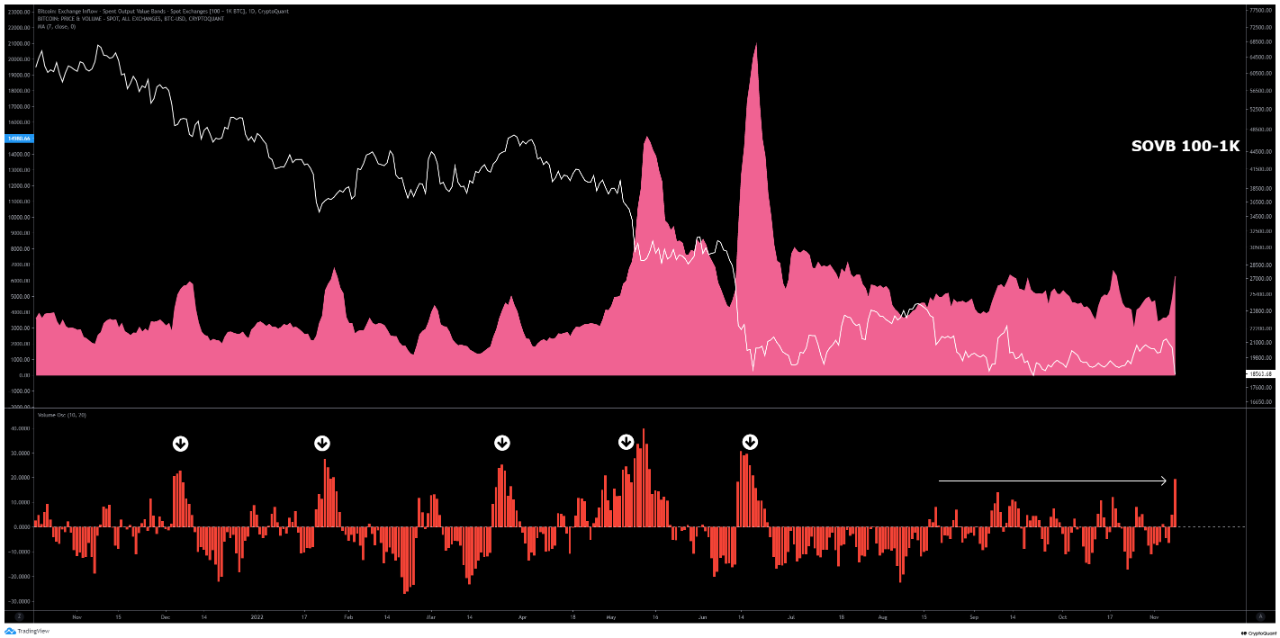

A akin inclination was besides seen for the 100-1k BTC worth band, arsenic the beneath illustration displays.

In the astir recent crash, however, portion determination was a spike successful these indicators, it was obscurity adjacent arsenic crisp arsenic successful the erstwhile instances. This suggests that these worth bands didn’t spot overmuch dumping this time.

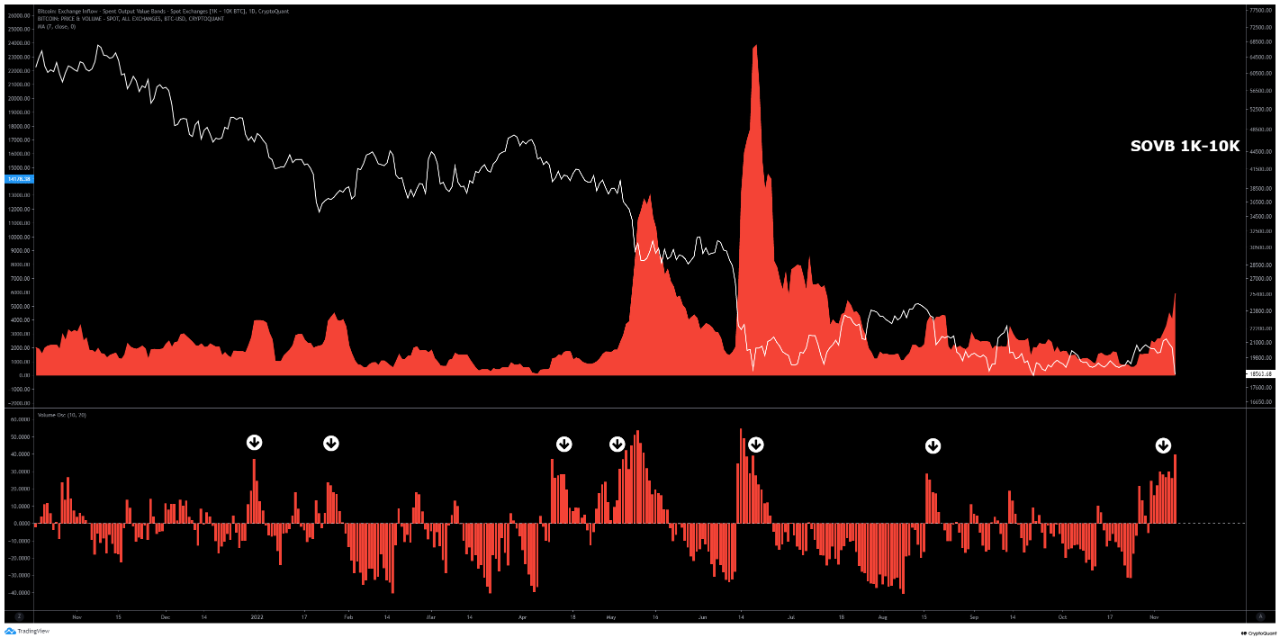

The 1k-10k BTC cohort, though, has showed a antithetic behavior. Below is the Spent Output graph for this worth band.

As is evident from the chart, the 1k-10k BTC worth set registered a ample magnitude of question successful the crash, suggesting that transactions worthy much than 1k BTC accounted for the bulk of the selling this clip around. Such large transfers beryllium to the whales, meaning that whales drove this crash.

While whale dumping is antagonistic for the market, the quant notes that the diminution successful the different 2 cohorts could beryllium a motion that selling unit is present astir exhausted successful the Bitcoin market.

BTC Price

At the clip of writing, Bitcoin’s price floats astir $17.1k, down 15% successful the past week.

3 years ago

3 years ago

English (US)

English (US)