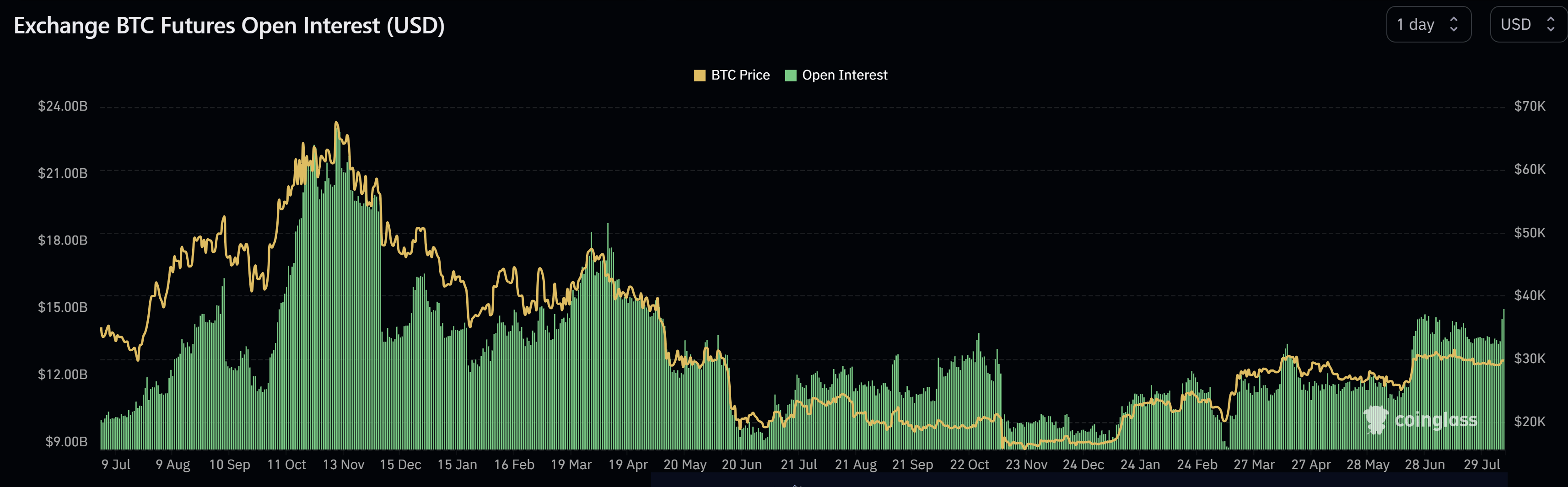

In a marketplace that has been comparatively quiescent for weeks, Bitcoin (BTC) has abruptly sprung to life, with its Futures Open Interest (OI) reaching levels not seen since the FTX crash. Open Interest, a metric that measures the full fig of outstanding futures that person not been settled, provides a glimpse into the trading enactment and imaginable aboriginal terms movements of an asset. A surge successful OI tin bespeak heightened trading enactment and involvement successful the market.

Starting aboriginal Tuesday, Bitcoin’s terms enactment surged by much than 3.5%, breaking the $30,300 people for the 2nd clip this month. This question began astir 5 americium EST, pushing the terms to a 16-day-high. The catalyst down this surge seemed to beryllium the rumor that insiders astatine BlackRock and Invesco person confirmed that a Bitcoin spot ETF is not a question of “if” but “when”, suggesting an support wrong the adjacent 4 to six months.

“Bitcoin whales opened giga agelong positions astatine $29k,” remarked CryptoQuant CEO Ki Young Ju. The Head of Research astatine CryptoQuant further added, “A batch of speech lately astir expanding probability of Bitcoin spot ETF support successful the US. Now Coinbase premium sharply up and moving towards affirmative territory (implies Bitcoin request successful the US is strengthening). GBTC terms discount has continued to narrow.”

Bitcoin Futures Open Interest Skyrockets To Yearly High

Aggregate OI for Bitcoin futures saw a important jump, expanding by implicit $1 cardinal from the erstwhile time to a staggering $14.95 billion, according to Coinglass data.

Bitcoin futures unfastened involvement | Source: Coinglass

Bitcoin futures unfastened involvement | Source: CoinglassThis surge marks the astir important summation successful implicit a month. However, derivatives enactment connected the CME, often seen arsenic a gauge of organization trading, remained comparatively unchanged successful OI, suggesting that the caller determination mightiness beryllium predominantly retail-driven.

Miles Deutscher commented connected Twitter, “Bitcoin unfastened involvement is present astatine its highest level since the FTX collapse. This indicates accrued BTC trading enactment from marketplace participants. Looks similar a large determination is brewing.” Similarly, James V. Straten observed, “Bitcoin unfastened involvement is present greater than 2.25% of the marketplace cap, approaching YTD highs, and looks exceptionally overheated.”

FOI vs marketplace headdress | Source: Twitter

FOI vs marketplace headdress | Source: TwitterThe Kingfisher, a renowned information supplier for Bitcoin derivatives, noted, “Coinbase selling into each different large speech buying. Looks similar Bybit & Bitmex degens are betting connected different $BTC limb up. While Bitfinex seems to beryllium selling here.”

On the options front, the analysts added that dealers look bullish, acceptable to capitalize connected some upward and downward movements. Their buying enactment is presently stabilizing the price, portion immoderate important upward trajectory could spot them intensifying their buying. Meanwhile, the BTC liquidation representation of The Kingfisher indicates that portion determination are inactive “some precocious high-leverage shorts to liquidate to the upside, but astir of the short-term liquidity is down.”

Renowned expert @52kskew provided insights into the BTC whale vs. algo divergence, stating, “Whales necessitate rather heavy liquidity to exit oregon adjacent positions & astir often this is during a compression event. Some firms volition usage algos successful bid to get the champion terms erstwhile closing retired sizeable presumption (this is wherever TWAP algos travel into play).”

BTC whale vs. algo divergence | Source: Twitter @52Skew

BTC whale vs. algo divergence | Source: Twitter @52SkewCPI Release To Take Out The Heat?

Notably, the Consumer Price Index (CPI) successful the US is scheduled for tomorrow, Thursday, 8:30 americium EST. The merchandise has the imaginable to origin a wide liquidation of the overheated BTC futures marketplace successful some directions. A large determination by the BTC terms seems imminent.

Forecasts suggest a rise successful the header CPI from 3% to 3.3% year-over-year (YoY) for July, marking a important modulation arsenic the affirmative impacts from the anterior twelvemonth commencement to wane. Notably, the Cleveland Fed’s Inflation Nowcast exemplary projects a 3.42% header CPI, marginally surpassing wide expectations. Core CPI is expected to somewhat diminution from 4.8% to 4.7% YoY.

At property time, the BTC terms was conscionable beneath cardinal absorption astatine $30,000.

BTC terms beneath cardinal resistance, 4-hour illustration | Source BTCUSD connected TradingView.com

BTC terms beneath cardinal resistance, 4-hour illustration | Source BTCUSD connected TradingView.comFeatured representation from BTCC, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)