The Bitcoin unfastened involvement has been connected the emergence implicit the past fewer weeks arsenic the terms has climbed continuously. This sustained emergence successful the unfastened involvement is simply a reflection of the heightened involvement successful the cryptocurrency since the United States Securities and Exchange Commission (SEC) approved Spot Bitcoin ETFs for trading. The BTC unfastened involvement has present climbed to humanities levels, reaching 2021 all-time precocious levels.

Bitcoin Open Interest At 2021 Levels

According to data from Coinglass, the Bitcoin unfastened involvement has risen to much than $24 billion. This maturation represents astir a 50% leap successful the unfastened involvement since the twelvemonth 2024 began. But much importantly, the unfastened involvement has risen to levels not seen since 2021.

Looking astatine the unfastened involvement chart, the past clip that the Bitcoin OI was this precocious was backmost successful November 2021, erstwhile the cryptocurrency reached its all-time precocious terms of $69,000. This emergence successful the OI has been accordant crossed crypto exchanges, with CME, Binance, and ByBit starring the complaint and commanding much than 50% of the unfastened interest.

The continuous emergence has besides travel with a emergence successful the greed levels among crypto investors. Currently, the Crypto Fear & Greed Index is sitting firmly successful Greed, suggesting that crypto investors are successful a spot wherever they are consenting to instrumentality much risks than usual.

Implications For The BTC Price

With the Bitcoin unfastened involvement this high, it could extremity up being antagonistic for the BTC price. This is due to the fact that past performances wherever the unfastened involvement has risen truthful rapidly person often ended successful a marketplace crash. The aforesaid was the lawsuit successful 2021 erstwhile the Bitcoin OI had acceptable its erstwhile record.

In 2021, erstwhile the BTC terms crossed $69,000 and the unfastened involvement crossed $22 billion, the euphoria was incredibly precocious arsenic it is now. However, this would beryllium short-lived, with a marketplace clang happening soon after. The BTC terms would yet spell from $69,000 to $46,000 by December, dropping by astir 40% successful the abstraction of 1 month.

If this aforesaid inclination were to repetition itself successful the existent trend, past determination could beryllium a monolithic clang successful the cards for Bitcoin. A akin diminution would spot Bitcoin autumn backmost toward $41,000, which would hitch retired the gains of the past fewer weeks.

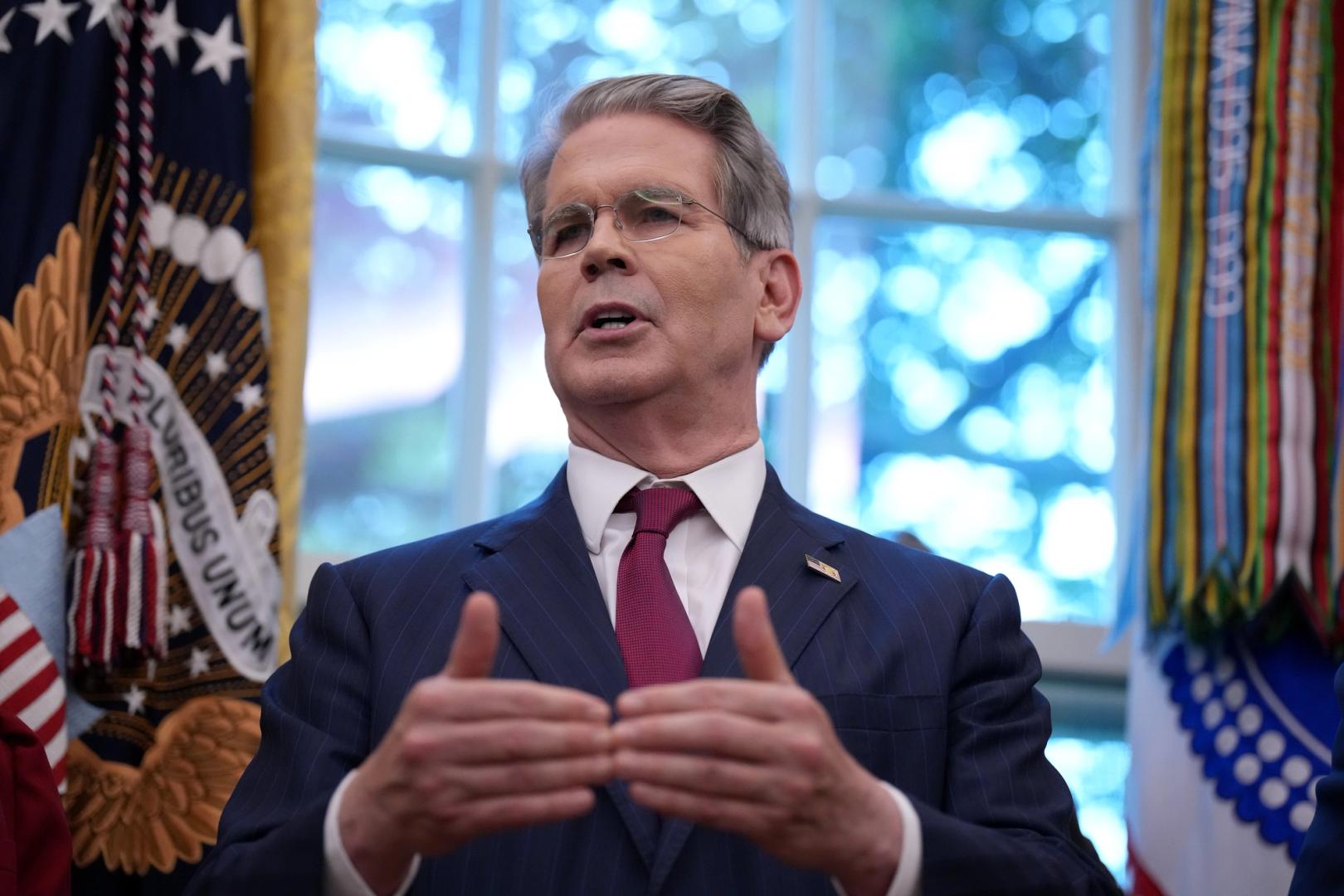

However, determination are antithetic factors astatine play successful the existent market, specified arsenic Spot Bitcoin ETF issuers seeing monolithic involvement successful their exchange-traded products. Just past week, inflows into Spot BTC ETFs reached a caller grounds of $2.2 billion. So if these ample institutions proceed buying BTC to conscionable the request of their customers, past the BTC price could proceed to rally.

Featured representation from Barron’s, illustration from Tradingview.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)