On-chain information shows Bitcoin unfastened involvement has reached dangerously precocious values, a motion that a leverage flush whitethorn beryllium coming soon.

Bitcoin Open Interest Rises To High Values

As pointed retired by an expert successful a CryptoQuant post, the BTC unfastened involvement has present reached values wherever wide liquidations person taken spot successful the past.

The “open interest” is an indicator that measures the full magnitude of BTC futures positions presently unfastened connected derivatives exchanges. The metric accounts for some agelong and abbreviated positions.

When the worth of the metric is low, it means investors aren’t utilizing overmuch leverage close now. Such values usually effect successful debased volatility successful the terms of Bitcoin.

On the different hand, precocious values of the indicator suggest that futures declaration users are presently utilizing a precocious magnitude of leverage. This concern tin pb to precocious volatility successful the marketplace arsenic large terms swings tin effect successful a liquidation squeeze.

Related Reading | Exchange Whale Ratio Suggests Bitcoin Dump Incoming

Now, present is simply a illustration that shows the inclination successful the BTC unfastened involvement implicit the past year:

As you tin spot successful the supra graph, worth of the Bitcoin unfastened involvement looks to beryllium climbing up successful the past fewer weeks.

The quant has marked successful the illustration the erstwhile times the indicator showed likewise precocious values. It’s wide that astatine immoderate constituent aft reaching these values, the metric has had a crisp decline.

The abrupt alteration successful the unfastened involvement implies that a leverage flush took spot astatine those times. Such a compression happens erstwhile liquidations cascade unneurotic successful effect to a plaything successful the terms of Bitcoin.

During specified leverage flush incidents successful the play of the chart, the terms of the crypto besides seems to person crashed alongside it. This means that those erstwhile liquidations mostly progressive agelong positions.

Related Reading | Why Did China Ban Bitcoin Mining? Here Are The Seven Leading Theories

Since the marketplace seems to beryllium overleveraged close present arsenic hinted by the unfastened involvement values, it’s imaginable a akin liquidation lawsuit could instrumentality spot successful the adjacent future.

BTC Price

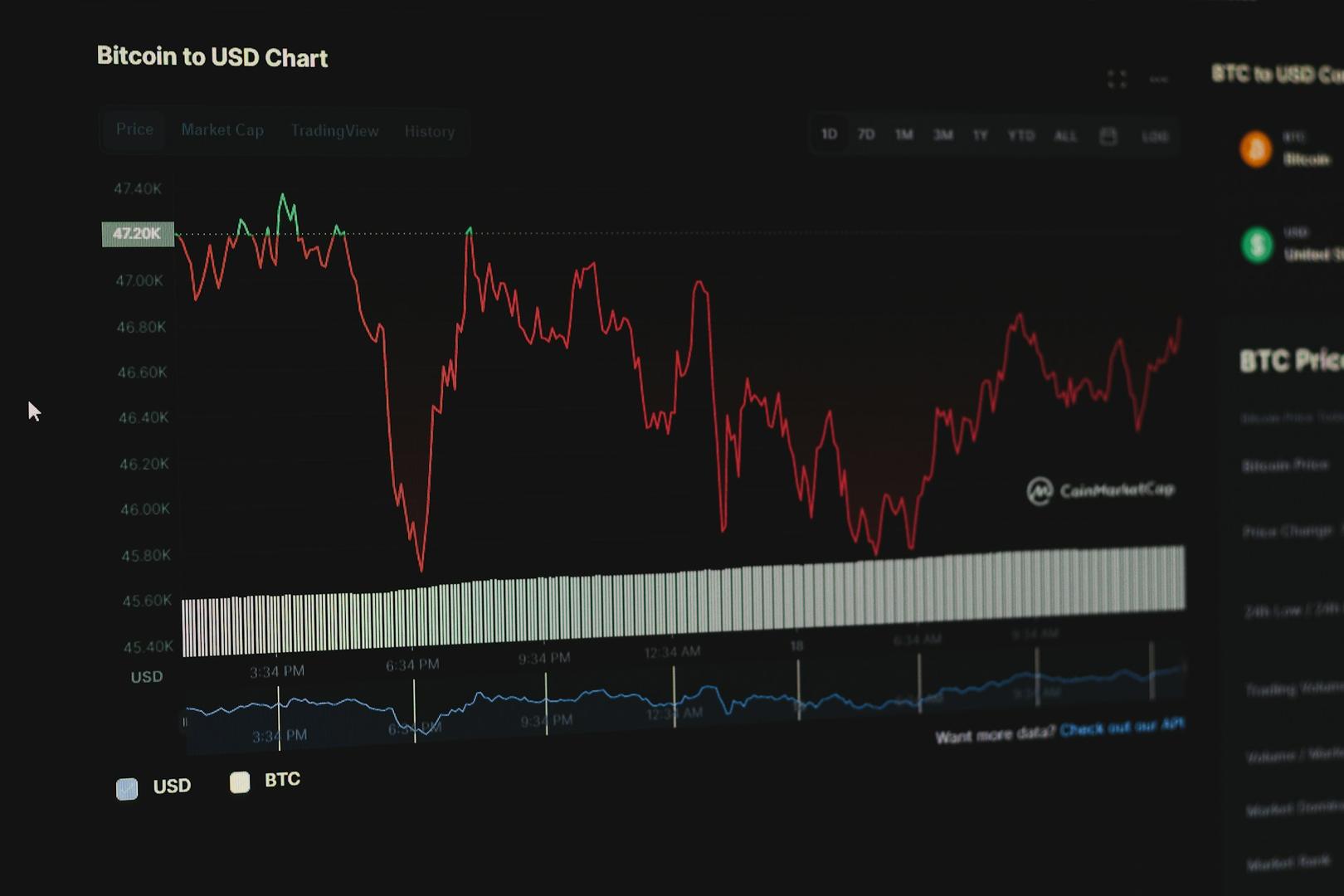

At the clip of writing, Bitcoin’s price floats astir $46.7k, down 5% successful the past 7 days. Over the past month, the coin has mislaid 12% successful value.

The beneath illustration shows the inclination successful the terms of BTC implicit the past 5 days.

In the past week, Bitcoin seems to person again started consolidating successful the $45k to $50k range. It’s unclear astatine the infinitesimal erstwhile the coin whitethorn flight this sideways movement, but if the unfastened involvement is thing to spell by, a liquidation lawsuit whitethorn hap soon.

Featured representation from Unsplash.com, charts from TradingView.com, CryptoQuant.com

4 years ago

4 years ago

English (US)

English (US)