Key takeaways:

97% of the $8.3 cardinal successful Bitcoin enactment options expire worthless astatine a $102,000 BTC price.

Short covering supra $105,000 could trigger a Bitcoin terms rally to caller highs.

Bitcoin (BTC) soared supra $101,000 connected May 8, reaching its highest level successful implicit 3 months. The 4.6% regular BTC terms summation triggered $205 cardinal successful liquidations of bearish futures positions and eroded the worth of astir each enactment (sell) option. Traders present question whether Bitcoin is poised to interruption its $109,354 all-time precocious successful the adjacent term.

The aggregate Bitcoin enactment (sell) enactment unfastened involvement for the adjacent 3 months stands astatine $8.3 billion, but 97% of those person been placed beneath $101,000 and volition apt expire worthless. Still, this does not mean each enactment options trader was betting connected Bitcoin’s downside, arsenic immoderate whitethorn person sold those instruments and profited from the terms gains.

Among the largest enactment strategies traded astatine Deribit is the “bull enactment spread,” which involves selling a enactment enactment portion simultaneously buying different enactment astatine a little onslaught price, capping some maximum nett and downside risk. For example, a trader aiming to nett from higher prices mightiness merchantability the $100,000 enactment and bargain the $95,000 put.

Cryptocurrency traders are known for their exaggerated optimism, and this is reflected successful the starring strategies connected Deribit’s options markets, specified arsenic the “bull telephone spread” and the “bull diagonal spread.” In some cases, traders expect Bitcoin prices astatine expiry to beryllium adjacent to oregon higher than the options traded.

$100,000 Bitcoin boosts bullish options, but shorts whitethorn resist

If Bitcoin sustains the $100,000 level, astir bullish strategies volition output affirmative results successful the May and June options expiries, giving traders further incentives to enactment upward momentum. However, determination is the anticipation that sellers (shorts) utilizing futures markets volition exert their power to forestall a caller Bitcoin all-time high.

Related: Coinbase to get options trading level Deribit for $2.9B

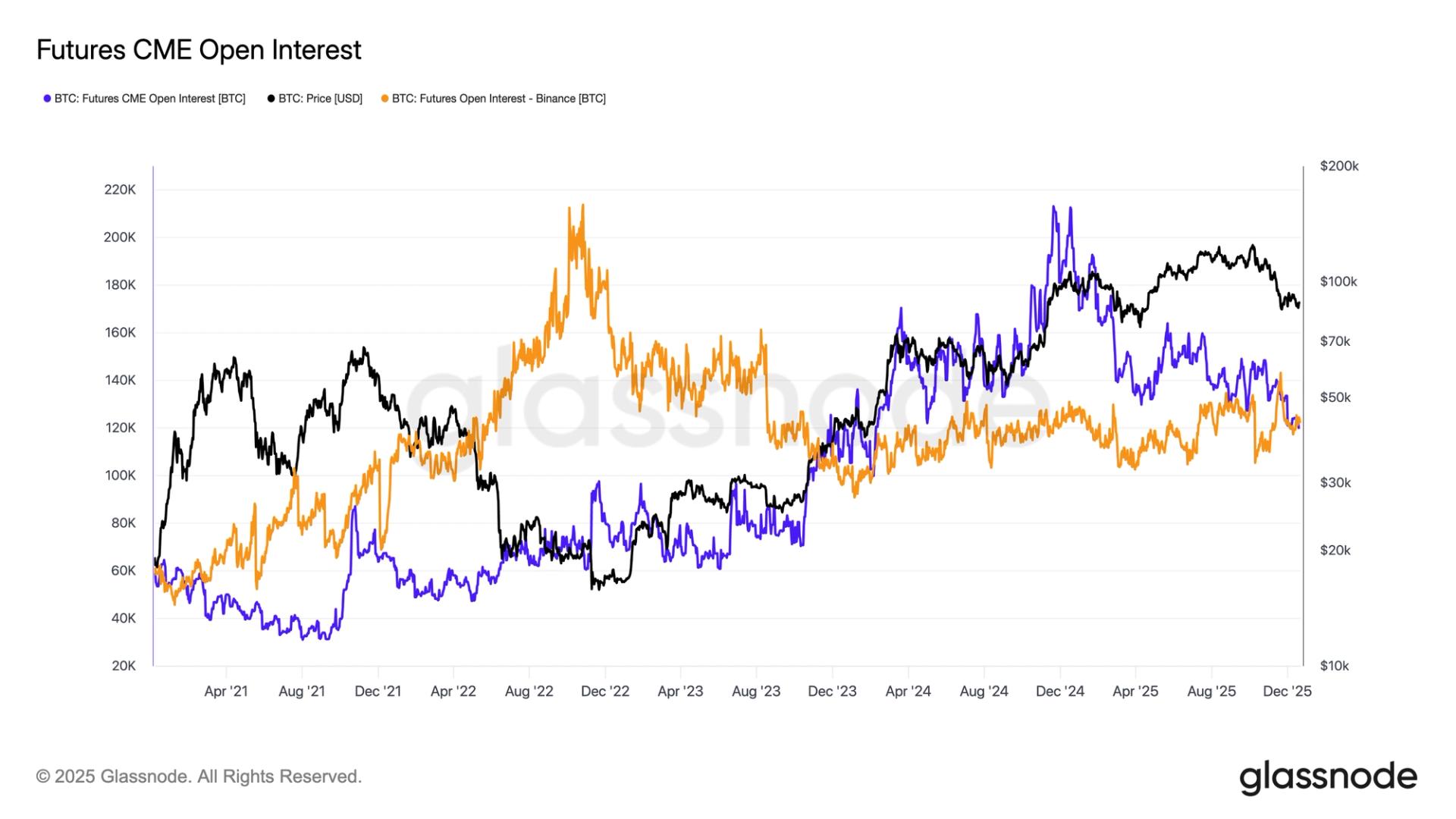

The aggregate unfastened involvement connected Bitcoin futures presently stands astatine $69 billion, indicating important request for abbreviated (sell) positions. At the aforesaid time, higher prices mightiness unit bears to adjacent their positions. However, this “short covering” effect is importantly muted successful afloat hedged positions, meaning those traders are not peculiarly delicate to Bitcoin terms movements.

For instance, 1 could bargain spot Bitcoin positions utilizing margin oregon spot exchange-traded funds (ETFs) portion simultaneously selling the equivalent successful BTC futures. Known arsenic the “carry trade,” this strategy is delta neutral, truthful the nett comes careless of terms swings, arsenic the monthly Bitcoin futures commercialized astatine a premium to compensate for the longer colony period.

The Bitcoin futures premium has been beneath 8% for the past 3 months, truthful the incentives for the “carry trade” person been limited. Hence, it is apt that immoderate signifier of “short covering” volition hap if Bitcoin surges supra $105,000, which greatly improves the likelihood of a caller all-time precocious implicit the adjacent mates of months.

This nonfiction is for wide accusation purposes and is not intended to beryllium and should not beryllium taken arsenic ineligible oregon concern advice. The views, thoughts, and opinions expressed present are the author’s unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

7 months ago

7 months ago

English (US)

English (US)