Key takeaways:

Rising request for enactment options and miner BTC deposits highlights increasing caution among traders contempt terms resilience adjacent $108,000.

Analysts astatine Bitwise reason that heavy drops successful marketplace sentiment often precede rebounds, framing the correction arsenic a “contrarian buying window”.

Bitcoin (BTC) fell to $107,600 connected Thursday, prompting traders to question whether Friday’s flash clang signaled the extremity of the bull tally that peaked astatine an all-time precocious connected Oct. 6. A informing awesome successful Bitcoin’s options marketplace has enactment traders connected edge, particularly amid rising miner outflows, investigating the spot of the $108,000 enactment level.

The Bitcoin options delta skew climbed supra 10%, showing that nonrecreational traders are paying a premium for enactment (sell) options, a motion emblematic of bearish sentiment. Under neutral conditions, this indicator usually ranges betwixt -6% and +6%. More importantly, the skew has worsened since Friday, suggesting that traders are increasing much doubtful astir Bitcoin’s bullish momentum.

US President Donald Trump’s confirmation that the commercialized warfare with China remains ongoing has besides weighed connected marketplace sentiment. Trump has threatened to further restrict commercialized with China pursuing its suspension of US soybean purchases, according to Yahoo Finance. Another origin adding unit is the uncertainty surrounding US economical information amid the ongoing authorities shutdown.

Demand for downside extortion strategies connected Deribit surged connected Thursday arsenic trading volumes for enactment options exceeded telephone options by 50%, a motion of mounting marketplace stress. The indicator climbed to its highest level successful implicit 30 days. Cryptocurrency traders are typically optimistic, truthful a neutral speechmaking for the put-to-call ratio tends to beryllium astir -20%, favoring telephone options.

Bitcoin derivatives simply bespeak the worsening US macroeconomics

Bitcoin wasn’t the lone marketplace affected by investors’ displacement successful sentiment, arsenic seen successful gold’s caller all-time precocious connected Thursday. Demand for short-term US authorities bonds besides spiked, adjacent arsenic 2 Federal Reserve Governors signaled further involvement complaint cuts successful October — a determination that typically reduces the entreaty of fixed-income investments.

Yields connected the US 2-year Treasury dropped to their lowest level successful much than 3 years, showing that investors are consenting to judge smaller returns successful speech for the information of government-backed assets. Meanwhile, golden climbed to $4,300, up 23% since September, pushing the worth of cardinal banks’ golden reserves supra their holdings of US Treasurys, according to Reuters.

Despite affirmative developments successful the tech sector, including chipmaker TSMC’s (TSM) upgraded 2025 outlook and beardown quarterly results from Bank of America and Morgan Stanley, the S&P 500 fell 0.9% connected Thursday. The Dow Jones US Select Regional Banks Index slid 4.4% aft 2 fiscal firms reported losses successful the private-credit market, according to the Financial Times.

Related: SEC chair: US is 10 years down connected crypto, fixing this is ‘job one’

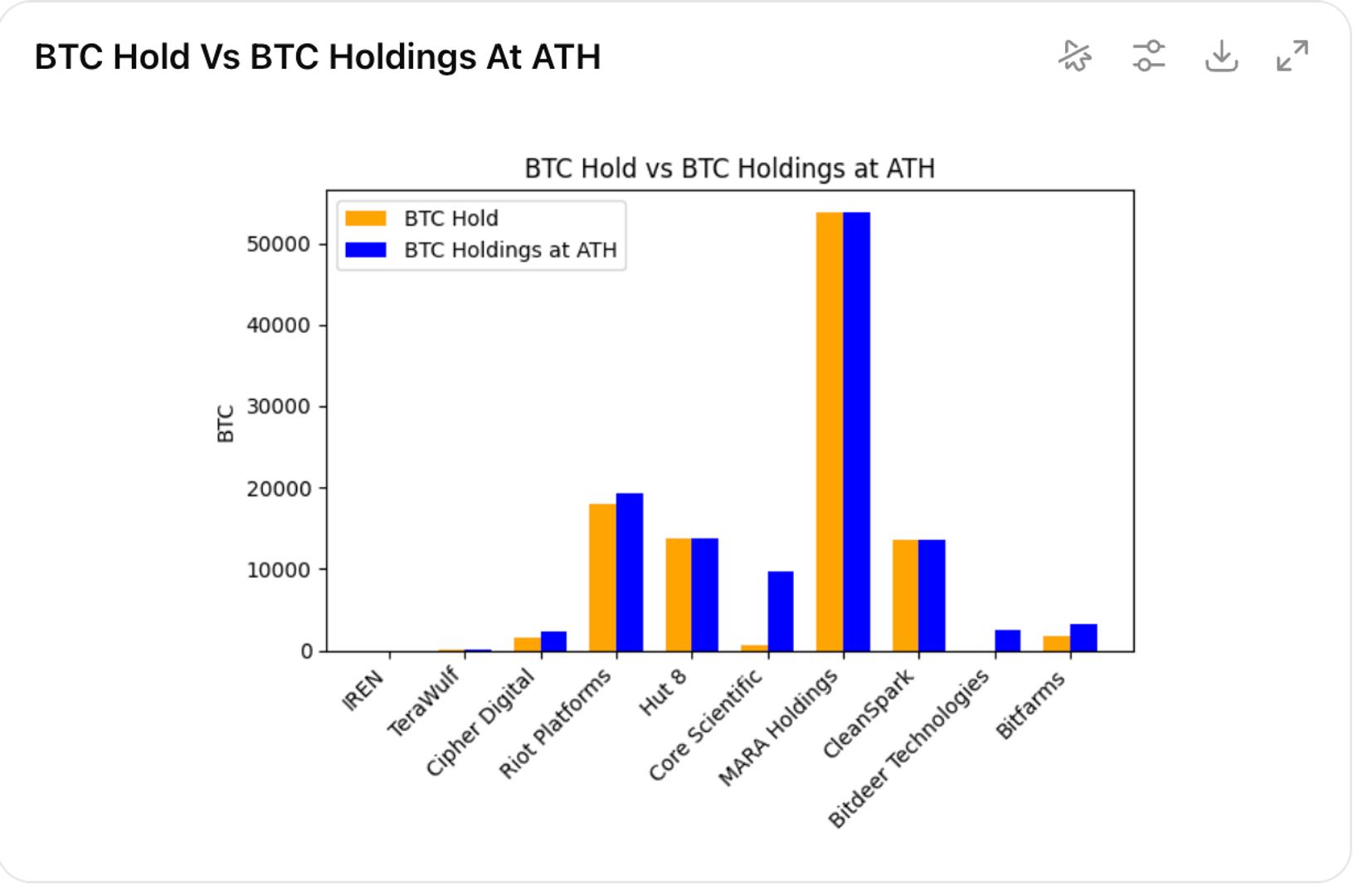

Movements from Bitcoin miner-linked addresses person besides raised concern. Data from CryptoQuant shows that miners deposited 51,000 BTC (worth implicit $5.5 billion) connected exchanges implicit the past 7 days, the largest outflow since July. The investigation noted that specified behaviour often precedes terms weakness, arsenic miners person historically been among Bitcoin’s largest holders.

While the informing from Bitcoin’s options marketplace points to fearfulness of further correction, Bitwise analysts said that utmost drops successful sentiment person often “marked favorable introduction points,” adding that “the caller correction was driven mostly by outer factors.” Bitwise caput of probe André Dragosch added that Friday’s liquidation lawsuit has acceptable the signifier for a “contrarian buying window.”

Further downside for Bitcoin remains possible, but the surge successful request for enactment options should not needfully beryllium seen arsenic a motion of sustained bearish momentum, arsenic outer factors person simply made traders much risk-averse.

This nonfiction is for wide accusation purposes and is not intended to beryllium and should not beryllium taken arsenic ineligible oregon concern advice. The views, thoughts, and opinions expressed present are the author’s unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

4 months ago

4 months ago

English (US)

English (US)