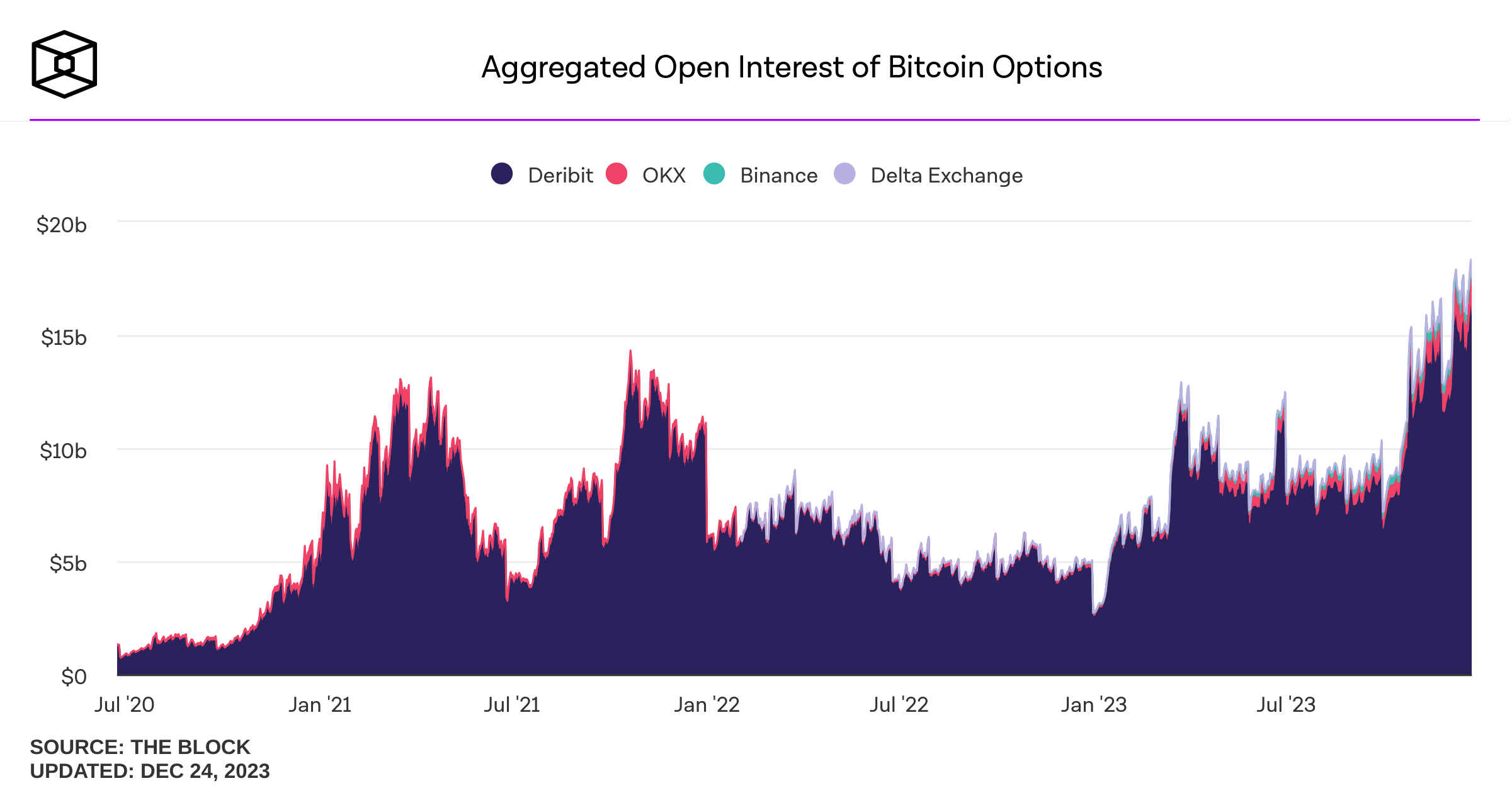

Bitcoin options unfastened involvement has soared to unprecedented levels, surpassing the $18 cardinal threshold connected Dec. 22, 2023. Currently, grounds indicates that bitcoin traders are leveraging bitcoin options to mitigate hazard and speculate connected the aboriginal terms trajectories of bitcoin, peculiarly successful anticipation of large developments specified arsenic the U.S. Securities and Exchange Commission’s (SEC) upcoming verdict connected a spot bitcoin exchange-traded money (ETF).

Traders Flock to Bitcoin Options arsenic SEC ETF Decision Looms

In December 2023, Bitcoin options unfastened involvement deed a grounds peak. Bitcoin options trading entails the acquisition oregon merchantability of contracts granting the bitcoin trader the option, though not the obligation, to bargain oregon merchantability a foundational plus astatine a predetermined terms by a specified date.

Traders utilize options to forecast BTC’s terms shifts oregon to safeguard existent holdings against imaginable terms fluctuations. The SEC is acceptable to marque a determination connected a spot bitcoin ETF by Jan. 10, 2023. Numerous reports bespeak that bitcoin traders are guarding their investments against the volatility expected to travel the SEC’s ruling.

A favorable determination could catalyze a terms increase, whereas an adverse 1 mightiness trigger a downturn. Through options, traders purpose to shield their portfolios from unfavorable terms changes. On Dec. 22, 2023, the open involvement successful bitcoin options was noted to beryllium astir $18.33 billion.

As of Dec. 23, 2023, the unfastened involvement successful bitcoin options is valued astatine $17.55 billion. The last 4th of the twelvemonth – October, November, and December – has seen the highest options volume successful BTC’s history. Records amusement a important $36.27 cardinal successful October, $36.16 cardinal successful November, and $34.47 cardinal successful December to date.

“The astir caller rally is being driven by leveraged/speculative money,” Ryan Kim, the pb astatine Falconx’s derivatives section told Bloomberg’s David Pan. “These traders could beryllium uncovering it prudent to walk premium to support their leveraged longs with immoderate [bitcoin] puts, betting connected a large determination successful either direction,” Kim added.

What bash you deliberation astir the soaring bitcoin options up of the SEC determination connected Jan. 10? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)