Bitcoin options data, peculiarly unfastened involvement and onslaught prices, is important for knowing the market’s expectations for aboriginal terms movements.

Options are fiscal derivatives that springiness the purchaser the right, but not the obligation, to bargain (call option) oregon merchantability (put option) an underlying plus astatine a predetermined terms (strike price) connected oregon earlier a circumstantial date. They’re a captious constituent of fiscal markets, providing insights into aboriginal terms expectations and marketplace sentiment.

Open involvement represents the full fig of outstanding options contracts that person not been settled. For Bitcoin options, a rising unfastened involvement indicates accrued marketplace information and interest, showing that investors are positioning themselves for aboriginal terms movements. Analyzing the organisation of onslaught prices tin uncover wherever investors expect these prices to move.

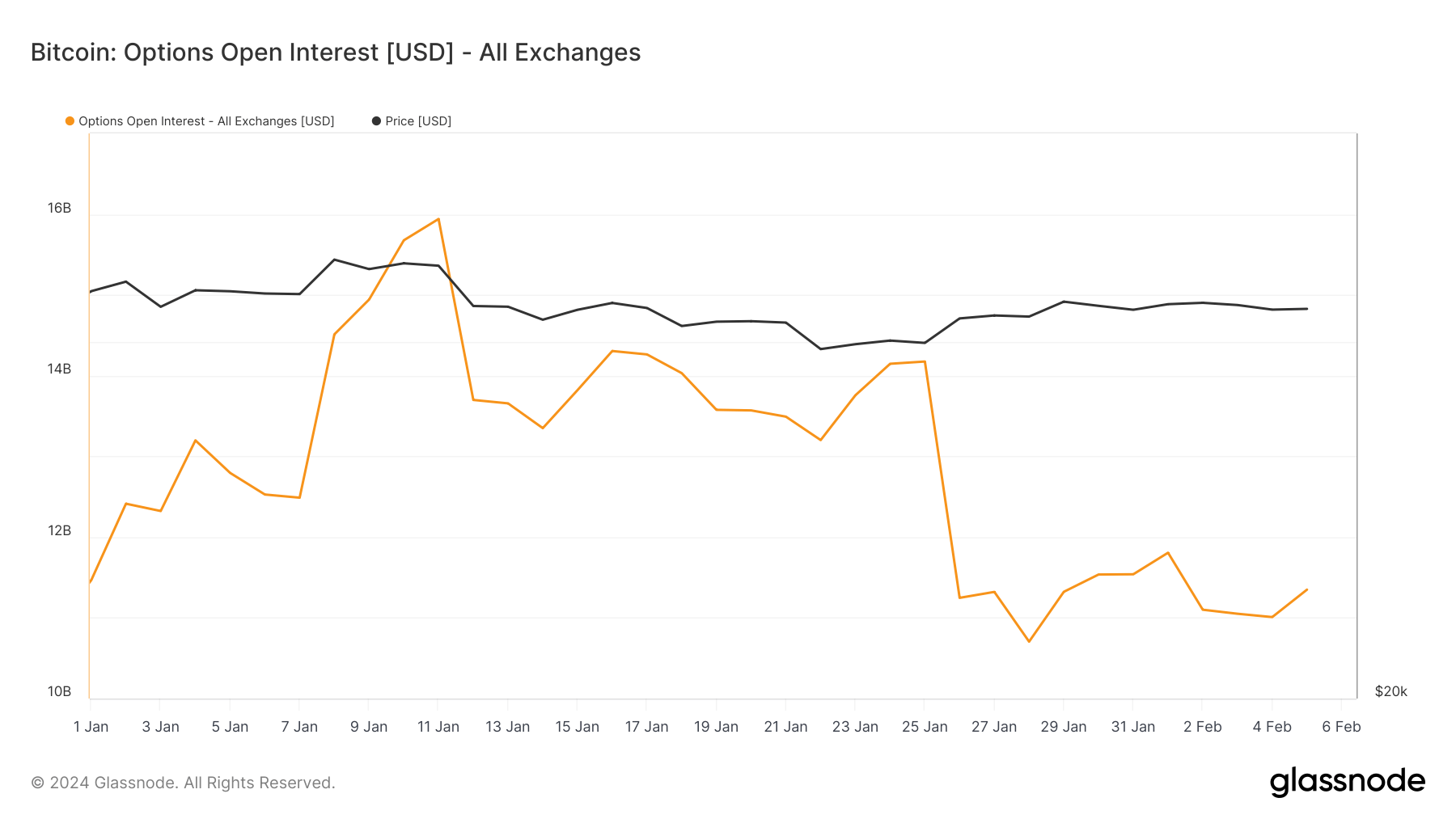

CryptoSlate’s investigation of Glassnode information showed a notable summation successful unfastened involvement and trading volumes starring up to the support of spot Bitcoin ETFs successful the U.S. Open involvement spiked to $15.94 cardinal connected Jan. 11, the time ETFs began trading, up from $11.46 cardinal connected Jan. 1.

This surge suggests accrued marketplace information and perchance a bullish sentiment arsenic investors mightiness person sought to hedge caller positions oregon speculate connected the terms absorption post-ETF approval. However, the consequent diminution to $10.704 cardinal by Jan. 28 and a flimsy betterment to $11.348 cardinal by Feb. 5 indicates volatility and perchance a reevaluation of marketplace positions arsenic archetypal enthusiasm tempered.

Graph showing the unfastened involvement successful Bitcoin options from Jan. 1 to Feb. 5, 2024 (Source: Glassnode)

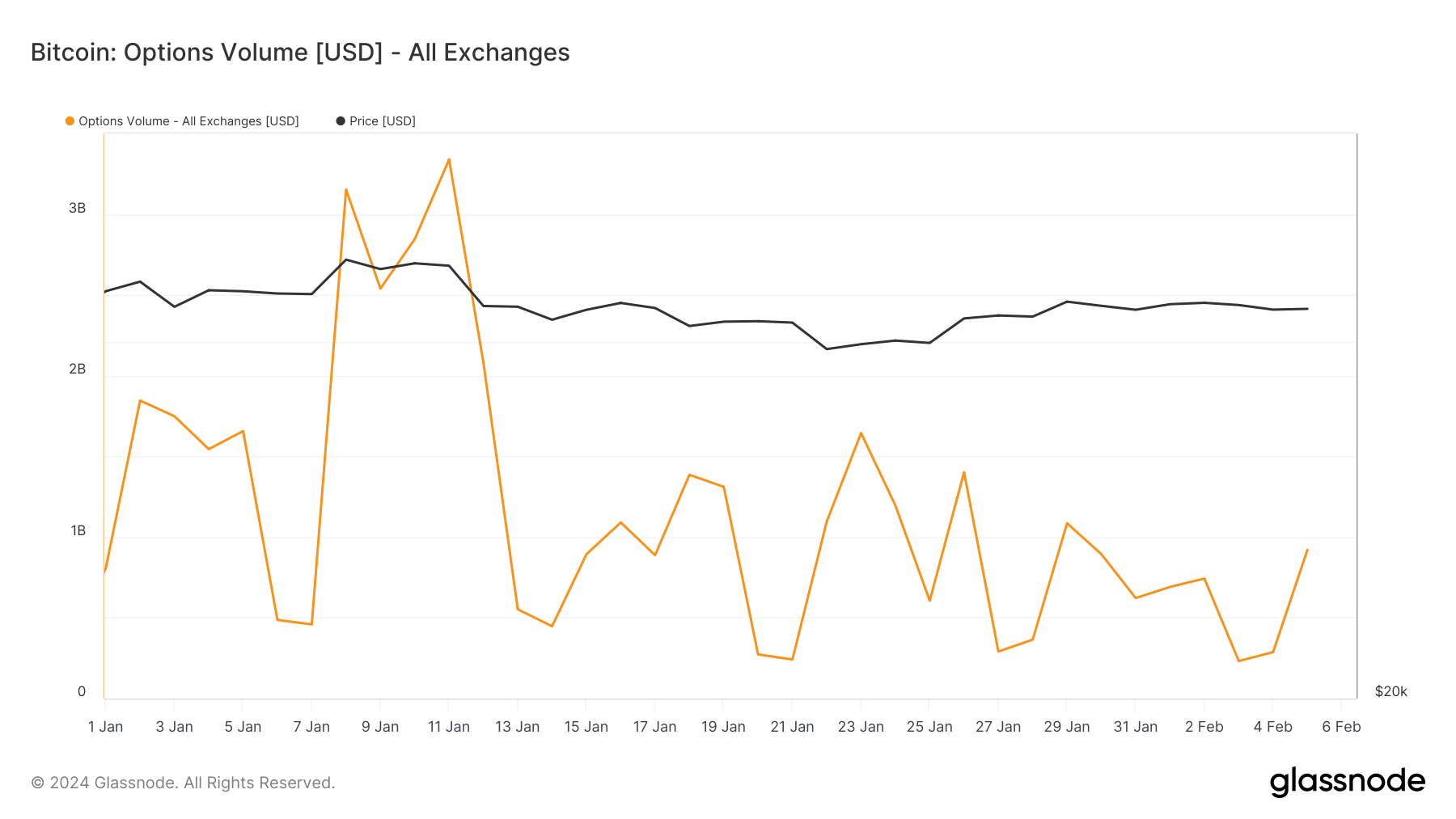

Graph showing the unfastened involvement successful Bitcoin options from Jan. 1 to Feb. 5, 2024 (Source: Glassnode)Trading measurement peaked astir the ETF launch, with a notable precocious of $3.338 cardinal connected Jan. 11, which aligns with the spike successful unfastened interest. The fluctuation successful volumes, peculiarly the driblet to $364.900 cardinal by Jan. 28, further underscores the market’s uncertainty and reassessment of strategies arsenic the archetypal reactions to the ETF trading normalize.

Graph showing the measurement for Bitcoin options from Jan. 1 to Feb. 5, 2024 (Source: Glassnode)

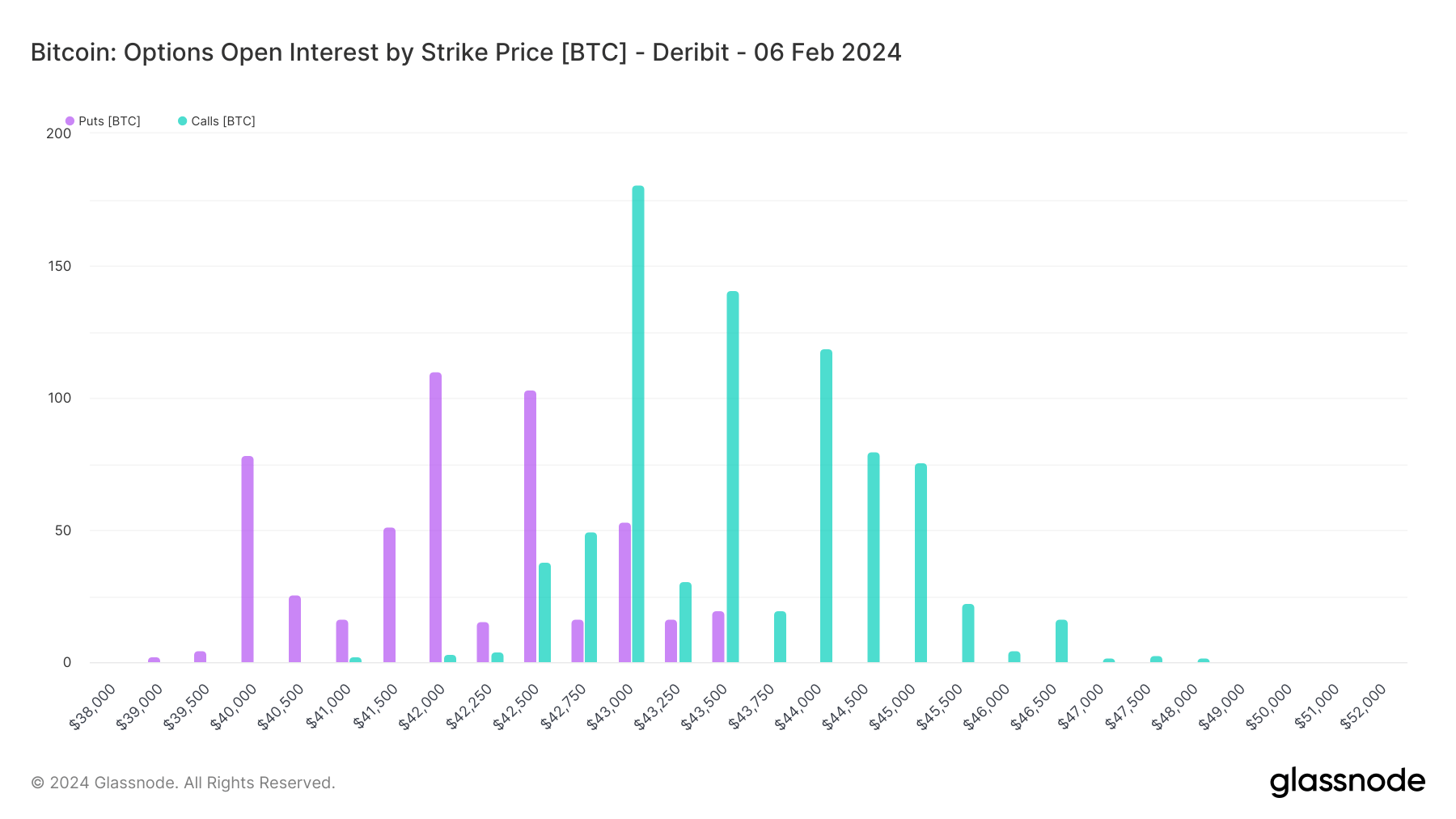

Graph showing the measurement for Bitcoin options from Jan. 1 to Feb. 5, 2024 (Source: Glassnode)The organisation of unfastened involvement crossed onslaught prices connected Deribit shows a divers scope of marketplace expectations: near-term pessimism and semipermanent optimism. Specifically, for contracts expiring connected Feb. 6, we observe a attraction of unfastened involvement successful puts astatine little onslaught prices and calls astatine somewhat higher but not overly ambitious onslaught prices.

This signifier indicates a near-term bearish sentiment oregon a protective stance among options holders. They mightiness beryllium hedging against imaginable short-term downside risks oregon speculating connected contiguous terms corrections.

Chart showing the unfastened involvement for Bitcoin options expiring connected Feb. 6, 2024, by onslaught terms (Source: Glassnode)

Chart showing the unfastened involvement for Bitcoin options expiring connected Feb. 6, 2024, by onslaught terms (Source: Glassnode)The onslaught prices for Feb. 6, specified arsenic $43,000 and $43,500 for calls and notably little volumes for puts, show a cautious optimism for a humble upward question oregon stableness successful the adjacent term.

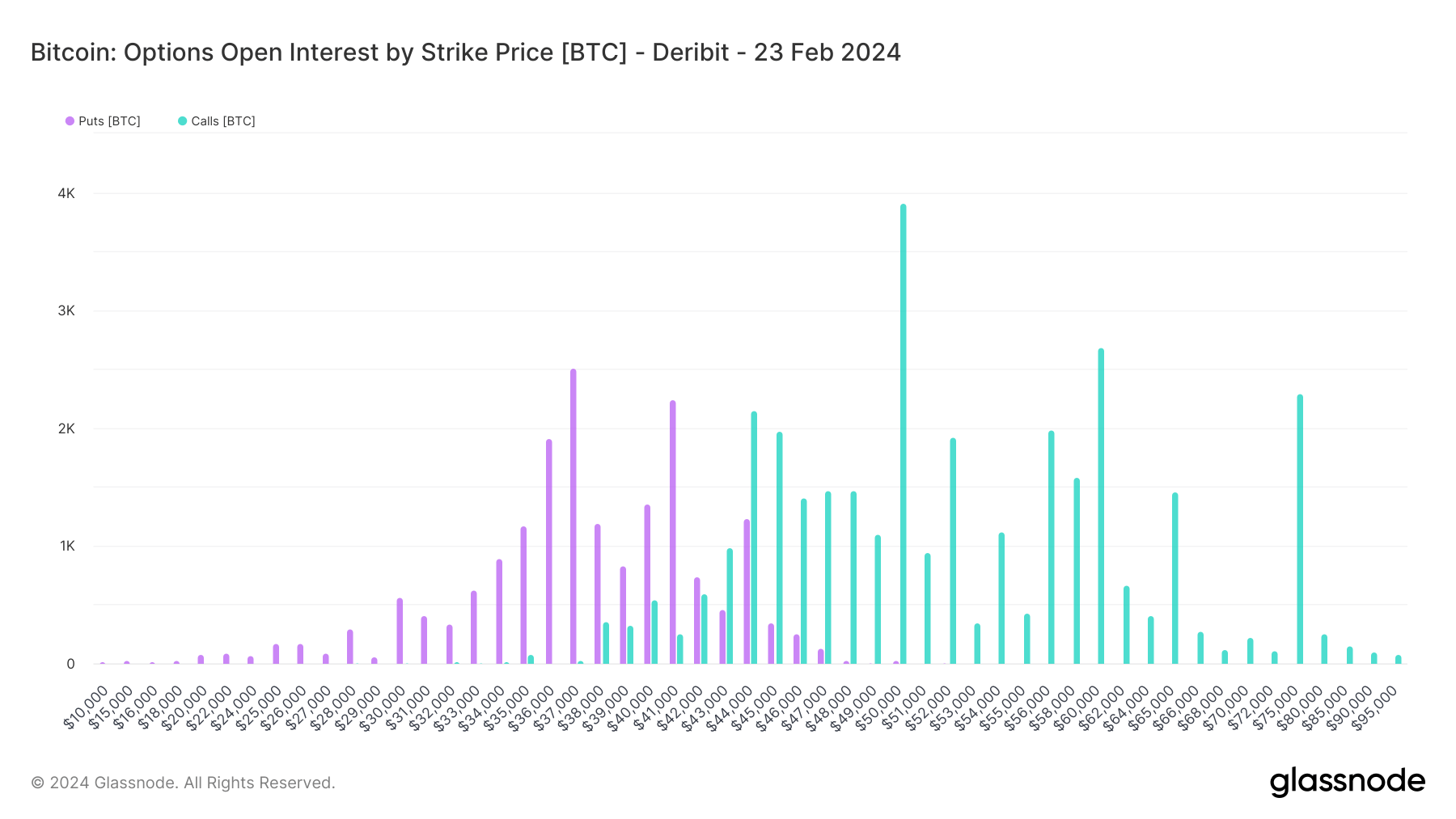

Chart showing the unfastened involvement for Bitcoin options expiring connected Feb. 23, 2024, by onslaught terms (Source: Glassnode)

Chart showing the unfastened involvement for Bitcoin options expiring connected Feb. 23, 2024, by onslaught terms (Source: Glassnode)For contracts expiring connected Feb. 23, the marketplace sentiment shifts much dramatically towards optimism. The higher unfastened involvement successful puts astatine little onslaught prices ($37,000 and $41,000) aligns with a protective stance against important terms drops.

However, the important involvement successful calls astatine overmuch higher onslaught prices ($50,000, $52,000, $60,000, and $75,000) underscores a semipermanent bullish outlook among investors. This suggests that contempt near-term uncertainties oregon volatility, determination is simply a beardown content successful Bitcoin’s imaginable for a important terms summation by the extremity of the month.

The station Bitcoin options amusement semipermanent bullishness and near-term pessimism appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)