By James Van Straten (All times ET unless indicated otherwise)

September has started overmuch similar August ended, with debased volumes, subdued volatility, and astir of the market-moving headlines coming from accepted finance.

Gold rose to $3,560 earlier easing back, portion authorities enslaved yields globally retreated from caller highs.

Bitcoin perpetual backing rates, payments designed to support perpetual futures contracts adjacent to the spot price, person cooled and are present astir 6% aft hitting double-digit levels earlier. Open interest, meantime, continues to drop, with conscionable implicit 720,000 contracts outstanding, denominated successful BTC.

As for publically listed bitcoin treasury companies, their multiples to nett plus worth (mNAV) are besides extending declines.

Strategy (MSTR) present trades astatine an mNAV of conscionable implicit 1.55 and Metaplanet (3350) sits astatine 1.71 aft a 7% share-priced ecline successful Japan trading. KindlyMD (NAKA) dropped a further 9% connected Wednesday, leaving it down 75% from its all-time high, and present trades astatine an mNAV of 2.5.

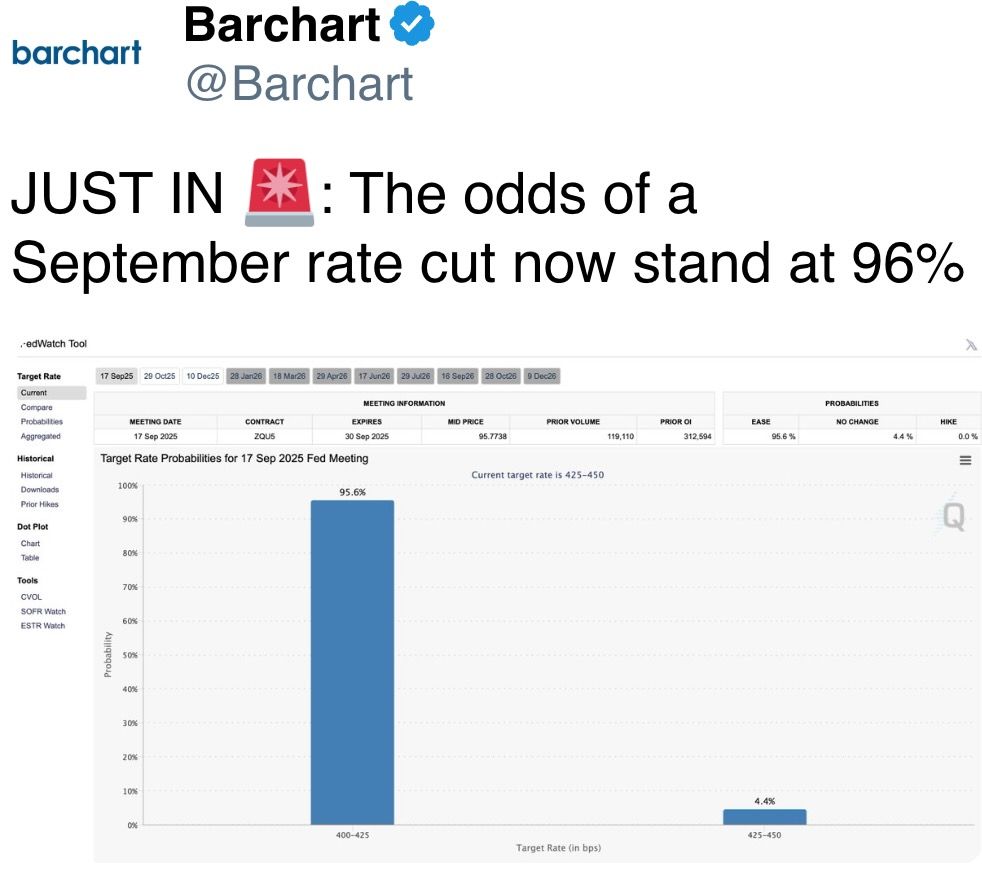

More than $4.5 cardinal successful crypto options are acceptable to expire connected Deribit, connected Friday, which is besides the time of the U.S. nonfarm payrolls report. For bitcoin, $3.28 cardinal successful notional worth is due, with a max symptom constituent astatine $112,000 and a put-call ratio of 1.38.

"Open involvement is tilted toward puts, with notable clustering astir the $105,000 to $110,000 strikes, suggesting downside extortion remains a cardinal theme," the derivatives speech said successful a station connected X.

Ether options relationship for $1.27 cardinal successful notional value, with a put-call ratio of 0.78 and a max symptom level of $4,400.

Deribit notes "flows are much balanced, but calls are gathering supra $4,500, signaling increasing involvement successful upside optionality". Stay alert!

What to Watch

- Crypto

- Sept. 4: Polygon volition switch its mainnet token to POL from MATIC. Holders of MATIC connected Ethereum, Polygon zkEVM oregon centralized exchanges whitethorn request to instrumentality action.

- Sept. 4: Apex Fusion's dedicated EVM-compatible layer-2 blockchain, Nexus, goes live. The chain, which aims to unite UTXO and EVM ecosystems, integrates with Tenderly’s infrastructure and improvement toolkit.

- Sept. 10, 9:15 a.m.: Comptroller of the Currency Jonathan V. Gould volition talk about integer assets astatine the CoinDesk: Policy & Regulation Conference successful Washington.

- Macro

- Sept. 4, 8:15 a.m.: Automatic Data Processing (ADP) releases August U.S. private-sector employment data.

- Employment Change Est. 68K vs. Prev. 104K

- Sept. 4, 9:30 a.m.: S&P Global releases August Canada information connected manufacturing and services activity.

- Composite PMI Prev. 48.7

- Services PMI Prev. 49.3

- Sept. 4, 9:45 a.m.: S&P Global releases (final) August U.S. information connected manufacturing and services activity.

- Composite PMI Est. 55.4 vs. Prev. 55.1

- Services PMI Est. 55.4 vs. Prev. 55.7

- Sept. 4, 10 a.m.: The Institute for Supply Management (ISM) releases August U.S. services assemblage data.

- Services PMI Est. Est. 51 vs. Prev. 50.1

- Sept. 4, 1 p.m.: Uruguay's National Institute of Statistics releases August ostentation data.

- Inflation Rate YoY Prev. 4.53%

- Sept. 4, 3 p.m.: Colombia's National Administrative Department of Statistics (DANE) releases August shaper terms ostentation data.

- PPI YoY Prev. 2.2%

- Sept. 4, evening: President Donald Trump volition big a private dinner successful the recently renovated White House Rose Garden for astir 2 twelve apical tech and concern leaders, including Mark Zuckerberg, Tim Cook, Bill Gates and Sam Altman.

- Sept. 5, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases July shaper terms ostentation data.

- PPI MoM Prev. -1.25%

- PPI YoY Prev. 3.24%

- Sept. 5, 8:30 a.m.: Statistics Canada releases August employment data.

- Unemployment Rate Est. 7% vs. Prev. 6.9%

- Employment Change Est. 7.5K vs. Prev. -40.8K

- Sept. 5, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases August employment data.

- Nonfarm Payrolls Est. 75K vs. Prev. 73K

- Unemployment Rate Est. 4.3% vs. Prev. 4.2%

- Government Payrolls Prev. -10K

- Manufacturing Payrolls Est. -5K vs. Prev. -11K

- Sept. 5: S&P 500 Rebalance update released aft marketplace close. Strategy (MSTR) is 1 of the companies being considered for inclusion successful the index.

- Sept. 5, 7 p.m.: Colombia’s National Administrative Department of Statistics releases August user terms ostentation data.

- Inflation Rate MoM Prev. 0.28%

- Inflation Rate YoY Prev. 4.9%

- Sept. 5, 7 p.m.: El Salvador's Statistics and Census Office releases August user terms ostentation data.

- Inflation Rate MoM Prev. 0.33%

- Inflation Rate YoY Prev. -0.14%

- Sept. 4, 8:15 a.m.: Automatic Data Processing (ADP) releases August U.S. private-sector employment data.

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on upgrading Arbitrum One and Nova to ArbOS 50 Dia, adding enactment for Ethereum’s Fusaka fork, caller EIPs, bug fixes and a autochthonal mint/burn feature (for Orbit chains only). Voting ends Sept. 4.

- Uniswap DAO is voting on deploying Uniswap v3 connected Ronin with $1M successful RON and $500K successful UNI incentives to marque it the chain’s superior decentralized exchange. Voting ends Sept. 6.

- Lido DAO is voting connected a proposal to migrate Nethermind’s ~7,000 Ethereum validators to infrastructure operated by Twinstake, a staking supplier co-founded by Nethermind. Voting ends Sept. 8.

- Uniswap DAO is voting to found “DUNI,” a Wyoming DUNA arsenic its ineligible entity, preserving decentralized governance portion enabling off-chain operations and liability protections, with $16.5M successful UNI for legal/tax budgets and $75K successful UNI for compliance. Voting ends Sept. 8.

- Uniswap DAO is voting connected an updated Unichain-USDS maturation program to accelerate adoption done performance-based incentives and DAO-guided distribution. The connection introduces minimum KPIs, a “No result, nary reward” model. Voting ends Sept. 9.

- Unlocks

- Sept. 5: Immutable (IMX) to unlock 1.27% of its circulating proviso worthy $12.43 million.

- Sept. 11: Aptos (APT) to unlock 2.2% of its circulating proviso worthy $48.41 million.

- Sept. 15: Starknet (STRK) to unlock 5.98% of its circulating proviso worthy $15.33 million.

- Sept. 15: Sei (SEI) to unlock 1.18% of its circulating proviso worthy $15.89 million.

- Sept. 16: Arbitrum (ARB) to unlock 2.03% of its circulating proviso worthy $46.02 million.

- Token Launches

- Sept. 4: Gata (GATA) to beryllium listed connected Binance Alpha, MEXC, Bitget, Gate.io, and others.

- Sept. 4: Tradoor (TRADOOR) to beryllium listed connected Binance Alpha, Bitget, MEXC and others.

Conferences

The CoinDesk Policy & Regulation Conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB15 for 15% disconnected your registration.

- Day 2 of 2: CONF3RENCE (Dortmund, Germany)

- Day 2 of 3: bitcoin++ (Istanbul)

- Day 1 of 2: ETHWarsaw 2025 (Warsaw)

- Day 1 of 3: Taipei Blockchain Week (Taiwan)

- Sept. 5: Bitcoin Indonesia Conference 2025 (Bali)

- Sept. 9-10: Fintech Week London 2025

- Sept. 9-10: WOW Summit Hong Kong 2025

- Sept. 9-13: Boston Blockchain Week (Quincy, Massachusetts)

Token Talk

By Oliver Knight

- Donald Trump-linked DeFi token connection liberty fiscal (WLFI) slumped to a grounds debased $0.174 connected Thursday arsenic the token's popularity begins to slice conscionable days aft its trading debut.

- The 21% regular drawdown tin beryllium attributed to a fig of factors, notably the information that immoderate token holders are inactive successful nett aft purchasing during the token sale. These holders volition beryllium tempted to fastener successful their profits arsenic hype astir the task fades.

- One trader made $250 million aft buying $15 cardinal during the sale, different lost $2.2 million aft going agelong connected WLFI futures.

- While WLFI is linked to the U.S. president, successful presumption of improvement and innovation, there's thing evident to differentiate it from the thousands of different DeFi-themed tokens. As a effect traders whitethorn beryllium inclined to leap vessel until they spot improvement of the project.

- "WLFI team, halt sleeping and commencement taking action. The assemblage is already angry, astatine slightest don’t suffer the past remaining investors," 1 holder wrote connected X.

- The illustration looks eerily akin to the TRUMP memecoin that was released successful January. After a play of archetypal upside, TRUMP mislaid 89% of its worth and regular measurement dwindled from $39 cardinal connected opening time to conscionable $210 cardinal successful the past 24 hours.

- In an effort to quell the selling pressure, the task revealed connected X that WLFI held by the squad would not beryllium sold connected the unfastened market, stating that each token successful the treasury would beryllium taxable to governance and not the team's discretion.

- The tweet failed to stem the decline, and prices continued to tumble soon after.

Derivatives Positioning

- BTC derivatives positioning has cooled, enactment is inactive determination however, with momentum and directional condemnation looking muted alternatively than stagnant.

- Open involvement successful perpetual futures crossed large venues has dropped from the caller highest adjacent $33 cardinal to astir $30 billion.

- At the aforesaid time, the three-month annualized ground keeps compressing to astir 5%–6% crossed Binance, OKX and Deribit, leaving the transportation commercialized lone marginally profitable.

- Options information is sending mixed signals. While the upward-sloping implied volatility curve suggests the marketplace expects semipermanent volatility to beryllium higher than short-term, different metrics constituent to a much contiguous bearish outlook.

- Specifically, the 25 delta skew continues to beryllium either level oregon somewhat negative, with traders paying a premium for puts implicit calls to summation downside protection. This short-term bearish sentiment is contradicted by 24-hour enactment telephone volume, with calls (63%) dominating options contracts for BTC.

- Funding complaint APRs crossed large perpetual swap venues are small changed astir 4%-6% annualized, according to Velo data. Hyperliquid is the lone speech with a complaint higher than 6% for BTC, reflecting a pouch of stronger semipermanent involvement comparative to different exchanges. Overall, backing dynamics suggest a unchangeable marketplace with isolated signs of froth, alternatively than wide directional conviction.

- Coinglass information shows $225 cardinal successful 24-hour liquidations, with a 50-50 divided betwixt longs and shorts. ETH ($65million), BTC ($46 million) and others ($19 million) were the leaders successful presumption of notional liquidations.

- The Binance liquidation heatmap indicates $110,250 arsenic a halfway liquidation level to monitor, successful lawsuit of a terms drop.

Market Movements

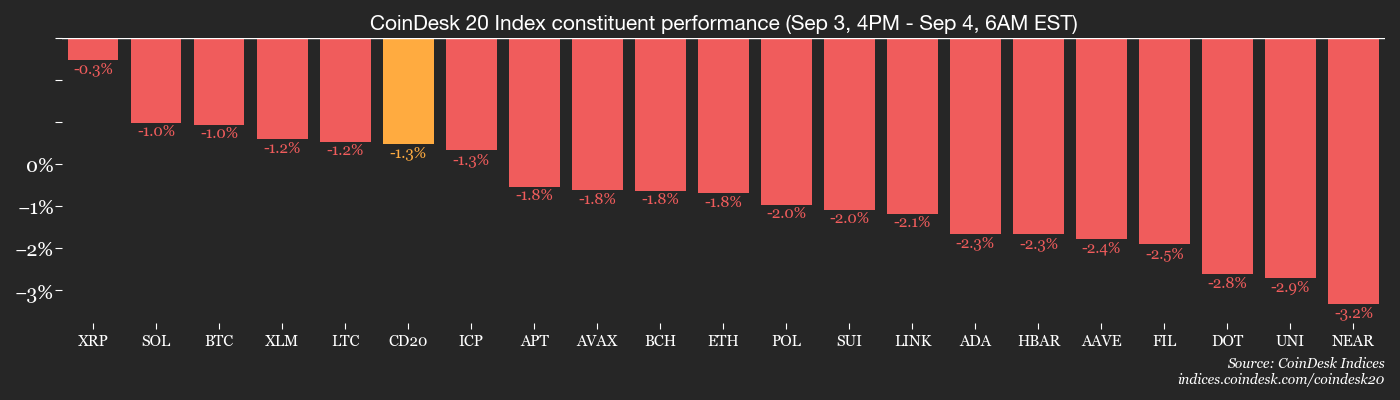

- BTC is down 1.06% from 4 p.m. ET Wednesday astatine $111,024.03 (24hrs: -0.39%)

- ETH is down 1.58% astatine 4,395.87 (24hrs: +0.84%)

- CoinDesk 20 is down 1.28% astatine 4,035.47 (24hrs: -0.24%)

- Ether CESR Composite Staking Rate is down 2 bps astatine 2.87%

- BTC backing complaint is astatine 0.0038% (4.1873% annualized) connected Binance

- DXY is up 0.15% astatine 98.29

- Gold futures are down 1.01% astatine $3,598.80

- Silver futures are down 1.23% astatine $41.03

- Nikkei 225 closed up 1.53% astatine 42,580.27

- Hang Seng closed down 1.12% astatine 25,058.51

- FTSE is up 0.19% astatine 9,194.99

- Euro Stoxx 50 is unchanged astatine 5,326.92

- DJIA closed connected Wednesday unchanged astatine 45,271.23

- S&P 500 closed up 0.51% astatine 6,448.26

- Nasdaq Composite closed up 1.02% astatine 21,497.73

- S&P/TSX Composite closed up 0.47% astatine 28,751.36

- S&P 40 Latin America closed down 0.11% astatine 2,756.91

- U.S. 10-Year Treasury complaint is down 1.6 bps astatine 4.195%

- E-mini S&P 500 futures are up 0.17% astatine 6,468.25

- E-mini Nasdaq-100 futures are up 0.24% astatine 23,505.75

- E-mini Dow Jones Industrial Average Index are unchanged astatine 45,308.00

Bitcoin Stats

- BTC Dominance: 58.44% (+0/13%)

- Ether-bitcoin ratio: 0.03961 (-0.58%)

- Hashrate (seven-day moving average): 990 EH/s

- Hashprice (spot): $54.54

- Total fees: 6.28 BTC / $701,021

- CME Futures Open Interest: 134,255 BTC

- BTC priced successful gold: 31.3 oz.

- BTC vs golden marketplace cap: 8.77%

Technical Analysis

- Altcoin dominance (excluding the apical 10) has rebounded from a bottommost conscionable nether 6% and is present investigating cardinal absorption adjacent 8%. A decisive interruption supra this level could awesome sustained outperformance of alts comparative to bitcoin

- However, the determination truthful acold has been driven by a prime fig of tokens alternatively than a broad-based “alt season.”

- Even if absorption is broken, this inclination is apt to stay concentrated, not a wholesale surge crossed the full altcoin universe.

Crypto Equities

- Coinbase Global (COIN): closed connected Wednesday astatine $302.31 (-0.41%), unchanged successful pre-market

- Circle (CRCL): closed astatine $118.46 (-1.4%), +0.82% astatine $119.43

- Galaxy Digital (GLXY): closed astatine $24.39 (+0.95%), +1.15% astatine $24.67

- Bullish (BLSH): closed astatine $54.26 (-12.53%), -1.68% astatine $53.35

- MARA Holdings (MARA): closed astatine $15.89 (-1.06%), -1.13% astatine $15.71

- Riot Platforms (RIOT): closed astatine $13.45 (-4.54%), -0.3% astatine $13.41

- Core Scientific (CORZ): closed astatine $13.58 (-3%)

- CleanSpark (CLSK): closed astatine $9.44 (-2.07%), -0.42% astatine $9.40

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $30.70 (-2.97%)

- Exodus Movement (EXOD): closed astatine $24.33 (-1.86%)

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $330.26 (-3.33%), -0.17% astatine $329.71

- Semler Scientific (SMLR): closed astatine $29.01 (-1.23%)

- SharpLink Gaming (SBET): closed astatine $16.82 (-0.94%), -2.79% astatine $16.35

- Upexi (UPXI): closed astatine $6.63 (-3.77%), +1.66% astatine $6.74

- Mei Pharma (MEIP): closed astatine $4.53 (-6.6%)

ETF Flows

Spot BTC ETFs

- Daily nett flows: $300.5 million

- Cumulative nett flows: $54.85 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: -$38.2 million

- Cumulative nett flows: $13.36 billion

- Total ETH holdings ~6.54 million

Source: Farside Investors

Chart of the Day

- Comparing bitcoin terms enactment with planetary M2 (a wide measurement of wealth supply) connected a six-week pb — shorter than the much commonly utilized 10-week pb — shows a striking correlation since the 2nd quarter.

- If this narration persists, the exemplary points to a imaginable BTC bottommost astir Sept. 11, followed by a resumption of the rally.

While You Were Sleeping

- Trump Takes Tariffs Fight to U.S. Supreme Court (Reuters): The Justice Department is appealing a ruling that Trump exceeded his authorization nether a 1977 exigency law, with judges citing the large questions doctrine requiring Congress to authorize actions of wide economical significance.

- Gold Outshines successful 2025 arsenic Bitcoin-Gold Ratio Eyes Q4 Breakout (CoinDesk): Gold’s rally, fueled by falling enslaved yields successful large economies, underscores its benchmark role, portion illustration patterns connected the bitcoin-gold ratio constituent to a imaginable breakout by year-end.

- Currency Hedging Gets Expensive Again Ahead of US Jobs Report (Bloomberg): Traders are piling into bets connected large currency swings, particularly successful the euro-dollar rate, arsenic Friday’s study could impact the Fed's interest-rate way with governmental and fiscal risks worldwide adding pressure.

- Crypto Hackers are Now Using Ethereum Smart Contracts to Mask Malware Payloads (CoinDesk): Researchers discovered astute contracts utilized to disguise malware successful 2 packages distributed via NPM, an open-source instrumentality utilized by developers to find, instal and negociate reusable code.

- Ripple Brings $700M RLUSD Stablecoin to Africa, Trials Extreme Weather Insurances (CoinDesk): The steadfast partnered with Chipper Cash, VALR and Yellow Card to grow RLUSD successful Africa, portion Kenya pilots the usage of the stablecoin successful escrow astute contracts for drought and rainfall insurance.

- Bond Investors Count connected Trump Tariff Revenues to Rein In U.S. Debt (Financial Times): Investors are banking connected tariff revenues, which the Congressional Budget Office estimates volition rise $4 trillion implicit 10 years, astir matching the outgo of Trump’s taxation cuts implicit the aforesaid period.

In the Ether

Saksham Diwan contributed to this newsletter.

3 months ago

3 months ago

English (US)

English (US)