Recent days person seen accrued marketplace volatility arsenic the FTX saga blows up.

Binance’s connection to bargain FTX gives the beleaguered speech a lifeline. However, arsenic made wide by Binance CEO Changpeng Zhao (CZ,) the woody is taxable to satisfactory due diligence.

Crypto Twitter is awash with speculation that erstwhile FTX’s books person been reviewed and cost-benefit investigation has been considered CZ volition propulsion retired of the deal.

Meanwhile, investigation conducted with Glassnode information showed Bitcoin derivatives markets person responded accordingly.

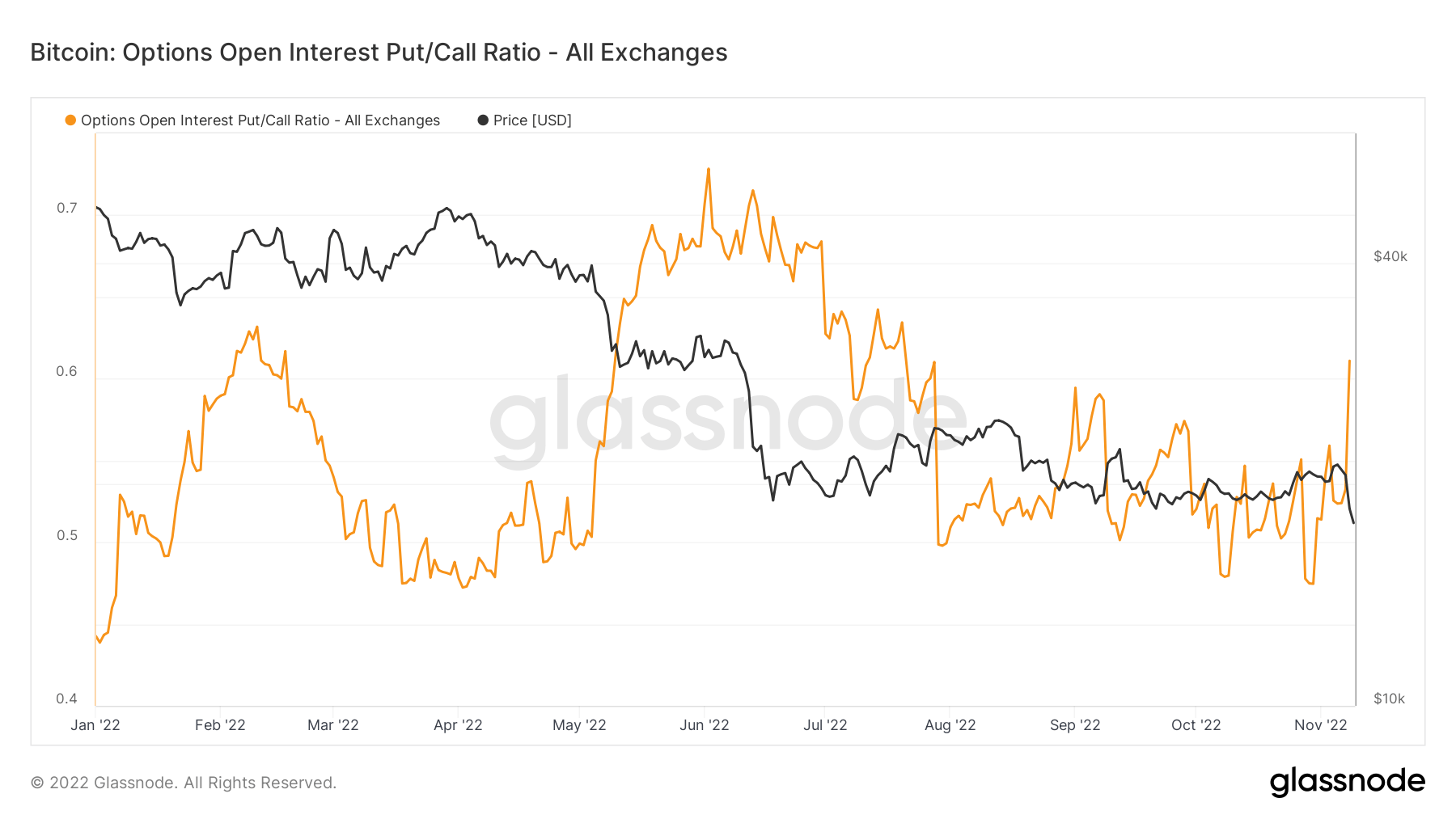

Bitcoin Open Interest Put/Call Ratio

A enactment is the close to merchantability an plus astatine a acceptable terms by a specified expiration date. Whereas a telephone refers to the close to bargain an plus astatine a acceptable terms by a specified expiration date.

The Open Interest Put/Call Ratio (OIPCR)is calculated by dividing the full fig of puts unfastened involvement by the full fig of calls unfastened involvement connected a peculiar day.

Open involvement is the fig of contracts, either enactment oregon call, outstanding successful the derivatives market, i.e. unsettled and open. It tin beryllium considered an denotation of wealth flow.

The illustration beneath shows the OIPCR spiked higher arsenic the FTX concern took hold. The plaything towards buying puts suggests bearish marketplace sentiment among options traders.

Crucially, the OIPCR has not (yet) reached the extremes seen successful June, during the Terra Luna collapse. Nonetheless, arsenic a processing situation, determination is scope for puts to widen further.

Source: Glassnode.com

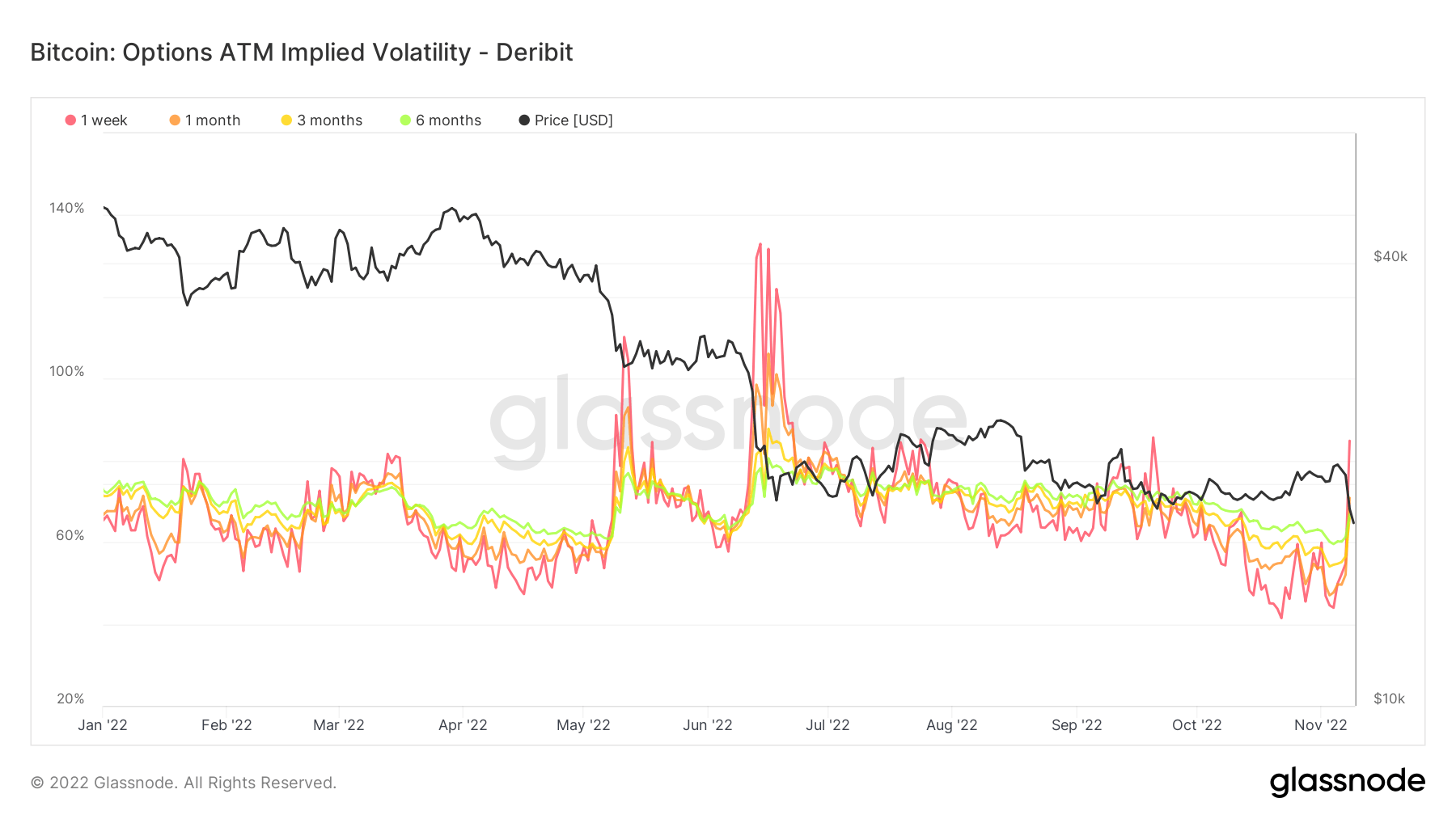

Source: Glassnode.comATM Implied Volatility

Implied Volatility (IV) gauges marketplace sentiment toward the probability of changes successful a peculiar asset’s terms – often utilized to terms options contracts. IV usually increases during marketplace downturns and decreases nether bullish marketplace conditions.

It tin beryllium considered a proxy of marketplace hazard and is usually expressed successful percent presumption implicit a peculiar clip frame.

IV follows expected terms movements wrong 1 modular deviation implicit a year. The metric tin beryllium further supplemented by delineating IV for options contracts expiring successful 1 week, 1 month, 3 months, and 6 months from the present.

The illustration beneath shows a crisp reversal from erstwhile bullish lows, suggesting options traders are expecting an uptick successful volatility ahead.

Source: Glassnode.com

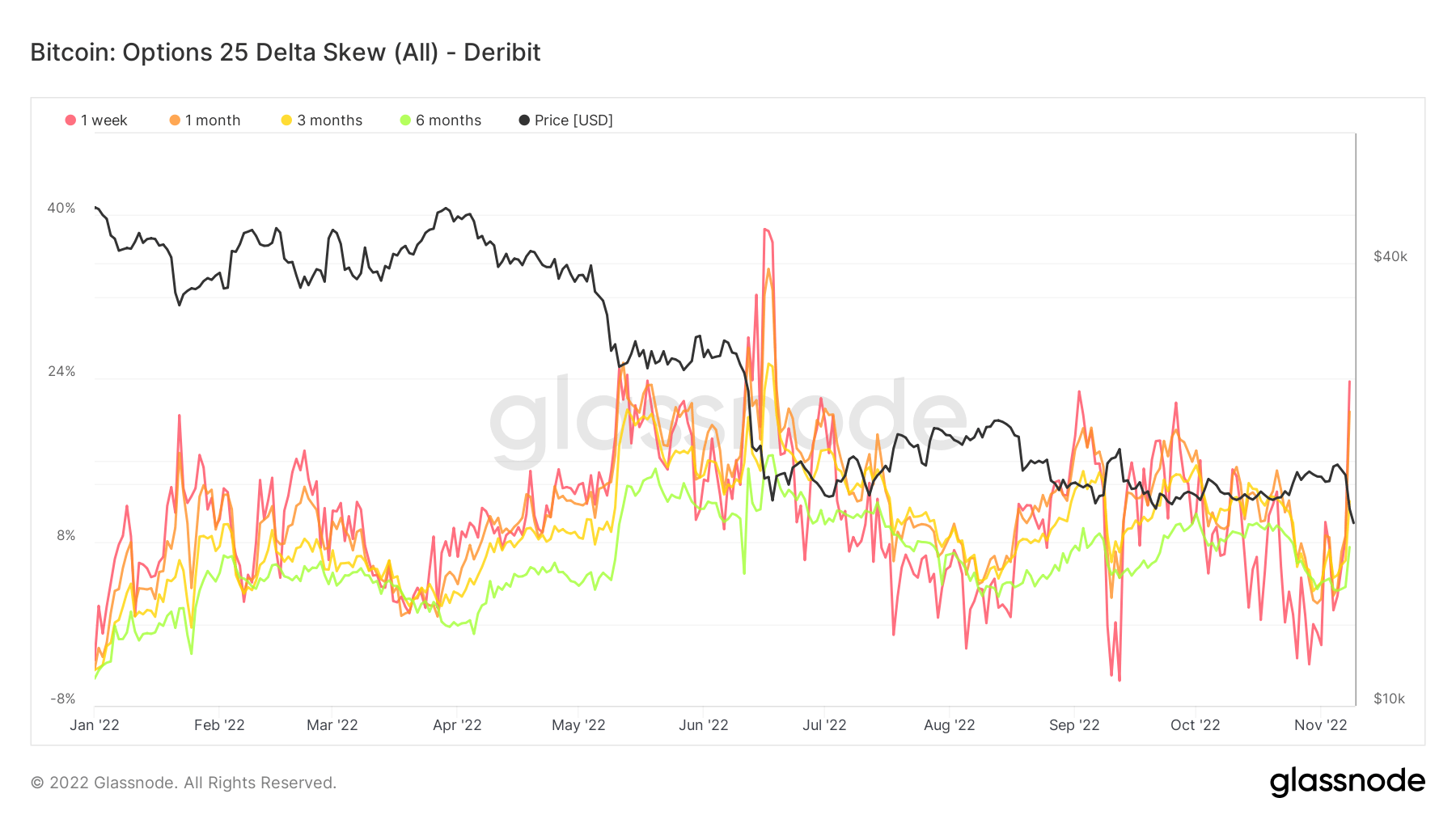

Source: Glassnode.comOptions 25 Delta Skew

The Options 25 Delta Skew metric looks astatine the ratio of put-to-call options expressed successful presumption of Implied Volatility (IV).

For options with a circumstantial expiration date, this metric looks astatine puts with a delta of -25% and calls with a delta of +25%, netted disconnected to get astatine a information point. In different words, this is simply a measurement of the option’s terms sensitivity fixed a alteration successful the spot Bitcoin price.

The idiosyncratic periods notation to enactment contracts expiring 1 week, 1 month, 3 months, and 6 months from now, respectively.

The uptick successful the 25 Delta Skew shows traders are scrambling for puts, marking a U-turn successful sentiment confirmed by OIPCR data.

Source: Glassnode.com

Source: Glassnode.comThe station Bitcoin options traders plaything bearish arsenic FTX fallout takes hold appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)