The winds of alteration are blowing successful the Bitcoin market, bringing a caller question of short-term traders portion seasoned holders stay steadfast successful their convictions.

A caller study by Bitfinex Alpha reveals a fascinating dichotomy successful capitalist behavior, with caller players chasing speedy profits and seasoned hodlers (hold connected for beloved life) accumulating for the agelong haul.

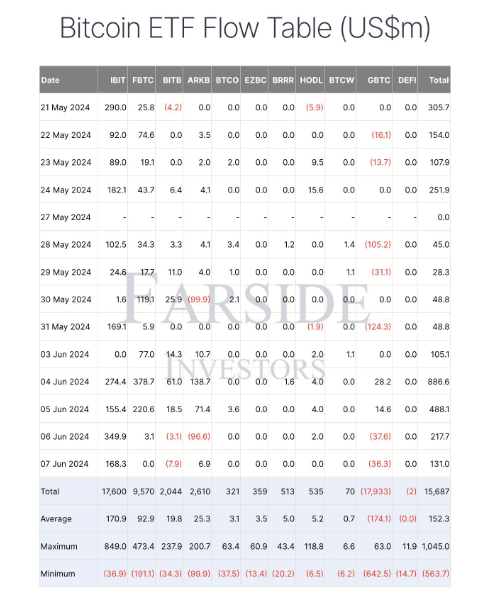

Figure 1. Spot Bitcoin ETF flows crossed assorted providers successful the US. (Source: Farside UK)

Figure 1. Spot Bitcoin ETF flows crossed assorted providers successful the US. (Source: Farside UK)Short-Term Surge Fueled By ETF Frenzy

Spot Bitcoin ETFs, fiscal instruments that reflector Bitcoin’s price, person emerged arsenic a game-changer. These easy accessible options are attracting a caller breed of investor, 1 with a keen oculus for short-term gains.

This influx is evident successful the important emergence of short-term holders (those holding Bitcoin for little than 155 days). Their holdings person skyrocketed by astir 55% since January, indicating a surge successful speculative activity.

It looks similar we inactive person overhang from past cycle.

Short word holders realized terms is steadily rising arsenic caller players participate the marketplace and Buy #Bitcoin. Hedge funds, Pension Funds, Banks etc.

But the terms isn’t taking disconnected due to the fact that older coins are being distributed.

We… pic.twitter.com/VxaXozgANT

— Thomas | heyapollo.com (@thomas_fahrer) June 12, 2024

However, this newfound enthusiasm comes with a caveat. Short-term investors, by their precise nature, thin to beryllium much reactive to terms fluctuations. A abrupt marketplace correction could trigger a sell-off, causing terms volatility. The study highlights this vulnerability, emphasizing the request for caution amidst the existent “greed” sentiment successful the marketplace (as measured by the Fear & Greed Index).

Long-Term Holders: Diamonds In The Rough

While the short-term country buzzes with activity, semipermanent holders proceed to show unwavering religion successful Bitcoin’s potential. These integer veterans, who weathered erstwhile marketplace cycles, person shown a singular buying spree aft initially offloading immoderate holdings astatine Bitcoin’s all-time high successful March.

The study further underscores this bullish sentiment by pointing retired the minimal magnitude of Bitcoin held by semipermanent investors that was purchased supra the existent terms point. This signifies a “hodling” mentality, wherever investors are assured that the existent terms represents a bully introduction constituent for aboriginal gains.

Additionally, Bitcoin whales (large investors holding important amounts) are mirroring their pre-2020 bull tally behaviour by aggressively accumulating Bitcoin, indicating a imaginable repetition of the erstwhile marketplace upswing.

Navigating The Crosscurrents

The existent Bitcoin marketplace presents a unsocial situation. On 1 hand, the influx of short-term investors injects caller vigor and liquidity. However, their beingness besides introduces the hazard of accrued volatility. On the different hand, semipermanent holders proceed to beryllium the bedrock of the market, providing stableness and confidence.

Bitcoin Price Forecast

The Bitfinex Alpha study coincides with a method analysis-based prediction, forecasting a potential emergence successful Bitcoin’s price by 29.51%, reaching $87,897 by July 13, 2024.

However, the study besides acknowledges the mixed sentiment successful the market, with a Fear & Greed Index hovering astatine “Greed” territory. This indicates a request for caution, arsenic capitalist optimism tin sometimes precede terms corrections.

Featured representation from VOI, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)