Bitcoin extended losses to scope levels past seen successful January 2021 connected Wednesday amid a broader marketplace sell-off.

The peer-to-peer integer currency struggled to clasp the $30,000 level passim the time arsenic U.S. ostentation levels were reported supra marketplace expectations and a macroeconomic risk-off question keeps gaining traction globally.

U.S. ostentation reached 8.3% successful the 12 months ending successful April 2022, the U.S. Department of Labor Statistics reported Wednesday morning.

The marketplace had pinned user prices scale (CPI) expectations astatine 8.1% and the worse-than-expected results ensued a overwhelmingly reddish time for equity markets successful the country.

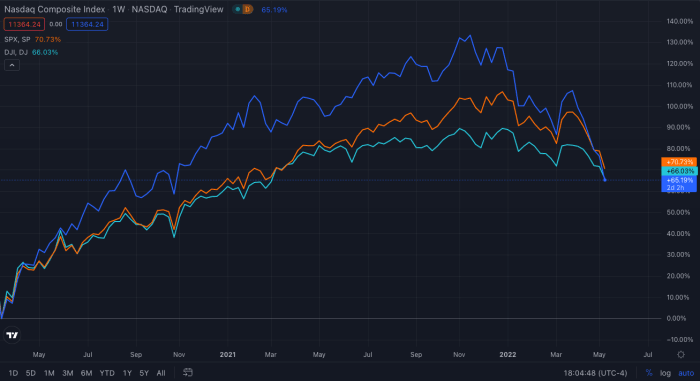

The Nasdaq dropped by much than 3% connected Wednesday to levels not seen since November 2020. The Dow Jones and the S&P 500 besides did not flight the carnage. The 2 indexes plunged to levels some hadn’t revisited since March 2021. The Dow denoted a 1% nonaccomplishment portion the S&P 500 slid by 1.65% today.

Markets person mostly turned southbound ever since the U.S. Federal Reserve Board walked distant from its overly accommodative policies that began astatine the outset of the COVID-19 pandemic.

Turning connected a much hawkish tone, the Fed began diminishing its plus purchases a fewer months ago, but it wasn’t until March that the cardinal bank’s Federal Open Markets Committee (FOMC) raised rates for the archetypal clip successful 3 years. The blimpish 0.25% rise would acceptable a precedent for higher hikes to follow.

Earlier this month, the FOMC announced that the Fed’s benchmark involvement complaint would emergence by 0.5% – treble the summation of the erstwhile meeting. The committee’s hike successful May denoted the biggest summation successful involvement rates successful implicit 2 decades.

Additionally, the FOMC announced it would statesman shrinking its equilibrium sheet, meaning it would nary longer beryllium a holder of assets similar bonds and mortgages, driving enslaved yields and owe rates up and putting other unit connected equities.

Bitcoin’s correlation with equity markets tin beryllium partially explained by the greater engagement of nonrecreational investors and institutions, which are delicate to the availability of superior and truthful involvement rates, Morgan Stanley reportedly said.

In summation to a hawkish U.S. cardinal bank, planetary issues similar the Russian warfare successful Ukraine and China’s ongoing lockdowns person stressed proviso chains worldwide, further pressuring markets down to erase portion of the gains made since precocious 2020 – Bitcoin included.

3 years ago

3 years ago

English (US)

English (US)