Editor’s note: This nonfiction is the 2nd successful a three-part series. Plain substance represents the penning of Greg Foss, portion italicized transcript represents the penning of Jason Sansone.

In part 1 of this series, I reviewed my past successful the recognition markets and covered the basics of bonds and enslaved mathematics successful bid to supply discourse for our thesis. The intent was to laic the groundwork for our “Fulcrum Index,” an scale which calculates the cumulative worth of recognition default swap (CDS) security contracts connected a handbasket of G20 sovereign nations multiplied by their respective funded and unfunded obligations. This dynamic calculation could signifier the ground of a existent valuation for bitcoin (the “anti-fiat”).

The archetypal portion was dry, elaborate and academic. Hopefully, determination was immoderate absorbing information. At the extremity of the day, though, mathematics is typically not a beardown taxable for most. And, arsenic for enslaved math, astir radical would alternatively chew glass. Too bad. Bond and recognition markets marque the capitalist satellite function. However, erstwhile we socialize losses, and reward the hazard takers with authorities funded bailouts, the self-correcting mechanics of capitalism (creative destruction) is jeopardized. This taxable is important: Our leaders and children request to recognize the implications of credit, however to terms credit, and ultimately, the outgo of crony-capitalism.

Heretofore, we volition proceed our treatment of bonds, focusing connected the risks inherent to owning them, the mechanics of recognition crises, what is meant by contagion and the implications these risks person for idiosyncratic investors and the recognition markets successful general. Buckle up.

Bond Risks: An Overview

The main risks inherent to investing successful bonds are listed below:

- Price*: rRsk that the involvement rates connected U.S. treasuries rise, which past increases the output the marketplace requires connected each indebtedness contracts, thereby lowering the terms of each outstanding bonds (this is besides referred to arsenic involvement complaint risk, oregon marketplace risk)

- Default*: Risk that the issuer volition beryllium incapable to conscionable their contractual work to wage either coupon oregon principal

- Credit*: Risk that the issuer’s “creditworthiness” (e.g., recognition rating) decreases, thereby rendering the instrumentality connected the enslaved inadequate for the hazard to the investor

- Liquidity*: Risk that enslaved holder volition request to either merchantability the enslaved declaration beneath archetypal marketplace worth oregon people it to marketplace beneath archetypal marketplace worth successful the future

- Reinvestment: Risk that involvement rates connected U.S. treasuries fall, causing the output made connected immoderate reinvested aboriginal coupon payments to decrease

- Inflation: Risk that the output connected a enslaved does not support gait with inflation, thereby causing the existent output to beryllium negative, contempt having a affirmative nominal yield

*Given their importance, these risks volition each beryllium covered separately below.

Bond Risk One: Price/Interest, Rate/Market Risk

Historically, investors person chiefly been acrophobic with involvement complaint hazard connected authorities bonds. That is due to the fact that implicit the past 40 years, the wide level of involvement rates (their output to maturity, oregon YTM) person declined globally, from a level successful the aboriginal 1980s of 16% successful the U.S., to today’s rates which attack zero (or adjacent antagonistic successful immoderate countries).

A antagonistic yielding enslaved is nary longer an investment. In fact, if you bargain a enslaved with a antagonistic yield, and clasp it until maturity, it volition person outgo you wealth to store your “value.” At past count, determination was adjacent to $19 trillion of antagonistic yielding indebtedness globally. Most was “manipulated” authorities debt, owed to quantitative easing (QE) by cardinal banks, but determination is negative-yielding firm debt, too. Imagine having the luxury of being a corp and issuing bonds wherever you borrowed wealth and idiosyncratic paid you for the privilege of lending it to you.

Going forward, involvement complaint hazard owed to ostentation volition beryllium 1 directional: higher. And owed to enslaved math, arsenic you present know, erstwhile involvement rates rise, enslaved prices fall. But determination is simply a bigger hazard than this involvement rate/market hazard that is brewing for authorities bonds: recognition risk. Heretofore, recognition hazard for governments of developed G20 nations has been minimal. However, that is starting to change…

Bond Risk Two: Credit Risk

Credit hazard is the implicit hazard of owning a recognition work that has the hazard of defaulting. When G20 authorities equilibrium sheets were successful decent signifier (operating budgets were balanced and accumulated deficits were reasonable) the implied hazard of default by a authorities was astir zero. That is for 2 reasons: First, their quality to taxation to rise funds to wage their debts and, secondly and much importantly, their quality to people fiat money. How could a national authorities default if it could conscionable people wealth to wage down its outstanding debt? In the past, that statement made sense, but yet printing wealth volition (and has) go a recognition “boogie man,” arsenic you volition see.

For the intent of mounting a “risk-free rate,” though, let’s proceed to presume that benchmark is acceptable by the national government. In markets, recognition hazard is measured by calculating a “credit spread” for a fixed entity, comparative to the risk-free authorities complaint of the aforesaid maturity. Credit spreads are impacted by the comparative recognition riskiness of the borrower, the word to maturity of the work and the liquidity of the obligation.

State, provincial and municipal indebtedness tends to beryllium the adjacent measurement arsenic you ascend the recognition hazard ladder, conscionable supra national authorities debt, thereby demonstrating the lowest recognition dispersed supra the risk-free rate. Since nary of the entities person equity successful their superior structure, overmuch of the implied recognition extortion successful these entities flows from assumed national authorities backstops. These are surely not guaranteed backstops, truthful determination is immoderate grade of escaped marketplace pricing, but mostly these markets are for precocious people borrowers and debased hazard tolerance investors, galore of whom presume “implied” national support.

Corporates are the past step(s) connected the recognition hazard ladder. Banks are quasi-corporates and typically person debased recognition hazard due to the fact that they are assumed to person a authorities backstop, each other being equal. Most corporations bash not person the luxury of a authorities backstop (although lately, airlines and car makers person been granted immoderate peculiar status). But successful the lack of authorities lobbying, astir corporations person an implied recognition hazard that volition construe into a recognition spread.

“Investment grade” (IG) corporations successful the U.S. marketplace (as of February 17, 2022) commercialized astatine a output of 3.09%, and an “option adjusted” recognition dispersed (OAS) to U.S. treasuries of 1.18% (118 ground points, oregon bps), according to immoderate Bloomberg Terminal wherever you mightiness attraction to look. “High-yield” (HY) corporations, connected the different hand, commercialized astatine a output of 5.56% and an OAS of 3.74% (374 bps), besides per information disposable done immoderate Bloomberg Terminal. Over the past year, spreads person remained reasonably stable, but since enslaved prices successful wide person fallen, the output (on HY debt) has accrued from 4.33%… Indeed, HY indebtedness has been a horrible risk-adjusted instrumentality of late.

When I started trading HY 25 years ago, the output was really “high,” mostly amended than 10% YTM with spreads of 500 bps (basis points) and higher. However, due to the fact that of a 20-year “yield chase” and, much recently, the Federal Reserve interfering successful the recognition markets, HY looks beauteous debased output to maine these days… but I digress.

Subjective Ratings

From the above, it follows that spreads are mostly a relation of recognition hazard gradations supra the baseline “risk-free” rate. To assistance investors measure recognition risk, and frankincense terms recognition connected caller contented debt, determination are standing agencies who execute the “art” of applying their cognition and intellect to standing a fixed credit. Note that this is simply a subjective standing that qualifies recognition risk. Said differently: The standing does not quantify risk.

The 2 largest standing agencies are S&P and Moody’s. In general, these entities get the comparative levels of recognition hazard correct. In different words, they correctly differentiate a mediocre recognition from a decent credit. Notwithstanding their bungling of the recognition evaluations of astir structured products successful the Great Financial Crisis (GFC), investors proceed to look to them not lone for advice, but besides for concern guidelines arsenic to what determines an “investment grade” recognition versus a “non-investment grade/high yield” credit. Many pension money guidelines are acceptable utilizing these subjective ratings, which tin pb to lazy and unsafe behaviour specified arsenic forced selling erstwhile a recognition standing is breached.

For the beingness of me, I cannot fig retired however idiosyncratic determines the concern merits of a recognition instrumentality without considering the terms (or contractual return) of that instrument. However, somehow, they person built a concern astir their “credit expertise.” It is rather disappointing and opens the doorway for immoderate superior conflicts of involvement since they are paid by the issuer successful bid to get a rating.

I worked precise concisely connected a declaration ground for Dominion Bond Rating Service (DBRS), Canada’s largest standing agency. I heard a communicative among the analysts of a Japanese slope who came successful for a standing due to the fact that they wanted entree to Canada’s commercialized insubstantial (CP) market, and a DBRS standing was a prerequisite for a caller issue. The Japanese manager, upon being fixed his ratingm, inquired, “If I wage much money, bash I get a higher rating?” Sort of makes you think…

Regardless, standing scales are arsenic follows, with S&P/Moody’s highest to lowest rating: AAA/Aaa, AA/Aa, A/A, BBB/Baa, BB/Ba, CCC/Caa and D for “default.” Within each class determination are affirmative (+) and antagonistic (-) adjustments of opinion. Any recognition standing of BB+/Ba+ oregon little is deemed “non-investment grade.” Again, nary terms is considered and frankincense I ever say, if you springiness maine that indebtedness for free, I committedness it would beryllium “investment grade” to me.

Poor mathematics skills are 1 thing, but adhering to subjective evaluations of recognition hazard are another. There are besides subjective evaluations specified arsenic “business risk” and “staying power,” inherently built into these ratings. Business hazard tin beryllium defined arsenic volatility of currency flows owed to pricing powerfulness (or deficiency thereof). Cyclical businesses with commodity vulnerability specified arsenic miners, alloy companies and chemic companies person a precocious grade of currency travel volatility and therefore, their maximum recognition standing is restricted owed to their “business risk.” Even if they had debased indebtedness levels, they would apt beryllium capped astatine a BBB standing owed to the uncertainty of their net earlier interest. tax, depreciation, and amortization (EBITDA). “Staying power” is reflected successful the manufacture dominance of the entity. There is nary regularisation that says large companies past longer than tiny ones, but determination is surely a standing bias that reflects that belief.

The respective ratings for governments are besides very, if not completely, subjective. While full debt/GDP metrics are a bully starting point, it ends there. In galore cases, if you were to enactment up the operating currency flows of the authorities and its debt/leverage statistic compared to a BB-rated corporation, the firm indebtedness would look better. The quality to rise taxes and people wealth is paramount. Since it is arguable that we person reached the constituent of diminishing returns successful taxation, the quality to people fiat is the lone redeeming grace. That is until investors garbage to instrumentality freshly printed and debased fiat arsenic payment.

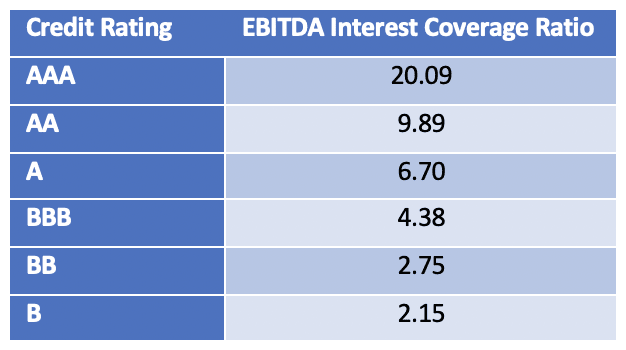

Objective Measures Of Credit Risk: Fundamental Analysis

In the lawsuit of firm debt, determination are immoderate well-defined metrics which assistance to supply guidance for objectively evaluating recognition risk. EBITDA/interest coverage, full debt/EBITDA and endeavor worth (EV)/EBITDA are large starting points. EBITDA is fundamentally pre-tax currency flow. Since involvement is simply a pre-tax expense, the fig of times EBITDA covers the pro-forma involvement work makes consciousness arsenic a measurement of recognition risk. In fact, it was this metric that I had determined to beryllium the astir applicable successful quantifying the recognition hazard for a fixed issuer, a uncovering I published successful “Financial Analysis Journal” (FAJ) successful March 1995. As I mentioned successful portion one, I had worked for Royal Bank of Canada (RBC), and I was good alert that each banks needed to amended recognize and terms recognition risk.

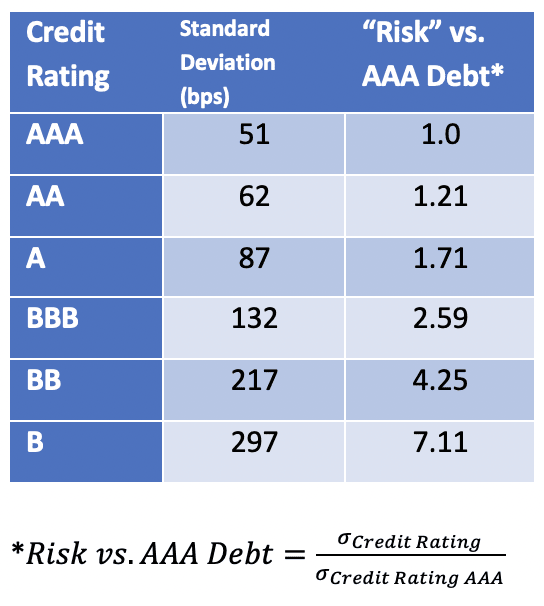

The nonfiction was titled “Quantifying Risk In The Corporate Bond Markets.” It was based connected an exhaustive survey of 23 years of information (18,000 information points) that I painfully accumulated astatine the McGill Library successful Montreal. For our younger readers retired there, this was earlier physics information of firm enslaved prices was available, and the information was compiled manually from a past of phonebook-like publications that McGill Library had kept arsenic records. In it, I showed a bully pictorial of hazard successful the firm markets. The dispersions of the recognition dispersed distributions measures this risk. Notice, arsenic the recognition prime decreases the dispersion of the recognition dispersed distributions increases. You tin measurement the modular deviations of these distributions to get a comparative measurement of recognition hazard arsenic a relation of the recognition rating.

The information and results were awesome and unique, and I was capable to merchantability this information to the RBC to assistance with its superior allocation methodology for recognition hazard exposure. The nonfiction was besides cited by a probe radical astatine JPMorgan, and by the Bank for International Settlements (BIS).

It should beryllium evident by present that anyone who is investing successful a fixed income instrumentality should beryllium keenly alert of the quality of the indebtedness issuer to grant their contractual work (i.e., creditworthiness). But what should the capitalist usage to quantitatively measure the creditworthiness of the indebtedness issuer?

One could extrapolate the creditworthiness of a corp by assessing assorted fiscal metrics related to its halfway business. It is not worthy a heavy dive into the calculation of EBITDA oregon involvement sum ratios successful this article. Yet, we could each hold that comparing a corporation’s periodic currency travel (i.e., EBIT oregon EBITDA) to its periodic involvement disbursal would assistance to quantify its quality to repay its indebtedness obligations. Intuitively, a higher involvement sum ratio implies greater creditworthiness.

Referencing the aforementioned article, the information proves our intuition:

Indeed, 1 could person the supra information into circumstantial comparative hazard multiples, but for the purposes of this exercise, simply knowing the conception is sufficient.

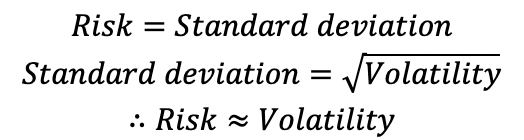

Similarly, 1 tin usage immoderate basal mathematics to person subjective ratings into comparative recognition risk. But first, recognize that hazard is related to some modular deviation and volatility arsenic follows:

A glimpse astatine marketplace information provides the modular deviation of the hazard premium/yield dispersed for assorted recognition standing categories, which past allows the calculation of comparative risk.

The modular deviation of hazard premium/yield for assorted recognition ratings allows for the calculation of comparative risk.

Therefore, arsenic an example, if an capitalist wishes to acquisition the indebtedness of corp XYZ, which has a recognition standing of BB, that capitalist should expect a hazard premium/yield dispersed of 4.25 times the existent marketplace output for AAA-rated investment-grade indebtedness (all different factors being equal).

Objective Measures Of Credit Risk: Credit Default Swaps

CDS are a comparatively caller fiscal engineering tool. They tin beryllium thought of arsenic default security contracts wherever you tin ain the security connected an entity’s credit. Each CDS declaration has a notation work that trades successful a recognition marketplace truthful determination is simply a earthy nexus to the underlying name. In different words, if CDS spreads are widening connected a name, credit/bond spreads are widening successful fastener step. As hazard increases, security premiums do, too.

Allow maine to get into the weeds a spot connected CDS. For those little inclined to bash so, consciousness escaped to skip down to the italicized section… CDS contracts commencement with a five-year term. Every 90 days, a caller declaration is issued and the anterior declaration is four-and-three-quarters-years old, etc. As such, five-year contracts yet go one-year contracts that besides trade. When a recognition becomes precise distressed, galore buyers of extortion volition absorption connected the shorter contracts successful a signifier that is referred to arsenic “jump to default” protection.

The dispersed oregon premium is paid by the proprietor of the declaration to the seller of the contract. There tin be, and usually is, overmuch higher notional worth of CDS contracts among blase organization accounts, than the magnitude of indebtedness outstanding connected the company. The CDS contracts tin frankincense thrust the terms of the bonds, not the different mode around.

There is nary bounds to the notional worth of CDS contracts outstanding connected immoderate name, but each declaration has an offsetting purchaser and seller. This opens the doorway for important counterparty hazard considerations. Imagine if you owned CDS connected Lehman Brothers successful 2008 but the counterparty was Bear Stearns? You whitethorn person to tally retired and acquisition extortion connected Bear Stearns, thereby pouring state connected the recognition contagion fire.

I judge it was Warren Buffet who famously referred to CDS arsenic a “financial limb of wide destruction.” That is simply a small harsh, but it is not altogether untrue. The sellers of CDS tin usage hedging techniques wherever they bargain equity enactment options connected the aforesaid sanction to negociate their exposure. This is different crushed that if CDS and recognition spreads widen, the equity markets tin get punched astir similar a artifact clown.

Many readers whitethorn person heard of the CDS. Although technically not an security contract, it fundamentally functions the nonstop aforesaid way: “insuring” creditors against a recognition event. Prices of CDS contracts are quoted successful ground points. For example, the CDS connected ABC, Inc. is 13 bps (meaning, the yearly premium to insure $10 cardinal of ABC, Inc. indebtedness would beryllium 0.13%, oregon $13,000). One tin deliberation of the premium paid connected a CDS declaration arsenic a measurement of the recognition hazard of the entity the CDS is insuring.

In different words, applying the logic from Foss’ FAJ nonfiction described above, let’s estimation the comparative CDS premiums of 2 firm entities:

- ABC, Inc.: Credit standing AA+, EBITDA involvement sum ratio 8.00

- XYZ, Inc.: Credit standing BBB, EBITDA involvement sum ratio 4.25

For which entity would you expect the CDS premium to beryllium higher? That’s right: XYZ, Inc.

It turns retired that the quality betwixt CDS premiums and hazard premiums/yield spreads is typically rather small. In different words, if the market’s cognition is that the recognition hazard of a fixed entity is increasing, some the CDS premium and the required output connected its indebtedness volition increase. Two examples from caller events item this point:

- Look astatine the caller fluctuations successful CDS pricing connected HSBC (a bank). It turns retired HSBC is 1 of the main creditors of Evergrande (of Chinese existent property fame). According to my mentation of humanities CDS data, five-year CDS pricing connected September 1, 2021 was 32.75 bps. Just implicit a period later, it had accrued astir 36% to 44.5 bps connected October 11, 2021. Note: This was during the period of September that quality of Evergrande’s impending illness circulated.

- Turkey has been experiencing a well-publicized currency illness of late. The one-month and s-month variance connected five-year CDS pricing of Turkey’s sovereign indebtedness is +22.09% and +37.89%, respectively. Note: The output connected the Turkish 10-year authorities enslaved presently sits astatine 21.62% (up from 18.7% six months ago).

One could reason that the astir close mode to measure recognition hazard is via tracking CDS premiums. They are neither subjective, nor are they an abstraction from fiscal data. Rather, they are the effect of an nonsubjective and businesslike market. As the saying goes: “Price is truth.”

This dynamic interplay betwixt CDS premia and recognition spreads is highly important for firm recognition and it is simply a well-worn path. What is not truthful good worn, though, is CDS connected sovereigns. This is comparatively new, and successful my opinion, could beryllium the astir unsafe constituent of sovereign indebtedness going forward.

I judge ostentation hazard considerations for sovereigns volition go overwhelmed by recognition hazard concerns. Taking an illustration from the firm world, 2 years anterior to the GFC, you could acquisition a CDS declaration connected Lehman Brothers for 0.09% (9 bps), per humanities CDS data. Two years later, that aforesaid declaration was worthy millions of dollars. Are we headed down the aforesaid way with sovereigns?

Think of the imaginable for long-dated sovereign bonds to get smoked if recognition spreads widen by hundreds of ground points. The resultant alteration successful enslaved worth would beryllium huge. This volition origin galore enslaved managers (and galore economists) indigestion. Most sovereign enslaved money managers and economists are inactive focused connected involvement complaint hazard alternatively than the brewing recognition focus.

Moreover, the terms of sovereign CDS premia efficaciously acceptable the basal recognition dispersed for which each different credits volition beryllium bound. In different words, it is improbable that the spreads of immoderate instauration oregon entity higher up the recognition ladder volition commercialized wrong the recognition dispersed of the jurisdictional sovereign. Therefore, a widening of sovereign CDS premia/credit spreads leads to a cascading effect crossed the recognition spectrum. This is referred to arsenic “contagion.”

So, I inquire the scholar again: Is the U.S. treasury complaint truly “risk free”? This would connote that the inherent recognition hazard is zero… yet, astatine present, the CDS premium connected U.S. sovereign indebtedness costs 16 bps. To my knowledge, 16 bps is greater than zero. You tin look up CDS premia (and frankincense the implied default risk) for galore sovereigns astatine WorldGovernmentBonds.com. Remember, terms is truth…

Bond Risk Three: Liquidity Risk

What precisely is liquidity, anyway? It’s a word that gets thrown astir each the time: “a highly liquid market,” oregon “a liquidity crunch,” arsenic though we are each conscionable expected to cognize what it means… yet astir of america person nary idea.

The world explanation of liquidity is arsenic follows: The quality to bargain and merchantability assets rapidly and successful measurement without moving the price.

OK, fine. But however is liquidity achieved? Enter signifier left: Dealers…

Let’s ideate you ain 100 shares of ABC, Inc. You would similar to merchantability these 100 shares and bargain 50 shares of XYZ, Inc. What bash you do? You log into your brokerage relationship and spot the orders… wrong a substance of seconds each commercialized is executed. But what really happened? Did your broker instantly find a consenting counterparty to acquisition your 100 shares of ABC, Inc. and merchantability you 50 shares of XYZ, Inc.?

Of people they didn’t. Instead, the broker (i.e., “broker-dealer”) served arsenic the counterparty successful this transaction with you. The trader “knows” that yet (in minutes, hours oregon days) they volition find a counterparty who desires to ain ABC, Inc. and merchantability XYZ, Inc., thereby completing the other limb of the trade.

Make nary mistake, though. Dealers bash not bash this for free. Instead, they bargain your shares of ABC, Inc. for $x and past merchantability those shares for $x + $y. In the business, $x is termed the “bid” and $x + $y is termed the “ask.” Note: The quality betwixt the 2 prices is termed the “bid-ask spread” and serves arsenic the nett inducement to the trader for providing the marketplace with liquidity.

Let’s recap: Dealers are for-profit entities that marque markets liquid by managing surplus and/or shortage inventory of assorted assets. The nett is derived from the bid-ask spread, and successful liquid markets, the spreads are small. But arsenic dealers consciousness marketplace risk, they rapidly statesman to widen the spreads, demanding much nett for taking the hazard of holding inventory.

Except… What happens if widening the bid-ask dispersed is not capable compensation for the risk? What if the dealers simply halt making markets? Imagine, you are holding the indebtedness of ABC, Inc., and privation to merchantability it, but nary 1 is consenting to bargain (bid) it. The hazard that dealers/markets prehend up, describes the conception of liquidity risk. And this, arsenic you could imagine, is simply a large problem…

For precise liquid securities you tin execute tens of millions of dollars of trades connected a precise choky market. While equity markets person the semblance of liquidity due to the fact that they are transparent and commercialized connected an speech that is disposable to the world, enslaved markets are really acold much liquid adjacent though they commercialized implicit the antagonistic (OTC). Bond markets and rates are the grease of the planetary fiscal monetary instrumentality and for that crushed cardinal banks are precise delicate to however the liquidity is working.

Liquidity is reflected successful the bid/ask dispersed arsenic good arsenic the size of trades that tin beryllium executed. When assurance wanes and fearfulness rises, bid/ask spreads widen, and commercialized sizes diminish arsenic market-makers (dealers) retreat from providing their hazard superior to grease the machine, arsenic they don’t privation to beryllium near holding a container of hazard (inventory) for which determination are nary buyers. What tends to hap is everybody is moving successful the aforesaid direction. Generally, successful “risk off” periods, that absorption is arsenic sellers of hazard and buyers of protection.

Perhaps the astir important constituent for assessing recognition marketplace liquidity is the banking system. Indeed, assurance amongst entities wrong this strategy is paramount. Accordingly, determination are a fewer unfastened marketplace rates that measurement this level of counterparty confidence/trust. These rates are LIBOR and BAs. LIBOR is the London Interbank Offered Rate, and BAs is the Bankers’ Acceptance complaint successful Canada. (Note: LIBOR precocious transitioned to Secured Overnight Financing Rate [SOFR], but the thought is the same). Both rates correspond the outgo astatine which a slope volition get oregon lend funds successful bid to fulfill its indebtedness demand. When these rates emergence meaningfully it signals an erosion of spot betwixt counterparties and a increasing instability successful the interbank lending system.

Contagion, Exhibit One: The Great Financial Crisis

Leading up to the GFC (Summer 2007), LIBOR and BAs were rising, indicating that the recognition markets were starting to grounds emblematic stresses seen successful a “liquidity crunch” and spot successful the strategy was starting to erode. Equity markets were mostly unaware of the existent quality of the occupation but that they were being flung astir arsenic credit-based hedge funds reached for extortion successful the CDS and equity volatility markets. When successful doubt, look to the recognition markets to find stresses, not the equity markets (they tin get a small irrational erstwhile the punch vessel is spiked). This was a clip of preliminary contagion, and the opening of the Global Financial Crisis.

At that time, 2 Bear Stearns hedge funds were rumored to beryllium successful large occupation owed to subprime owe exposure, and Lehman Brothers was successful a precarious spot successful the backing markets. Market participants astatine the clip volition nary uncertainty retrieve the celebrated Jim Cramer rant (“They cognize nothing!”), erstwhile connected a sunny afternoon, successful aboriginal August 2007, helium mislaid his patience and called retired the Fed and Ben Bernanke for being clueless to the stresses.

Well, the Fed did chopped rates and equities rallied to all-time highs successful October 2007, arsenic recognition investors who were purchasing assorted forms of extortion reversed course, frankincense pushing up stocks. But remember, recognition is simply a dog, and equity markets are its tail. Equities tin get whipped astir with reckless wantonness due to the fact that the recognition markets are truthful overmuch larger and recognition has precedence of assertion implicit equity.

It is worthy noting that contagion successful the enslaved marketplace is overmuch much pronounced than successful the equity markets. For example, if provincial spreads are widening connected Ontario bonds, astir different Canadian provinces are widening successful lockstep, and determination is simply a trickle-down effect done interbank spreads (LIBOR/BAs), IG firm spreads and adjacent to HY spreads. This is existent successful the U.S. markets too, with the interaction of IG indices bleeding into the HY indices.

The correlation betwixt equity markets and recognition markets is causal. When you are agelong recognition and agelong equity, you are abbreviated volatility (vol). Credit hedge funds who privation to dampen their vulnerability volition acquisition much vol, thereby exacerbating the summation successful vol. It becomes a antagonistic feedback loop, arsenic wider recognition spreads beget much vol buying, which begets much equity terms movements (always to the downside). When cardinal banks determine to intervene successful the markets to stabilize prices and trim volatility, it is not due to the fact that they attraction astir equity holders. Rather, it is due to the fact that they request to halt the antagonistic feedback loop and forestall seizing of the recognition markets.

A little mentation is warranted here:

- Volatility = “vol” = risk. The long/short narration tin truly beryllium thought of successful presumption of correlation successful value. If you are “long x” and “short y,” erstwhile the worth of x increases, the worth of y decreases, and vice versa. Thus, for example, erstwhile you are “long credit/equity” and “short volatility/“vol”/risk,” arsenic hazard successful markets increases, the worth of recognition and equity instruments decreases.

- The VIX, which is often cited by analysts and quality media outlets, is the “volatility index,” and serves arsenic a wide indicator of volatility/risk successful the markets.

- “Purchasing vol” implies buying assets oregon instruments that support you during an summation successful marketplace risk. For example, buying protective enactment options connected your equity positions qualifies arsenic a volatility purchase.

Regardless, world soon returned arsenic 2007 turned into 2008. Bear Stearns banal traded down to $2 per stock successful March 2008 erstwhile it was acquired by JP Morgan. Subprime owe vulnerability was the culprit successful the illness of galore structured products and successful September 2008, Lehman Brothers was allowed to fail.

My fearfulness was that the strategy genuinely was connected the brink of collapse, and I was not the lone one. I rode the bid to enactment each greeting successful the winter/spring of 2009 wondering if it was “all over.” Our money was hedged, but we had counterparty hazard vulnerability successful the markets. It was a blessing that our investors had agreed to a lockup play and could not redeem their investments.

We calculated and managed our hazard vulnerability connected a minute-by-minute basis, but things were moving astir truthful fast. There was existent fearfulness successful the markets. Any stabilization was lone a intermission earlier assurance (and truthful prices) took different deed and dropped lower. We added to our hedges arsenic the marketplace tanked. Suffice to say: Contagion builds connected itself.

Liquidity is champion defined arsenic the quality to merchantability successful a carnivore market. By that definition, liquidity was non-existent. Some securities would autumn 25% connected 1 trade. Who would merchantability thing down 25%? Funds that are being redeemed by investors who privation cash, that’s who. In this case, the money needs to merchantability careless of the price. There was panic and humor successful the streets. The strategy was breached and determination was a de facto vote of nary confidence. People didn’t merchantability what they wanted to, they sold what they could. And this, successful turn, begot much selling…

Contagion, Exhibit Two: Reddit and GameStop (GME)

The events surrounding the caller “short squeeze” connected GME were good publicized successful the mainstream media, but not good explained. Let’s archetypal recap what really occurred…

According to my mentation of events, it began with Keith Gill, a 34-year-old begetter from the suburbs of Boston, who worked arsenic a marketer for Massachusetts Mutual Life Insurance Company. He was an progressive subordinate of the Reddit community, and was known online arsenic “Roaring Kitty.” He noticed that the abbreviated involvement connected GME was successful excess of 100% of the fig of shares outstanding. This meant that hedge funds, having smelled humor successful the h2o and predicting GME’s imminent demise, had borrowed shares of GME from shareholders, and sold them, pocketing the currency proceeds, with plans to repurchase the shares (at a overmuch little price) and instrumentality them to their archetypal owners astatine a aboriginal date, frankincense keeping the quality arsenic profit.

But what happens if, alternatively of the stock terms crashing, it really increases dramatically? The archetypal stock owners would past privation their invaluable shares back… but the hedge money needs to wage much than the nett from the archetypal abbreviated merchantability successful bid to repurchase and instrumentality them. A batch more. Especially erstwhile the fig of shares the hedge funds are abbreviated outnumbers the fig of shares successful existence. What’s more, if they can’t get the shares nary substance the terms they are consenting to pay, the borderline clerks astatine the brokerage houses request currency instead.

Galvanizing the Reddit community, “Roaring Kitty” was capable to person a throng of investors to bargain GME banal and clasp it. The banal terms skyrocketed, arsenic hedge funds were forced to unwind their trades astatine a important loss. And that is however David bushed Goliath…

GME caused a leverage unwind which cascaded done the equity markets and was reflected successful accrued equity volatility (VIX), and associated unit connected recognition spreads. It happened arsenic follows: Up to 15 large hedge funds were each rumored to beryllium successful occupation arsenic their archetypal period results were horrible. They were down betwixt 10% and 40% to commencement the 2021 year. Cumulatively, they controlled astir $100 cardinal successful assets, however, they besides employed leverage, often arsenic precocious arsenic 10 times implicit their magnitude of equity.

To punctuation from the “Bear Traps Report” connected January 27, 2021:

“Our 21 Lehman Systemic Indicators are screaming higher. The inmates are moving the asylum… erstwhile the borderline clerk comes walking by your table it is simply a precise unpleasant experience. You don’t conscionable merchantability your losers, you indispensable merchantability your winners. Nearly ‘everything indispensable go’ to rise precious cash. Here lies the occupation with cardinal bankers. Academics are often clueless astir systemic risk, adjacent erstwhile it is close nether their nose. The past books are filled with these lessons.”

The Federal Reserve Saves The Day?

As described antecedently successful portion one, the turmoil successful the GFC and COVID-19 situation fundamentally transferred excess leverage successful the fiscal strategy to the equilibrium sheets of governments via QE. Printed wealth was the painkiller, and unfortunately, we are present addicted to the symptom medicine.

The Troubled Asset Relief Program (TARP) was the opening of the fiscal acronyms that facilitated this archetypal hazard transportation successful 2008 and 2009. There was a immense magnitude of indebtedness that was written down, but determination was besides a immense magnitude that was bailed retired and transferred to the government/central slope books and frankincense are present authorities obligations.

And past successful 2020, with the COVID situation successful afloat swing, much acronyms came arsenic did the precocious likelihood that galore fiscal institutions would again beryllium insolvent… But the Fed ran into the marketplace again. This clip with not lone the aforesaid aged QE programs, but besides caller programs that would acquisition firm recognition and adjacent HY bonds. As such, the Federal Reserve has completed its modulation from being the “lender of past resort” to being the “dealer of past resort.” It is present consenting to acquisition depreciating assets successful bid to enactment prices and supply the marketplace with liquidity successful bid to forestall contagion. But astatine what cost?

Lessons From The GFC, COVID And The Fed’s QE

Price Signals In The Market Are No Longer Pure And Do Not Reflect The Real Level Of Risk

Quantitative easing by cardinal banks tends to absorption connected the “administered” level of involvement rates (some telephone it manipulation), and the signifier of the output curve, utilizing targeted treasury enslaved purchases (sometimes called “yield curve control”). Under these utmost conditions, it is hard to cipher a natural/open marketplace “risk-free rate,” and owed to cardinal slope interference, existent recognition risks are not reflected successful the terms of credit.

This is what happens successful an epoch of debased rates. Costs to get are low, and leverage is utilized to pursuit yield. What does each this leverage do? It increases the hazard of the inevitable unwind being highly painful, portion ensuring that the unwind fuels contagion. A default does not person to hap successful bid for a CDS declaration to marque money. The widening of spreads volition origin the proprietor of the declaration to incur a mark-to-market gain, and conversely, the seller of the declaration to incur a mark-to-market loss. Spreads volition widen to bespeak an summation successful the imaginable for default, and the price/value of recognition “assets” volition autumn accordingly.

For this reason, we implore marketplace participants to travel the CDS rates connected sovereign governments for a overmuch amended denotation of the existent risks that are brewing successful the system. One glaring illustration successful my caput is the five-year CDS rates connected the pursuing countries:

- USA (AA+) = 16 bps

- Canada (AAA) = 33 bps

- China (A+) = 64 bps

- Portugal (BBB) = 43 bps

Even though Canada has the highest recognition standing of the three, the CDS marketplace is telling america otherwise. There is information successful these markets. Do not travel subjective recognition opinions blindly.

Falsely rated “AAA” recognition tranches were a large origin of the unraveling of structured recognition products successful the GFC. Forced selling owed to downgrades of antecedently “over-rated” structures and their respective recognition tranches was contagious. When 1 operation collapsed, others followed. Selling begets selling.

While a default by a G20 sovereign successful the abbreviated word is inactive a little probability event, it is not zero. (Turkey is simply a G20 and truthful is Argentina). As such, investors request to beryllium rewarded for the hazard of imaginable default. That is not presently happening successful the situation of manipulated output curves.

There are implicit 180 fiat currencies, and implicit 100 volition apt neglect earlier a G7 currency does. However, CDS rates are apt to proceed to widen. Contagion and the domino effect are existent risks, arsenic past has taught us.

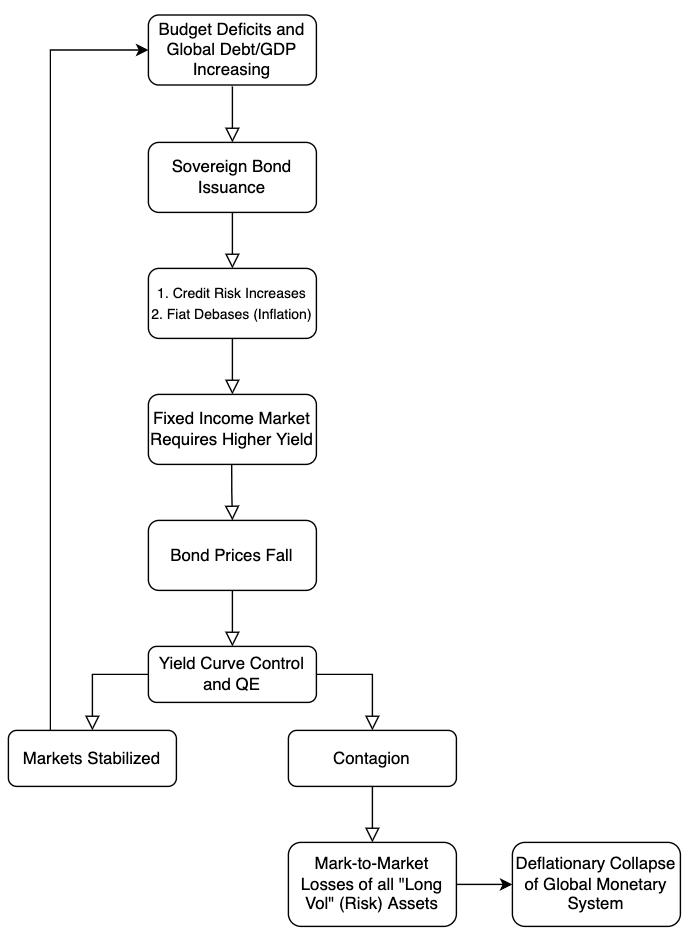

Sovereign Debt Levels Resulting From QE And Fiscal Spending Are Unsustainable

According to the Institute for International Finance, successful 2017, global debt/global GDP was 3.3x. Global GDP has grown a small successful the past 3 years, but planetary indebtedness has grown overmuch faster. I present estimation that the planetary debt/GDP ratio is implicit 4x. At this ratio, a unsafe mathematical certainty emerges. If we presume the mean coupon connected the indebtedness is 3% (this is conservatively low), past the planetary system needs to turn astatine a complaint of 12% conscionable to support the taxation basal successful enactment with the organically-growing indebtedness equilibrium (sovereign involvement expense). Note: This does not see the accrued deficits that are contemplated for battling the recessionary impacts of the COVID crisis.

In a debt/GDP spiral, the fiat currency becomes the mistake term, meaning that printing much fiat is the lone solution that balances the maturation successful the numerator comparative to the denominator. When much fiat is printed, the worth of the outstanding fiat is debased. It is circular and mistake presumption connote an impurity successful the formula.

Therefore, erstwhile you lend a authorities wealth astatine clip zero, you are highly apt to get your wealth backmost astatine clip x; however, the worth of that wealth volition person been debased. That is simply a mathematical certainty. Assuming determination is nary contagion that leads to a default, the indebtedness declaration has been satisfied. But who is the fool? Moreover, with involvement rates astatine historical lows, the contractual returns connected the obligations volition surely not support gait with the Consumer Price Index (CPI), fto unsocial existent ostentation arsenic measured by different less-manipulated baskets. And announcement we person not adjacent mentioned the instrumentality that would beryllium required for a just reward owed to the recognition risk.

I paraphrase the main question arsenic follows: If countries tin conscionable print, they tin ne'er default, truthful wherefore would CDS spreads widen? Make nary mistake: sovereign credits bash default adjacent though they tin people money.

Remember the Weimar hyperinflation pursuing World War I, the Latin American Debt Crisis successful 1988, Venezuela successful 2020 and Turkey successful 2021, wherever fiat is (actually oregon effectively) shoveled to the curb arsenic garbage. There are plentifulness of different examples, conscionable not successful the “first world.” Regardless, it becomes a situation of assurance and existing holders of authorities indebtedness bash not rotation their obligations. Instead, they request cash. Governments tin “print” the cash, but if it is shoveled to the curb, we would each hold that it is simply a de facto default. Relying connected economics professors/modern monetary theorists to opine that “deficits are a myth” is dangerous. The information whitethorn beryllium inconvenient, but that makes it nary little true.

Conclusion

We reason this conception with a ocular flowchart of however things could theoretically “fall apart.” Remember, systems enactment until they don’t. Slowly past suddenly…

Proceed accordingly. Risk happens fast.

This is simply a impermanent station by Greg Foss and Jason Sansone. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)