Editor’s note: This nonfiction is the 3rd successful a three-part series. Plain substance represents the penning of Greg Foss, portion italicized transcript represents the penning of Jason Sansone.

In the archetypal 2 installments of this series, we reviewed galore of the foundational concepts indispensable for knowing the recognition markets, some successful “normal” times and during contagion. To reason this series, we would similar to research a fewer methods by which 1 could get astatine a valuation for bitcoin. These volition beryllium dynamic calculations, and admittedly, somewhat subjective; however, they volition besides beryllium 1 of galore rebuttals to the oft-suggested assertion by no-coiners that bitcoin has nary cardinal value.

Prior to doing so, we privation to authorities 5 foundational principles that underlie our thesis:

- Bitcoin = mathematics + codification = truth

- Never stake against open-source platforms

- Money has ever been exertion for making our expenditure of work/energy/time contiguous disposable for depletion tomorrow

- Bitcoin is programmable monetary energy... A store of value, transferable connected the world’s astir almighty machine network

- Fiats are programmed to debase

Valuation Method One: The Fulcrum Index

I judge that bitcoin is the “anti-fiat.” As such, it tin beryllium thought of arsenic default security connected a handbasket of sovereigns/fiat currencies. This conception has a worth that is reasonably easy computed. We person coined this calculation the “fulcrum index,” and it indicates the cumulative worth of recognition default swaps (CDS) security connected a handbasket of G20 sovereign nations multiplied by their respective funded and unfunded obligations. This dynamic calculation forms the ground of 1 existent valuation method for bitcoin.

Why is bitcoin the “anti-fiat”? Put simply, it cannot beryllium debased. The implicit proviso is fixed. Forever. This is the nonstop other of the existent planetary fiat currency regime. How, then, tin it beryllium considered “default insurance” connected a handbasket of sovereigns/fiat currencies? Foundationally, security declaration worth increases arsenic hazard increases, and (credit) hazard increases arsenic fiat printing continues.

Let’s usage the U.S. arsenic a illustration calculation. The national authorities has implicit $30 trillion successful outstanding debt. According to usdebtclock.org, astatine the clip of this penning it besides has $164 trillion of unfunded liabilities successful Medicare and Medicaid obligations. Thus, the full of funded and unfunded obligations is $194 trillion. This is the magnitude of fiat that needs to beryllium insured successful the lawsuit of default.

At the clip of this writing, the five-year CDS premium for the U.S. is priced astatine 0.12% (12 ground points, oregon bps). Multiplying this by the full indebtedness obligations ($194 trillion), 1 arrives astatine the worth of CDS default security of $232 billion. In different words, based upon information from the CDS market, that is the magnitude of fiat that the cumulative full of planetary investors would request to walk to bargain default extortion connected the U.S. implicit the adjacent 5 years.

If five-year CDS premia widen to 30 bps (to lucifer Canada astatine the clip of this writing), the worth increases to $570 billion. Note: This calculation uses a fixed five-year term. That said, the outstanding weighted-average work is longer than 5 years, owed to Medicare and Medicaid, and consequently we person decided to extrapolate to a word of 20 years. Using a tenor calculation, the implied 20-year CDS premium for the U.S. is 65 bps. In different words, conscionable utilizing the U.S. arsenic 1 constituent successful the G20 basket, we person a valuation of $194 trillion multiplied by 65 bps = $1.26 trillion.

If we present grow to a broader view, our calculation of the existent G20 fulcrum scale is implicit $4.5 trillion.

Regardless, by this methodology, a just worth for bitcoin is astir $215,000 per bitcoin today. Note: This is simply a dynamic calculation (since the input variables are continuously changing). It is somewhat subjective, but is based upon valid benchmarks utilizing different clearly-observed CDS markets.

At a existent terms of astir $40,000 per bitcoin, the fulcrum scale would bespeak that bitcoin is precise inexpensive to just value. As such, fixed that each fixed income portfolio is exposed to sovereign default risk, it would marque consciousness for each fixed income capitalist to ain bitcoin arsenic default security connected that portfolio. It is my contention that arsenic sovereign CDS premia summation (reflecting accrued default risk) the intrinsic worth of bitcoin volition increase. This volition beryllium the dynamic that allows the fulcrum scale to continually revalue bitcoin.

Valuation Method Two: Bitcoin Vs. Physical Gold

Bitcoin has been called “Gold 2.0” by some. The statement for this is beyond the scope of this article. Regardless, the marketplace capitalization of carnal golden is approximately $10 trillion. If we disagreement that magnitude by the 21 cardinal hard-capped proviso of bitcoin, the effect is astir $475,000 per bitcoin.

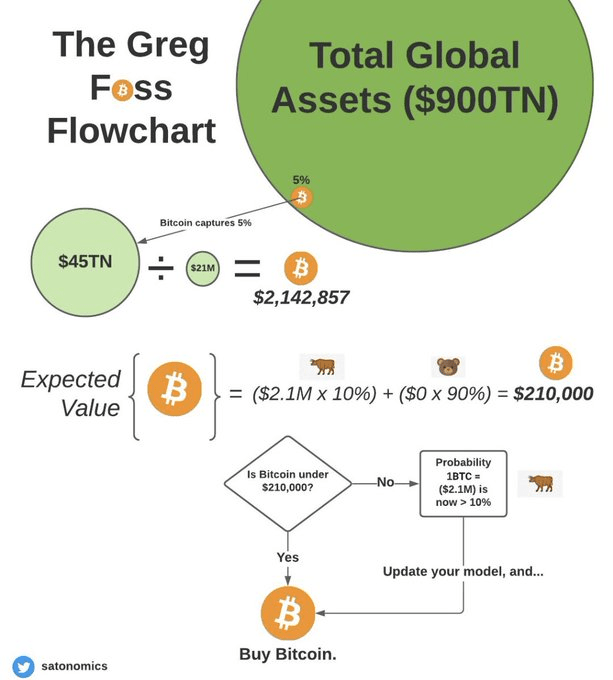

Valuation Method Three: Bitcoin As A Percentage Of Global Assets

According to my recollection, the Institute for International Finance estimated the full planetary fiscal assets successful 2017, including existent estate, to beryllium $900 trillion. If bitcoin were to seizure 5% of that market, we could cipher $45 trillion divided by 21 cardinal to find a worth of $2.14 cardinal per bitcoin, successful today’s dollars. At 10% marketplace share, it is implicit $4 cardinal per bitcoin.

Valuation Method Four: Expected Value Analysis

On an expected worth basis, bitcoin is besides cheap, and, with each time that the Bitcoin web survives, the left-hand broadside (toward zero) of the probability organisation continues to alteration portion the right-hand broadside asymmetry is maintained. Let’s bash a elemental investigation utilizing the numbers calculated above. We volition formulate a organisation that has lone 5 outcomes, with arbitrarily assigned probabilities.

Bitcoin Failure | $0/Bitcoin | 75% |

Fulcrum Index | $215,000/Bitcoin | 15% |

Bitcoin Versus Physical Gold | $475,000/Bitcoin | 7% |

5% Of Global Assets | $2.1 Million/Bitcoin | 2% |

10% Of Global Assets | $4.3 Million/Bitcoin | 1% |

The expected worth result from this illustration is implicit $150,000 per bitcoin.

Given caller terms levels of bitcoin, if you believed this to beryllium aligned with your expected worth calculation, you would beryllium buying with some hands. Of course, determination is nary certainty that I americium right. And this is not fiscal proposal to tally retired and bargain bitcoin. I americium simply presenting a valuation methodology that has served maine good successful my 32-year career. Do. Your. Own. Research.

For the record, my basal lawsuit is substantially higher than this, arsenic I judge determination is simply a existent accidental bitcoin becomes the reserve plus of the planetary economy. The tipping constituent for that lawsuit is erstwhile bitcoin is adopted arsenic a planetary portion of relationship for the commercialized of vigor products. I judge it is logical for countries who are selling their invaluable vigor resources successful instrumentality for worthless fiat to determination from the U.S. dollar to bitcoin. Interestingly, Henry Ford foreshadowed this erstwhile helium declared agelong ago that helium would displace golden arsenic the ground of currency and substitute successful its spot the world’s imperishable earthy wealth. Ford was a Bitcoiner earlier Bitcoin existed.

Digital monetary vigor stored connected the world’s largest and astir unafraid machine web successful instrumentality for vigor to powerfulness electrical grids crossed the globe is simply a earthy improvement built upon the archetypal instrumentality of thermodynamics: conservation of energy.

Conclusion

These are immense numbers, and they intelligibly amusement the asymmetric instrumentality possibilities of the bitcoin terms curve. In reality, the probability/price organisation is continuous, bounded astatine zero with a precise agelong process to the right. Given its asymmetric instrumentality distribution, I judge it is riskier to person zero vulnerability to bitcoin than it is to person a 5% portfolio position. If you are not agelong bitcoin, you are irresponsibly short.

If you are a fixed income capitalist today, the mathematics is not successful your favor. The existent output to maturity connected the “high yield” scale is approximately 5.5%. If you origin successful expected and unexpected losses (due to default), adhd successful a absorption disbursal ratio and past relationship for inflation, you are near with a antagonistic existent return. Put simply, you are not earning an due instrumentality connected your risk. The high-yield enslaved marketplace is headed for a large reckoning.

Don’t overthink this. Lower your clip preference. Bitcoin is the purest signifier of monetary vigor and is portfolio security for each fixed-income investors. In my opinion, it is inexpensive connected astir rational expected worth outcomes. But again, you tin ne'er beryllium 100% certain. The lone things that are certain:

- Death

- Taxes

- Ongoing fiat debasement

- A fixed proviso of 21 cardinal bitcoin

Study mathematics people… oregon extremity up playing anserine games and winning anserine prizes. Risk happens fast. Bitcoin is the hedge.

Epilogue

It would look that everyone should recognize the basics of the credit-based monetary strategy upon which our governments and countries run. If we are to uphold the ideals of a antiauthoritarian republic (as Lincoln declared: “… a authorities of the people, by the people, for the people”), past we indispensable request transparency and integrity from those among america whom we person selected arsenic leaders. This is our work arsenic citizens: to clasp our enactment accountable.

But we cannot bash that if we don’t recognize what it is they are doing successful the archetypal place. Indeed, fiscal literacy is severely lacking successful the satellite today. Sadly, it would look that this is by design. Our nationalist acquisition systems person 12 years to teach, and thus, empower america to deliberation critically and question the presumption quo. It is done this process of societal empowerment that we strive for, and collectively achieve, a amended future.

Yet, this is the aforesaid process by which we region the centrality of power. And that, marque nary mistake, is simply a menace to those who beryllium atop the system. Often, this powerfulness is concentrated successful the hands of a prime fewer (and stays that way) owed to a cognition disparity. Thus, we find it tragic that an nonfiction specified arsenic this adjacent needs to beryllium written… Perhaps, though, the top acquisition Satoshi gave the satellite was to reignite the occurrence of curiosity and captious thought wrong each of us. This is wherefore we Bitcoin.

Never halt learning. The satellite is dynamic.

This is simply a impermanent station by Greg Foss and Jason Sansone. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)