Are we witnessing the extremity of bitcoin’s emblematic four-year cycle? How does European adoption of the World Economic Forum’s docket interaction the euro?

Watch This Episode On YouTube oregon Rumble

Listen To The Episode Here:

“Fed Watch” is the macro podcast for Bitcoiners. Each occurrence we sermon existent events successful macro from crossed the globe, with an accent connected cardinal banks and currency matters.

In this occurrence of the “Fed Watch” podcast, I beryllium down with Tone Vays, a existent Bitcoiner and long-time terms and macro expert of Bitcoin. Our treatment ranges from the existent conditions to bitcoin cycles to broader macro topics including the authorities of U.S. politics, Europe and the euro.

You tin find the charts for this occurrence here.

Current Bitcoin Market Conditions

In the archetypal conception of the podcast, Vays talks astir the intelligence authorities of the bitcoin market.

“I was astir for the past 2 carnivore markets. 2013 was the classical bubble chart, you were mentally prepared for what’s to come. 2017, again, the ICOs, it was an unreasonable exponential rise, truthful you were mentally prepared. I wasn’t mentally prepared for this one. Because, erstwhile the apical came successful April 2021, we had an unthinkable magnitude of bully news. Michael Saylor, Elon Musk, Jack Dorsey leaving Twitter to spell each successful connected Bitcoin with Square [now Block], El Salvador [legal tender law], past El Salvador buying bitcoin.

“That turned into a merchantability the quality event. 50% correction, nary large deal. Everyone was mentally good with it. Then, this is wherever it’s each astir your intelligence state. When we went backmost and broke that apical successful November, that was the breakout. Everyone thought we were going higher; I thought we were going higher. That fake retired successful November was mentally brutal. We crashed backmost to the $30,000 low, broke down to $20,000, and implicit the past 3 to six months radical person been very, precise concerned.

“This prolonged determination has made radical tighten their belts. Mentally, they consciousness similar they were cheated and don’t deliberation bitcoin should beryllium astatine these lows. Bitcoin was built for this satellite we are seeing close present with each the uncertainty. They are stealing slope accounts from not conscionable individuals, similar successful Canada, but from sovereign countries. Bitcoin was built for this, but the terms keeps going down. People are starting to propulsion successful the towel. Everyone is saying lower, lower, lower. This is wherever I person to judge that the bulk is ever wrong.”

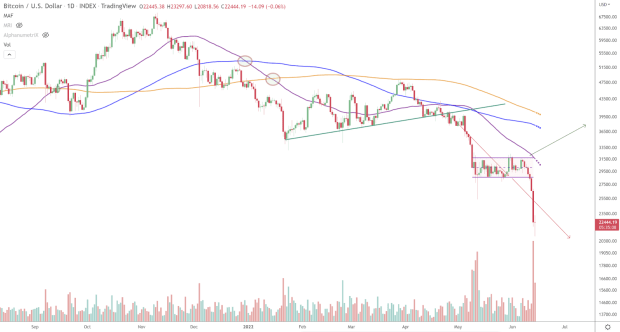

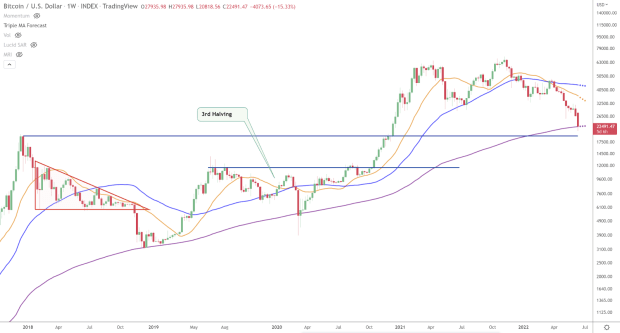

Credit: Tone Vays

Credit: Tone Vays

Credit: Tone Vays

Credit: Tone Vays

Bitcoin Cycles

I asked Vays astir bitcoin valuation models and four-year cycles. My question is whether they are each breached and if we request to find a caller model.

He said helium thinks models ever fail. Stock-to-flow is theoretically close successful Vays’ mind, but it cannot beryllium successfully utilized arsenic a method indicator. As for the four-year halving cycle, Vays believes that it is partially owed to hype and partially owed to existent proviso shocks.

That is my presumption present connected “Fed Watch" arsenic well. The four-year halving rhythm has its ain hype cycle, wholly abstracted from the wide bitcoin hype. Kind of akin to however altcoins effort to hype their hard fork upgrades, bitcoin accomplishes that people done the halving.

However, I deliberation the hype is lessening with each cycle, on with the proviso daze aspect. That is wherefore I present judge we person a two-year rhythm of sorts. A smaller effect from the halving but 1 that inactive causes an echo a mates years later.

Vays insightfully points retired that determination is overmuch little of a wide favoritism betwixt bull and carnivore markets. Price enactment successful 2020 and 2021 bash not lend themselves to a wide dividing line. Going forward, it volition go harder to delineate these cycles.

Europe Crisis And Global Macro

We started moving up connected our hard clip bounds earlier we got into the juicy stuff, truthful hopefully we tin person Vays backmost connected successful a fewer months to proceed this discussion. But we did get his opinions connected Europe and the euro.

“I volition accidental that I person a precise debased sentiment of Western Europe. It’s nice; you spell determination and it’s safe. You tin locomotion astir the street; you consciousness reasonably safe. It has remnants of a collapsing capitalist society, arsenic they manus implicit each powerfulness to the World Economic Forum (WEF). I judge that the WEF is simply a liberal, socialist organization. They person excessively overmuch power implicit politics. To punctuation Klaus Schwab, ‘We person penetrated the cabinets.’ And they have.

“I deliberation the way of the WEF is simply a very, precise unsafe path, and I abbreviated the aboriginal of Western countries that bargain into its power. That’s wherefore I’m precise bearish connected Europe. I deliberation the communal currency volition interruption up.”

We speech astir truthful overmuch more, from bitcoin’s correlation to stocks and altcoins, to monetary policy. This is 1 of my favourite episodes we’ve ever done connected “Fed Watch,” truthful it is decidedly a must-listen.

That does it for this week. Thanks to the readers and listeners. If you bask this content, delight subscribe, reappraisal and share!

This is simply a impermanent station by Ansel Lindner. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)