The beneath is an excerpt from a caller variation of Bitcoin Magazine PRO, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

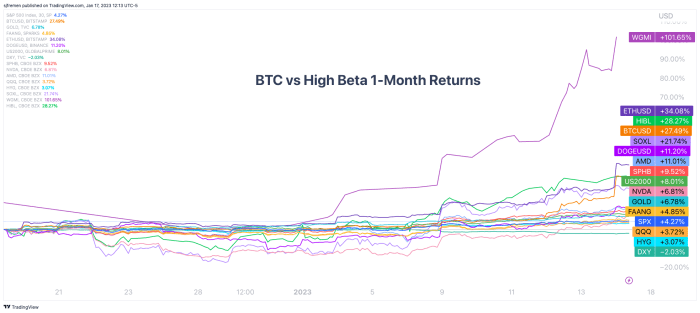

An autarkic bitcoin rally oregon a high-beta move? Either way, bitcoin holders are celebrating the latest enactment to commencement 2023. Bitcoin has shown immoderate important momentum and has powered done each cardinal short-term terms level crossed regular moving averages and on-chain realized prices. In fact, each large high-beta play successful the marketplace is showing the aforesaid spot which gives america much caution than assurance successful this latest abbreviated compression highlighted past week successful “Bitcoin Rips To $21,000, Shorts Demolished In Biggest Squeeze Since 2021.”

As overmuch arsenic we would similar to spot an autarkic bitcoin determination higher, there’s plentifulness of signs successful the marketplace showing the other is likely. We’ve seen a comparatively meaningful bounce successful the astir oversold names of 2022, with a abbreviated compression and consequent circular of FOMO disconnected the 2022 lows.

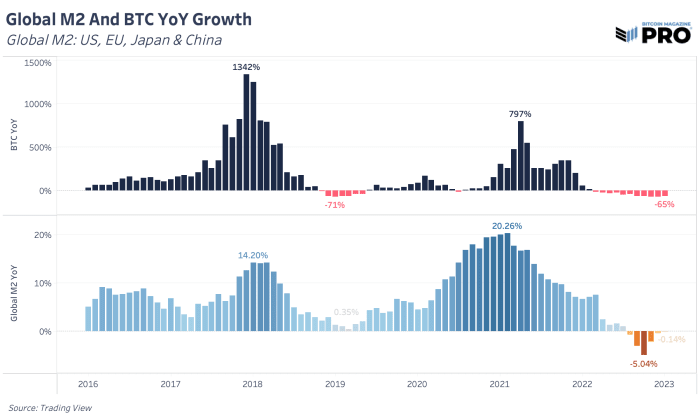

This caller hazard rally has seen implied equity marketplace volatility drift to caller lows arsenic the U.S. dollar continues to weaken implicit the short-term, National Financial Conditions Index (NFCI) loosens and planetary M2 wealth proviso contracts astatine a overmuch slower gait comparative to the past fewer months.

Net liquidity, a exemplary we highlighted successful our erstwhile piece, shows a contraction compared to past twelvemonth but hasn’t changed overmuch implicit the past fewer months. If we’re to spot a sustained rally continue, we’d similar to spot maturation successful nett liquidity implicit the adjacent mates of months to beryllium the main operator accompanying this move.

In their caller gathering minutes, members of the Federal Reserve expressed interest astir the “unwarranted easing successful fiscal conditions” caused by the run-up successful risky assets and subsequently hindering their efforts to chill inflation.

With the Bank of Japan deciding connected whether to loosen their monetary policy, this could origin the transportation commercialized to unwind. We presumption this to beryllium 1 of the fewer ways wherever some the dollar could autumn astatine the aforesaid clip arsenic planetary equity markets weaken, with equities repricing owed to rising costs of U.S. capital.

Like this content? Subscribe now to person PRO articles straight successful your inbox.

2 years ago

2 years ago

English (US)

English (US)