In a singular surge, Bitcoin’s terms has soared past the $41,500 mark, fueled by a confluence of factors ranging from marketplace anticipation of a Bitcoin spot ETF to broader fiscal trends. Here’s a elaborate investigation of the cardinal reasons down this rally:

#1 Spot Bitcoin ETF: The Anticipation Game

The buzz astir the support of a spot Bitcoin ETF remains astir apt the astir important operator of the caller terms surge. Although determination hasn’t been a circumstantial update, the marketplace anticipation is palpable, with a FOMO effect kicking in. Last week, Bloomberg expert James Seyffart suggested that a spot ETF is apt to beryllium approved betwixt January 8 and 10, causing the marketplace to react.

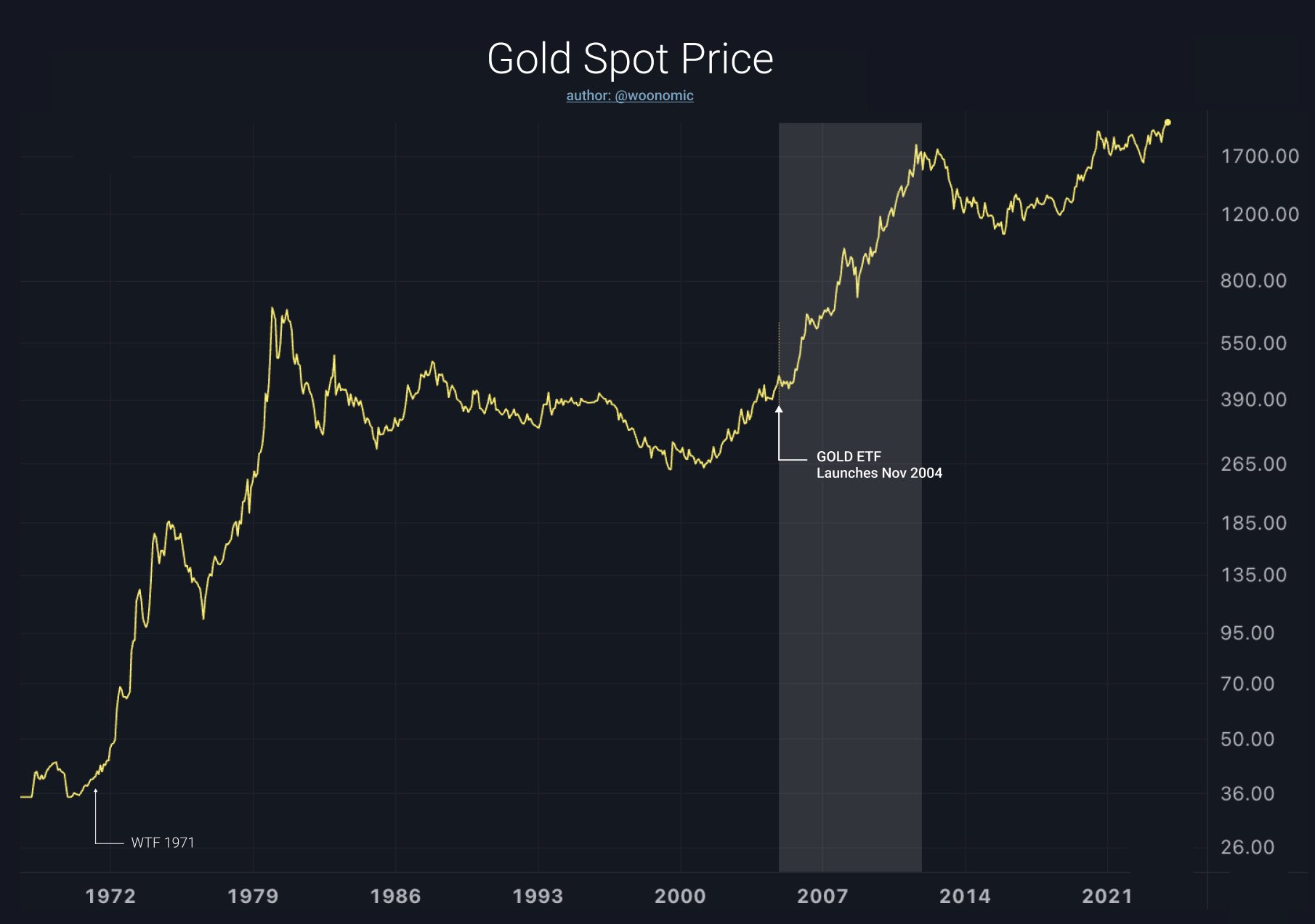

Renowned Bitcoin expert Willy Woo mirrored the anticipation with this statement, “It’s precise apt we are connected the eve of a Bitcoin spot ETF. The archetypal commodity ETF was SPDR Gold Trust. It provided a elemental mode for investors to entree golden successful their portfolio. When it launched golden went connected to an 8 twelvemonth rally with nary azygous down twelvemonth betwixt 2005 – 2012.”

gold spot terms rally aft archetypal ETF | Source: X @woonomic

gold spot terms rally aft archetypal ETF | Source: X @woonomic#2 Gold’s Meteoric Rise And Its Correlation With BTC

The unexpected emergence of gold, surging by 3.5% successful conscionable 30 minutes to a caller all-time precocious connected a Sunday afternoon, whitethorn person besides had repercussions for Bitcoin. This accelerated ascent successful gold’s worth could awesome much than conscionable marketplace fluctuations; it could bespeak deeper economical shifts that person nonstop implications for Bitcoin.

Crypto Analyst @TheFlowHorse remarked, “Unless idiosyncratic is getting carried retired close present aft shorting Gold, this is saying thing important. Gold doesn’t conscionable arbitrarily rip connected a Sunday similar this unless it means something.” Tom Crown, laminitis and CEO of Crown Analysis, added, “Something VERY BIG is coming tomorrow. Gold conscionable BLASTED past all-time highs connected a Sunday night. Someone knows something.”

#3 Bitcoin Short Squeeze

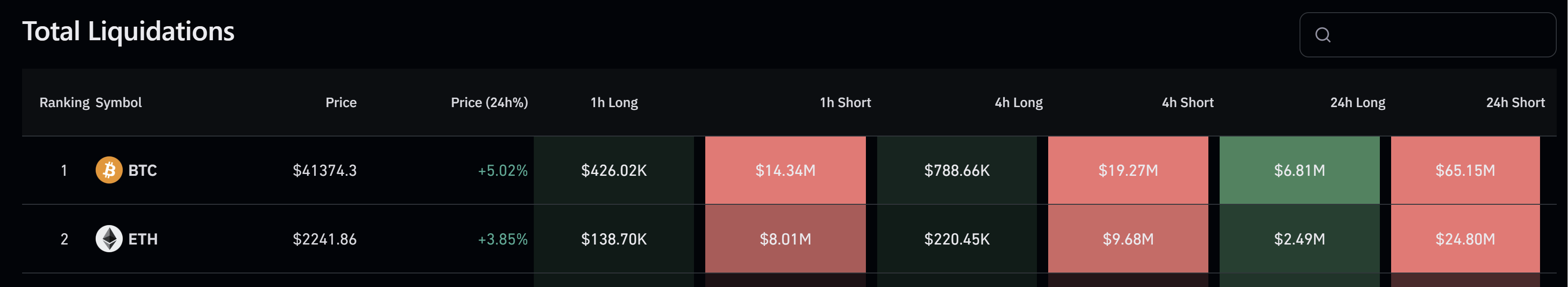

The liquidation of $65.15 cardinal successful Bitcoin abbreviated positions, according Coinglass data, has further propelled Bitcoin’s price. The abbreviated squeeze, combined with beardown spot demand, has been a cardinal factor. Crypto expert Skew noted, “Another large abbreviated compression pushing terms supra $40K. Slight perp premium connected Binance during the squeeze, indicating spot selling into the abbreviated squeeze.”

Bitcoin liquidations | Source: Coinglass

Bitcoin liquidations | Source: Coinglass#4 Whales And Institutional Buyers

The existent surge successful Bitcoin’s terms has been importantly influenced by whales and organization buyers. Market expert Skew pointed retired their impact, stating, “Someone is inactive aggressively chasing terms here. More importantly if said ample marketplace entity really allows immoderate bids to get filled oregon not. IF filled past expected for them to propulsion the terms higher. Clearly $40K is the terms for organization players.”

Keith Alan, co-founder of Material Indicators, further emphasized the relation of these ample holders, tweeting, “Bitcoin Whales conscionable blasted done $40k.” His connection underlines the important power whales person successful driving up Bitcoin’s price. He added, “Locking successful immoderate nett here. $42k is simply a precocious probability, but decidedly not guaranteed.”

Additionally, GreeksLive, a trading tools provider, noted the broader marketplace trend, stating, “Bitcoin broke done $41,000, Ethereum broke done $2,200… The elephantine whale erstwhile again showed a consciousness of odor earlier the market.”

December saw a emergence beyond expectations, bitcoin broke done $41,000, ethereum broke done $2,200, and continued to emergence astir without retracement.

The elephantine whale erstwhile again showed a consciousness of odor earlier the market, from past week to re-add positions successful the artifact call,… https://t.co/EO6MddoNXX pic.twitter.com/ekD4LiLExs

— Greeks.live (@GreeksLive) December 4, 2023

#5 Liquidity: The Underlying Force

The surge successful Bitcoin’s terms is besides importantly influenced by planetary liquidity conditions, a origin often overlooked but important successful knowing BTC and cryptocurrency marketplace dynamics. Zerohedge highlighted the standard of this power successful a post: “In November, cardinal banks added $350BN successful liquidity, the third-largest summation since March.”

This monolithic injection of liquidity by cardinal banks astir the satellite plays a pivotal relation successful plus terms movements, including cryptocurrencies similar Bitcoin. David Marlin, CEO of Marlin Capital, pointed out the value of this inclination successful fiscal conditions, “US Financial Conditions eased 90 bps successful November, the largest monthly easing connected grounds (dating backmost to 1982).”

Adding to this narrative, cryptocurrency adept Charles Edwards commented connected the historical quality of this easing, saying, “November saw the largest easing successful implicit 40 years!” Such a important easing of fiscal conditions suggests a highly conducive situation for concern successful assets similar Bitcoin, which are seen arsenic hedges against ostentation and currency devaluation.

Arthur Hayes, laminitis of BitMEX, summed up the sentiment by stating, “Eye connected the prize. RRP balances proceed to autumn and BTC continues to pump. Yachtzee!!!”

At property time, BTC traded astatine $41,505.

Bitcoin price, 1-week illustration | Source: BTCUSD connected TradingView.com

Bitcoin price, 1-week illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)