In a swift turnaround from yesterday’s dip, Bitcoin (BTC) surged to astir $26,000 during Asian trading hours connected Tuesday. This recovery, which saw the BTC ascent from $25,210 to $25,973 successful a specified 30 minutes (from 3:00 americium to 3:30 americium UTC), was not driven by immoderate circumstantial quality event. Instead, the dynamics wrong the Bitcoin futures marketplace played a pivotal role.

Why Has The Bitcoin Price Bounced Upwards?

Renowned expert Skew provided a method position connected the terms movement, referring to it arsenic a “textbook abbreviated squeeze.” Delving deeper into Skew’s analysis, helium pointed retired a wide divergence successful the Cumulative Volume Delta (CVD) of perpetual contracts (or “perps”) with the existent price. In trading, a divergence betwixt CVD and terms tin awesome a imaginable reversal. In this context, portion sellers were trying to propulsion the terms beneath $25,000, the CVD indicated that buying unit was mounting.

Furthermore, the futures marketplace had a precocious fig of abbreviated positions comparative to the unfastened involvement (OI), and the backing complaint was negative. A antagonistic backing complaint typically means that shorts are paying longs, indicating a bearish sentiment. Despite attempts to thrust the terms down, Bitcoin was reclaiming its plaything agelong terms level astatine $25,300 and failed to support the bearish inclination successful the little clip framework (LTF).

The spot market, wherever assets are bought and sold for contiguous delivery, was showing signs of a bullish operation change, with prices gradually moving higher. Skew suggested that the culmination of these factors led to a abbreviated squeeze, wherever those who stake against the marketplace (short sellers) are forced to bargain backmost into the marketplace to screen their positions, further driving up the price.

Skew’s investigation fundamentally highlights that portion determination was a bearish sentiment with galore traders betting against Bitcoin, underlying indicators were hinting astatine a imaginable bullish reversal. For traders, the contiguous extremity post-squeeze is to reclaim $26,000.

Bitcoin CVDs & Price | Source: X @52kskew

Bitcoin CVDs & Price | Source: X @52kskewTheKingfisher offered a much succinct take, hinting astatine the abbreviated compression and its interaction connected those who were betting against Bitcoin: “See you astir precocious lev shorters. BTC Cleared them again.”

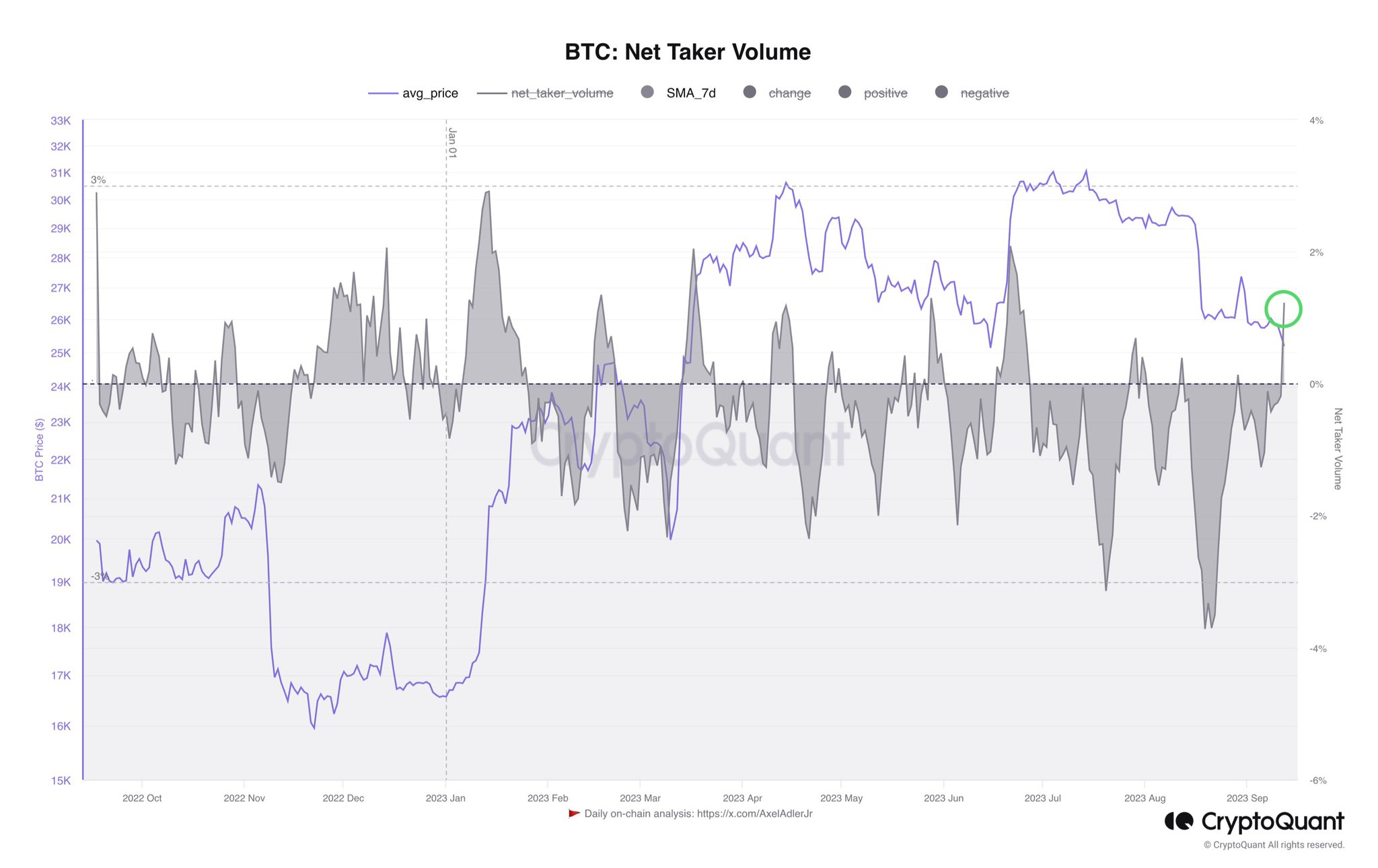

Axel Adler Jr. shed airy connected the broader marketplace sentiment, noting, “Traders bash not program to spell immoderate lower. Net Taker Volume has risen by 9.79%. Over the past year, this is simply a caller grounds for the equilibrium of unfastened Taker orders with agelong positions.”

Bitcoin Net Taker Volume SMA 7 days | Source: X @AxelAdlerJr

Bitcoin Net Taker Volume SMA 7 days | Source: X @AxelAdlerJrDespite the accelerated terms movement, the abbreviated squeeze’s magnitude was comparatively modest. Coinglass information reveals that astir $12.32 cardinal successful BTC shorts were liquidated. For context, the astir important abbreviated liquidation lawsuit successful the past 3 months occurred connected August 17, amounting to $120 million, erstwhile BTC concisely dipped to $24,700 earlier making a speedy betterment supra $26,600.

The diminution successful unfastened involvement successful futures connected the large exchanges was besides alternatively small. According to Coinglass, unfastened involvement fell from $10.66 cardinal to $10.65 billion. This flimsy diminution suggests that fewer traders had to adjacent their bets, with backing rates turning positive, signaling a displacement from bearish to bullish sentiment.

At property time, BTC stood astatine $25,768.

BTC jmups to $26,000, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC jmups to $26,000, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from Millionero Magazine, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)