On Tuesday, the Bitcoin terms plunged from $49,900 to $48,300 pursuing the merchandise of the US ostentation data. As NewsBTC reported, the information came successful hotter than expected. Instead of 2.9%, header CPI came successful astatine 3.1%, portion the halfway CPI was adjacent astatine 3.9% alternatively of the expected 3.7%.

The accepted fiscal marketplace reacted negatively and dragged Bitcoin down with it, arsenic expectations for involvement complaint cuts person shifted further into the future. The prediction markets are present pricing successful lone 4 complaint cuts successful 2024 aft CPI ostentation reached 3.1% successful January.

This is simply a immense driblet successful expectations arsenic conscionable implicit a period agone the markets were inactive pricing successful 6 complaint cuts. The Fed’s astir caller forecast was for 3 complaint cuts successful 2024. The probability of a complaint chopped successful March is beneath 10% and the probability of a complaint chopped successful May is falling rapidly.

In opposition to the S&P 500, however, the Bitcoin terms showed a beardown absorption and rapidly roseate again to $49,900. The absorption of the Bitcoin marketplace is rather telling for the short-term future. And the Bitcoin terms is showing conscionable that today. At property time, BTC roseate supra $51,500, marking a caller yearly high. Here are 4 cardinal reasons:

#1 Record-Breaking Bitcoin ETF Inflows

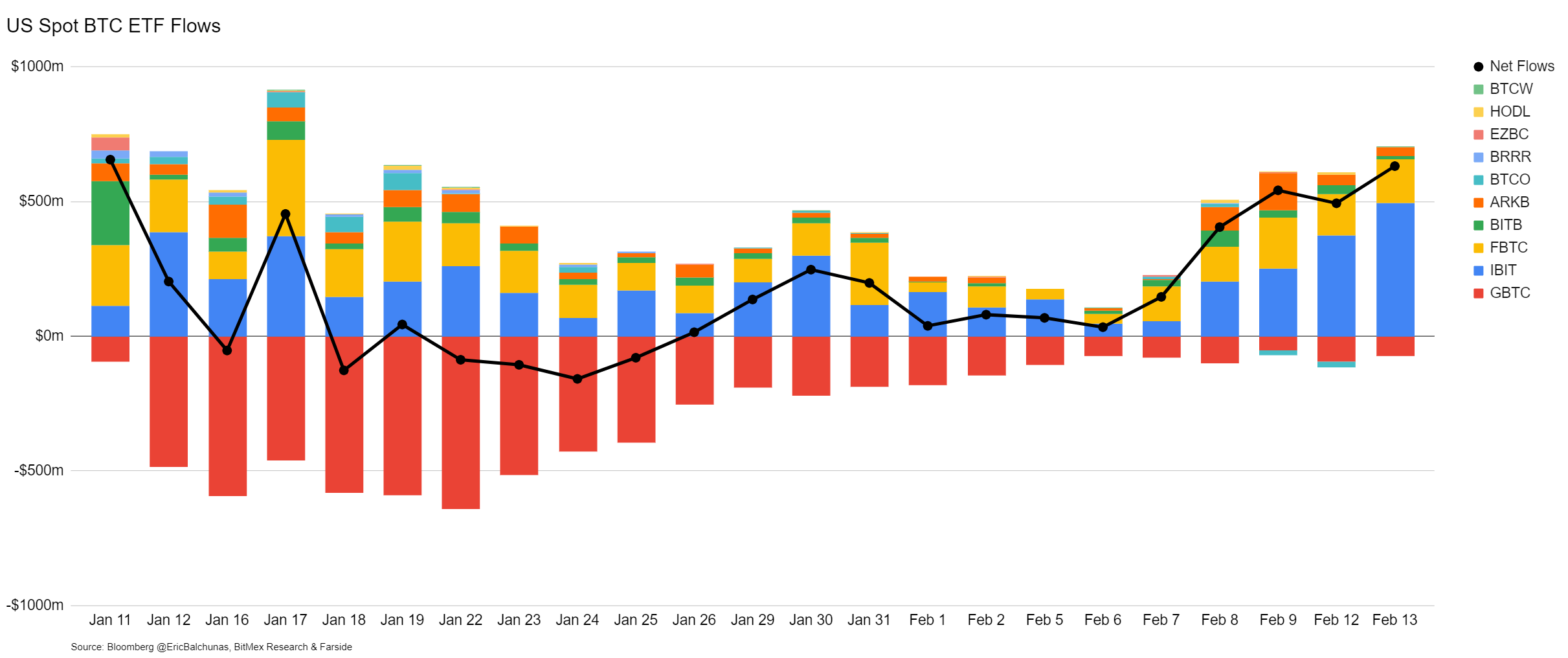

The surge successful Bitcoin ETF inflows marks a pivotal infinitesimal for Bitcoin, reflecting a important displacement successful capitalist sentiment and marketplace dynamics. On a record-breaking time connected Tuesday, the nett inflows into spot Bitcoin ETFs reached $631 million, led by The Nine with an inflow of $704 million, signaling a important accumulation of Bitcoin.

Bitcoin ETF inflows | Source: X @CarpeNoctom

Bitcoin ETF inflows | Source: X @CarpeNoctomKey players similar Blackrock and Fidelity played a important relation successful this influx, with Blackrock experiencing astir fractional a cardinal dollars ($493 million) successful inflows and Fidelity $164 million. The wide nett inflow of $2.07 cardinal implicit 4 trading days, averaging implicit fractional a cardinal per day, highlights the staggering sustained request for Bitcoin.

This request is notably caller capital, arsenic GBTC outflows remained unchangeable astatine $73 million, indicating these inflows are not simply a rotation from GBTC but correspond caller investments. Matt Hougan, CIO of Bitwise emphasized the value of this movement:

IMHO the [numbers] undercounts the cardinal caller capitalist request for these ETFs. People presume each of the wealth flowing retired of GBTC to day is rotating into different bitcoin ETFs. But a bully chunk of it is from inorganic holders […] Long-term investors person backfilled that and added $3b much connected top. I fishy the existent caller investor-led caller request is northbound of $5b, and shows nary signs of slowing.

#2 Genesis GBTC Liquidation Concerns Alleviated

Fears of a Bitcoin crash, akin to FTX’s merchantability of GBTC, triggered by Genesis’ planned liquidation of Grayscale Bitcoin Trust (GBTC) shares person been alleviated, arsenic reported contiguous connected Bitcoinist. The liquidation, indispensable owed to Genesis’ bankruptcy, was initially viewed arsenic a imaginable marketplace downturn catalyst.

The bankrupt lender needs to liquidate astir 36 cardinal shares of GBTC, valued astatine astir $1.5 billion, arsenic portion of its strategy to resoluteness fiscal challenges stemming from important loans and regulatory settlements.

However, the projected Chapter 11 colony involves in-kind repayments to creditors, reducing nonstop selling unit connected Bitcoin. This strategy aligns with the interests of semipermanent Bitcoin holders, perchance limiting marketplace volatility. Greg Schvey, CEO astatine Axoni, highlighted:

The projected Ch 11 colony requires Genesis to repay creditors successful benignant (i.e. bitcoin lenders person bitcoin successful return, alternatively than USD). […] Notably, in-kind organisation was a precedence dialog taxable to forestall semipermanent BTC holders from recognizing gains erstwhile receiving USD backmost (i.e. a forced sale). This would look to bespeak a important measurement of lenders don’t program to merchantability immediately.

#3 OTC Demand Exceeds Supply

The statement by CryptoQuant CEO Ki Young Ju that “Bitcoin request exceeds proviso astatine OTC desks currently” is simply a important indicator of underlying marketplace strength. OTC transactions, preferred by ample organization investors for their discretion and minimal marketplace impact, are reflecting a robust request for Bitcoin. This demand-supply imbalance astatine OTC desks suggests that ample players are accumulating Bitcoin, a bullish awesome for the cryptocurrency’s terms outlook.

Bitcoin OTC flows | Source: X @ki_young_ju

Bitcoin OTC flows | Source: X @ki_young_ju#4 Futures And Spot Market Dynamics

The investigation of futures and spot marketplace indicators by @CredibleCrypto sheds light connected the method factors signaling a bullish continuation for Bitcoin. The expert points out, “Data supporting the thought that that was ‘the dip’. – OI reset backmost to levels earlier the past pump – Funding decreasing done this section consolidation – Spot premium is back.”

Bitcoin investigation | Source: X @CredibleCrypto

Bitcoin investigation | Source: X @CredibleCryptoThese observations suggested a steadfast marketplace correction alternatively than the commencement of a bearish trend, with the reset successful unfastened involvement and the alteration successful backing rates indicating that the marketplace has absorbed the daze and is primed for upward movement.

In conclusion, The operation of grounds ETF inflows, alleviated concerns implicit Genesis’ GBTC liquidation, beardown OTC demand, and favorable futures and spot marketplace dynamics provides a compelling lawsuit for Bitcoin’s imaginable rally. Each of these factors, supported by adept insights and marketplace data, underscores a increasing capitalist confidence.

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)