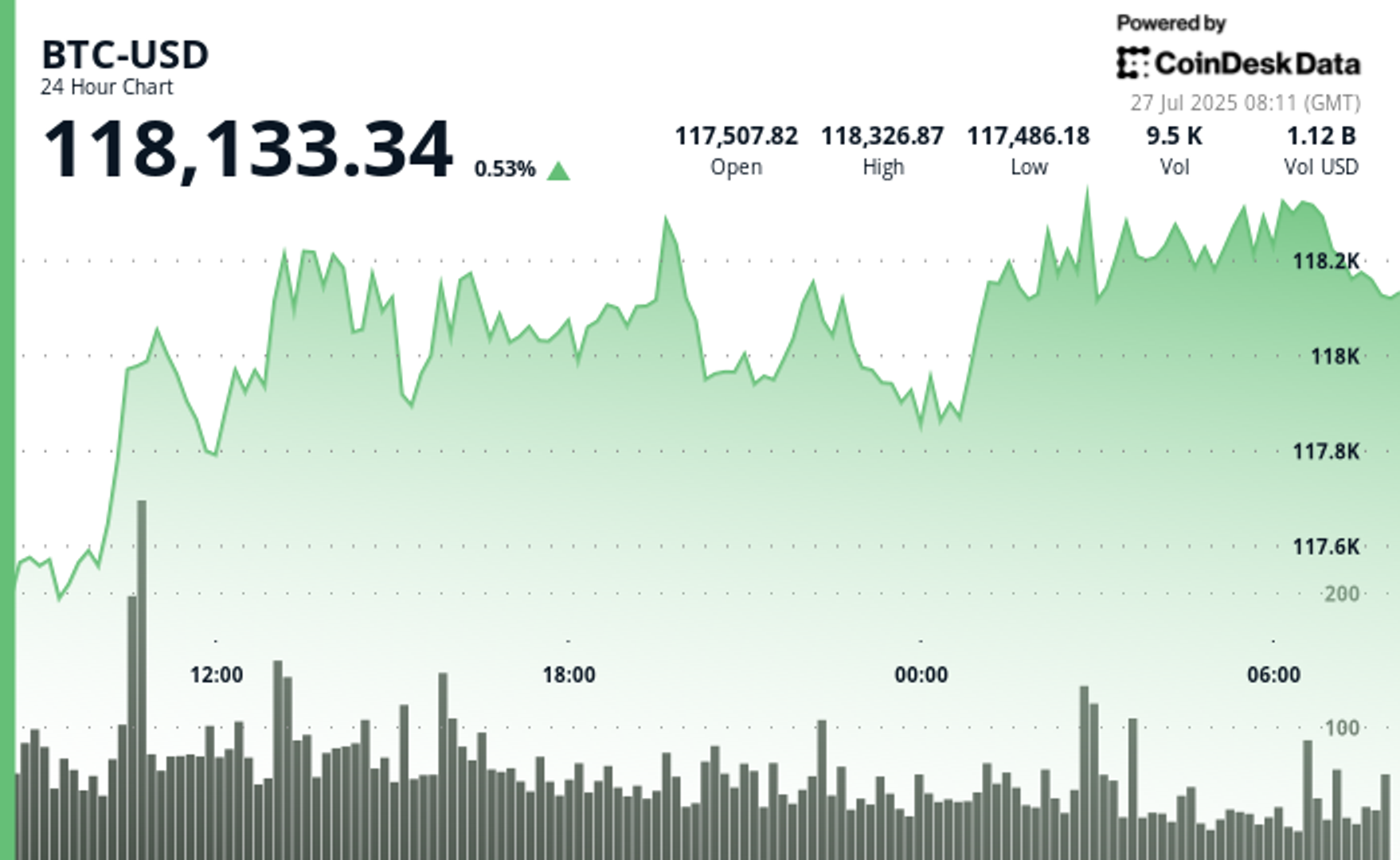

BTC terms cooled disconnected aft an awesome 30% monthly gain, but MicroStrategy CEO Michael Saylor made the lawsuit for wherefore helium remains bullish connected Bitcoin.

This week Bitcoin (BTC) terms came wrong a hairsbreadth of the $36,000 mark, earlier abruptly reversing people and correcting to $34,250. After a adjacent 30% tally implicit the past month, it is earthy for the terms to chill disconnected arsenic immoderate traders instrumentality nett and marketplace participants measure whether oregon not the catalysts for the rally stay valid.

Despite the intra-day terms action, which saw a 4.67% drawdown, a fig of analysts stay bullish connected Bitcoin, and immoderate expect different “gamma squeeze” if BTC terms manages to propulsion done the $36,300 level.

Perma-bulls similar MicroStrategy CEO Michael Saylor look unbothered by the whipsaw terms action, and connected Nov.1, MicroStrategy announced the acquisition of 155 BTC for $5.3 cardinal successful October.

In October, @MicroStrategy acquired an further 155 BTC for $5.3 cardinal and present holds 158,400 BTC. Please articulation america astatine 5pm ET arsenic we sermon our Q3 2023 fiscal results and reply questions astir the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/w7eRUcGobi

— Michael Saylor⚡️ (@saylor) November 1, 2023When asked astir the upcoming Bitcoin halving during an interview with CNBC Squawk connected the Street big Sara Eisen, Saylor said,

“Most of the earthy sellers of Bitcoin successful the marketplace close present are Bitcoin miners, and they person to merchantability to screen their energy bills and superior costs and discontinue their debt. That’s astir a cardinal dollars per period worthy of selling into the market. The protocol forces that to beryllium chopped successful fractional arsenic of adjacent April, oregon precocious April.”Considering the interaction of the halving connected selling and demand, Saylor said,

“So you’re going to spot $12 cardinal of earthy selling per twelvemonth converted to $6 cardinal of earthy selling a year. At the aforesaid clip arsenic things similar spot Bitcoin ETFs summation the request for Bitcoin. So that’s wherefore each of america are reasonably bullish implicit the adjacent 12 months. Demand is going to increase, and proviso is going to declaration and this is reasonably unprecedented successful the past of Wall Street.”Now is simply a ‘pretty perfect introduction point’ for Bitcoin

To date, Bitcoin terms has gained 114%, 30% of which was added successful the past month. Despite these gains, the terms remains astir 50% down from its all-time high, and the mean idiosyncratic is apt to person memories of the FTX implosion and different crypto scandals successful their caput earlier considering BTC’s show successful 2023.

When asked whether helium believed the good of organization capitalist involvement had been poisoned by “bad and acheronian applications of this cryptocurrency and radical similar Sam Bankman-Fried, Saylor said,

“I deliberation that the liabilities oregon the aboriginal crypto cowboys, the crypto tokens which are unregistered securities, the unreliable crypto custodians, for the manufacture to determination to the adjacent level, we’re going to request to migrate to big supervision.”Related:BTC terms dips 3.5% arsenic 'overheated' Bitcoin derivatives spark angst

Regarding the existent investing climate, Saylor suggested that “If you’ve got a 12-month to 48-month clip horizon, this is simply a beauteous perfect introduction constituent into the asset.”

“When banks connected Wall Street and liable custodians are managing Bitcoin and the manufacture takes its eyes distant from each the shiny small tokens that person distracted and demolished shareholder value, I deliberation the manufacture moves to the adjacent level and we 10x from here.”This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

1 year ago

1 year ago

English (US)

English (US)