The post Bitcoin Price Could Fall to $56,000, Warns Galaxy Digital Head appeared first on Coinpedia Fintech News

After dropping from last week’s high of $90,562 bitcoin price is now facing one of its toughest market phases in recent years. Alex Thorn, Head of Research at Galaxy Digital, the world’s largest cryptocurrency, may fall much lower in the coming weeks.

He believes Bitcoin could slide toward the $56,000 level as market weakness continues. Here’s Why!

Why Bitcoin Price May Drop to $56,000

According to Alex Thorn, Bitcoin’s recent performance shows clear weakness following a big sell-off in late January. The price fell nearly 15% in one week and dropped to around $74,551, close to its April 2025 low.

This sudden crash also triggered more than $2 billion in long-position liquidations, one of the largest in Bitcoin history.

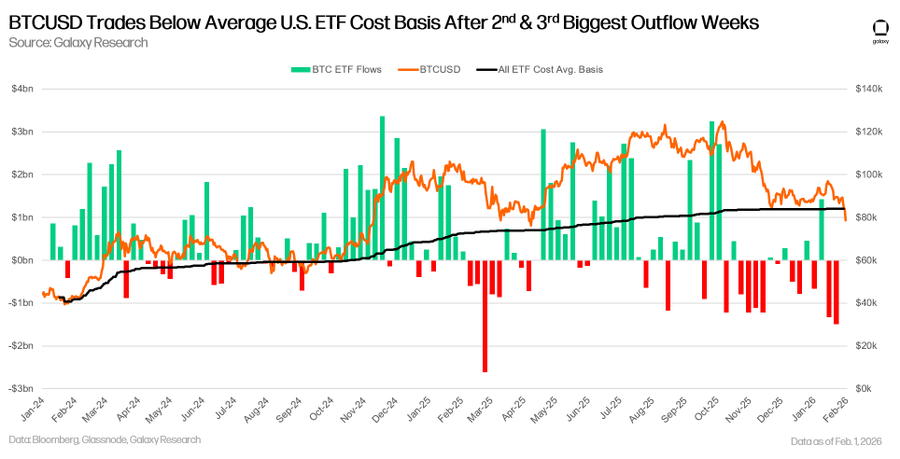

Another major concern Thorn highlighted is that Bitcoin has fallen below the average buying price of U.S. Bitcoin ETFs, which is around $84,000. ETF investors are usually long-term holders, so this drop is a negative sign.

In the last two weeks, Bitcoin ETFs saw outflows of about $2.8 billion, showing weaker confidence from big investors.

What is more concerning is that Bitcoin has failed to rise along with traditional safe-haven assets like gold and silver, which hit new ATHs. This has weakened Bitcoin’s image as a hedge against currency devaluation.

Nearly Half of Bitcoin Supply Now in Loss

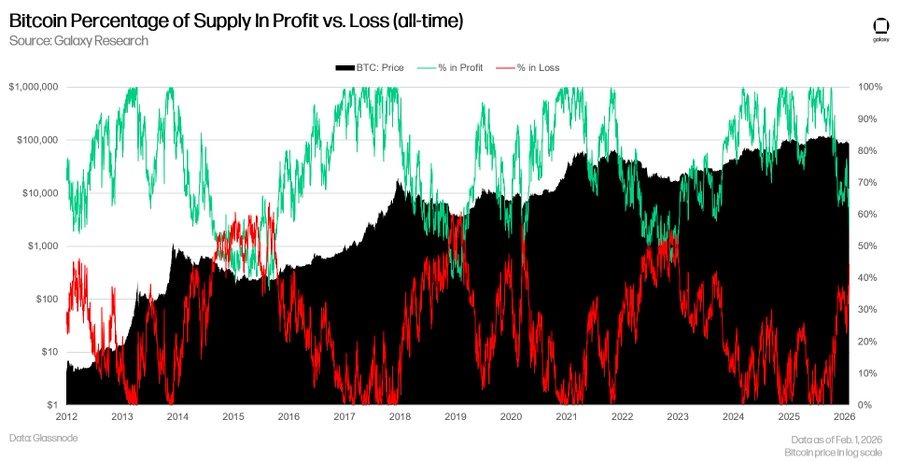

Right now, Bitcoin is trading near $78,392, which is almost 38% below its all-time high of $126,296. Because of this drop, on-chain data shows that around 46% of the total Bitcoin supply is now in loss. This means nearly half of all BTC was last bought at prices higher than today.

In past bear markets like 2015, 2018, and 2022, major Bitcoin bottoms have often formed when the number of holders in profit and loss was nearly equal.

Right now, it’s moving toward that point, suggesting the market could be nearing a bottom.

Why Bitcoin Price May Drop to $56,000

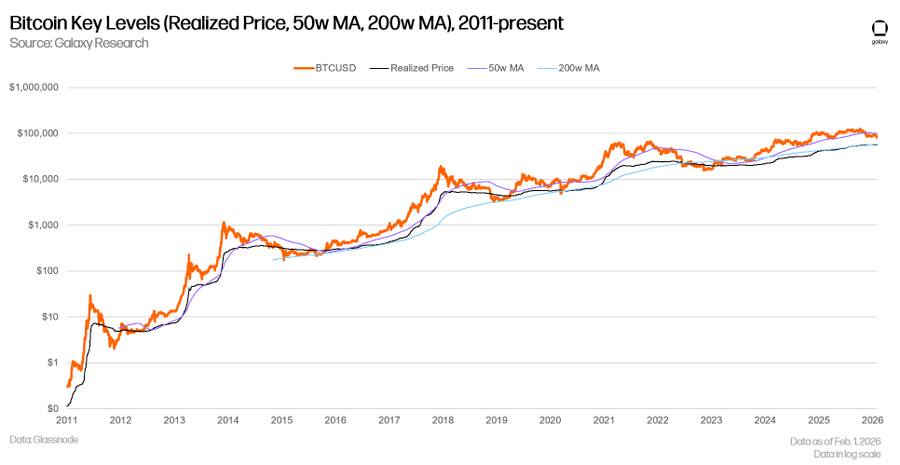

Further into the analysis, Alex Thorn noted that Bitcoin has already lost an important technical level, the 50-week moving average. In past market cycles, whenever BTC breaks below this level, the price often falls toward the 200-week moving average.

Currently, the 200-week moving average is near sept 2024 low of $58,000, while Bitcoin’s realized price stands around $56,000. These levels have historically acted as strong long-term support zones, and Thorn believes BTC could test these ranges in the coming weeks or months.

And one of the biggest reasons for this to happen is the supply gap between $70,000 and $80,000, where fewer coins were bought, making support weak.

If demand doesn’t pick up, Bitcoin could first dip toward $70,000 and then possibly reach $58,000–$56,000, which are strong long-term support levels.

1 hour ago

1 hour ago

English (US)

English (US)