The Bitcoin marketplace is presently experiencing a turning point, mostly driven by caller trends successful Bitcoin exchange-traded funds (ETFs). Yesterday, Bitcoin’s terms roseate supra $43,000, a question intimately tied to changing dynamics successful ETF inflows and outflows, peculiarly involving the Grayscale Bitcoin Trust (GBTC).

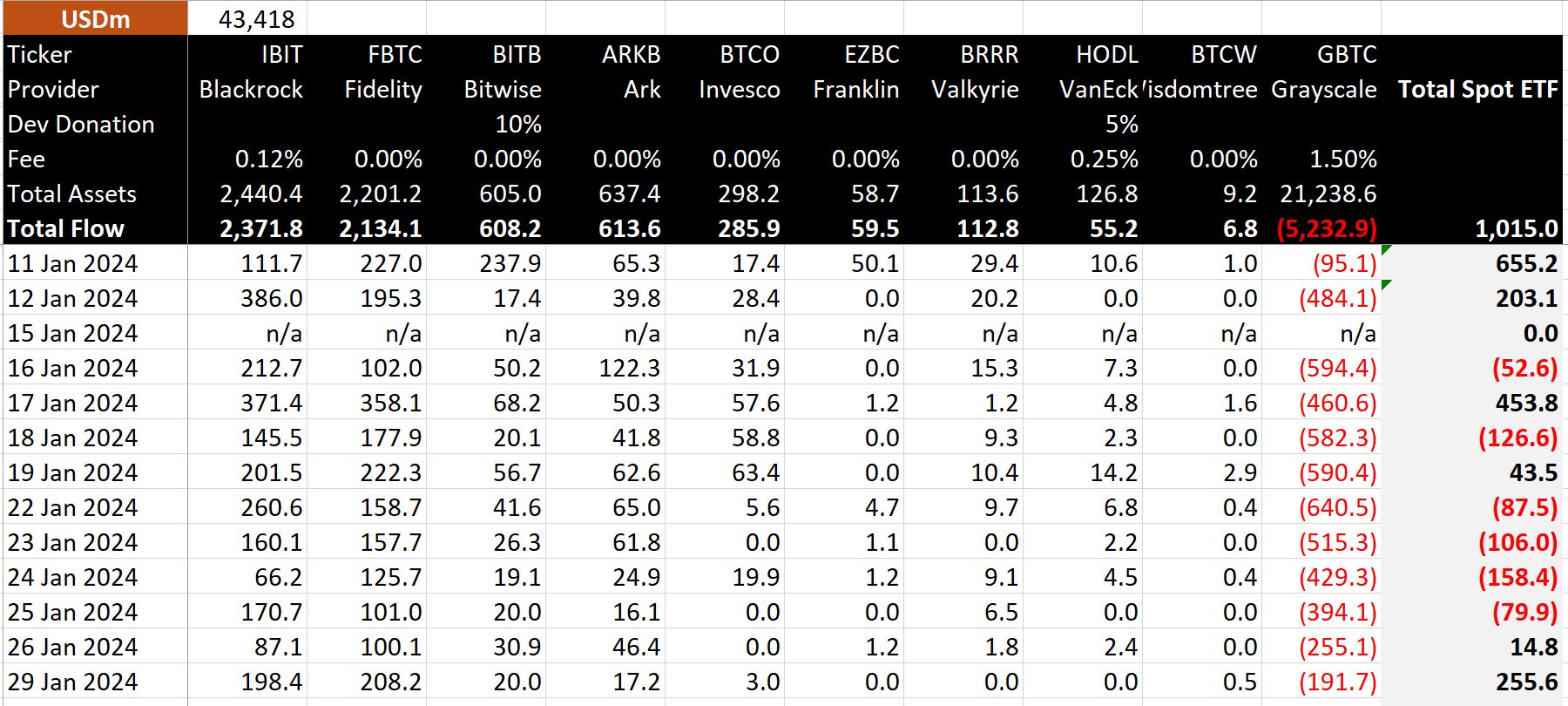

On January 29, (Bitcoin ETF Day 12), a notable displacement occurred. The Bitcoin spot ETFs witnessed a important nett inflow of US$255 million, portion Grayscale’s GBTC experienced a important nett outflow of $191 million. The different 9 ETFs, led by Fidelity and BlackRock, saw a combined nett inflow of $446 million, making it the third-highest inflow time for Bitcoin ETFs.

Bitcoin ETF Flow – Day 12 | Source: @BitMEXResearch

Bitcoin ETF Flow – Day 12 | Source: @BitMEXResearchNew All-Time High Until Bitcoin Halving?

This script of precocious inflows and reduced outflows from Grayscale’s GBTC presents an intriguing alteration from erstwhile days, wherever GBTC outflows dominated and weighed heavy connected the marketplace sentiment.

Crypto expert @WhalePanda, who’s portion of the “Magical Crypto Friends” YouTube channels (along with Samson Mow, Charlie Lee, and Riccardo Spagni), commented connected this development, stating, “Net inflow of $250 cardinal successful a time is crazy. That’s 5800 Bitcoin being removed from the marketplace successful conscionable 1 day.”

He highlighted the value of this volume, particularly erstwhile compared to the regular Bitcoin mining complaint of 900 BTC. MicroStrategy bought $615 cardinal BTC betwixt November 30 and December 26.

While WhalePanda acknowledged that inflows volition dilatory down 1 day, helium expects this to hap aboriginal on. “The accrued terms is driving much exposure, starring to much inflows, which successful crook pushes the terms adjacent higher. This is simply a classical illustration of the bull rhythm flywheel mechanics astatine play, adjacent earlier the halving,” helium remarked.

The renowned crypto adept further elaborated that “the magnitude of Bitcoin interval volition importantly driblet implicit the adjacent mates of days and erstwhile the terms starts moving with constricted proviso left… Things tin spell crazy. No, not $1 cardinal crazy. Crazy for maine is breaking ATH earlier halving.”

In a abstracted post connected X, @WhalePanda expressed his outlook for the week, “This is going to beryllium a large week for #Bitcoin. With GBTC outflows decreasing and a beardown inflow time past Friday, we mightiness beryllium seeing the opening of a caller trend.” He emphasized the imaginable of this momentum to go a self-fulfilling prophecy, driving Bitcoin’s terms higher.

Spot BTC ETFs Remain The Focus

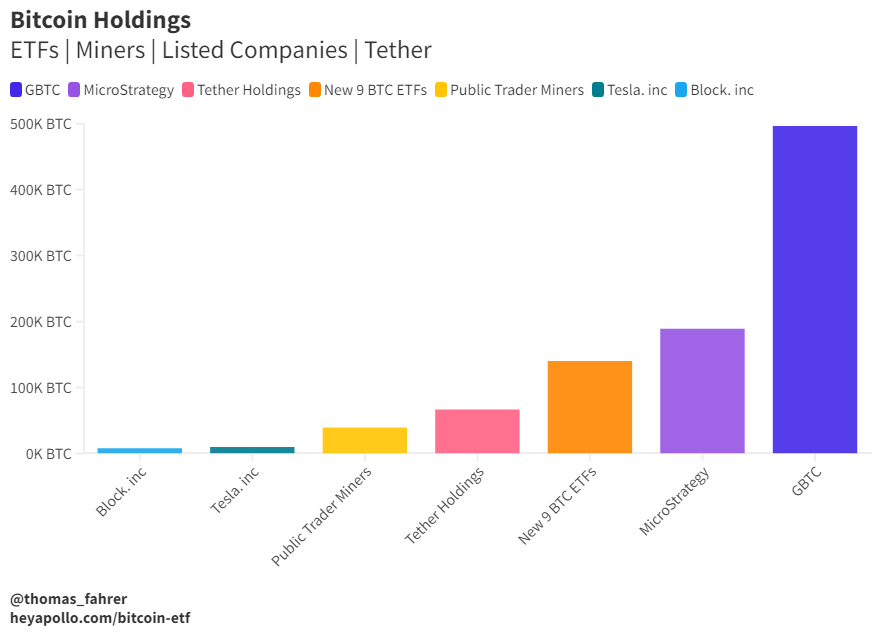

Thomas Fahrer, co-founder of Apollo Sats, added discourse to these monolithic spot BTC figures, noting, “The 9 New ETFs clasp much BTC than Tether, Tesla, Block, and each of the Public Miners combined. Soon they volition surpass MSTR, and aboriginal adjacent GBTC.”

Bitcoin holdings | Source: X @thomas_fahrer

Bitcoin holdings | Source: X @thomas_fahrerAlex Thorn, caput of probe astatine Galaxy, commented connected the imaginable implications for BTC’s terms trajectory, particularly successful narration to ETH: “With Grayscale outflows appearing to dilatory down and different Bitcoin ETF flows remaining positive, I’m funny astir the aboriginal absorption of the ETHBTC cross. A little trajectory seems similar the way of slightest absorption successful the adjacent term.”

with grayscale outflows seeming to abate and different #bitcoin etf flows present appearing holding positive, i’m again wondering wherever the ETHBTC transverse is headed. little again feels similar the way of slightest absorption near-term pic.twitter.com/DVPi1pdWP0

— Alex Thorn (@intangiblecoins) January 30, 2024

This confluence of ETF inflows, decreasing outflows from Grayscale, and the anticipation of the upcoming Bitcoin halving are creating a unsocial bullish marketplace environment. However, astatine property time, BTC is trading beneath a cardinal absorption astatine $43,444.

BTC terms hovers beneath cardinal resistance, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC terms hovers beneath cardinal resistance, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)