In an analysis shared connected X, Kelly Greer, Vice President of Trading astatine Galaxy Digital, presents a compelling statement for wherefore the Bitcoin terms could surge to arsenic precocious arsenic $118,000 by the extremity of the year. Greer’s insights are grounded successful a operation of humanities show data, existent marketplace dynamics, and broader macroeconomic factors, each of which she believes are aligning to make a highly favorable situation for Bitcoin.

Here’s Why Bitcoin Could Skyrocket To $118,000

Greer begins by highlighting Bitcoin’s beardown humanities show successful the 4th fourth (Q4) of erstwhile years. She pointed retired that since 2020, Bitcoin’s mean Q4 instrumentality to its intra-quarter precocious watermark has been astir 85%. This fig includes a best-case script wherever the instrumentality reached a staggering 230%, and a worst-case script with a 12% decline.

“BTC mean Q4 instrumentality (to max [intra 4th precocious watermark, afloat q return]) since 2020 is +85% (worst -12%, champion +230%)—press you to find a stronger asymmetry,” Greer writes. This statistical asymmetry suggests a important imaginable upside compared to the downside, making Q4 historically a play of robust maturation for Bitcoin.

A simply mean Q4 with a terms summation of 85% could mean a year-end terms of $118,000 for Bitcoin. If the BTC outperforms its grounds of 230%, the terms could adjacent emergence good supra $200,000.

Notably, Greer believes that the existent marketplace is not afloat positioned to instrumentality vantage of this potential. She attributes this underallocation to a fewer cardinal factors. Firstly, determination is apprehension surrounding the upcoming US statesmanlike election scheduled for November 5. Secondly, different assets specified arsenic golden and China’s A-shares are attracting important attraction and capital, perchance diverting concern distant from Bitcoin.

“I inactive don’t deliberation the marketplace is allocated accordingly—2024 is simply a unsocial lawsuit wherever immoderate information of the marketplace is underindexing connected the Q4 asymmetry owed to a) Nov 5 US predetermination hazard and/or b) different assets are screaming (gold, China A-shares etc.),” Greer remarks.

Key Reasons To Be Bullish On BTC

To enactment her appraisal of the market’s existent positioning, Greer cites her interactions with hazard managers and noted circumstantial marketplace indicators. She mentioned observing “low volatility and contained perp funding,” which suggests that traders are not aggressively betting connected important terms movements.

Beyond these marketplace dynamics, Greer identifies respective macroeconomic and industry-specific factors that she believes are creating a “broadly precise positive” backdrop for Bitcoin. One important constituent is the beingness of global stimulus measures successful large economies specified arsenic the United States and China, excluding Japan.

Greer besides highlights that BNY Mellon, the world’s largest custodian bank, received a SAB 121 exemption. This exemption allows the slope to connection custody services for Bitcoin without the stringent superior requirements that antecedently made specified services little attractive. Greer describes this improvement arsenic “massive and underappreciated,” noting that it volition “loosen financing successful our manufacture substantially.”

Furthermore, Greer points retired that ETF flows person go “very constructive.” Over the past fewer days, spot BTC inflows person reaccelerated massively. Last Friday, nett flows were $494.8 million, making it the highest nett inflow time of the 4th and the highest nett inflow time since June 4th.

Another affirmative indicator is that Bitcoin miners are entering agreements with hyperscalers—large-scale unreality work providers. These partnerships tin heighten mining ratio and trim operational costs.

Greer besides mentions that “supply overhangs [are] mostly done,” suggesting that ample sell-offs that could suppress the terms are improbable successful the adjacent term. Additionally, she anticipates that “demand from FTX currency distros [is] astir the corner,” implying that funds distributed from the FTX exchange could find their mode into Bitcoin investments, further boosting demand.

However, Greer besides acknowledges imaginable risks that could interaction Bitcoin’s trajectory. These see signals from the Federal Reserve regarding monetary argumentation and the anticipation of a pullback successful equity markets. Such events could present volatility oregon dampen capitalist enthusiasm.

However, she believes that the wide sentiment remains positive. “There are risks of course—Fed signaling, equities pullback, what person you—but nett net vibes are rather good, and flows are conscionable getting started,” she remarks.

Greer besides describes Bitcoin arsenic a “reflexive asset.” She explains, “BTC is the eventual reflexive asset: terms -> flows -> price.” This means that arsenic the terms of Bitcoin increases, it attracts much concern flows, which successful crook propulsion the terms adjacent higher—a self-reinforcing cycle.

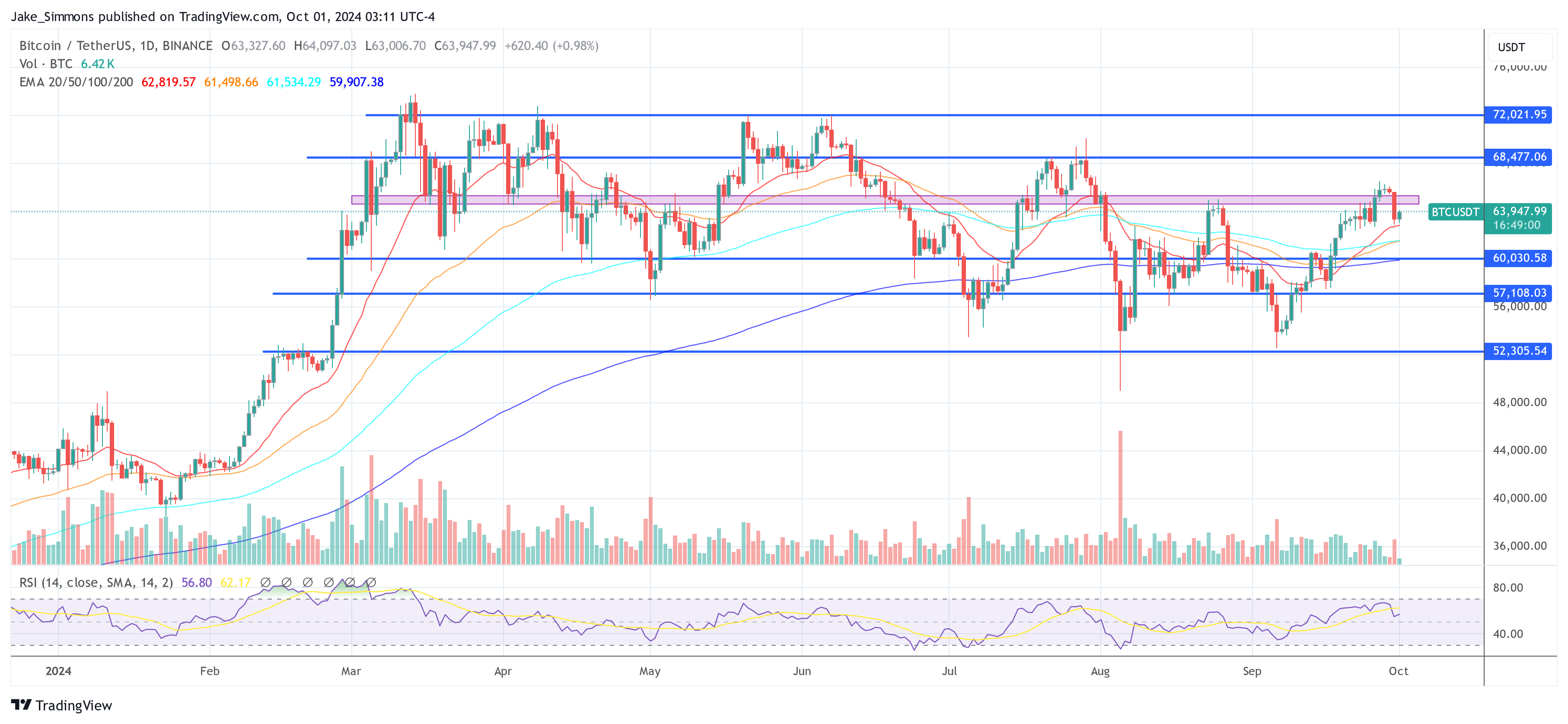

Greer notes that Bitcoin is entering Q4 aft breaking a cardinal terms level astatine $65,000. If the terms were to reclaim the $70,000 mark, she expects that the inflows would accelerate arsenic investors respond to the affirmative momentum and callback the beardown Q4 performances of erstwhile years.

At property time, BTC traded astatine $63,947.

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.com

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)