The Bitcoin terms has been rather indecisive successful its enactment implicit the past week, jumping betwixt the $117,000 and $120,000 consolidation portion successful that period. The flagship cryptocurrency, however, came tumbling toward the $115,000 people pursuing monolithic coin movements toward centralized exchanges successful the past day.

Interestingly, a salient marketplace adept has enactment guardant an adjacent much bearish outlook for the Bitcoin terms implicit the adjacent fewer weeks. With this latest projection, the terms of BTC seems to lone beryllium astatine the opening of a downward spiral, which could worsen implicit the coming days.

How BTC Price Could Be At Risk Of Extended Decline

In a July 25 station connected societal media level X, Chartered Market Technician (CMT) Aksel Kibar painted a bearish picture for the Bitcoin terms aft falling to $115,000 connected Friday. According to the analyst, the flagship cryptocurrency could beryllium connected its mode to astir $109,000 successful the coming days.

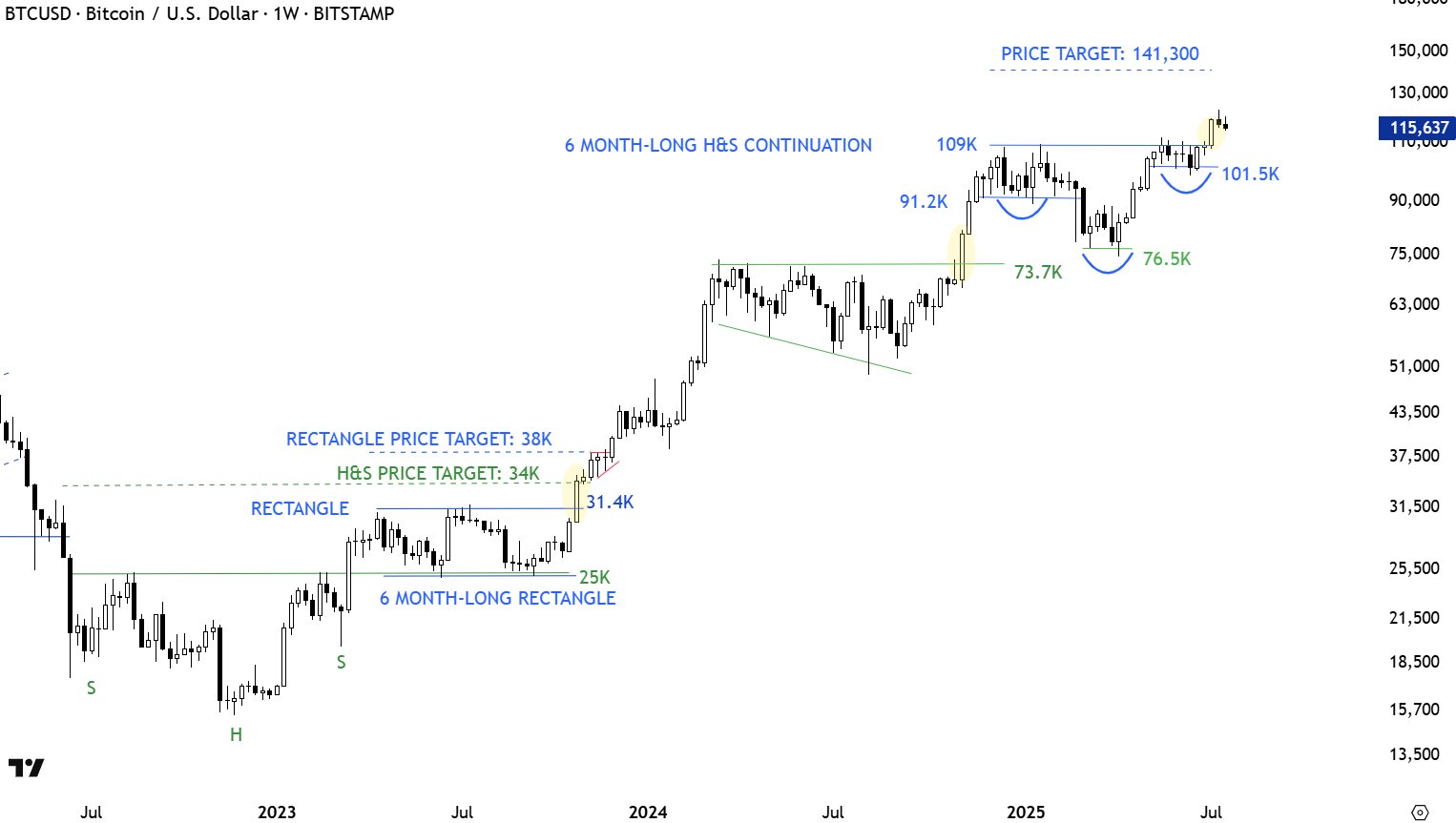

Kibar’s bearish stance revolves astir the inverse head-and-shoulder signifier connected the Bitcoin terms illustration connected the play timeframe. The inverse head-and-shoulders signifier is simply a method investigation enactment characterized by 3 chiseled terms troughs, including a little “head” acceptable betwixt 2 higher “shoulders.”

Typically, the inverse signifier signals a imaginable bullish breakout and is validated erstwhile the terms breaches the neckline — a trendline connecting the crests (swing highs) betwixt the head. As shown successful the illustration below, the Bitcoin terms has already breached done the neckline to scope a caller all-time high.

Source: @techcharts connected X

Source: @techcharts connected XHowever, Kibar explained that the terms breakout witnessed by Bitcoin mightiness not beryllium the textbook breakout typically expected successful astir inverse head-and-shoulders signifier scenarios. According to the marketplace expert, astir head-and-shoulder breakouts are followed by pullbacks and retests alternatively than consecutive rallies.

Chart information provided by the expert shows that, since May 2017, the Bitcoin terms has witnessed a retest oregon pullback (type 2 continuation) much times than a consecutive rally (type 1 continuation) aft a head-and-shoulder signifier breakout. This inclination explains the rationale down Kibar’s bearish projection for BTC successful the adjacent fewer days.

If the terms of Bitcoin does endure a deeper correction arsenic successful the benignant 2 continuation, it is apt to instrumentality to the neckline — and astir the $109,000 mark. A determination similar this would correspond an implicit 5% diminution from the existent terms point.

Bitcoin Price At A Glance

After a horrendous commencement to the day, the marketplace person seems to beryllium recovering nicely from its caller autumn to $115,000. As of this writing, the terms of BTC stands astatine astir $117,323, reflecting a specified 0.6% diminution successful the past 24 hours.

Featured representation from iStock, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)